Interest rates, rising demand driving annuity sales growth

LIMRA recently published its U.S. Individual Annuity Sales Forecast for 2024 through 2026. Over the past two years, significant annuity sales growth has been driven by interest rates, rising demand for protection and guaranteed income, and strong economic conditions.

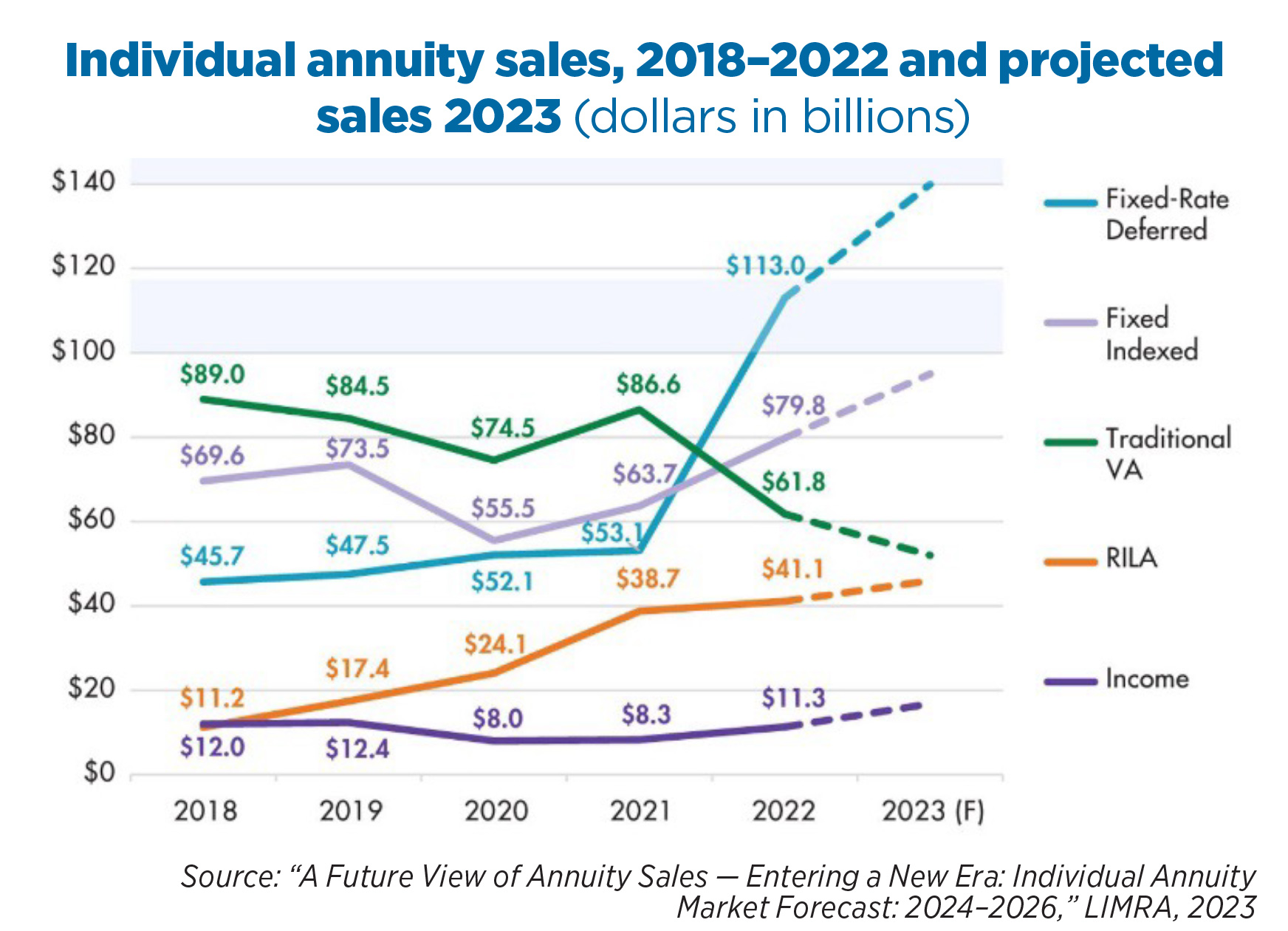

In 2022, annuity sales totaled a record high of $313 billion. At the end of 2023, LIMRA is projecting sales will exceed $350 billion, largely based on strong fixed annuity sales. The two years of record annuity sales were fueled by the enormous growth across products such as fixed-rate deferred, fixed indexed and income annuities, and registered index-linked annuities.

As we look toward the future, we believe the sales momentum experienced in 2022 and 2023 will continue for the industry through 2025.

What’s ahead in 2024 and 2025

While interest rates are expected to peak in 2023, the forecast for the 10-year Treasury rate is that it will remain around 4% through 2025. This slight decline will dampen annuity sales in 2024, particularly for income annuity products and fixed-rate deferred products. Countering this are the turnaround in the equity markets and the expectation that annuity sales will rebound in 2025.

Overall, LIMRA is forecasting annuity sales will total between $311 billion and $331 billion in 2024. Much of the variance depends on how interest rates play out. As interest rates recover in 2025, sales of indexed annuities and income annuities are expected to return to or exceed the levels set in 2023, with total sales growing as much as 10% and ranging from $342 billion to $362 billion.

Products expected to see growth in 2024

With the steady growth in the equity markets and minimal volatility, variable annuity products are expected to grow in 2024 and 2025.

» Registered index-linked annuities will have a strong year as steady equity market growth and lower interest rates make the value proposition of RILAs particularly attractive. In 2024 and 2025, LIMRA is forecasting RILA products will expand on the five consecutive years of record sales. RILA sales are likely to be as high as $52 billion in 2024 and $57 billion in 2025.

» Traditional variable annuity sales should benefit from a growing equity market over the next two years, but regulatory headwinds may counter the sales growth potential. LIMRA predicts traditional VA sales will grow as much as 10% to $60 billion in 2024 and increase as much as 8% to $65 billion in 2025.

Products that are expected to decline in 2024

Lower interest rates early in 2024 will dampen demand for fixed annuity products in the first half of the year, but as rates rebound in late 2024 and through 2025, LIMRA is forecasting fixed annuity sales will recover.

» Fixed-rate deferred annuities will face growing competition from alternative products such as bank certificates of deposit as short-duration rates improve. While FRD sales will be considerably lower (down as much as 30%) than the record-high sales set in 2023, FRD sales will likely exceed $100 billion in 2024 and 2025.

» Fixed indexed annuities will be hampered by the pullback in interest rates, and as crediting rates decline, the demand for protection-based solutions will slow in 2024 and 2025. Despite the expected nominal decline of FIA sales in 2024, sales of this product will remain historically strong and are forecast to reach nearly $100 billion in 2025.

» Income annuity sales, although dampened in 2024 by declining interest rates, will continue being pushed to record sales due to growing demand for income. LIMRA is predicting income annuity sales to top $15 billion in 2024 and set a record — above $18 billion — in 2025.

While economic conditions, advances in technology, and shifts in the regulatory environment could change the sales outcomes LIMRA is forecasting, our research shows that investors’ growing need and desire for protection and guaranteed income will cement $300 billion a year as the new normal for U.S. annuity sales. The future is bright for the annuity market.

Keith Golembiewski is senior director of LIMRA’s strategic research program. He may be contacted at [email protected].

Your client is the executor. Now what?

Tech-savvy younger clients can find HSAs a strategic tool

Advisor News

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Idaho is among the most expensive states to give birth in. Here are the rankings

- Some farmers take hard hit on health insurance costs

Farmers now owe a lot more for health insurance (copy)

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

- Elevance making difficult decisions amid healthcare minefield

More Life Insurance News