Star Wars And IUL: Sometimes You Both Frustrate Me

The Death Star trench run in the original Star Wars movie was tense, and I loved it as a kid. But when Luke Skywalker, about to be pushed into the Sarlaac’s mouth, sprang off of the Desert Skiff’s plank and caught his lightsaber in Return Of The Jedi — that was a pivotal moment for me as a child. It deepened my love of a galaxy far, far away.

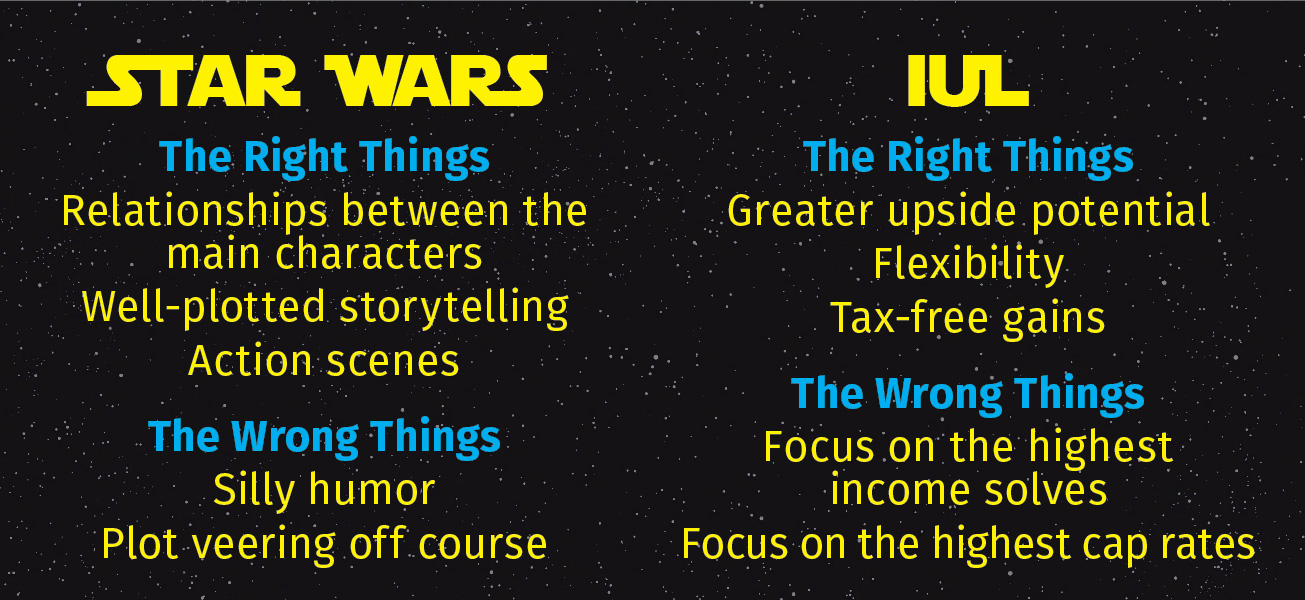

Years later, the disappointing (to me) Prequel Trilogy came out and my love for Star Wars was almost squashed. I still had the Original Trilogy, but that was all I really had. These days, we are knee-deep in Star Wars: Sequel Trilogy, Rogue One, Solo, Clone Wars, Rebels, The Mandalorian, video games, books, comics and more! Some of it is great, some of it is bad, and some of it is fine. It is disappointing, though, that something that was so great can also be so frustrating. At times, indexed universal life insurance, and especially how it is positioned and sold, makes me feel the same way.

Focused On The Wrong Things

I think Star Wars veers off course when it focuses on the wrong things – silly humor, midichlorians and the subversion of fan expectations. IUL sales can veer off course when we focus on the wrong things as well. What are some of the wrong things? Let’s talk about two items.

First, why do we focus so much on looking at which carriers have the highest income solves? I know why we do, (we’re often focused on the big numbers) but why do we put so much stock into it? An IUL illustration is run using a very specific set of parameters and assumptions that will almost certainly not happen in the real world, yet we are often asked, “Which carrier has the best income solves?” and that information is often the determining factor in a sales recommendation. How many of us would purchase a computer or smart phone based on which one has the highest multi-core performance score in Geekbench? I would guess not many view that statistic, important though it may be, as one of the crucial deciding factors in a purchase decision.

Second, why do we focus so much on which carriers have the highest cap rates? Again, I know why we do, but, again, why do we put so much stock into it? Cap rates will fluctuate based on a number of factors, such as market volatility, interest rate volatility, general account returns and options prices. We cannot control any of those factors, yet we are often asked, “Which carriers have the highest cap rate right now?” How many of us would purchase a house with a 3/1 adjustable rate mortgage and assume that the interest rate in the first three years will be the same rate in year 20? We would need to assume there will be movement, either up or down, and plan accordingly.

IUL illustrations certainly allow us to make changes to the default assumptions, such as lowering the illustrated rate from the default or max illustrated rate, or we may be able to insert a schedule of returns so that we can see the product’s performance when some years show a 0% return. Too often, though, we look at numbers in a ledger as the determining factor in why one product is recommended over another. Those numbers certainly matter, especially when a client’s budget and premium tolerance is more limited, but other criteria should be given more weight.

Focus On The Right Things

In my opinion, Star Wars stays on course when it focuses on the right things – relationships between the main characters, satisfying character arcs, well-plotted storytelling, and action that serves the story and characters. IUL sales stay on course when we focus on the right things as well. What are some of the right things? There are many considerations in any life insurance sale, including IUL sales, and in some cases, this may mean unlearning what you have learned.

Here are a few questions to keep in mind to help guide our discussions so we do not put too much focus on a number on the ledger page or a cap rate:

- Is the life insurance need for personal or business purposes?

- Is the focus on death benefit protection, accumulation/income, or somewhere in between?

- If it is protection-focused, is there a preference between lifetime guarantees or life expectancy guarantees?

- Is there an interest in non-S&P 500 indices for diversification purposes or is there more comfort in using the S&P 500?

- Is there a desire for long-term care or chronic illness protection?

- How highly does the client value a carrier that offers proactive post-issue policy management programs?

These questions, and many others, get to the heart of the matter. The client has goals to accomplish via life insurance and our role is to assist in finding the right carrier and product to accomplish those goals.

The Kessel Run Was Just A Shortcut

Han Solo is famous for making the “Kessel Run” in 12 parsecs. As a child, I thought that was because the Millennium Falcon was very fast, since Han’s boast was in the context of the Falcon’s speed. It turns out, a parsec is a unit of distance, not time. The movie Solo shows that Han took a dangerous shortcut through the Kessel Run and that is how he made the Kessel Run in 12 parsecs.

We all want rules of thumb and shortcuts to help us make a complex decision quicker and easier. Looking at numbers on a ledger, a temporary cap rate, or any other singular feature as a shortcut to determining a product’s strength is quick and easy, but it is short-sighted. If we are relying on cap rates, illustrated values, or other similar items that can (and will) change, we are likely to be disappointed. But, if we are basing our decision on product features, riders and benefits that will not change, we are far less likely to be disappointed.

May this serve as a gentle reminder of the importance of taking the time to understand our clients’ needs, their goals and the best overall package that a carrier and product may deliver, even if it is not the best income solve, highest cap rate, lowest premium or any other pre-conceived notion we have on what is “best.”

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Make Sure Your Client’s Wishes Are Carried Out

ABG: Always Be Growing

Advisor News

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

- Selling long-term-care insurance in a group setting

- How to overcome the fear of calling prospects

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Low-income diabetes patients more likely to be uninsured

- UnitedHealth execs bemoan ‘unusual and unacceptable’ Q1 financials

- LTCi proves its value beyond peace of mind

- Governor signs ban on drug middlemen owning pharmacies

- The lighter side of The News: Political theater; A bone to pick with a Yankee; Health insurers have mascots?

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News