Wink reports a 4Q dip in annuity sales to close a record-breaking 2024

Total 2024 annuity sales raced to another record, according to Wink’s Sales & Market Report, even if the industry did close the year on a down note.

Total fourth-quarter sales for all annuities were $100.2 billion, down 13% compared to the previous quarter. Total 2024 sales for all annuities were $427.7 billion.

All annuities include the multi-year guaranteed (MYG) annuity, traditional fixed annuity, indexed annuity, structured annuity, variable annuity, immediate income (SPIA), and deferred income annuity product lines.

Noteworthy highlights for all annuity sales in the fourth quarter include Athene USA ranking as the No. 1 carrier overall for annuity sales, with a market share of 8%. Equitable Financial came in second place, while Allianz Life, New York Life, and Corebridge Financial completed the top five carriers in the market, respectively.

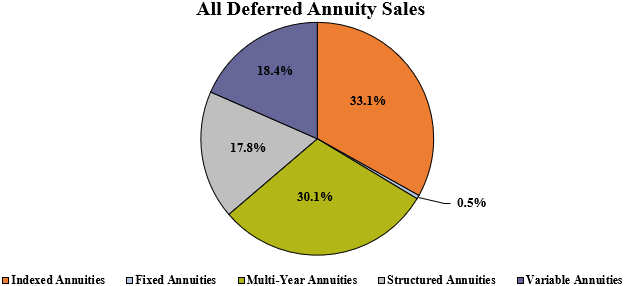

Total fourth-quarter sales for all deferred annuities were $96.6 billion, down 12.8% when compared to the previous quarter and down 6.7% when compared to the same period last year.

Total 2024 sales for all deferred annuities were $412.8 billion and increased 18.8% from the previous year. All deferred annuities include the multi-year guaranteed annuity, traditional fixed, indexed annuity, structured annuity, and variable annuity product lines.

Noteworthy highlights for all deferred annuity sales in the fourth quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 8.3%. Equitable Financial moved in the second-ranked position, while Allianz Life, Corebridge Financial, and Massachusetts Mutual Life Companies completed the top five carriers in the market, respectively.

Equitable’s Structured Capital Strategies Plus 21, a structured annuity, was the No. 1 selling deferred annuity, for all channels combined, in overall sales for the quarter.

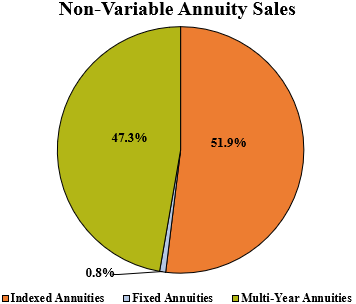

Total fourth-quarter non-variable deferred annuity sales were $61.6 billion, down 22.7% compared to the previous quarter and down 22.5% compared to the same period last year. Total 2024 non-variable deferred annuity sales were $288.5 billion and increased 13.8% from the previous year. Non-variable deferred annuities include the MYG annuity, traditional fixed annuity, and indexed annuity product lines.

Noteworthy highlights for non-variable deferred annuity sales in the fourth quarter include Athene USA ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 12.4%. Corebridge Financial continued in the second-ranked position, while Massachusetts Mutual Life Companies, Sammons Financial Companies, and Allianz Life completed the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year, a MYG annuity, was the No. 1 selling non-variable deferred annuity for the quarter, for all channels combined, in overall sales for the third consecutive quarter.

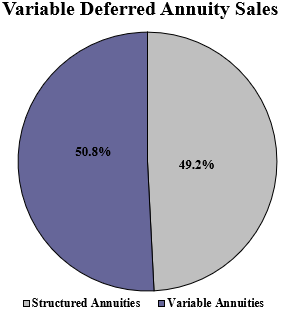

Total fourth-quarter variable deferred annuity sales were $35 billion, up 12.3% when compared to the previous quarter and up 45.2% when compared to the same period last year. Total 2024 variable deferred annuity sales were $124.3 billion and increased 32.2% from the previous year. Variable deferred annuities include structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the fourth quarter include Equitable Financial ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 16.7%. Jackson National Life continued in the second-place position, as Lincoln National Life, Prudential, and Allianz Life completed the top five carriers in the market, respectively.

Equitable’s Structured Capital Strategies Plus 21, a structured annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall sales for the third consecutive quarter.

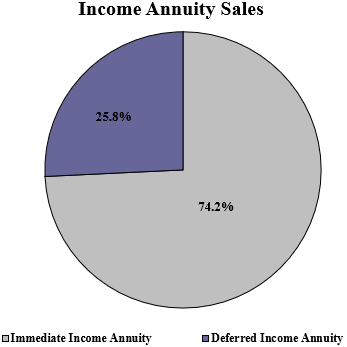

Total fourth-quarter income annuity sales were $3.5 billion, down 17.2% when compared to the previous quarter. Total 2024 income annuity sales were $14.9 billion. Income annuities include immediate income annuity (SPIA) and deferred income annuity product lines.

Noteworthy highlights for income annuity sales in the fourth quarter include New York Life ranking as the No. 1 carrier overall for income annuity sales, with a market share of 37.2%. Western-Southern Life Assurance Company continued in the second-ranked position, as Massachusetts Mutual Life companies, Nationwide, and Penn Mutual completed the top five carriers in the market, respectively.

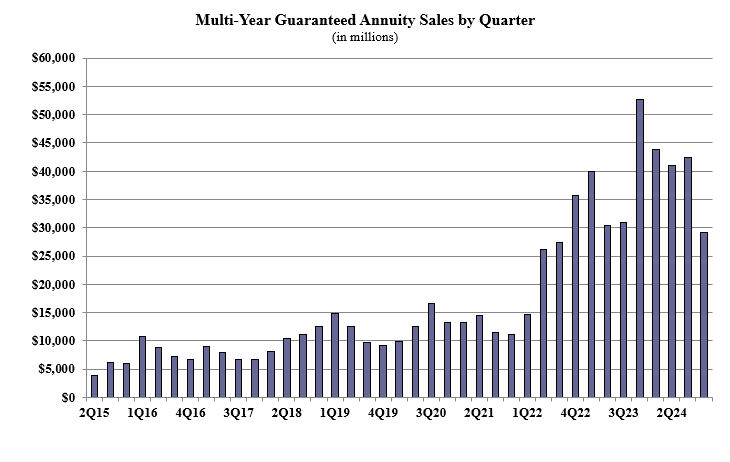

Multi-year guaranteed annuity (MYGA) sales in the fourth quarter were $29.1 billion, down 31.3% compared to the previous quarter, and down 44.6% compared to the same period, last year. Total 2024 MYGA sales were $156.3 billion and increased 1.5% from the previous year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the fourth quarter include Athene USA ranking as the No. 1 carrier, with a market share of 16.9%. Massachusetts Mutual Life Companies moved into the second-ranked position, while New York Life, Corebridge Financial, and Western-Southern Life Assurance Company concluded as the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year product was the No. 1 selling multi-year guaranteed annuity, for all channels combined, for the third consecutive quarter.

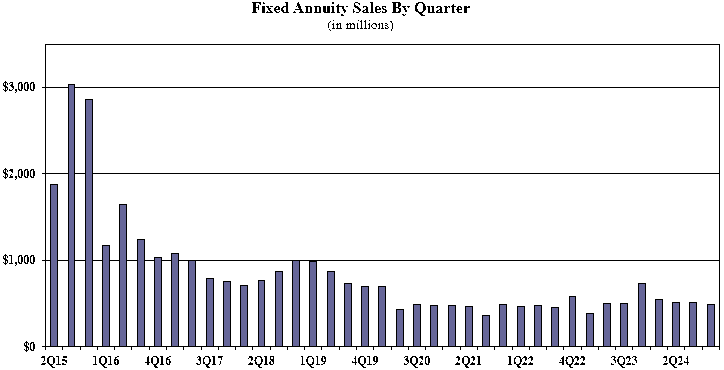

Traditional fixed annuity sales in the fourth quarter were $491.4 million, down 4.9% when compared to the previous quarter, and down 32.7% compared with the same period last year. Total 2024 traditional fixed annuity sales were $2 billion and declined 2.4% from the previous year. Traditional fixed annuities have a fixed rate guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the fourth quarter include Global Atlantic Financial Group ranking as the No. 1 carrier in fixed annuities, with a market share of 16.3%. CNO Companies ranked second, while Modern Woodmen of America, National Life Group, and EquiTrust concluded as the top five carriers in the market, respectively. Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined, for the eighteenth consecutive quarter.

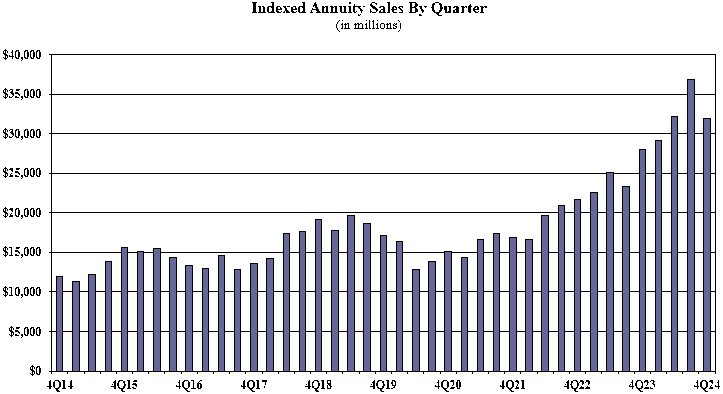

Indexed annuity sales for the fourth quarter were $31.9 billion, down 13.1% when compared to the previous quarter, and up 22.2% compared with the same period last year. This was a record-setting year. Total 2024 indexed annuity sales were $130 billion, topping the prior year’s record sales by 33.7%. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

Noteworthy highlights for indexed annuities in the fourth quarter include Sammons Financial Companies ranking as the No. 1 seller of indexed annuities, with a market share of 9.9%. Allianz Life ranked second, while Athene USA, Corebridge Financial, and American Equity Companies completed the top five carriers in the market, respectively. American Equity’s IncomeShield 10 was the No. 1 selling indexed annuity, for all channels combined, for the quarter.

“While indexed annuity sales were down for the quarter, low CD rates and an upward-trending market lent to increases in this product line for the same quarter last year, as well as for 2024,” said Sheryl Moore, CEO of both Wink, Inc., and Moore Market Intelligence.

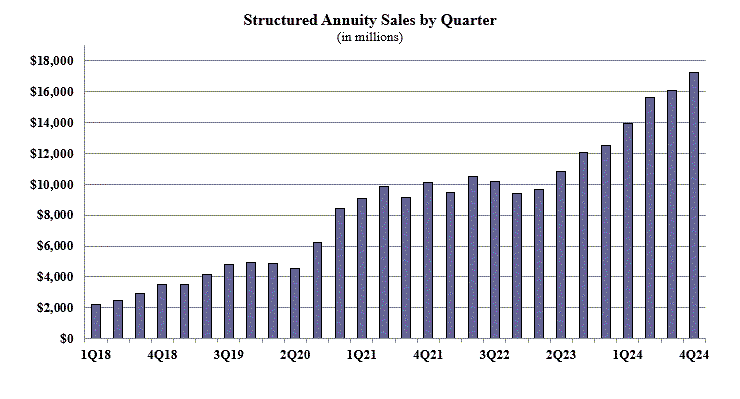

Structured annuity sales in the fourth quarter were $17.2 billion, up 7.1% compared to the previous quarter, and up 38% compared to the same period last year. This was a record-setting year; total 2024 structured annuity sales were $62.9 billion, topping the prior year’s record sales by 39.6%. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Noteworthy highlights for structured annuities in the fourth quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 21.7%. Prudential ranked second, while Allianz Life, Brighthouse Financial, and Jackson National Life completed the top five carriers in the market, respectively. Equitable’s Structured Capital Strategies Plus 21 was the No. 1 selling structured annuity, for all channels combined, for the third consecutive quarter.

“Structured annuity sales keep going up, up, up,” exclaimed Moore. “Consumers want a limit to how much they can lose but have the opportunity for fantastic gains as well.”

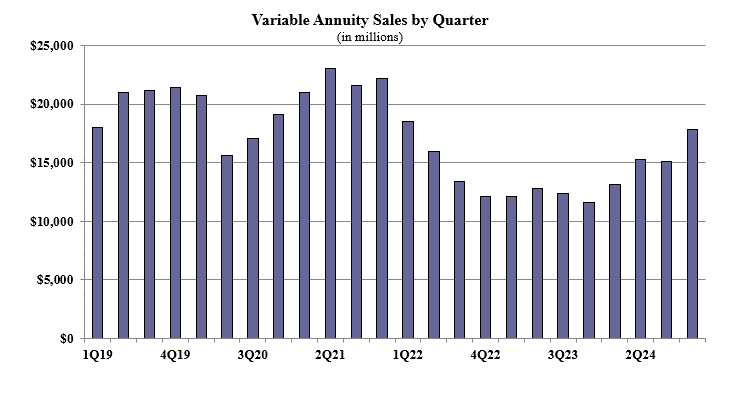

Variable annuity sales in the fourth quarter were $17.8 billion, up 17.9% compared to the previous quarter, and up 52.9% compared to the same period last year. Total 2024 variable annuity sales were $61.3 billion and increased 25.4% from the prior year. Variable annuities have no floor, and the potential for gains/losses is determined by the performance of subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the fourth quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 15.3%. Equitable Financial ranked second, while Lincoln National Life, Nationwide, and New York Life finished as the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the twenty-third consecutive quarter, for all channels combined.

“The steady growth in the market lent to much stronger VA sales, but with the volatility in the market for 1Q25, I would anticipate that VA sales will be down for next quarter’s data,” explained Moore.

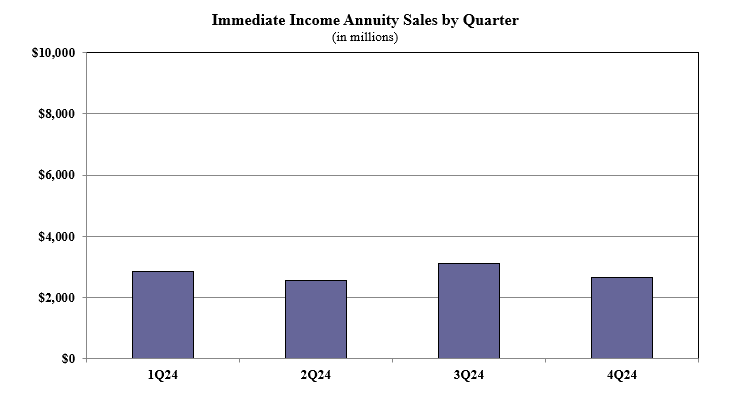

Immediate income annuity sales in the fourth quarter were $2.6 billion, down 14.8% compared to the previous quarter. Total 2024 immediate income annuity sales were $11.1 billion.

Noteworthy highlights for immediate income annuities in the fourth quarter include New York Life ranking as the No. 1 carrier in immediate income annuities, with a market share of 36%. Massachusetts Mutual Life Companies ranked second, while Nationwide, Western-Southern Life Assurance Company, and Penn Mutual finished as the top five carriers in the market, respectively.

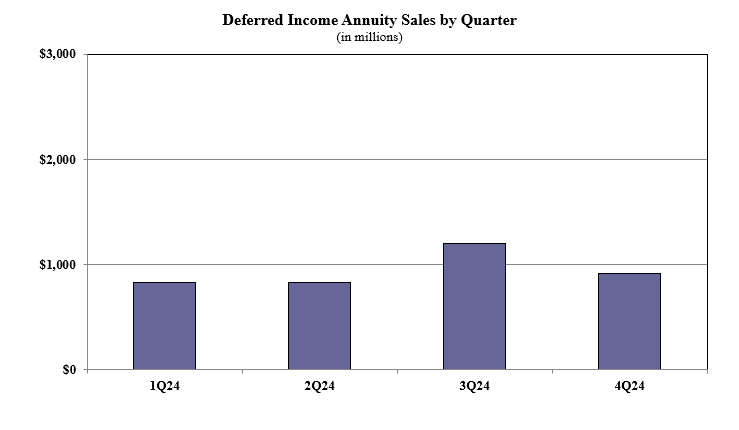

Deferred income annuity sales in the fourth quarter were $917.1 million, down 23.6% as compared to the previous quarter. Total 2024 deferred income annuity sales were $3.7 billion.

Noteworthy highlights for deferred income annuities in the fourth quarter include New York Life ranking as the No. 1 carrier in deferred income annuities, with a market share of 40.8%. Western-Southern Life Assurance Company ranked second, as Massachusetts Mutual Life Companies, Integrity Life Companies, and Global Atlantic Financial Group finished as the top five carriers in the market, respectively.

One hundred and thirty-seven annuity providers participated in the report.

Globe Life hit with a pair of lawsuits over handling of 2024 data breach

A changing approach to client prospecting

Advisor News

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

More Advisor NewsHealth/Employee Benefits News

- Lawsuit: Casey’s exploits employees with tobacco-use surcharge

- Pat Geraghty retiring as president and CEO of GuideWell/Florida Blue

- Preserve Medicaid and de-privatize Medicare for cost savings

- A guide to health insurance for startups

- He had short-term health insurance. His colonoscopy bill? $7,000

More Health/Employee Benefits NewsLife Insurance News

- Regulators tackle troubling illustration practices

- Global Atlantic 2025 Retirement Outlook Survey: Majority of Investors Worried about Outliving Assets

- Aegon announces changes to its Board of Directors

- Proxy Statement (Form DEF 14A)

- A-CAP Counters Desperate Attempt by Utah Insurance Department to Distance Itself from its Faulty Allegations

More Life Insurance NewsProperty and Casualty News

- Mercury Insurance Explains How Uninsured Drivers Affect Insurance Costs and How You Can Protect Yourself

- The Doctors Company Announces $15.1 Million Dividend

- Insurance industry and medical lobbyists oppose bill that eliminates Florida's no-fault auto-insurance

- Gen Z puts premium on culture and flexibility in insurance agency jobs

- Insubuy Celebrates 25 Years as a Pioneer in the Travel Insurance Industry

More Property and Casualty News