Make Sure Your Client’s Wishes Are Carried Out

When my wife and I moved into our house seven years ago, she asked me to paint a spare bathroom because she didn’t care for the dated colors. She brought it up to me again the other day, so I told her, “Honey, I said I will do it. You don’t need to remind me every six months.” Of course, I was stalling because, one, I hate painting, and two, I’m sure hunter green and burgundy will come back into style eventually.

Well, they aren’t back in style — yet —so I started the project, finally. While I was taping off the trim, I considered how painting projects are 80% preparation and 20% actual painting. And it isn’t until you are completely finished painting and remove the masking tape that you truly know how well you did. Because the masking tape doesn’t lie.

Helping a client set up the beneficiary designations on their annuity contract can be similar to a painting project. Sometimes it’s not until after the client dies that you find out whether you helped them set things up as they truly intended. Or even worse, you find out you didn’t. And once they have died, there is no going back; a client can’t sign a beneficiary change form from beyond.

Unfortunately, I have seen situations where a death claim did not pay out as intended. How did it happen? Something was overlooked, the annuity contract was misunderstood, or the advisors simply didn’t ask the right questions or conduct due diligence. I’m sharing my experiences with the hope that you can avoid potentially devastating situations with your clients.

As part of your fact-finding, ask your client, “How do you want these monies disbursed when you are gone?”

Setup May Vary By Carrier

Don’t assume that each carrier’s annuity contracts operate the same way. Is the annuity contract owner-driven or annuitant-driven? The distinction is important.

An owner-driven contract triggers a death-claim payout upon the death of the owner — not the annuitant. On owner-driven contracts, you need to consider joint ownership; does the contract pay out on the death of the first owner, or does it continue until the death of the second owner?

Annuitant-driven contracts might be more appropriate when non-natural ownership applies (corporate-owned, trust-owned), where there is no “death” of the owner and the death of the annuitant triggers the death claim payout.

Setup Combinations Abound

Consider the setup. Single owner/single annuitant, joint owner/joint annuitant or owner other than annuitant. There are a multitude of combinations for nonqualified annuities. Know how the annuity contract works in all situations.

Here’s an example: A married couple has two grown children to whom they want to pass money after they have both died. They choose an owner-driven annuity contract for their nonqualified money. A joint ownership is established with “surviving spouse” as the primary beneficiary and both children listed as contingent beneficiaries. The nursing home waiver or terminal illness waiver could apply to both owners. Upon the death of the first owner, the surviving spouse potentially has three options on a death claim:

» Keep the annuity contract going with the use of spousal continuation.

» Move the funds to another carrier.

» Take receipt of the funds through a death claim payout.

In addition, both owners are subject to nursing home and terminal illness waivers. If the owners die simultaneously, the proceeds go to the children instead of the parents’ estate.

Establish Contingent Beneficiaries

Use contingent beneficiaries to avoid claims paying to a client’s estate. When a claim is paid to a client’s estate, it can take much longer for the claim to be paid and could end up being paid to someone other than the client’s intended recipient. That uncle no one has heard from in decades could suddenly show up trying to claim a piece of the pie.

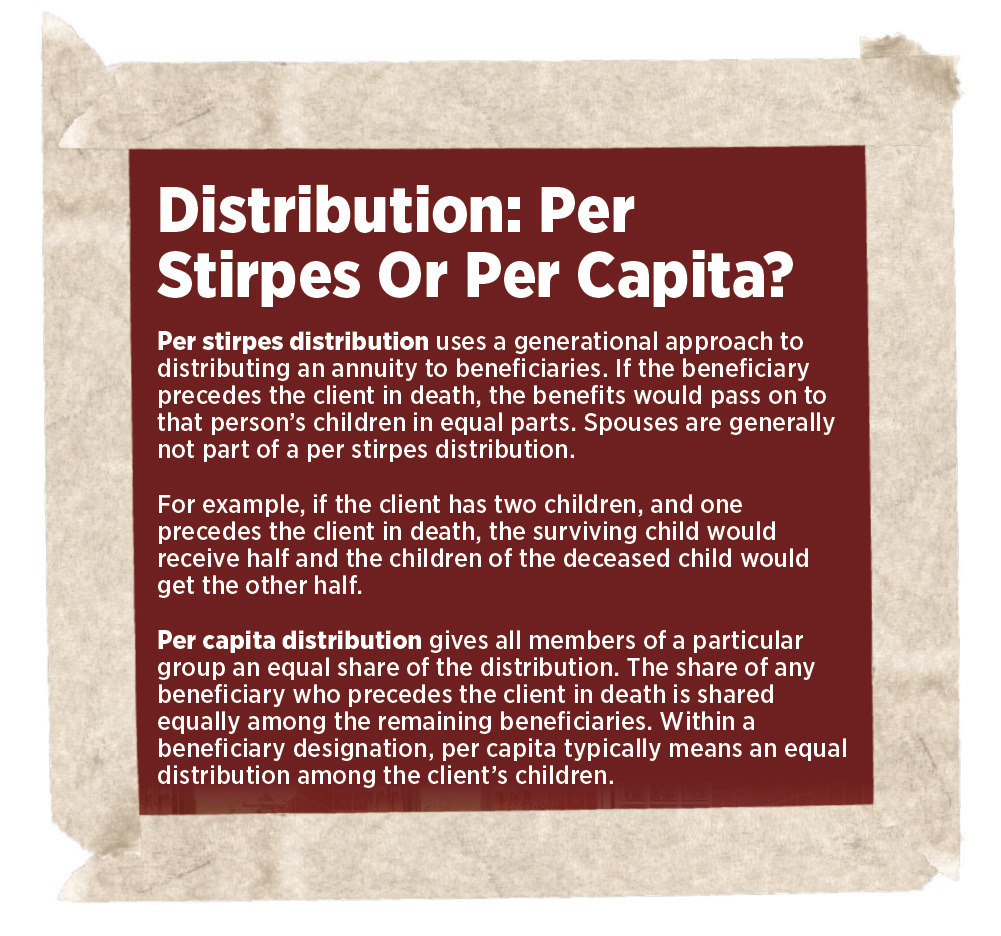

Per Stirpes vs. Per Capita

Per stirpes generally means that the descendants of the deceased beneficiary will inherit their share. Per capita generally means assets will be passed on equally to the beneficiaries who are living at the time of the death of the person whose death triggers the death payout. This is important if a beneficiary predeceases the client. Does the carrier default to one or to the other?

Don’t assume a client’s will is going to override everything, because it usually doesn’t.

When To Address Beneficiary Designations

Annual reviews provide an excellent opportunity to see whether anything in your client’s life has changed. Marriage and divorce as well as the births of children and grandchildren are big life events that should be considered. An annual review can also be an opportunity to make corrections if things are not set up as intended. Not to mention it’s an opportunity for additional sales, finding money in motion and getting referrals.

Asking the right questions and knowing how the carrier’s annuity contract actually operates after a death occurs can help you make sure you are painting the best outcome for your clients and their loved ones.

Sales tip: The next time you begin to fill out an annuity application with a client, start with the beneficiary section. That way, you are starting with a more emotional part of the process and you are spending an adequate amount of time on a very important part of the paperwork.

Painting tip: Stall as long as you can. Those trendy colors from yesteryear will come back in style. You’ll see.

Public Option Gets A New Look

Star Wars And IUL: Sometimes You Both Frustrate Me

Advisor News

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

- Selling long-term-care insurance in a group setting

- How to overcome the fear of calling prospects

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Low-income diabetes patients more likely to be uninsured

- UnitedHealth execs bemoan ‘unusual and unacceptable’ Q1 financials

- LTCi proves its value beyond peace of mind

- Governor signs ban on drug middlemen owning pharmacies

- The lighter side of The News: Political theater; A bone to pick with a Yankee; Health insurers have mascots?

More Health/Employee Benefits NewsLife Insurance News

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

- IUL sales: How to overcome ‘it’s too complicated’

More Life Insurance News