Life insurance and annuity sales: What’s ahead for 2025?

Variable universal life and registered index linked annuities are expected to see the highest percentage of growth across life and annuity products in 2025, two LIMRA executives said during a recent webcast.

Bryan Hodgens, head of LIMRA research, and John Carroll, LIMRA senior vice president and head of life and annuities, provided a glimpse at what 2025 could bring to life and annuity sales while recapping what is setting up to be a record year for some product sales in 2024.

Life sees sustainable spike since COVID-19

The COVID-19 pandemic brought about a significant amount of growth in life insurance sales, and that spike has been sustainable for the past four years, Carroll said.

For 2024, life insurance new annualized premium is expected to increase between 1% and 2% year over year, to $15.9 billion.

Policy count has been flat, Carroll said, while premium has gone up. “But overall, it’s good news. We did see growth this year.”

Whole life and term life make up about 85% of life insurance sales. Carroll said LIMRA expects whole life sales to end 2024 down from 2023. But term life sales have been on the rise, he noted, and attributed the increase to more young consumers buying term insurance digitally.

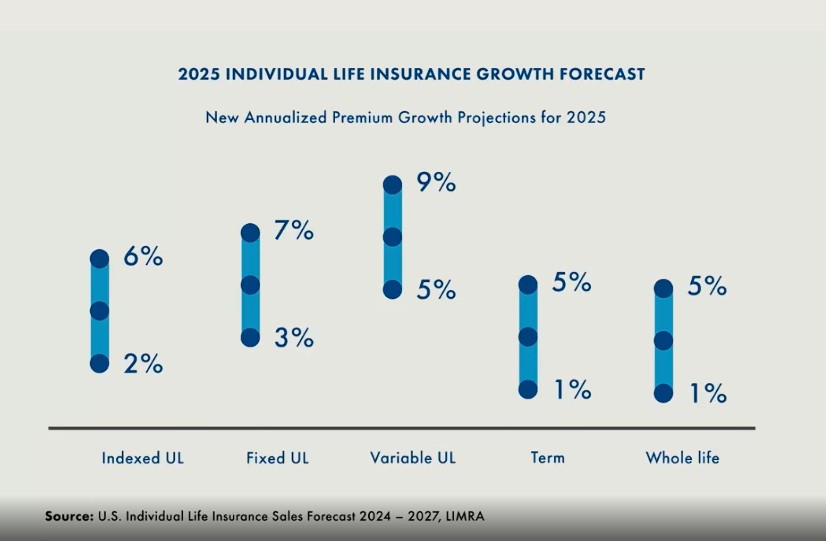

A big area of growth in life insurance will be VUL, Carroll predicted. LIMRA forecasts VUL sales for 2024 to be up between 12% and 16% over 2023. This year promises to be a strong year for VUL as well, he said, with sales expected to increase between 5% and 9% over 2024.

Indexed universal life carriers have been simplifying their products and processes, and sales figures are reflecting that, Carroll said. IUL sales are projected to grow between 3% and 7% from 2023 to 2024 and from 2% to 6% for 2025.

Conditions are ripe for annuity sales

Economic and demographic conditions combined to create a fertile environment for annuity sales, Hodgens said.

LIMRA estimates 2024 annuity sales to be $435 billion, up from $385 billion in 2023 and an increase of 70% since 2014.

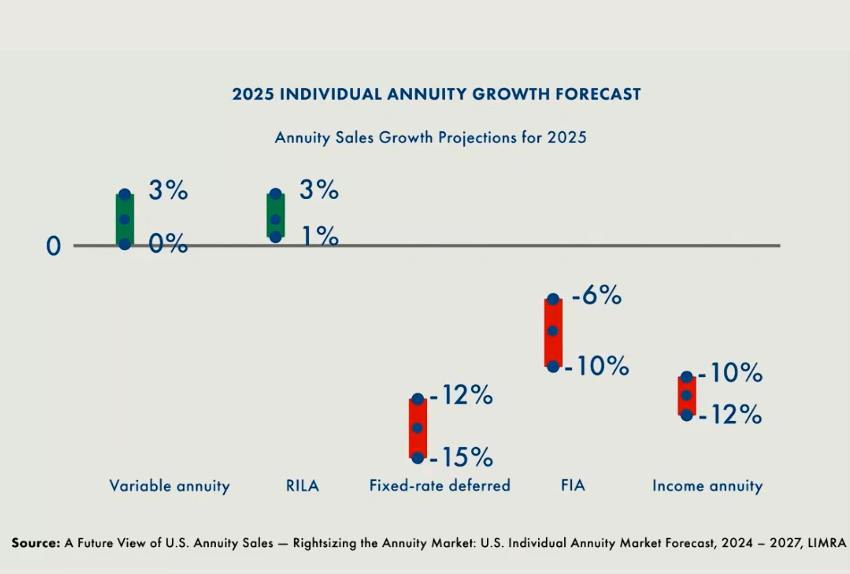

Fixed rate deferred annuities represent the largest area of growth in 2024, he said, with RILA and fixed indexed annuity sales also on the rise. Single premium immediate annuities and deferred income annuities will have record sales in 2024.

“It has been a really good few years but things are changing,” Hodgens said. Consumer interest in fixed rate deferred annuities is expected to wane as interest rates fall.

Still, annuity sales are predicted to be robust in 2025 as an aging population seeks security and equity markets continue to be strong but volatile.

RILAs and variable annuities are expected to see growth of between 1% and 3% from 2024 and 2025. Fixed rate deferred, fixed indexed and income annuities are expected to see sales decline.

RILAs are expected to close out 2024 with between $62 billion and $66 billion in sales, Hodgens said, for an 11th consecutive year of record sales. This comes after RILA sales in 2023 totaled $48 billion.

For 2025, LIMRA projects RILAs sales will continue to lead growth among annuity products.

“This is the future,” Carroll said.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

In wake of fires, Calif. issues 1-year moratorium on insurance cancellations

Common myths and misconceptions about IUL

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Wellmark still worries over lowered projections of Iowa tax hike

- Families defend disability services amid health cuts

- RANDALL LEADS 43 DEMOCRATS IN DEMANDING ANSWERS FROM OPM OVER DECISION TO ELIMINATE COVERAGE FOR MEDICALLY NECESSARY TRANS HEALTH CARE

- Trump's Medicaid work mandate could kick thousands of homeless Californians off coverageTrump's Medicaid work mandate could kick thousands of homeless Californians off coverage

- Senator Alvord pushes back on constant cost increases of health insurance with full bipartisan support

More Health/Employee Benefits NewsProperty and Casualty News

- New Mexico governor signs major medical malpractice bill into law

- 2 attorneys are in a runoff to represent New Orleans East in the state House

- State insurance commissioner is focusing insurance discounts for fortified roofs

- Governor signs medical malpractice bill, predicts it will deliver quick results

- Home insurance rates rising in La Plata County amid growing wildfire risk

More Property and Casualty News