Annuity sales on steady ‘positive trajectory’ through 2027, LIMRA predicts

The record-smashing tier of annuity sales will not be going away anytime soon, LIMRA analysts predict.

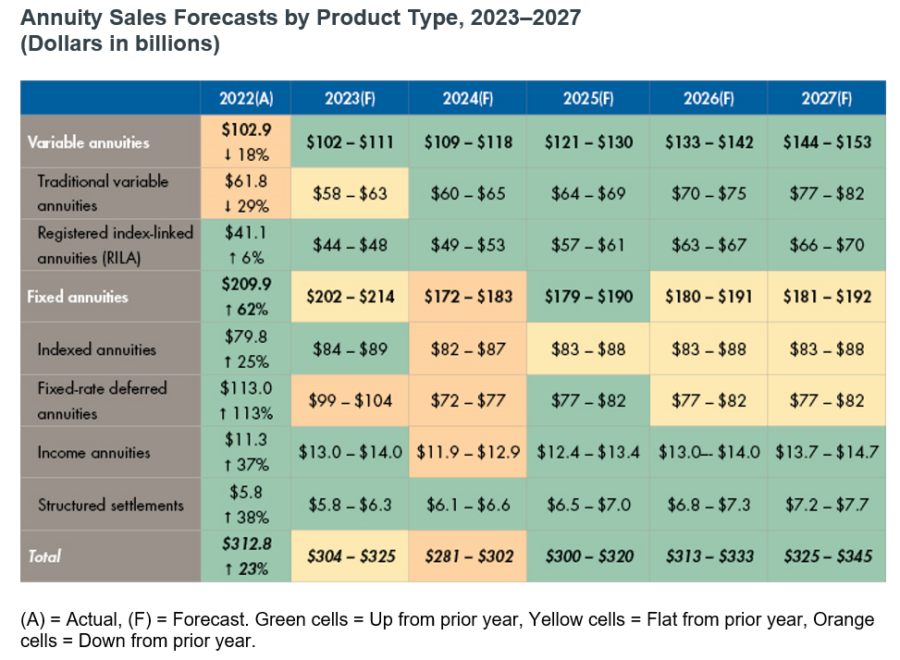

For two decades, annuity sales hovered around the $200 billion to $250 billion range before busting out in 2022 with sales of $312.8 billion, LIMRA found. That record could be short-lived depending on how 2023 plays out.

LIMRA’s forecast suggests that protection products will continue to boost growth in the annuity market for the next several years. Although the product mix may shift over time, LIMRA doesn’t anticipate sales going back to those lower numbers.

“Overall individual annuity sales could see a slight pullback in 2024 as interest rates decrease, yet the favorable demographics combined with improving equity markets will continue to propel sales in a positive trajectory through 2027,” said Todd Giesing, assistant vice president, LIMRA Annuity Research.

An age thing

On average, more than 10,000 baby boomers reach retirement age every day, a trend that will continue through at least 2030.

Those simple demographics will affect the future of annuities with more people reaching an age where they would consider purchasing one, LIMRA noted. The average age of an annuity buyer is in their early 60s with the majority purchased between ages 55–70.

According to Oxford Economics, the U.S. population aged 65 or over is expected to grow by more than 8.3 million from 2022 to 2027. Several other factors will also likely drive the annuity market:

• The momentum experienced in 2022 will maintain sales for most product lines and the industry as a whole.

• While economic conditions are forecasted to improve, expected declining interest rates will be a headwind.

• Products with protection features will continue to be in high demand.

• Demand for guaranteed income will grow.

LIMRA broke down each of the individual product categories:

Traditional variable annuities: Volatility in the equity markets will cause investors to continue shying away from traditional VAs. Unless there are drastic tax changes, it is unlikely traditional VA products will be utilized for tax deferral beyond what the industry experienced in 2022. Growth potential and guaranteed income solutions will be the drivers of growth in 2027, which means traditional VAs will see upward momentum.

At $198,000, average new contract premium for VAs with guaranteed living benefits is very high.

"Very lucrative and one of the highest average commission premiums for contracts," Giesing noted at the recent LIMRA Life and Annuity Conference.

Registered index-linked annuities: The RILA market has experienced remarkable growth over the past few years and LIMRA is projecting continued growth through the next several years. As equity markets turn back into growth mode, investors will be seeking out solutions with the balance of protection and growth potential.

By 2027, RILA sales are expected to be in the $66–$70 range with more carriers entering the market.

Fixed indexed annuities: Expectations are for FIAs to continue to reach new record levels as investors seek out solutions with a balance of protection and growth. A majority of the growth projected in the FIA market will be in products without a guaranteed living benefit. The growth is anticipated to flatten out between 2023 and 2027.

“Economic conditions remain favorable for FIA products and this is forecasted to continue throughout the year,” Giesing said. “LIMRA is predicting FIA sales to grow as much as 10% in 2023, as investors continue to seek out solutions with a balance of protection and growth.”

Fixed-rate deferred annuities: With the decline in interest rates, and as crediting rates decline, the demand for protection-based solutions like FRDs will abate. Yet even as sales are expected to decline in 2024, they will remain stronger than historical averages. LIMRA is forecasting FRD annuity sales to rebound in 2024 as a portion of the contracts coming out of surrender periods will seek out similar offerings. The FRD market will then flatten out through 2027.

“On average, FRD annuity crediting rates continue to outperform CD rates, making these products very attractive to conservative investors,” Giesing said.

Income annuities: Income annuities experienced a significant pop at the end of 2022, and if the message from the Federal Reserve starts to shift from rate hikes to a pattern of holding rates, we will likely see investors jumping to lock in favorable payout rates at or near their peak. This will provide a strong start to the year, with sales tapering off as interest rates retreat. LIMRA expects income annuities to see a modest uptick in sales in 2025 then flatten out through 2027.

“Overall, our research indicates that we can expect to see continued momentum in the individual annuity market as we move forward,” Giesing said. “The industry needs to continue to look at options to enhance the experiences for both advisors and customers through technology and process improvements to be able to meet the growing demand for annuities.”

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Why MYGAs are enjoying a renaissance

3 steps to mitigate financial risks in retirement

Advisor News

- More than half of Gen X investors support parents or children

- Year-end Roth IRA conversions: What you need to know before the deadline

- Debt is limiting American retirement savings

- How starting a conversation with a stranger is like dating

- Why your clients might face higher taxes in retirement

More Advisor NewsAnnuity News

Health/Employee Benefits News

- IBX and Penn Medicine have early agreement on reimbursement rates starting next July

- Long-term care: A view from the states

- Priority Health and Physicians Health Plan of Northern Indiana Complete Acquisition to Foster Innovation and Improve Access to Care

- WV lawmakers say they have ‘no great plan’ for PEIA during the 2025 session

- Health insurance costs are about to skyrocket. Here's how to stop it

More Health/Employee Benefits NewsLife Insurance News