What is the average 55-year-old prospect worth to an advisor?

From an advisor’s perspective, the lifetime relationship with a 55-year-old client can be highly valuable. But what is the average worth to an advisor in dollars and cents?

In its first in a series of consumer-focused profiles, SmartAsset has released an analysis of what the average 55-year-old prospect is worth to an advisor. SmartAsset also has unveiled a model that assesses the value to the client of working with a financial advisor.

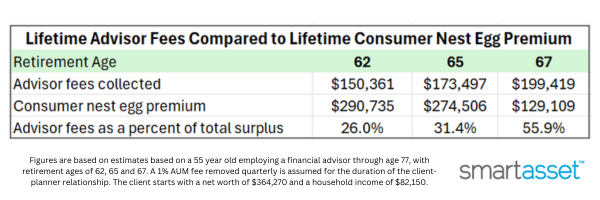

The following table shows how the numbers break down from an advisor’s perspective of the value of a lifetime relationship with a 55-year-old client:

These percentages illustrate that while the advisor earns a healthy fee, the proportion that is relative to the extra savings delivered varies with the client’s retirement horizon, according to SmartAsset. A shorter time horizon (such as a consumer retiring at 67) might result in a higher fee percentage because the window for accumulating surplus is smaller, and risk management is more pronounced.

Lifetime value

With fee revenues ranging from roughly $150,000 to $200,000 over the relationship, the average 55 -year-old client is a substantial asset to an advisor’s practice, SmartAsset said. This lifetime value not only reflects the advisor’s compensation for managing risk and orchestrating a long term financial plan but also underscores the mutual benefits of a well structured, client–planner relationship.

In essence, while the client enjoys increased net worth and higher retirement income, the advisor benefits from a lucrative fee stream that can amount to nearly $200,000 over the course of the relationship. This dual benefit reinforces the value of comprehensive financial planning, not just for the client’s bottom line, but also as a cornerstone of an advisor’s business success.

Working with clients

So how does this research help an advisor enhance his client-marketing efforts and ultimately gain more clients? Advisors can use this research to help clients understand their full value proposition, said DeJohn. Many consumers may feel pressured by sales tactics and prefer to take the time to digest information on their own and from a third party without stakes in the potential relationship.

The research can help put an advisor’s expertise into context and dispel misconceptions about the associated costs, DeJohn said. Potential clients often don’t have a full understanding of the financial pitfalls they face, whether from internal factors like emotional and cognitive biases or external factors like changing legislation and financial products. “Therefore, the model can also help potential clients develop a clearer understanding of the potential for maximizing their finances through offensive and defensive strategies implemented with the help of an expert over time,” she said.

Reasons for developing the model

SmartAsset developed a model to assess the value of working with a financial advisor to help bridge the gap between the uncertainty that potential clients may feel about what a financial advisor can potentially do for them, as well as to help financial advisors understand, facilitate and market their value proposition by putting it in a new, measurable context based on data-backed assumptions, said Jaclyn DeJohn, CFP, and director of economic analysis at SmartAsset.

“Some common frustrations we see among consumers are that they think a financial advisor collects fees just to put their money into an index, which they can do themselves,” said DeJohn. “They often do not have an understanding of the full breadth of how an advisor’s guidance can potentially translate to their own benefit. On the advisor side, the model can be used as a helpful tool to demonstrate to potential clients the value they may be able to offer.”

Advisor vs. no advisor results

One of the biggest findings of the study was that even after accounting for all money flowing out – including inflation, retirement withdrawals and advisor fees – financial advisors can potentially help clients earn an additional average annual net yield of 2.39% to 2.78% to their clients’ bottom lines versus those who do not employ an advisor, said DeJohn.

And perhaps just as important, DeJohn said, the client is still likely to take away the lion’s share of the dollar surplus generated by their relationship with a financial advisor. “The model estimates that roughly one-third of the extra money generated by the relationship goes to the advisor, while roughly two-thirds go to the client,” she said.

Additionally, the model suggests that several factors can potentially help improve the client’s ROI on the client-advisor relationship, including a higher starting net worth and starting the client-advisor relationship at a younger age to allow more time for the benefits to compound.

Financial advisor impact on a client's net worth

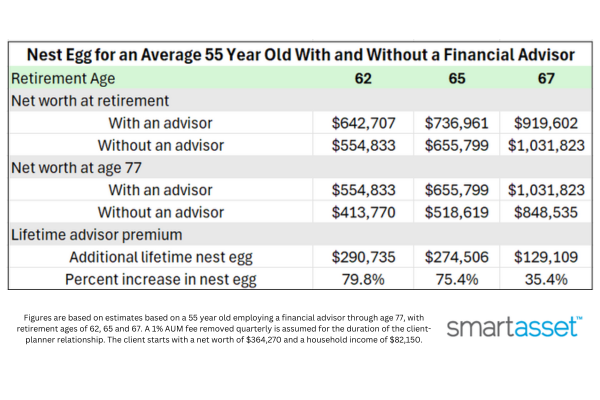

Financial advisors can help contribute to growing a client’s nest egg in many ways. SmartAsset’s estimates on the net benefit to this investment pot at age 77, not including any additional retirement income gained from the relationship, is as follows:

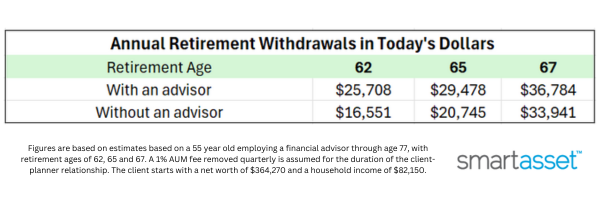

The improved annual withdrawal amounts demonstrate how professional planning can boost spending power in retirement, as well as the remaining nest egg, ensuring a better lifestyle even after fees are paid.

In summary, by age 77, the average 55-year-old stands to gain between $129,000 to nearly $291,000 in net worth, compared to a scenario without professional guidance, plus up to $763 more per month in retirement withdrawals, SmartAsset said.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

Utah regulators ask court to place Sentinel Security Life into rehab

Integrity Marketing Group acquiring The Quantum Group

Advisor News

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

More Advisor NewsAnnuity News

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

More Annuity NewsHealth/Employee Benefits News

- Pan-American Life Insurance Group Reports Record 2025 Results; Premiums Reached $1.86 Billion and Net Income Totaled $110 Million as Company Enters Its 115th Year

- LightSpun and Smile America Partners Announce Partnership to Accelerate Dental Provider Enrollment to Expand Treatment for 500K Underserved Kids

- Lawmakers try again to change ‘reflection in the mirror’ for cancer patients

- IF FINALIZED, PROPOSED CHANGES TO MEDICARE ADVANTAGE AND MEDICARE PART D WOULD IMPACT SENIORS' COVERAGE AND CARE IN 2027

- ASSEMBLYMEMBER WILSON INTRODUCES LEGISLATION TO PROTECT CALIFORNIANS FROM GENETIC AND BIOMARKER DISCRIMINATION IN INSURANCE

More Health/Employee Benefits NewsLife Insurance News

- National Life Group Ranked Second by The Wall Street Journal in Best Whole Life Insurance Companies of 2026

- Majority of Women Now Are the Chief Financial Officer of Their Household, Allianz Life Study Finds

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual Delivers Excellent 2025 Financial Results

- ACORE CAPITAL Named Alternative Lender of the Year ($15 Billion + AUM) by PERE Credit

More Life Insurance News