One-Size-Fits-All Retirement Planning Excludes People Of Color

The majority of Americans who identify as BIPOC (Black, Indigenous and people of color, including Hispanic and Asian) believe they won’t have enough money saved for retirement. But although this percentage is similar to that of white Americans, each BIPOC community has a different level of concern than those of other ethnic groups.

This is the latest from the Allianz Life 2021 Retirement Risk Readiness Study, which confirms the complexity of retirement planning for BIPOC communities and the approach necessary to help people from different ethnic groups achieve their financial goals. The study also showed the perceived barriers each ethnic community has in working with financial professionals.

The study showed that Asian Americans are the most concerned about having enough money to support their post-employment years, with 62% saying they believe they won’t have enough money saved. Meanwhile, 56% of whites and Hispanics are concerned about having enough retirement savings while 52% of Blacks said they are concerned about their savings.

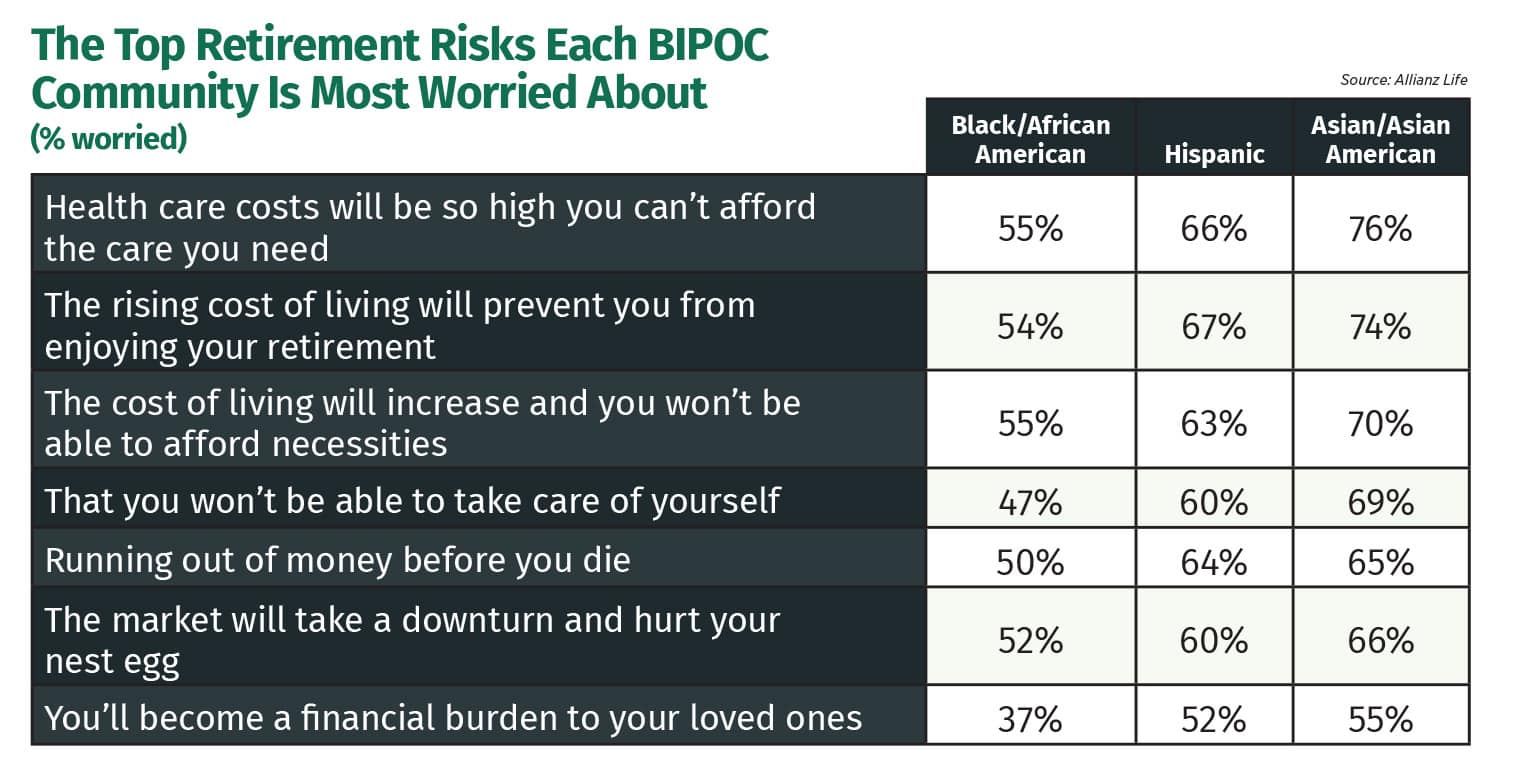

Black Americans tended to be less worried than other ethnic groups about other aspects of retirement, with Asian Americans most worried and Hispanics falling somewhere in the middle. Rising health care costs loomed as the biggest source of worry across the BIPOC spectrum, with 76% of Asian Americans most concerned about it, and 66% of Hispanics and 55% of Black Americans most worried about it.

At the bottom of BIPOC individuals’ retirement concerns was becoming a financial burden to their loved ones. About one-third (37%) of Black Americans were worried about burdening their families while more than half of Hispanic and Asian Americans were concerned about it.

Fewer Getting Advice With Finances

Although Asian Americans expressed concern they were the ethnic group most concerned about their retirement savings, the study showed they are the group least likely to get professional advice for retirement planning. More than one-third (38%) of Asian Americans are receiving professional help with their finances while 38% of Black Americans, 44% of Hispanics and 46% of white Americans are seeing an advisor.

However, the low percentages of Americans who are receiving professional financial help indicate there is still ample opportunity for financial professionals to assist BIPOC clients. But just as different ethnic groups have different concerns about their retirement finances, each ethnic group has different reasons for why they do or do not get professional advice, the study revealed.

When asked why they are not currently working with a financial professional, more than one-third (37%) of Black American respondents said it was because they “don’t have enough money,” versus only 30% of Hispanic and Asian American respondents. For Asian Americans, the biggest barrier was cost, with 45% indicating it “costs too much” to work with a financial professional versus 27% of Black American and 26% of Hispanic respondents.

Hispanic respondents report being most active in the financial planning process, with four in 10 indicating they have made a formal financial plan with a financial professional, versus less than one-third (32%) of Black Americans and only about a quarter (26%) of Asian American respondents.

Different Approaches To Retirement

Travis Walker, Allianz Life advisor specialist, said the differences in retirement concern among various ethnic groups say much about each group’s different approach to retirement.

“Some groups may be more about traveling or buying a boat or a vacation home in retirement. But others may think more about retirement as ‘My work is done. Now I just want to live in relative comfort and peace for the rest of my days,’” he said.

Each individual ethnic community is not a monolith, Walker said. “Retirement is not the same for everybody in the same group. It largely depends on the job you worked, how long you worked, the geographic area where you live, and what you want that retirement to look like.”

In some ethnic groups, having an elderly relative live with family instead of moving to a care facility is a cultural norm, Walker said, so members of those groups may be less concerned than others about the cost of long-term care. “When you’re not factoring in that cost with your retirement saving and planning, you’re going to have a different concern about retirement saving and not be as worried about that as you are some other concerns.”

Walker cautioned that a one-size-fits-all approach to retirement planning often leaves out people of color.

“Sometimes, people have some hesitancy talking to a professional about where they’re at in terms of their plans and their preparedness, because, frankly, there’s a little embarrassment or shame associated with it — they think that they should have done more,” he said.

“So you have to find what’s important to them and how to achieve it, because the reality of retirement is one that we’re all going to face,” he said.

Walker likened retirement planning for members of various ethnic groups to a set of golf clubs. “If someone gave me golf clubs and they were left-handed clubs and a really great set of clubs, that would be awesome provided I’m left-handed. Otherwise, they wouldn’t be of much use to me. Likewise, a one-size-fits-all approach to retirement isn’t much use either.

“It’s important to recognize that these communities are not monolithic. Asians are not all the same, and Blacks and Hispanics also have their own unique experiences. We’re not all the same. But the one thing that is the same is the reality that we’re all going to retire. If you approach it from that, you can talk about some of the things that make people hesitant toward retirement planning. And you can do yourself a service by having a conversation so you can get information you otherwise would not know.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

December: Maybe Not So Dark?

Open The Door To A Policy Review

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Legals for December, 12 2025

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

- AM Best Upgrades Credit Ratings of Starr International Insurance (Thailand) Public Company Limited

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

More Life Insurance News