Inflation driving changes to projected 2024 tax rates

In September, the consumer price index increased 3.7% from 12 months earlier, the same rate as in August, according to the U.S. Bureau of Labor Statistics.

The September rate was the most recently available when this issue went to press. Inflation is not just a persistent annoyance to Americans at the grocery store and the gas pumps; it also impacts federal tax rates.

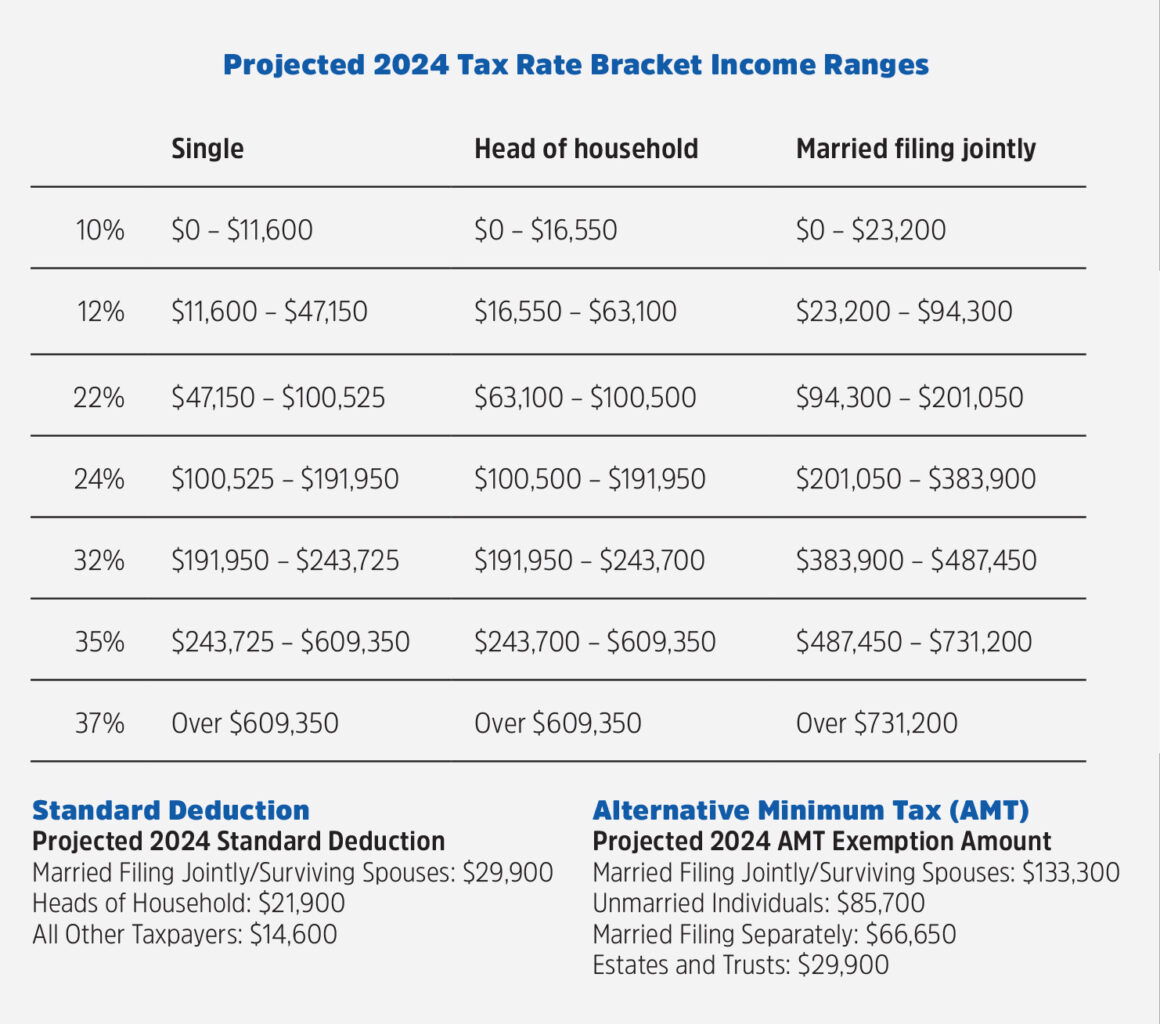

Higher inflation leads to increases in deduction limitations and drives upward adjustments to tax brackets and other key thresholds.

Bloomberg Tax & Accounting recently released its 2024 projected U.S. tax rates, which indicate inflation-adjusted amounts in the tax code will increase 5.4% from 2023. While this is a slight decrease from the 7.1% increase in 2023, it is nearly double the 2022 increase of 3%.

This year’s report projects that several key deductions for taxpayers will see notable year-over-year increases, with the foreign earned income exclusion increasing from $120,000 to $126,500 and the annual exclusion for gifts increasing from $17,000 to $18,000, thereby allowing taxpayers to increase their gifts without tax implications.

“For the second year in a row, high U.S. inflation has contributed to a significant increase in inflation-adjusted amounts in the tax code,” said Heather Rothman, vice president, analysis & content, Bloomberg Tax & Accounting. “Once again, our annual report provides actionable projections for tax professionals and taxpayers to begin planning for the upcoming year ahead of the official IRS announcement.”

The report accounts for changes made under the Inflation Reduction Act and the SECURE 2.0 Act that affect tax planning for corporate taxpayers in certain industries, Bloomberg noted in a news release.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Setting Corebridge on the path to the ‘one-click’ consumer — With Tim Heslin

A Taxing Problem: Many tax policy changes slated for 2024

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

More Annuity NewsHealth/Employee Benefits News

- Far fewer people buy Obamacare coverage as insurance premiums spike

- Findings from St. Marianna University School of Medicine Update Understanding of Vaccines [Active vaccine safety monitoring system using health insurance claims data in Japan: The Vaccine Effectiveness, Networking, and Universal Safety (VENUS) …]: Immunization – Vaccines

- Researchers at Gillings School of Global Public Health Report Findings in Chronic Pain (Racial/Ethnic and Sex Differences in Coping Mechanisms and Barriers to Health Care Among Adults with Chronic Pain: North Carolina, 2018-2019): Musculoskeletal Diseases and Conditions – Chronic Pain

- PALLONE REMARKS AT HEALTH AFFORDABILITY HEARING

- The Health Care Cost Curve Is Bending up Again

More Health/Employee Benefits NewsLife Insurance News