Public Option Gets A New Look

A new administration and a new Congress bring renewed opposition by the industry toward the possibility of a gradual broadening of current public health care programs — namely, the public option and single-payer health care.

Why do we have these proposals now?

“In general, there’s a lot of frustration that the cost of coverage is so much higher than it was in the past,” Janet Trautwein, CEO of the National Association of Health Underwriters, said at the association’s virtual Capitol Conference earlier this year. “Largely, it’s because of the high cost of medical care. But it’s also frustration over cost-sharing — how high deductibles are compared to in the past. People are asking, ‘Is there a different way to do this?’”

Frustration with the current system has led to full-blown single-payer proposals as well as to proposals for incremental additions to current government-run programs, Trautwein said. These proposals include Medicare for All, a buy-in to Medicare, a buy-in to Medicaid and a public option.

“What’s interesting and different and scary is that all of these programs would likely be permitted to use government-set prices in competition with private insurance,” she said. “Many providers have expressed concern over this. If everyone is paying Medicare rates, providers wouldn’t be able to stay in business. When you have a public option proposal offered alongside a private option, it creates a really unlevel playing field and it’s dangerous for the private system.”

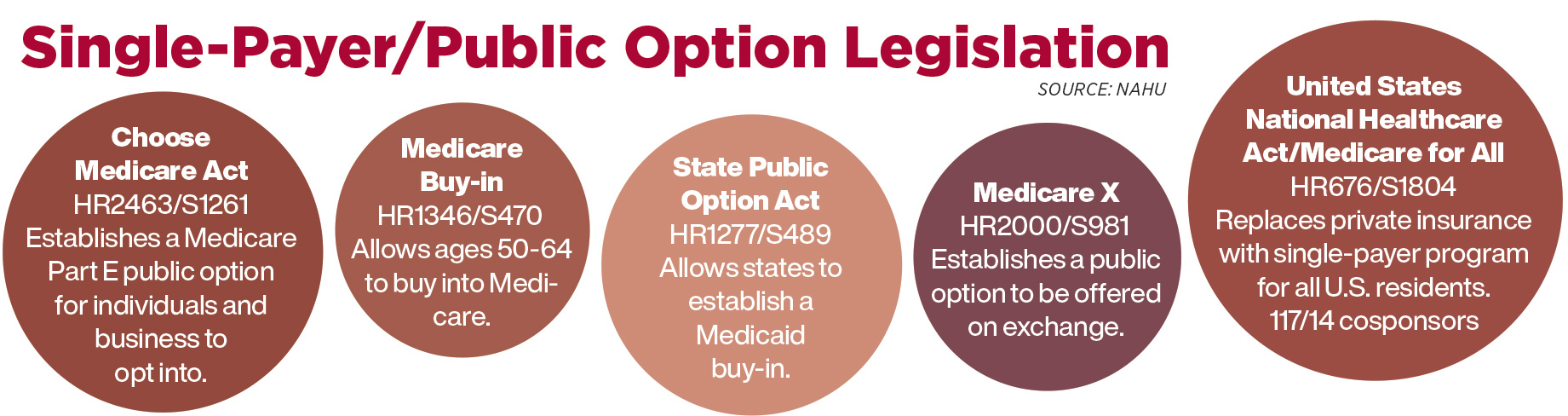

Several bills establishing government-run health programs already have been introduced in Congress. Trautwein gave a rundown on all of them.

Medicare for All Act. Most recently introduced in the House in 2019, this bill would replace private health insurance with a single-payer program for all U.S. residents. This would replace all current coverage, including the current Medicare system, Trautwein said. Coverage would be mandatory, and private or supplemental health insurance would not be permitted. Government would set the pricing for health care providers. The bill would cover a comprehensive set of services, including dental, vision and long-term care, with no cost-sharing. Physicians would not be permitted to take on private-paying patients outside the federal program.

Medicare buy-in proposals. Introduced during the previous House session, H.R. 1346/S 470 has not yet been reintroduced during the current session. It would permit a Medicare buy-in for those ages 50-64 for Parts A, B and D. Affordable Care Act premium tax credits and cost-sharing reductions would be available to reduce premiums and cost-sharing expense. The House version of this bill added a public plan Medicare Supplement. Those who are eligible for Medicaid cannot buy into this plan. Trautwein said it is unclear whether health insurance brokers have a role in this proposal.

Changes to Medicare eligibility. Proposed by the Biden campaign, this plan is different from a buy-in, Trautwein said. It creates an actual change to the Medicare eligibility age. Workers would be able to opt out of employer-sponsored coverage in favor of this program. Trautwein said it is unclear what the cost of accepting coverage at a younger age would be, and it’s unclear whether coverage would be offered on the health insurance exchange or whether participants would be eligible for a tax credit.

Public option proposals. Several of these have been announced, and all would create an unlevel playing field by establishing a government-set premium rate that would be lower than private insurance, Trautwein said. At the federal level, some proposals envision a public option run entirely by the Centers for Medicare & Medicaid Services. Other federal proposals envision programs run by other entities, such as carriers that already participate in the Medicare program.

Some proposals are aimed at only the individual market, others include the small-employer market and a few extend to the large-employer market.

Medicaid buy-in. Also known as the State Public Option Act, this proposal would allow states to create a buy-in for Medicaid. It would use modified community ratings, deductibles and coinsurance according to ACA rules. It would apply to the individual market. Primary care providers would be paid Medicare rates instead of Medicaid rates. Rates paid to other providers are not specified.

NAHU’s position on Medicare for All is that it would reduce standards of quality, eliminate choice, and create delays in treatment and access to care. This would be the result of doctors being unable to treat as many patients for the amount they would be paid, some doctors dropping out of the system, and continued financial pressure on hospitals.

An Uneven Playing Field

The public option “would destabilize current insurance markets by creating an unlevel playing field,” said Chris Hartmann, NAHU vice president of congressional affairs. “This would have the devastating effect of closing hospitals.”

A public option would destabilize the market by compelling providers to accept payments at much lower rates than private carriers can require them to accept, he said. More than 1,000 rural hospitals would be put at high risk of closure under a public option using Medicare provider reimbursement rates. These hospitals depend on a mixture of patient payment methods to allow them to provide services.

In addition, Hartmann said, the public option raises the questions of how much it would cost and how it would be paid for.

The cost of Medicare for All is not sustainable, Hartmann said, adding that such a plan would carry a price tag of $32 trillion over 10 years and an average tax increase of $24,000 per household at a time when the financial viability of our current Medicare plan is already in question.

Bad Debt Is Hurting Hospitals

However, a former health insurance executive turned health insurance whistleblower said he believes “another option for health insurance is good for you and bad for the insurance companies.” Wendell Potter is a former executive at Cigna and Humana, and now is president of the Center for Health & Democracy. Potter wrote a recent op-ed in Colorado’s Vail Daily, in which he spoke in favor of a public option proposal under consideration in Colorado.

Potter poked a hole in the argument that a government expansion of health care would deal a financial blow to rural hospitals. “The business practices of private insurers are perhaps the real (and biggest) threat to the state’s rural hospitals, and hospitals that serve racial and ethnic minority groups,” he wrote.

He cited a report by the Kaiser Family Foundation that found the gravest danger to small hospitals is “the outrageously high deductibles private insurers have imposed on Americans.”

The Kaiser report stated that many Americans end up buying high-deductible plans because the premiums are more affordable than those of plans with lower out-of-pocket costs. But consumers find they don’t have enough money to cover their deductibles, and the result is that hospitals are experiencing a growing problem of bad debt. To try to collect this debt, hospitals send unpaid bills to a collection agency or are forced to write the bills off as charity care.

According to the nonprofit National Rural Health Association, bad debt for rural hospitals has gone up about 50% since the passage of the Affordable Care Act in 2010.

Meanwhile, the executive director of an alliance committed to preventing single-payer health care said she is pessimistic on the chances that an expansion of government-run health care will happen this year, given the focus in Washington on pandemic relief.

Lauren Crawford Shaver heads the Partnership for America’s Health Care Future, an ad hoc alliance of American hospital, health insurance and pharmaceutical lobbyists committed to preventing legislation that would lead to single payer health care, expanding Medicare or creating Medicare for All.

Shaver also addressed NAHU on her belief that COVID-19 is driving the health care conversation in the U.S., and Medicare for All “is merely a talking point right now … it has lost steam in the broader conversation.”

Although Shaver was pessimistic on the likelihood of Medicare for All going anywhere in Congress this year, she said “there is still a lot of conversation around a public option.”

President Joe Biden campaigned in favor of establishing a public option over a single-payer system.

“But the devil is in the details of how you would pay for a public option,” Shaver told NAHU members. “At the federal level, I believe it will be hard to pass a public option at this point.” Shaver said she expects to see some public option bills introduced in Congress this year, “but it won’t drive the day. The public option is on the administration’s priority list, but it’s probably item three or four.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Readying For Retirement In A Recession

Make Sure Your Client’s Wishes Are Carried Out

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- Researchers at Eli Lilly and Company Target Migraine [The Role of Income and Health Insurance on Migraine Care: Results of the OVERCOME (US) Study]: Primary Headache Diseases and Conditions – Migraine

- Access Health CT Adds Special Enrollment Period For New State Subsidy

- Trademark Application for “EVERY DAY, A DAY TO DO RIGHT” Filed by Hartford Fire Insurance Company: Hartford Fire Insurance Company

- Researchers at City University of New York (CUNY) Target Mental Health Diseases and Conditions (Impact of Medicaid Institution for Mental Diseases exclusion on serious mental illness outcomes): Mental Health Diseases and Conditions

- Reports Outline Health and Medicine Findings from Jameela Hyland and Colleagues (Embedding Racial Equity in a Health Access Campaign in New York City: The Importance of Tailored Engagement): Health and Medicine

More Health/Employee Benefits NewsLife Insurance News