Intermediaries forecast growth in sales and recruitment

A recent LIMRA and NAILBA study of more than 60 brokerage general agencies and independent marketing organizations in the U.S. shows these firms have high expectations of seeing year-over-year sales growth. More than 6 in 10 (68%) intermediaries are expecting an average of 19% growth in 2023 over 2022.

Among the ways the intermediaries will do this is through growing their network of producers (which is their No. 1 business priority), increasing sales of their current product offerings, and improving the producer/advisor sales support and service-related issues. Sixty-five percent of intermediaries expect their producer network to grow in the next three years.

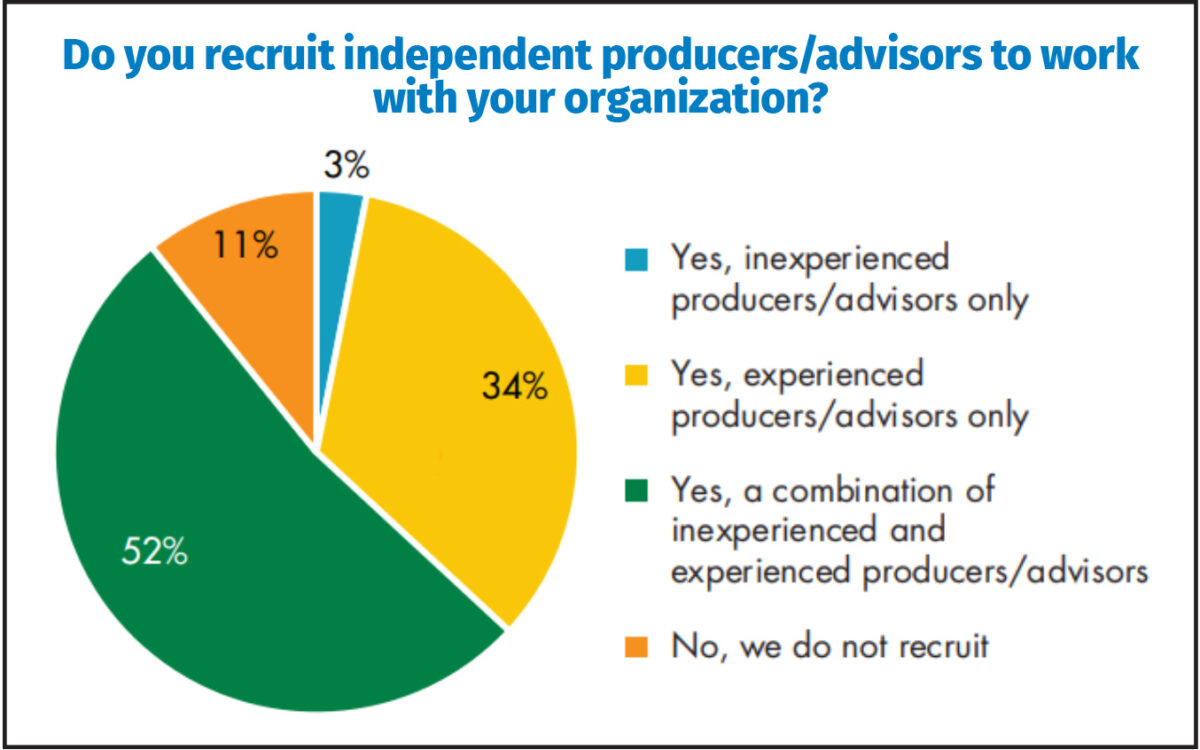

More than half of the intermediaries (52%) see this growth coming from recruiting a mix of experienced and inexperienced professionals. This tracks with the research, which shows that 42% of producers are older than age 55. There is also an effort to support financial professionals once hired. Seventy-eight percent of intermediaries offer tailored training based on the experience level of recruited producers.

There is also a focus on recruiting and training female producers/advisors. Almost 4 in 10 firms either currently have or plan to add specific programs devoted to recruiting female producers within the next year. In addition, almost half of the intermediaries (46%) said they either had programs to support female producers or plan to add one within the next year.

This is important because other LIMRA consumer research shows 33% of people consider “personal characteristics” an important attribute when choosing to work with a financial professional. Fifty-four percent of those surveyed said a financial professional’s gender is important.

When asked what’s behind their gender preference, consumers — particularly those who prefer a female financial professional — often describe soft skills (60%) that they associate with women.

Generation Z women (35%) and members of the LGBTQ+ community (27%) are more likely than others to prefer to work with a female financial professional. As Gen Z consumers age and look for financial advice, having female financial professionals will be critical to sales growth.

Looking ahead over the next three years, the IMOs and BGAs see the fastest growing products as life insurance (cited by 45%), followed by annuities (26%) and long-term care insurance (17%). Forty-two percent of intermediaries have experienced an increase in life insurance production over the past two years.

When it comes to services to be offered, the intermediaries see the highest growth potential in estate and trust services (26%), retirement-income planning (22%) and insurance planning (18%). Sixty percent of intermediaries, up from 31% in 2022, expect revenues from financial planning/wealth management products and services to increase 10% or more over the next three years.

As the U.S. demographic continues to evolve and change, it is important for the industry to keep pace. In a relatively short time, BGAs and IMOs have become the largest life insurance producer channel in the U.S. As such, their growth and productivity have become critically important in helping Americans get the financial guidance they need to protect the ones they love. Continuing to recruit new and experienced financial professionals and providing innovative services will help the industry meet the changing needs of consumers.

Laura A. Murach, ACS, ALMI, LLIF, is associate research director, distribution research, LIMRA. Laura may be contacted at [email protected].

The real cost of volatility-controlled indices in IUL policies

LTC planning’s power lies in relationships, not revenue

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Sick of fighting insurers, hospitals offer their own Medicare Advantage plans

- After loss of tax credits, WA sees a drop in insurance coverage

- My Spin: The healthcare election

- COLUMN: Working to lower the cost of care for Kentucky families

- Is cost of health care top election issue?

More Health/Employee Benefits NewsLife Insurance News