Open The Door To A Policy Review

The COVID-19 pandemic has spurred awareness and interest in life insurance like never before. A recent LIMRA study revealed nearly one-third of consumers (31%) said COVID-19 has made it more likely they will purchase life insurance in the next 12 months and 102 million Americans believe they need more life insurance. Coupled with potential tax law changes that threaten to drastically change estate tax and trust planning, now is an opportune time to reach out to clients to review their existing plans and coverage.

Why Is Policy Review Important?

All too often, life insurance policies are purchased and largely forgotten. This can lead to insufficient coverage, paying too much for coverage, familial discord when beneficiary designations are not up to date, and other issues. By helping your clients and trustees conduct routine policy reviews, you can uncover gaps in coverage and identify new planning opportunities.

The key to getting a client to engage in policy review and answer your email or return your call is by ensuring you are asking thoughtful, personalized, probing discovery questions. For example, consider asking:

1. “What has changed in your life since we last met?”

2. “When was the last time your policy was reviewed? I’d like to take a look to see whether it is still performing as expected.”

3. “There are significant proposed tax law changes that I am concerned may impact your estate plan. I’d like to discuss this with you as soon as possible.”

When it comes to sending emails or leaving voicemails, less is often more. Keeping your message short, but briefly highlighting the value you can offer, can help to hook clients who want to learn more and can lead to a call-back.

Policy Review Basics

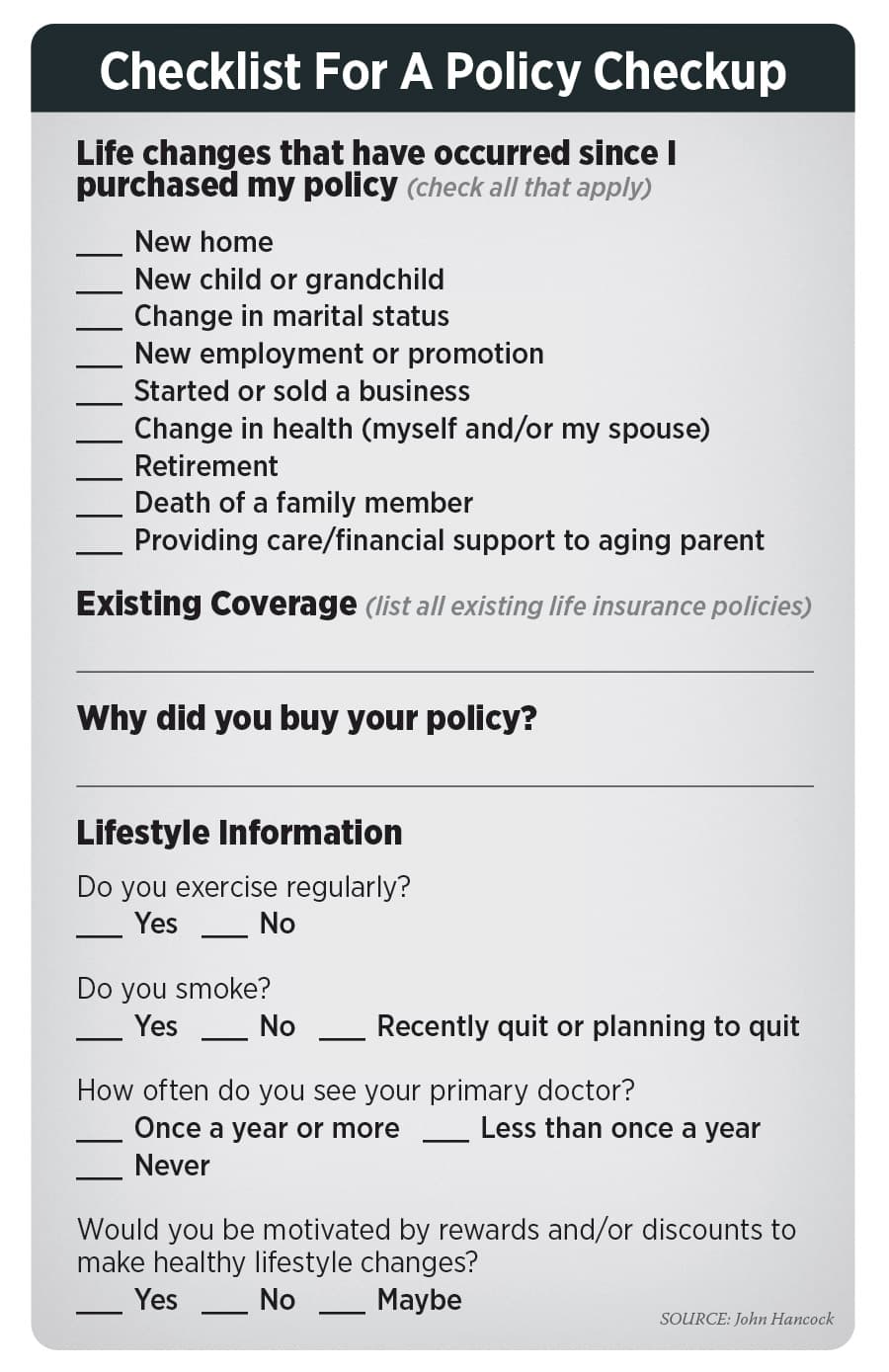

When you meet with your client to begin the policy review process, the first step is to understand why the insurance was purchased and to determine whether the existing policy is still meeting that need today. This includes helping clients review beneficiary designation changes at least every two to three years or sooner if there has been a change in life circumstances, such as the start of a business, marriage, divorce, the birth of a child or a death.

The second step is to determine whether the policy is still performing as intended by reviewing the underlying policy and investments. There are a variety of reasons a policy can fail to perform as initially illustrated. For example, older whole life or universal life policies may be performing poorly due to a combination of factors including a low interest rate environment and changes to a carrier’s cost of insurance charges.

Timing of premium payments or inadequate policy funding also can be an issue. In some cases, particularly where poor policy performance or large loans against the policy cash value put the policy at risk of lapse, you may need to increase the premium or reduce the death benefit. In other cases, a tax-free 1035 exchange of the policy may be advisable. For example, if an older mortality table was used or if the insured’s health has improved, a new policy may mean lower premiums.

Replacing the policy also can allow the client to address holistic planning goals, such as adding long-term care protection or providing clients access to new products or product features on the market.

Managing Trust-Owned Life Insurance

In the context of policies owned by irrevocable life insurance trusts, routine policy review by the trustee is especially critical. Failing to proactively manage and administer an underlying trust-owned policy potentially can frustrate planning goals. In addition, the trustee can be held personally liable for breach of fiduciary duty to the trust beneficiaries if a policy does not perform as expected. With changes to intentionally defective grantor trusts potentially on the horizon, now is an especially important time for insurance professionals to have discussions with ILIT trustees.

TOLI – A Ticking Time Bomb Or A Golden Opportunity?

Trustees have a fiduciary duty to the trust beneficiaries, meaning trustees are required to manage trust assets with the best interests of all beneficiaries in mind and to maintain an objective standard of care. For TOLI policies, trustees’ fiduciary responsibilities include facilitating the ongoing payment of premiums, income tax management and providing notice to Crummey beneficiaries. Trustees also have important investment duties, as outlined by the Uniform Prudent Investor Act and further defined by case law over the years, requiring that trustees today take a more proactive approach to managing trust-owned policies.

There have been several notable cases where ILIT beneficiaries have sued the trustee for breach of fiduciary duty. The TOLI litigation of the past decade has impacted both corporate trustees as well as trustees who were “nonprofessional” trustees, such as family members or friends. Nonprofessional trustees account for roughly 90% of ILIT trustees, according to “The Life Insurance Policy Crisis,” by Randolph Whiteclaw and Henry Montag (American Bar Association 2017).

The unfortunate reality is that many nonprofessional trustees may be unaware of their responsibilities with regard to ongoing insurance and investment management and are less likely to have expertise in understanding the mechanics of life insurance policies. These trustees may need to engage an independent entity to evaluate the policy’s health. Insurance professionals also have a unique opportunity to work alongside trustees to assist with ongoing policy review. Those who do so may be well-positioned to uncover opportunities to help trustees accomplish the trust’s goals.

Grantor Trust Tax Proposals As A Catalyst For Review

As of press time for this article, Congress was negotiating a $3.5 trillion infrastructure bill, with spending offset by numerous proposed tax increases on wealthy clients and corporations. In particular, changes to the grantor trust rules may have a significant impact on TOLI.

ILITs are typically “grantor trusts.” This is a type of irrevocable trust containing provisions or powers as defined in the Internal Revenue Code that cause the grantor to be treated as the owner of trust assets for income tax purposes but keep assets outside of the trust for estate tax purposes. Under the proposals, a new section of the code, IRC §2901, would cause property held in a grantor trust created after the enactment date to be included in the grantor’s gross estate. Additionally, contributions to grandfathered grantor trusts after the date of enactment would result in partial estate tax inclusion. This is concerning because many clients fund the premiums for life insurance owned in grantor ILITs on an annual basis using the annual exclusion or Crummey gifts.

Although what ultimately may become law still remains to be seen, there are certain steps insurance professionals can take now to alleviate concerns and offer flexible solutions. As a first course of action, consider reaching out to clients who have existing grantor trusts to discuss potential planning options before changes can go into effect.

For existing ILITs with ongoing premiums, the planning team may want to encourage some clients to make lump-sum gifts to these trusts before changes could go into effect. If large gifts are not an option, after the date of enactment, loans or split-dollar arrangements would likely be required to fund ongoing premiums in a grandfathered grantor trust. The client could consider funding the grantor trust with a smaller seed gift now to enable the trust to pay interest or economic benefit if loans or split-dollar arrangements are required to fund ongoing premiums in the future.

These types of planning conversations may open the door for reviewing existing coverage in the trust as well. While clients and their attorneys consider options for trust drafting and funding, insurance professionals can conduct policy reviews, which may uncover the need to update or improve coverage to meet current planning objectives and prepare for potential tax law changes. For example, if funding ongoing premiums after potential enactment is a concern, agents could explore 1035 exchanges for single pays and short pays. Moreover, if estate tax exemptions are reduced under proposed legislation, there may be a need for increased death benefit liquidity to pay for estate taxes.

With so much general uncertainty, clients are likely to be more concerned with their protection needs than ever before. Now is an excellent time to reach out to your clients to assist with policy review. Financial professionals may find that taking the initiative helps to build trust

and strengthen client relationships, and it may help identify new insurance needs.

Carly Brooks is senior vice president and head of advanced sales at Crump Life Insurance Services, an AmeriLife company. Contact her at [email protected].

December: Maybe Not So Dark?

Filling The Generational Pipeline — With Mark Squires

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- FACT SHEET: PLEDGES FROM MEDICAID TECHNOLOGY COMPANIES TO SUPPORT COMMUNITY ENGAGEMENT IMPLEMENTATION AND RELATED MEDICAID SYSTEM IMPROVEMENTS

- SSI in Florida: High Demand, Frequent Denials, and How Legal Help Makes a Difference

- SilverSummit continues investment in rural healthcare

- Could workplace benefits help solve America’s long-term care gap?

- Long-Term Care Insurance: What you need to know

More Health/Employee Benefits NewsLife Insurance News