Variable annuity sales on the ropes, but LIMRA forecasts mild rebound

SALT LAKE CITY – Market volatility did not help variable annuity sales. Nor did COVID-19 or ramped-up regulatory activities. And the changing face of the advisor force wasn't keen on VAs either.

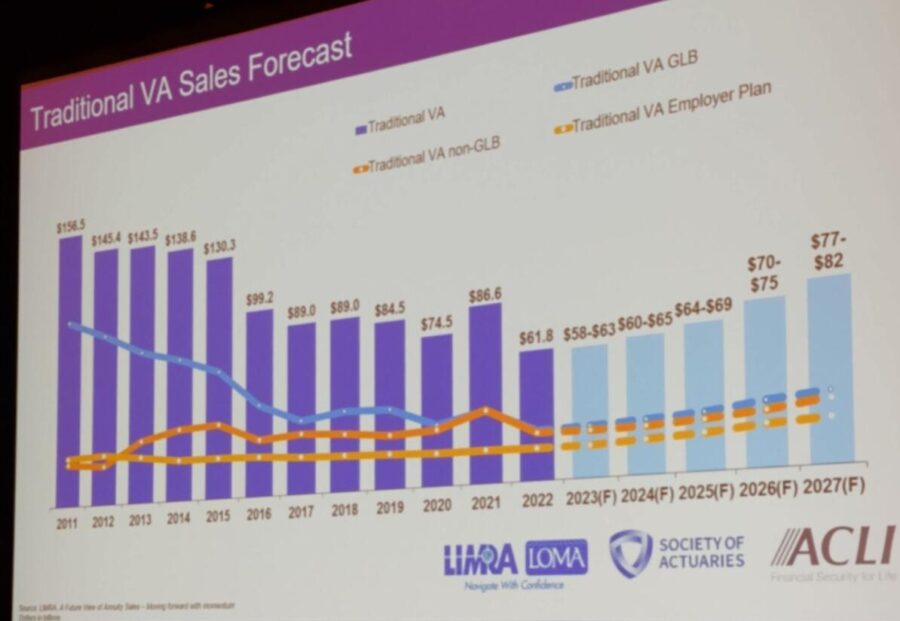

Some of these variables will get better and some will get worse in the coming years. But VA sales – coming off their worst year since 1995 – should bounce back a little bit, LIMRA forecasts.

Still, sales will be "nowhere near the level that we saw in 2011, 2012," said Todd Giesing, assistant vice president, LIMRA Annuity Research.

Giesing was part of a panel session titled, "The Future of Traditional Variable Annuities" Wednesday at the final day of the LIMRA Life Insurance and Annuity Conference.

Traditional VAs include an investment account that may grow on a tax-deferred basis and include certain insurance features, such as the ability to turn an account into a stream of periodic payments. VAs grew wildly popular while the stock market regained strength in the years after the 2008-09 economic crisis.

Numerous disruptions

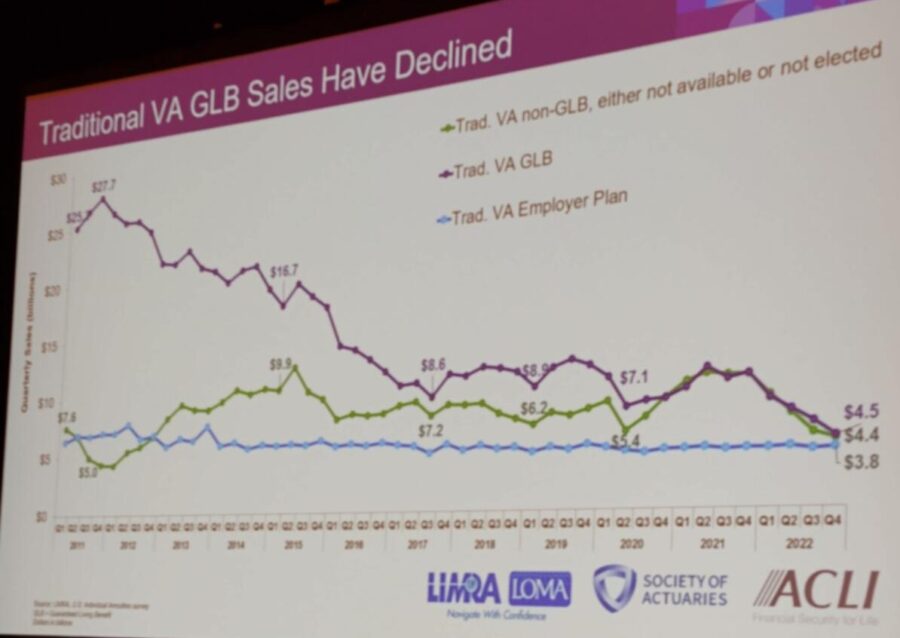

Disruptions to the monster VA sales started with insurers themselves. During the 2000s, carriers competed with one another to offer VAs with better guaranteed living benefits.

"We had carriers that were stepping on each other's toes and raising the bar literally every week," Giesing recalled.

Eventually, carriers became concerned about the amount of VA guarantees on their books, Giesing noted, and adopted different strategies to counter that risk.

"Carriers start to say, 'Okay, we want to balance out our annuity portfolios, and our annuity sales,'" he said. "So they started diversifying, offering products without guaranteed living benefits or looking at other product lines and putting an emphasis" on other annuity categories, like fixed indexed.

Traditional VA sales declined sharply through the 2010s. Then other factors contributed. The panel discussed several VA disruptions:

1. Regulatory pressure. VA sales were the main target of the Department of Labor fiduciary rule published by the Obama administration in 2016. The rule, which was later tossed out by a Fifth Circuit Court of Appeals, included a best interest contract exemption for VA sales.

"It put a big bullseye on the variable annuity market," Giesing said.

The industry hated the rule, but executives were sufficiently spooked to dial back emphasis on VAs. The DOL is again rewriting the definition of fiduciary, a process expected to yield a new rule by the end of 2023.

2. Changing advisor force. In simple terms, many in the producer ranks are just not tuned into VAs anymore, the panelists said.

"We've had a big focus lately on recruiting banking, credit union clients to affiliate with our firm so naturally with the growing number of that type of advisor population, they typically tend to use fixed annuities, fixed indexed annuities allow some of those more predictable returns," explained Lauren Mitchell, vice president, annuity and insurance products for LPL Financial.

The traditional advisory space does not use a business model that calls for annuities, added Scott Bowers, chief strategy and distribution officer for FIDx, a technology company that works with financial firms.

Bowers spent over 13 years at BlackRock, nearly five as national sales director. Annuity providers need to "get into the fiduciary mindset of the advisor to help them understand where annuities fit in a portfolio plan," he said.

3. COVID-19. The COVID-19 pandemic possibly played a role in declining sales, Mitchell said, raising the notion of a "COVID hangover" and American families just trying to survive the short term without being able to factor in longer-term retirement needs.

Nearly one in five Americans (17%) said they were saving less money for retirement due to the pandemic, according to a 2022 survey by The Penny Hoarder, a financial advice website.

Large deposits

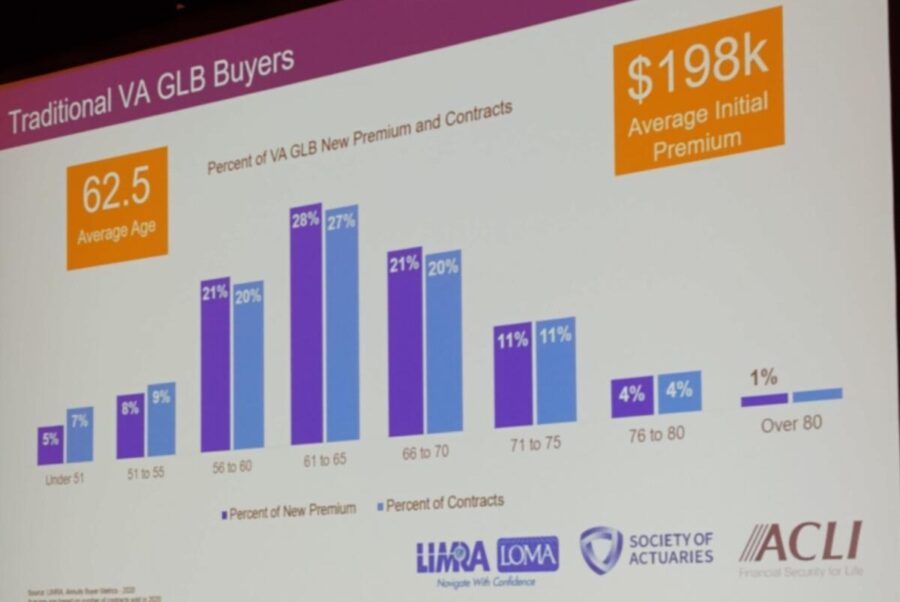

The news is not all bad for VA sellers. At $198,000, average new contract premium for VAs with guaranteed living benefits is very high.

"Very lucrative and one of the highest average commission premiums for contracts," Giesing noted.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Field underwriting: The key to increasing your revenue

‘Third rail’ heats up as Social Security reform talk increases

Advisor News

- Regulator group aims for reinsurance asset testing guideline by June

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

- Nationwide Financial Services President John Carter to retire at year end

More Advisor NewsAnnuity News

Health/Employee Benefits News

- NC bill would limit insurers' prior authorizations

- Plan to tax employer-provided insurance would harm lower-income Hoosiers

- 'Floridians need to pay attention.' Are we prepared for federal cuts to our health care?

- New New York state tax credit for small businesses introduced

- How did health insurance coverage changes affect older adults? Two new studies take a look: Michigan Medicine – University of Michigan

More Health/Employee Benefits NewsLife Insurance News

- Legals for January, 31 2025

- Automatic Shelf Registration Statement (Form S-3ASR)

- Best’s Special Report: Impairments in US Life/Health Insurance Industry Jump to 10 in 2023

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of Solidarity Bahrain B.S.C.

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of First Insurance Company

More Life Insurance News