‘Third rail’ heats up as Social Security reform talk increases

A senator working on a plan to save Social Security says Social Security reform does not have to be the proverbial third rail of politics, but he is touching on a proposal that has zapped a few policymakers, chiefly the idea of investing some of the trust fund in the private sector.

Sen. Bill Cassidy, R-La., said that Tuesday during a Bipartisan Policy Center “fireside chat” on fixing Social Security. Cassidy, who is on the Subcommittee on Social Security, Pensions and Family Policy, has partnered with Sen. Angus King, an independent from Maine who caucuses with Democrats, on an effort to save Social Security.

During Tuesday’s chat, Cassidy said approaching the issue of reforming Social Security is not the deadly third rail of politics but rather it is ignoring the issue that is dangerous.

“The third rail according to our leading presidential candidates is pretending there’s nothing wrong with Social Security,” Cassidy said. “If the 24% cut in Social Security benefits under current law goes into effect, it will double the rate of poverty among the elderly. That should be the third rail. The conversation has to change.”

Groups like the National Committee to Preserve Social Security and Medicare might agree the conversation needs to change, but they don’t like where Cassidy and King are taking it.

“The Cassidy-King plan attempts to address the projected shortfall in the Social Security trust fund by borrowing $1.5 trillion to invest on Wall Street (modeled on the concept of a “sovereign wealth fund”) — in hopes it would yield sufficient returns to pay back the loans and still have enough money left over to cover any future gap in Social Security funding,” the committee said last month. “This funding scheme really is a trojan horse for benefit cuts that reportedly are at the core of the Cassidy-King proposal.”

Social Security reform: Reckoning & reasoning

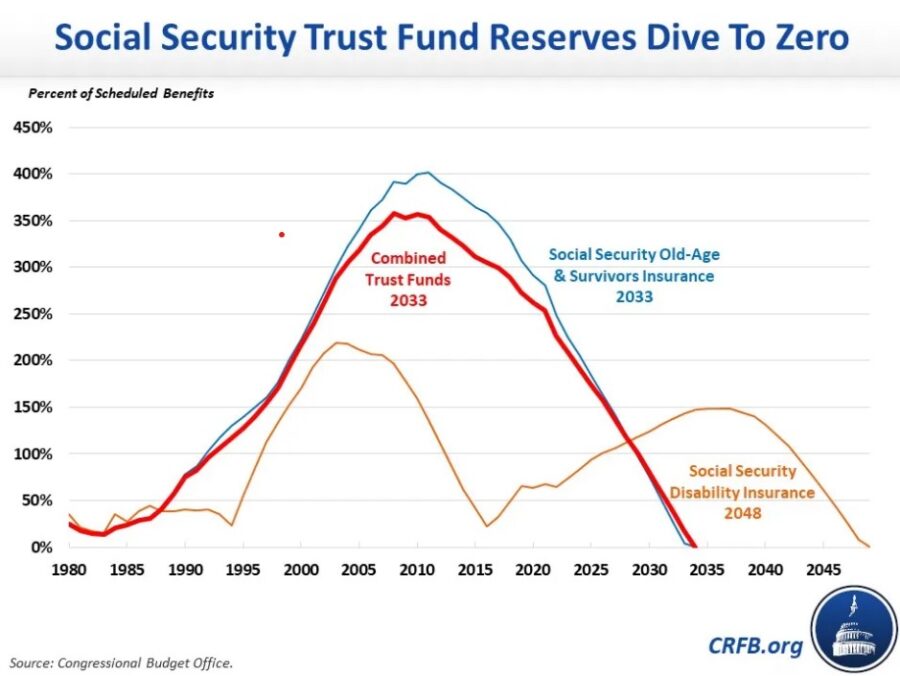

Whatever the solution, it is clear that there is a problem. The Congressional Budget Office recently said the Social Security Trust Fund is expected to run dry by 2032 – the second adjustment down in the past half year. CBO Director Phillip Swagel said if no changes were made to the system, beneficiaries would lose more than 20% of their benefit.

Last year’s historically large 8.7% cost of living adjustment helped hasten the trust fund’s expected insolvency. That was a negative aspect of inflation, but Swagel added that wage inflation was a positive because it boosts contributions into the system, although not enough.

“On net, it led to a deterioration in the system,” Swagel said of inflation, “and that moves our exhaustion date just forward one year but into the budget window [of 10 years].”

Social Security spending expected to double

Social Security spending is expected to nearly double from $1.2 trillion in 2022 to $2.4 trillion by 2033, according to the CBO, expanding it to 6% of the GDP, up from 4.8%.

The last time Republicans seriously proposed privatizing at least some of Social Security was 2005 when President George W. Bush pushed personal Social Security accounts and the option for taxpayers to divert some of their payroll tax into “secured investments.” Bush floated the idea in that year’s State of the Union address, but the public generally was not enthusiastic about the idea. Democrats, who opposed the plan, gained a majority in both the House and Senate in 2006.

President Barack Obama took a crack at it in 2011, when his National Committee on Fiscal Responsibility and Reform released the Bowles-Simpson proposal to increase the payroll tax and trim benefits for upper-income people – insuring that neither Republicans nor Democrats liked the plan.

Although President Joe Biden has not made any proposals on Social Security reform, Democrats have suggested raising the cap on income that is subject to the payroll tax, which is currently $160,200.

Alternatives for raising payroll tax wage cap

The CBO looked into two alternatives in raising the payroll tax wage cap. One is raising the cap to cover 90% of wages, which translates to raising the taxable cap to about $300,000. That option would reduce the deficit by $693 billion between 2023 and 2032.

Another alternative is applying the 12.4 percent payroll tax to earnings over $250,000, but skipping income between $160,200 and $250,000. The tax would eventually apply to all income because the maximum cap (that is now $160,200) would continue to rise but the $250,000 threshold would remain, and eventually the gap would close. That would decrease the deficit by $1.2 trillion from 2023 through 2032. Both estimates take into account the likelihood that employers would change compensation to nontaxable benefits, such as health insurance.

Republicans have said that raising the payroll tax would be a disincentive to work, which the CBO acknowledged.

“Changing the share of earnings subject to Social Security payroll taxes would also affect people's incentive to work,” according to the CBO. “The decline in after-tax earnings would have opposing effects. On the one hand, people would tend to work fewer hours because lower earnings would make other uses of their time relatively more attractive. On the other hand, because their after-tax income would decline, they would also tend to work more hours to maintain the same standard of living. On balance, CBO estimates, the first effect would be greater than the second effect, and thus people in those earnings ranges would work less.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Variable annuity sales on the ropes, but LIMRA forecasts mild rebound

Recession fears grow as economic growth slows

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

- How the life insurance industry can reach the social media generations

More Life Insurance News