Help workers understand and use their benefits

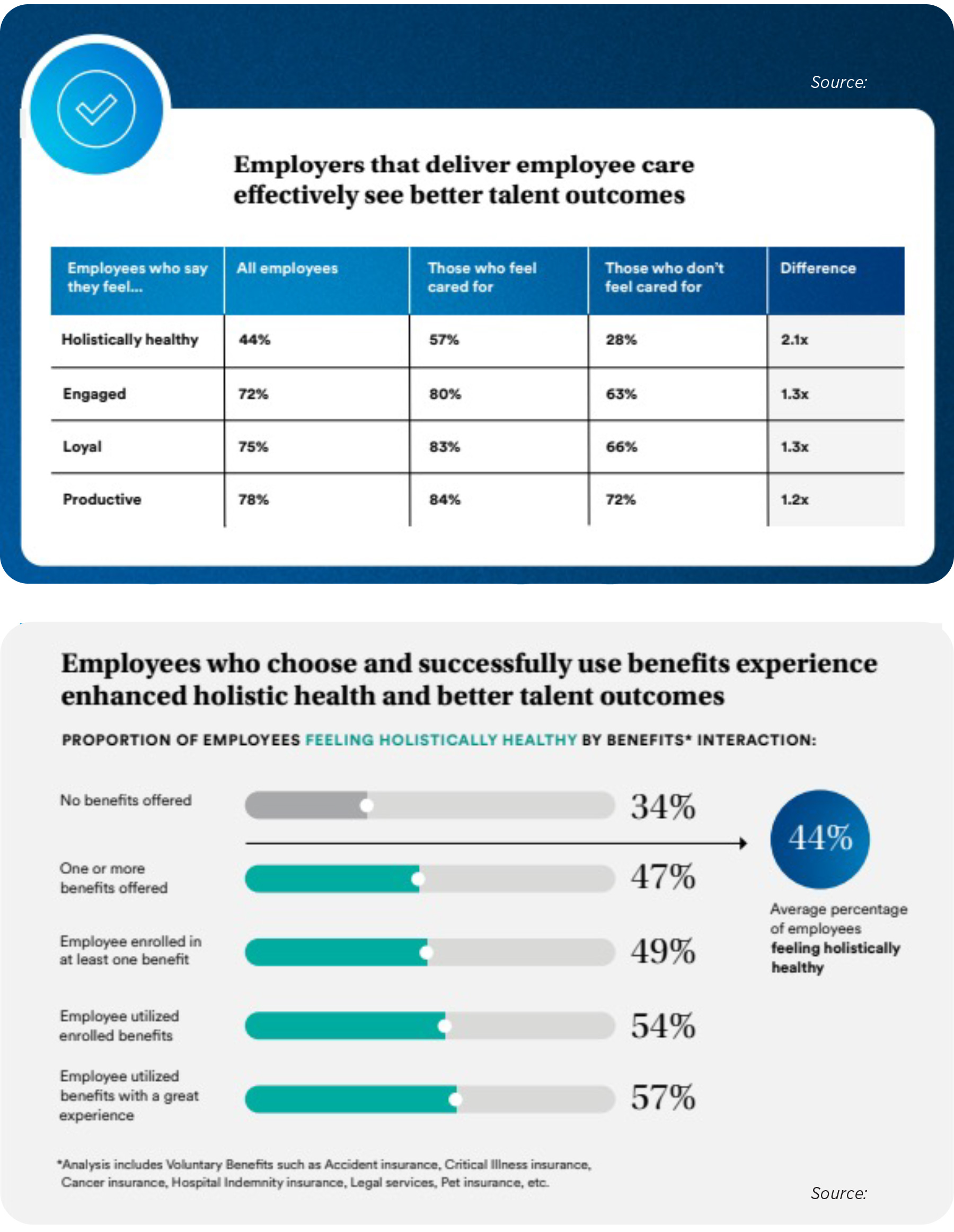

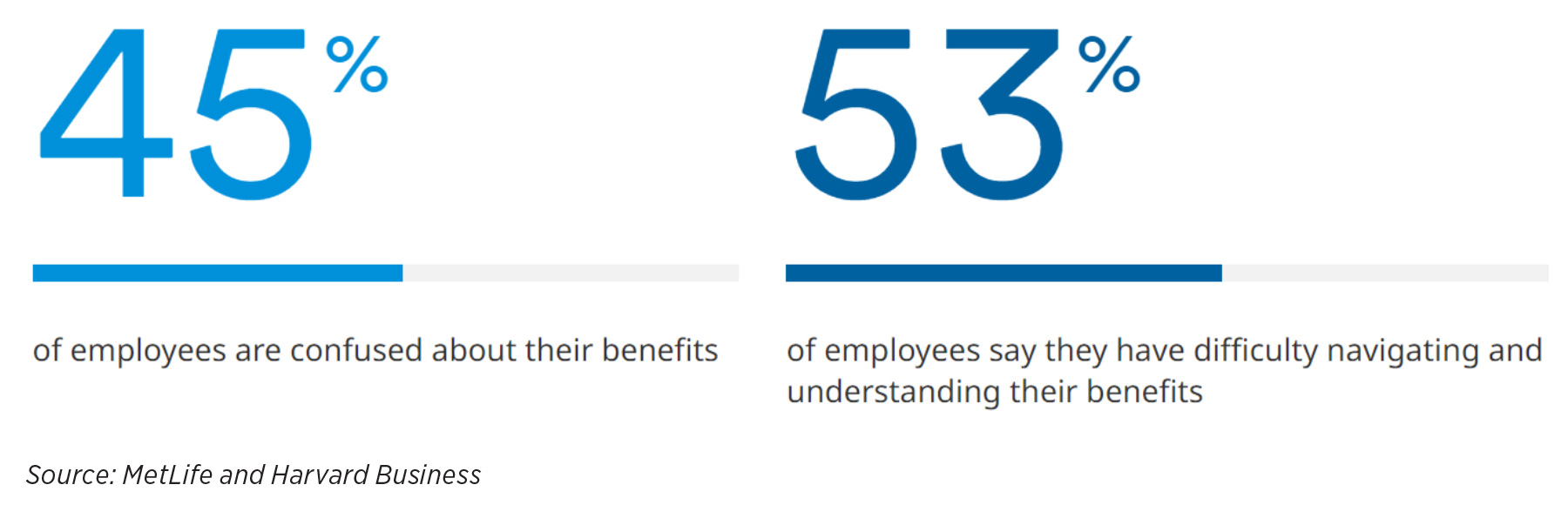

A disconnect exists between what workplace benefits employers offer their workers and how workers understand and use these benefits.

Todd Katz, MetLife’s head of U.S. group benefits, told InsuranceNewsNet that benefits brokers must communicate those benefits to workers in a way they understand, and then determine how many workers are actually using their benefits.

Workers’ share of health care costs continues to increase, Katz said, and that puts more pressure on employers to offer a broad array of wellness and voluntary benefit options.

“But what some of our research has told us is that employees aren’t particularly satisfied with their benefits, nor do they fully understand their benefits, nor are they using them in the way that their employer would expect them to do,” he said. “So, you sort of have this dichotomy of employers going out of their way to make it better, and employees really not seeing that benefit.”

Katz said several issues contribute to employees not understanding their benefits. One issue is time. “Everybody’s busy. All the data out there says people aren’t spending a great deal of time thinking through what their benefits are,” he said.

Another issue is the tools that help workers through the benefits selection, support and enrollment process.

“Employers put these tools out there and they get very low usage,” Katz said. “I’d also argue that they’re not easy to connect into the enrollment experience. Then when people use their benefits throughout the year, they’re not experiencing them in a way that creates endearment. I think there’s an opportunity to do better.”

Employees need tools to help them make the benefit decisions that are best for their unique needs, Katz said.

“I think employees have had enough of reading long booklets, whether they’re printed or online,” he said. “Everyone has their own medical situation; they have their own financial situation. I think the tools out there have been a bit too generic. Employees look at them and ask themselves, ‘Is this really helping me?’”

MetLife developed its own tool, Upwise, which is used by more than 1 million workers to help determine the voluntary and wellness workplace benefits that are right for them.

First, employees start by taking a short and secure survey to pinpoint their specific needs and tailor guidance and recommendations specific to them. Second, upon completion of the survey, employees receive a personalized recommendation covering all of their available employer-sponsored benefits, factoring in their health, financial situation, future plans and preferences.

And third, once employees receive their recommendations, Upwise then helps educate employees about their benefits, where to access them and how to set up real-time notifications to take advantage of their benefits.

“It’s designed to create personalized benefit recommendations using your own data,” Katz said. “You give us permission to look at your medical data and your financial data, and then we give you insights on all your benefit plans, not just the ones we offer. We give you robust recommendations and the pros and cons of those recommendations.”

A diverse workplace needs diverse benefits

As workplaces become more diverse, employers are challenged to create an array of voluntary benefit offerings that are attractive to and work for a greater range of employees. Katz said some of the voluntary benefits that are trending include:

» Mental health benefits, including access to apps such as Calm or online mental health tools.

» Maternity benefits such as breast milk storage.

» Identity theft protection and cyber theft protection.

» Legal services.

MetLife research has found that as each generation experiences various life stages and moments, they also prioritize certain benefits accordingly.

» Employees who are expanding their family (e.g., having or adopting a child) are more likely to prioritize legal services, with millennials most likely to experience this (30% of millennials vs. 22% overall).

» Employees experiencing unplanned financial stress are more likely to prioritize pet insurance and emergency fund support, with Generation Z and Generation X most likely to experience this (50% of Gen Z and 43% of Gen X, vs. 39% overall).

» Employees facing ongoing mental health challenges are more likely to prioritize employee assistance programs, with Gen Z employees most likely to experience this (51% of Gen Z vs. 38% overall).

» Workers are also looking for support in choosing the right benefits — 75% would like custom decision-making support based on their mental, physical and financial needs.

Benefits brokers spend a lot of time enrolling workers in coverage, but Katz said that enrollment “is just the starting line.”

“You need to see whether people are using their benefits and seeing value in them,” he said. “That means looking at how those programs are running, so brokers can see what can be tweaked in the future. You have this broad set of needs in the workforce. Figure out what those needs are and work with your clients to develop benefit offerings that meet workers’ needs.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

What will 2025 hold for the insurance industry?

Why your clients might face higher taxes in retirement

Advisor News

- How OBBBA is a once-in-a-career window

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- An Application for the Trademark “HUMPBACK” Has Been Filed by Hanwha Life Insurance Co., Ltd.: Hanwha Life Insurance Co. Ltd.

- ROUNDS LEADS LEGISLATION TO INCREASE TRANSPARENCY AND ACCOUNTABILITY FOR FINANCIAL REGULATORS

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

More Life Insurance News