Indexed products lead Q3 life, annuity sales boom, Wink reports

Indexed life and annuity products are the subject of many regulator meetings and class-action lawsuits. Despite that negative publicity, indexed life and annuity sales are booming.

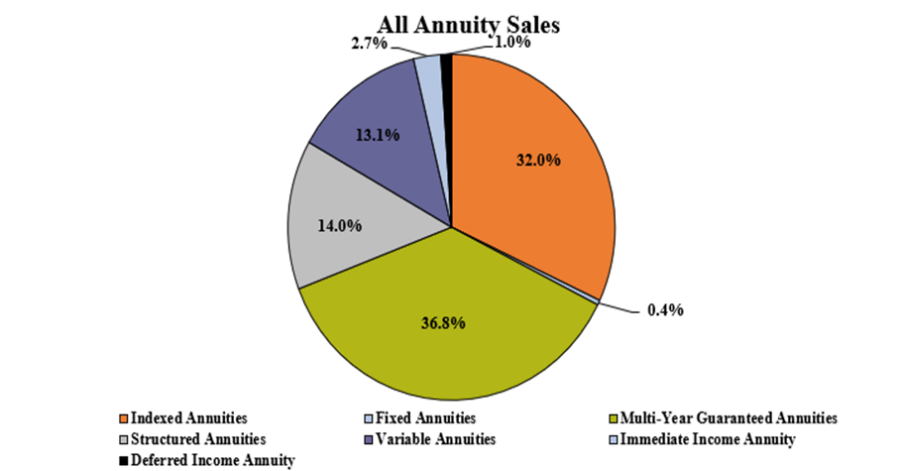

Wink, Inc. reported third-quarter annuity sales of $115.2 billion, up 6.6% compared to the previous quarter. All annuities include the multi-year guaranteed annuity, traditional fixed annuity, indexed annuity, structured annuity, variable annuity, immediate income and deferred income annuity product lines.

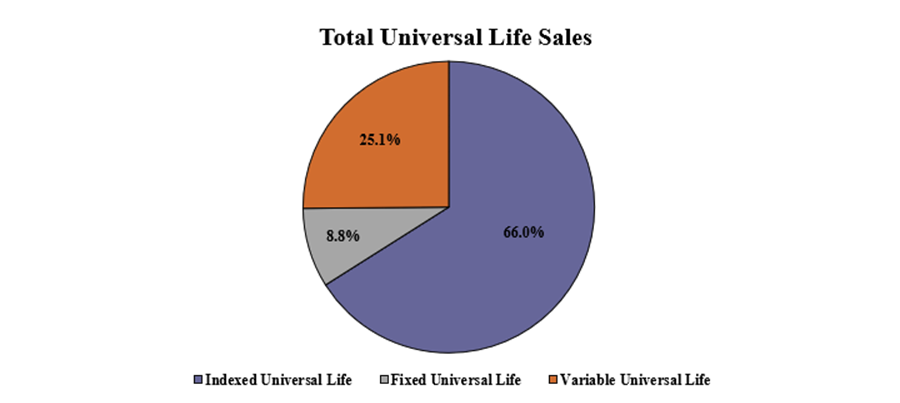

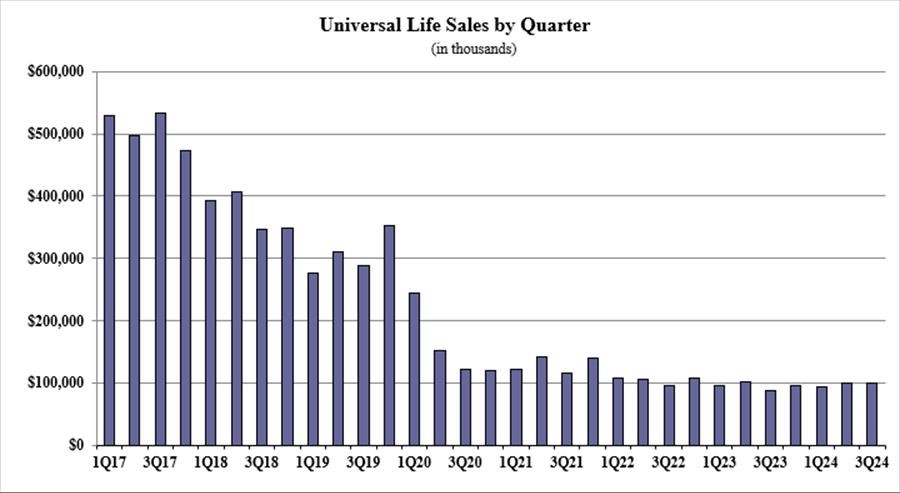

On the life insurance side, indexed products were a lone bright spot, Wink reported. All universal life sales for the third quarter were more than $1.1 billion, down 0.5% compared to the previous quarter. All universal life sales include fixed UL, indexed UL, and variable UL product sales.

The annuity story

Noteworthy highlights for all annuity sales in the third quarter include Athene USA ranking as the No. 1 carrier overall for annuity sales, with a market share of 8.1%. Massachusetts Mutual Life Companies came in second place, while Allianz Life, Corebridge Financial, and Jackson National Life rounded out the top five carriers in the market, respectively.

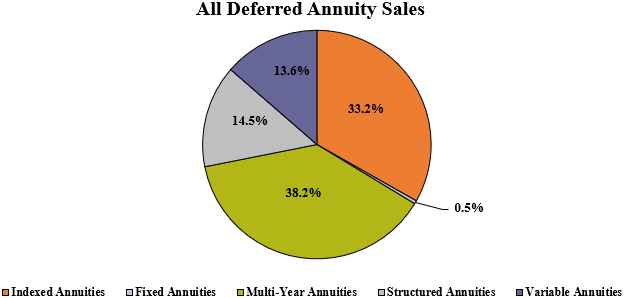

Total third-quarter sales for all deferred annuities were $110.9 billion, up 6% compared to the previous quarter and up 40% compared to the same period last year. All deferred annuities include the multi-year guaranteed annuity, traditional fixed, indexed annuity, structured annuity and variable annuity product lines.

Noteworthy highlights for all deferred annuity sales in the third quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 8.4%. Massachusetts Mutual Life Companies continued in the second-ranked position, while Allianz Life, Corebridge Financial, and Equitable Financial completed the top five carriers in the market, respectively. Massachusetts Mutual Life’s Stable Voyage 3-Year, a MYG annuity, was the No. 1 selling deferred annuity, for all channels combined, in overall sales for the second consecutive quarter.

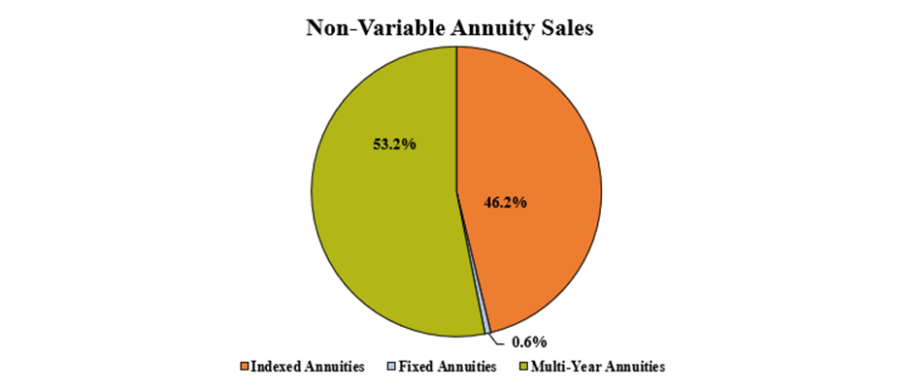

Total third quarter non-variable deferred annuity sales were $79.7 billion, up 8.2% compared to the previous quarter and up 45.5% compared to the same period last year. Non-variable deferred annuities include the MYG annuity, traditional fixed annuity, and indexed annuity product lines.

Noteworthy highlights for non-variable deferred annuity sales in the third quarter include Athene USA ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 11.3%. Massachusetts Mutual Life Companies continued in the second-ranked position, while Corebridge Financial, Allianz Life, and Global Atlantic Financial Group completed the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year, a MYG annuity was the No. 1 selling non-variable deferred annuity for the quarter, for all channels combined, in overall sales for the second consecutive quarter.

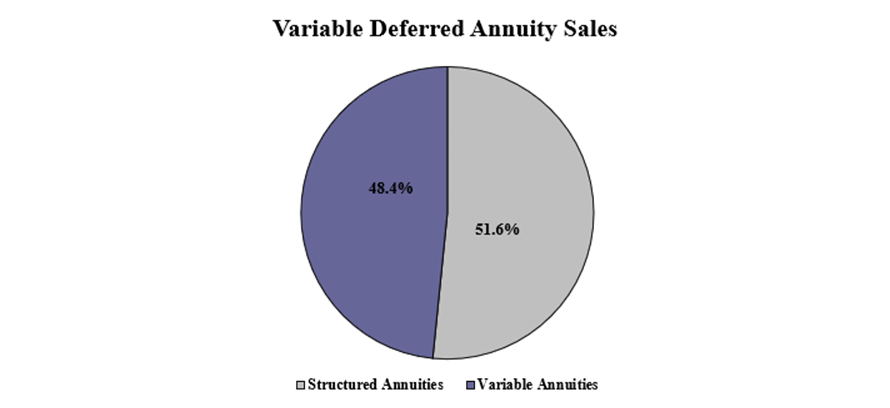

Total third-quarter variable deferred annuity sales were $31.2 billion, up 0.7% compared to the previous quarter and up 27.7% compared to the same period last year. Variable deferred annuities include structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the third quarter include Equitable Financial ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 18.3%. Jackson National Life continued in the second-place position, as Lincoln National Life, Allianz Life, and Prudential concluded as the top five carriers in the market, respectively. Equitable Financial’s Structured Capital Strategies Plus 21, a structured annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall for the second consecutive quarter.

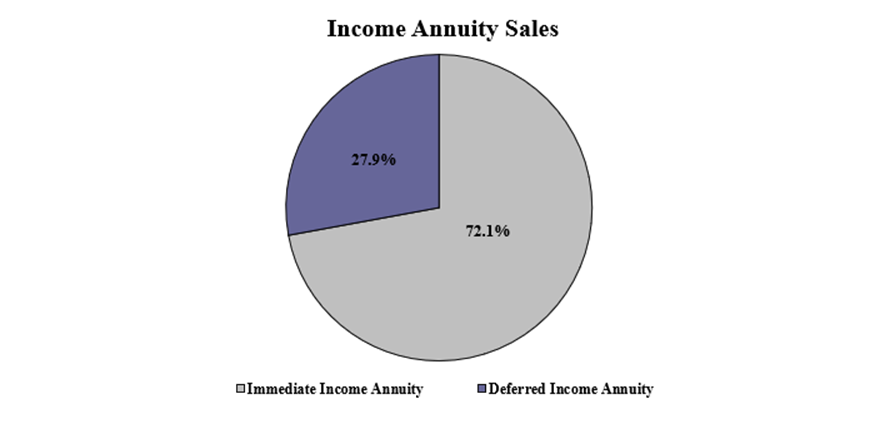

Total third quarter income annuity sales were $4.3 billion, up 27.4% compared to the previous quarter. Income annuities include immediate income annuity (SPIA) and deferred income annuity product lines.

Noteworthy highlights for income annuity sales in the third quarter include New York Life ranking as the No. 1 carrier overall for income annuity sales, with a market share of 36.1%. Massachusetts Mutual Life Companies moved into second-ranked position, as Nationwide, Western-Southern Life Assurance Company, and Penn Mutual concluded the top five carriers in the market, respectively.

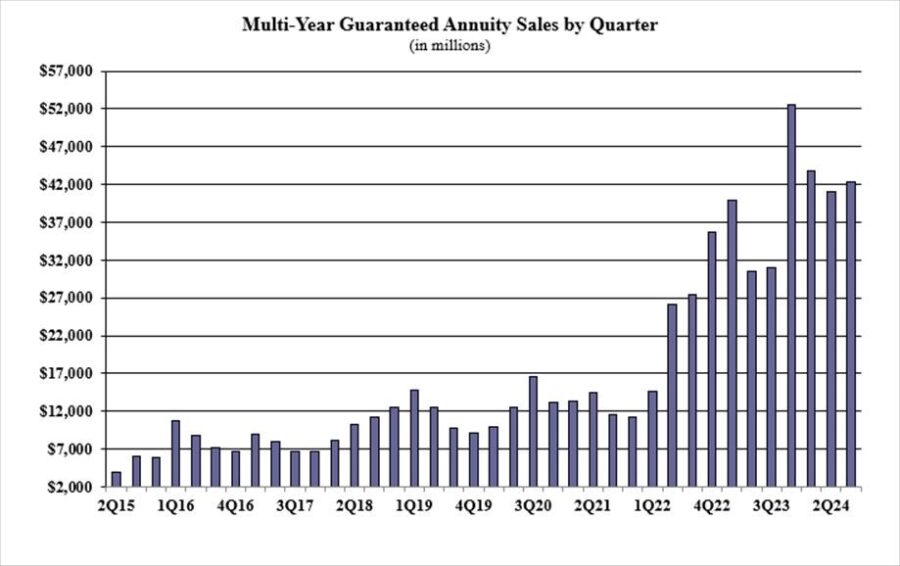

Multi-year guaranteed annuity sales in the third quarter were $42.4 billion, up 3.3% compared to the previous quarter, and up 36.9% compared to the same period, last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the third quarter include Massachusetts Mutual Life Companies ranking as the No. 1 carrier, with a market share of 14.2%. Athene USA continued in the second-ranked position, while Corebridge Financial, New York Life and Global Atlantic Financial Group rounded out the top five carriers in the market, respectively. Massachusetts Mutual Life’s Stable Voyage 3-Year product was the No. 1 selling multi-year guaranteed annuity, for all channels combined, for the second consecutive quarter.

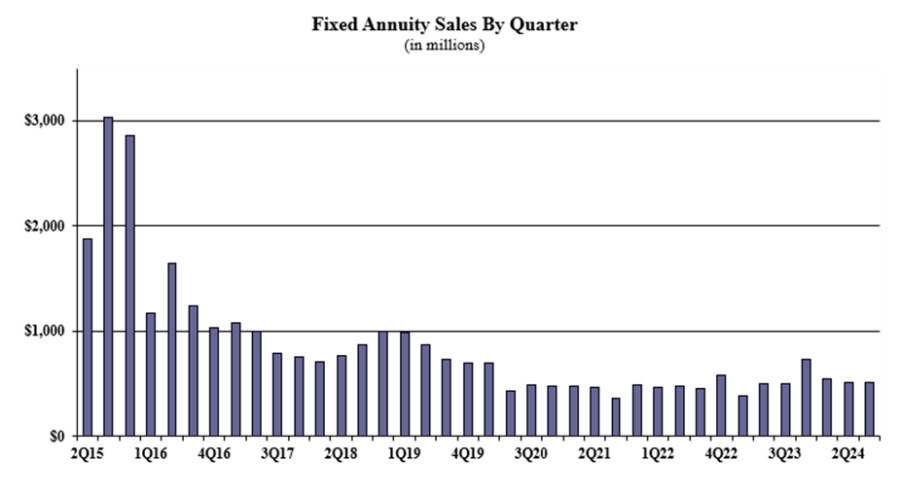

Traditional fixed annuity sales in the third quarter were $516.7 million, up 2% compared to the previous quarter, and up 4.2% compared to the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the third quarter include Global Atlantic Financial Group ranking as the No. 1 carrier in fixed annuities, with a market share of 15.7%. CNO Companies ranked second, while Modern Woodmen of America, CL Life and EquiTrust completed the top five carriers in the market, respectively. Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined, for the seventeenth consecutive quarter.

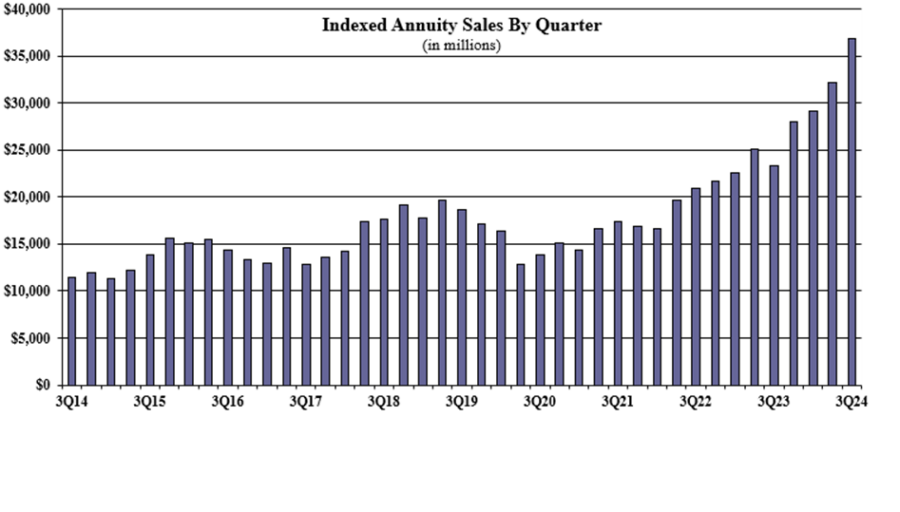

Indexed annuity sales for the third quarter were $36.8 billion; sales were up 14.6% compared to the previous quarter, and up 57.8% compared to the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500. This was a record-setting quarter for indexed annuity sales, topping the second-quarter 2024 record by 14.6%.

Noteworthy highlights for indexed annuities in the third quarter include Allianz Life ranking as the No. 1 seller of indexed annuities, with a market share of 13%. Sammons Financial Companies ranked second, while Athene USA, Corebridge Financial, and Global Atlantic Financial Group completed the top five carriers in the market, respectively. Allianz Life’s Allianz Benefit Control Annuity was the No. 1 selling indexed annuity, for all channels combined, for the quarter.

Sheryl Moore, CEO of both Wink, Inc., and Moore Market Intelligence, said, “It was another record-setting quarter for indexed annuity sales. Already YTD sales have nearly beat out the full year 2023’s results.”

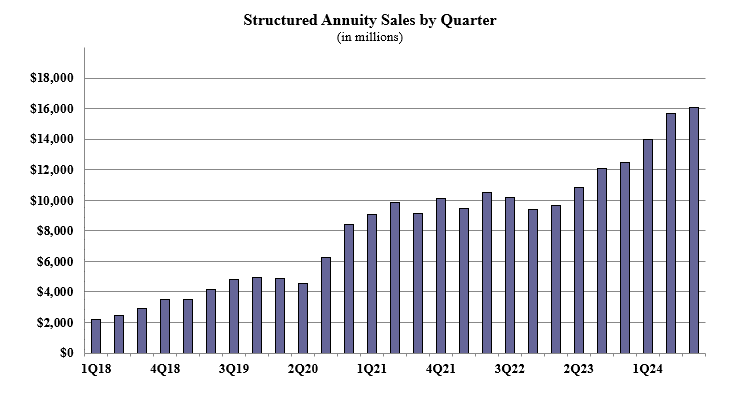

Structured annuity sales in the third quarter were $16.1 billion, up 2.8% compared to the previous quarter, and up 33.1% compared to the year-ago quarter. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts. This was a record-setting quarter for structured annuity sales, topping the second quarter 2024 record by 2.8%.

Noteworthy highlights for structured annuities in the third quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 22.5%. Allianz Life ranked second, while Prudential, Brighthouse Financial, and Jackson National Life completed the top five carriers in the market, respectively. Equitable Financial’s Structured Capital Strategies Plus 21 was the No. 1 selling structured annuity, for all channels combined, for the second consecutive quarter.

“Structured annuity sales YTD have already eclipsed total 2023 results,” Moore said. “It appears that VAs are losing market share to their indexed brethren.”

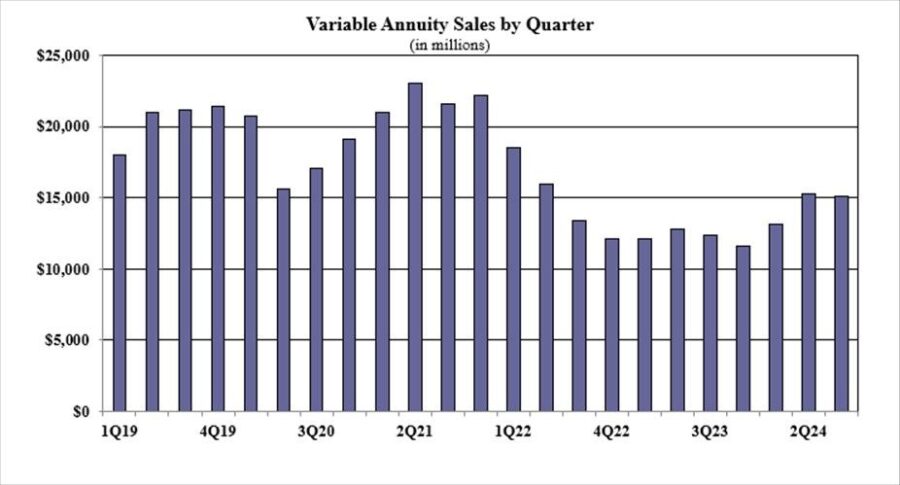

Variable annuity sales in the third quarter were $15.1 billion, down 1.4% compared to the previous quarter, and up 22.3% compared to the same period last year. Variable annuities have no floor, and the potential for gains/losses is determined by the performance of subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the third quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 17.1%. Equitable Financial ranked second, while Nationwide, New York Life, and Lincoln National Life finished as the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the twenty-second consecutive quarter, for all channels combined.

“The steady increase in the market has lent to stronger VA sales, but structured annuities will likely continue to rule the variable subset,” explained Moore.

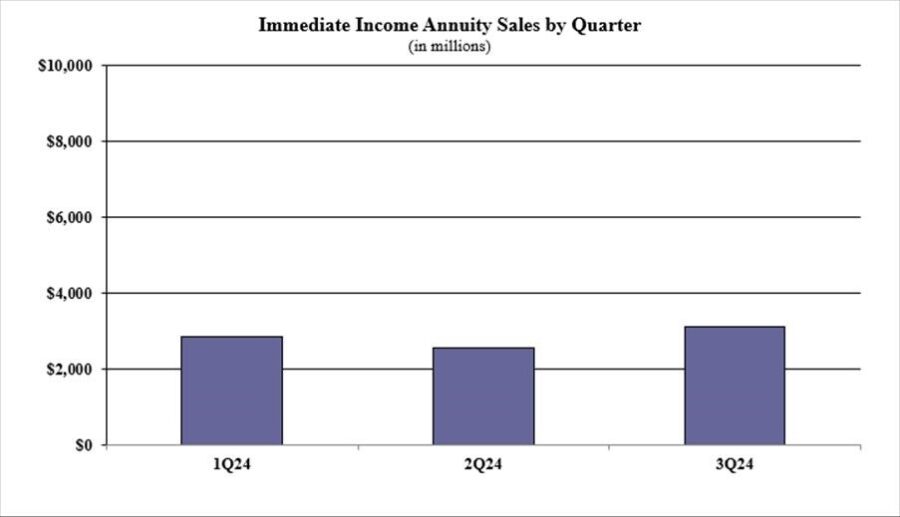

Immediate income annuity (Single Premium Immediate Annuity) sales in the third quarter were $3.1 billion; up 21.8% compared to the previous quarter.

Noteworthy highlights for immediate income annuities in the third quarter include New York Life ranking as the No. 1 carrier in immediate income annuities, with a market share of 32.9%. Massachusetts Mutual Life Companies ranked second, while Nationwide, Western-Southern Life Assurance Company, and Penn Mutual finished as the top five carriers in the market, respectively.

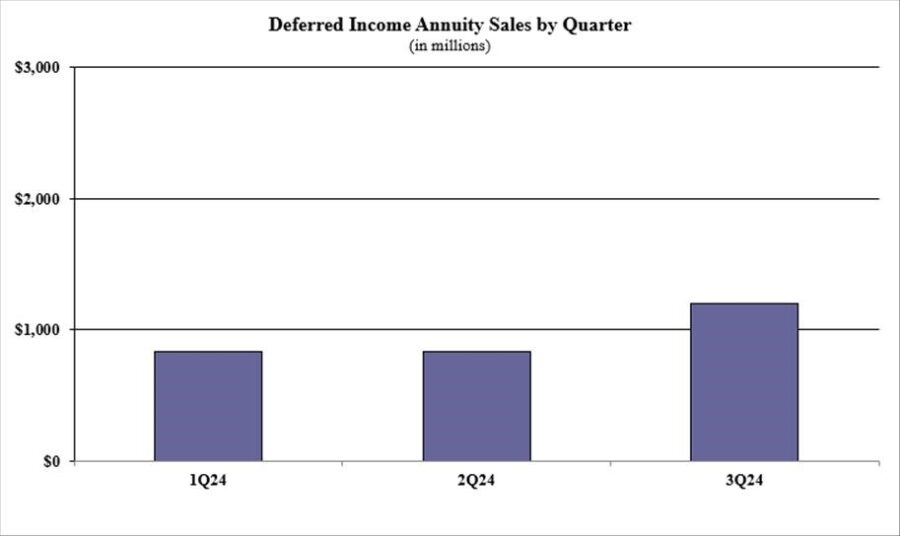

Deferred income annuity sales in the third quarter were $1.2 billion; up 44.6% compared to the previous quarter.

Noteworthy highlights for deferred income annuities in the third quarter include New York Life ranking as the No. 1 carrier in deferred income annuities, with a market share of 44.5%. Massachusetts Mutual Life Companies ranked second, as Western-Southern Life Assurance Company, Integrity Life Companies, and Corebridge Financial finished as the top five carriers in the market, respectively.

The life story

Noteworthy highlights for total all universal life sales in the third quarter included National Life Group ranking as No. 1 in overall sales for all universal life sales, with a market share of 10.9%. Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling product for all universal life sales, for all channels combined, for the third consecutive quarter.

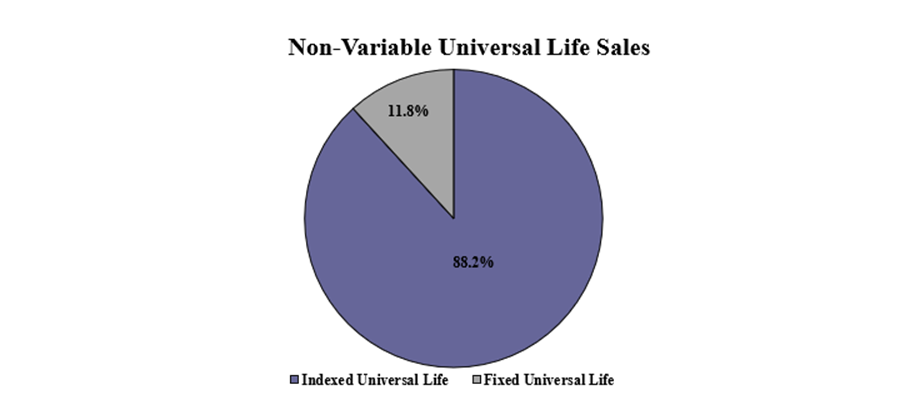

Non-variable universal life sales for the third quarter were $847.8 million; sales remained flat when compared to the previous quarter and up 9.5% compared to the same period last year. Non-variable universal life sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the third quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 14.6%. Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined, for the fourteenth consecutive quarter.

Fixed UL sales for the third quarter were $100 million, down 0.5% compared to the previous quarter and up 15.2% compared to the same period last year.

Items of interest in the fixed UL market included Nationwide retaining their No. 1 ranking in fixed universal life sales, with a 16.7% market share, John Hancock, Pacific Life Companies, Protective Life Companies, and Prudential completed the top five, respectively.

Pacific Life’s Pacific Life Promise GUL was the No. 1 selling fixed universal life insurance product, for all channels combined for the quarter. The top primary pricing objective of No Lapse Guarantee captured 39.5% of sales. The average fixed UL target premium for the quarter was $7,757, an increase of nearly 13% from the prior quarter.

“The second quarter was a strong quarter for life insurance sales," Moore said, "so sales being flat this quarter isn’t such a surprise.”

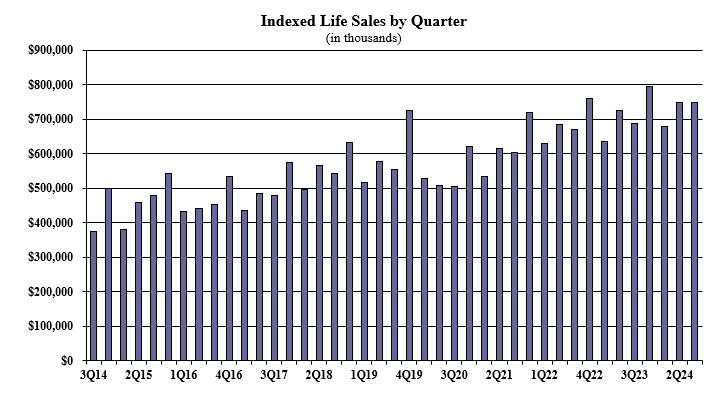

Indexed life sales for the third quarter were $748.8 million, up 0.2% compared with the previous quarter, and up 8.9% compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

Items of interest in the indexed life market included National Life Group keeping their No. 1 ranking in indexed life sales, with a 16.4% market share, Transamerica, Pacific Life Companies, Nationwide, and Lincoln National Life rounded-out the top five, respectively.

Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined, for the fourteenth consecutive quarter. The top primary pricing objective for sales this quarter was Cash Accumulation, capturing 71.7% of sales. The average indexed life target premium for the quarter was $13,156, an increase of 22% from the prior quarter.

"Indexed life was the only line of business which experienced an increase in sales from last quarter," commented Moore. "And sales were only up 0.2%."

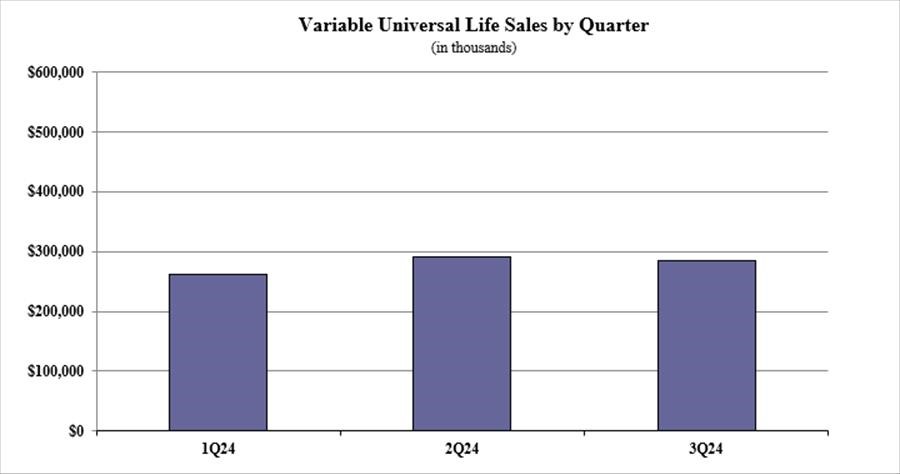

Variable Universal Life sales for the third quarter were $284.7 million, down 2.3% compared with the previous quarter.

Items of interest in the variable universal life market included Prudential retaining the No. 1 ranking in variable universal life sales, with a 34.3% market share, Pacific Life Companies, RiverSource Life, John Hancock and Nationwide completed the top five, respectively.

Pruco Life’s VUL Protector was the No. 1 selling variable universal life insurance product, for all channels combined for the third consecutive quarter. The top primary pricing objective for sales this quarter was Cash Accumulation, capturing 54.5% of sales. The average variable universal life target premium for the quarter was $20,001, a decline of nearly 2% from the prior quarter.

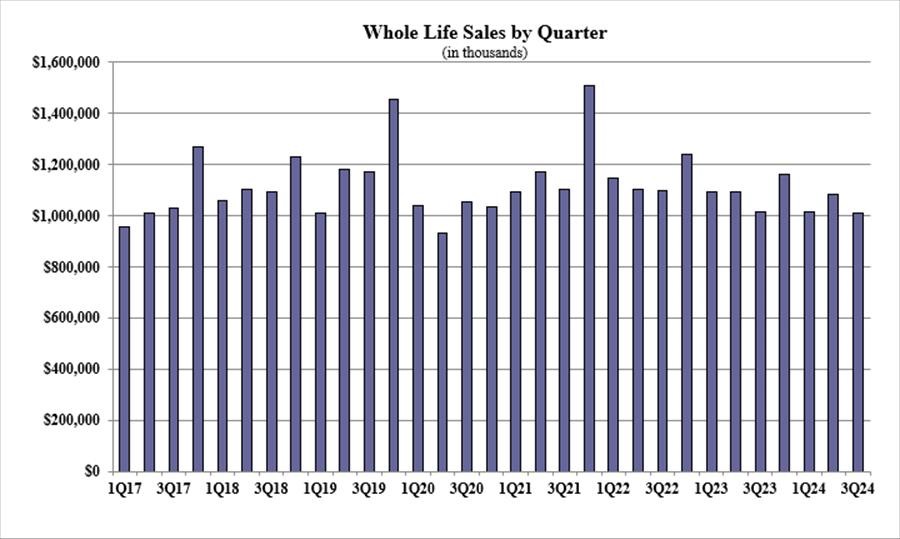

Whole life third quarter sales were $1 billion, down 6.7% compared with the previous quarter, and down 0.8% compared to the same period last year. Items of interest in the whole life market included the top primary pricing objective of final expense capturing 56.1% of sales. The average premium per whole life policy for the quarter was $3,655, an increase of more than 4% from the prior quarter.

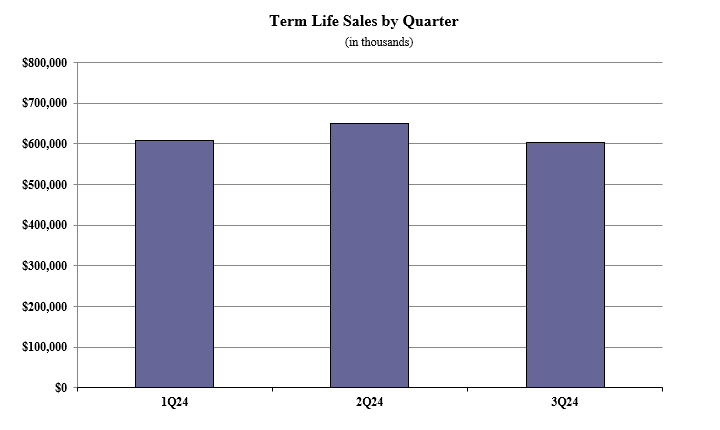

Term life third quarter sales were $602.3 million; down 7.4% compared with the previous quarter.

Items of interest in the term life market included Prudential ranking as No. 1 in term life sales, with a 5.4% market share. Pacific Life Companies, Corebridge Financial, Protective Life Companies and Massachusetts Mutual Life Companies rounded the top five, respectively.

Pruco Life’s Term Essential 10 was the No. 1 selling term life insurance product, for all channels combined, for the quarter. The average annual term life premium per policy reported for the quarter was $2,412, a decline of more than 19% from the previous quarter.

Wink now reports on all annuity and life insurance lines of business.

Disruption hitting Medicare for 2025

Empowering clients to enjoy their hard-earned wealth

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- FINEOS and PwC Partner to Drive the Future of Modern Insurance

- Vermont looking to transform health care system as costs rise

- NFIB DELIVERS 2026 GEORGIA MEMBER BALLOT RESULTS TO LAWMAKERS

- RESIDENTS ENCOURAGED TO ENROLL IN GET COVERED NEW JERSEY AHEAD OF JANUARY 31 DEADLINE FOR HEALTH COVERAGE

- Gov. Scott, officials detail health reform measures

More Health/Employee Benefits NewsLife Insurance News