Morningstar: U.S. life insurers maintaining cash liquidity levels

Despite extended low interest rates, private equity takeovers, and a trend toward riskier investments, U.S. life insurers are maintaining solid cash liquidity reserves, Morningstar DBRS reports.

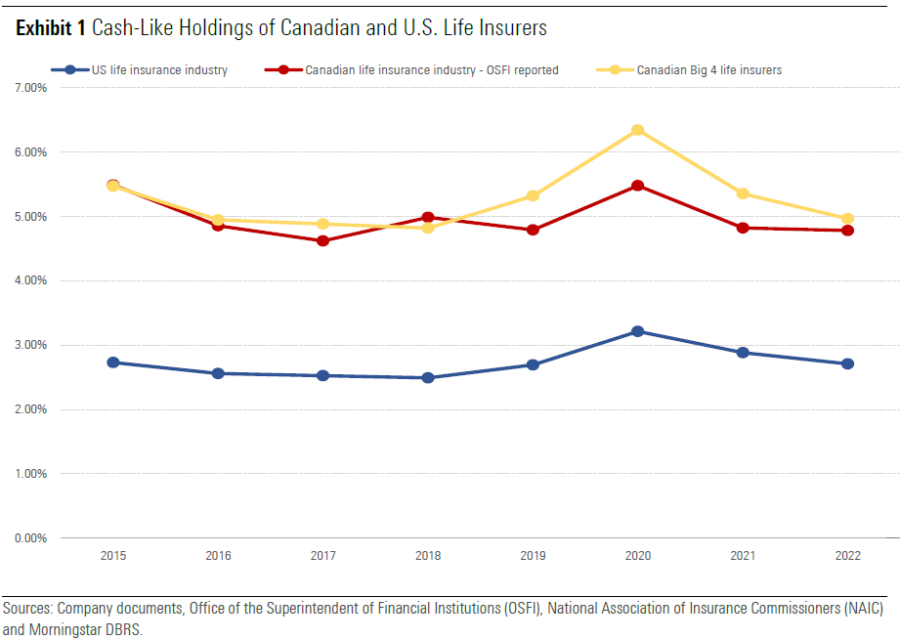

New Morningstar DBRS research finds that life insurance company cash reserves trended higher during the COVID-19-influenced 2020, then settled back to where they were in 2015 – just under 3%. That is higher than the industry’s cash reserves were from 2016-2019.

Liquidity, or an insurer’s ability to meet short-term financial obligations, “is among the key credit risk considerations for insurance companies given the size and complexity of their insurance and other liabilities,” Morningstar DBRS wrote.

But liquidity is just one of the five building blocks of Morningstar DBRS’s credit rating analysis, said Nadja Dreff, senior vice president and sector lead for Global Insurance & Pension Ratings. As such, the latest research report is just a snippet of the overall financial health of life insurance companies.

“Our goal was to just focus on one very small area of liquidity risk management of insurance companies,” she explained. “So, we're kind of keeping the liability side of insurance policies out of out of the research question.”

One of the research goals was to compare American life insurers with their Canadian counterparts, Dreff said. North-of-the-border insurers historically carry about double the amount of cash reserves, Morningstar DBRS found.

The struggle is real

For many years, American life insurers have struggled to earn a decent yield via traditional safe investments such as bonds. An extended low-interest-rate environment forced life insurers to get creative with investments and partnerships to earn a good return from their pool of policyholder money.

Private equity firms either took over or formed partnerships with many life insurers. The result is many different kinds of asset classes on the books, such as private credit.

“As a credit rating agency, we're keeping an eye on all these trends,” Dreff said. “They enter our analysis as we review the credit rating of each of these insurance companies.”

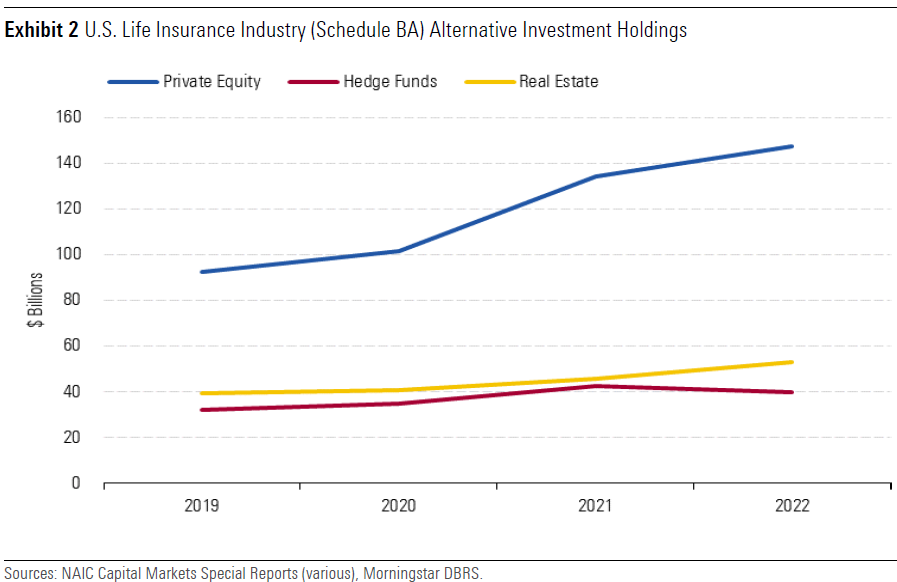

The latest research does not break out cash reserves by company, however. The statistics Morningstar DBRS uses are industrywide. In research last year, Morningstar found that alternative assets – real estate, hedge funds and private equity, for example – made up less than 10% of insurance companies' total assets in 2022, the most recent year statistics are available.

"However, we recognize that individual companies may have much higher concentrations of riskier assets, which warrants more regulatory scrutiny to ensure that risks are appropriately managed," Morningstar DBRS wrote.

'Market-stress events'

During "market-stress events" such as the 2008-2009 financial crisis, U.S. insurers can typically easily gain access to the regional Federal Home Loan Banks system for government-supported funding, Morningstar DBRS notes in its research paper this week. That resource adds additional liquidity in a pinch.

"Many insurers maintain an open undrawn liquidity line in order to minimize any delay in accessing the FHLB funds should such a need ever arise," researchers write. "We view ready-to-access FHLB capacity positively in assessing insurance companies' liquidity resources."

As of Q3 2024, FHLBs have offered $157 billion in advances to 593 insurance company members, researchers add, representing an increase from $111 billion in advances offered to 471 insurers in 2019.

While less than 3% cash liquidity might seem low, it isn't worthy of concern, Dreff concluded,

"An insurance company is not going to hold a lot of cash," she said. "There's an opportunity cost to that. It's okay to invest, as long as you're not investing it into very long-term and very illiquid assets."

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Charitable giving tools available for taxpayers; due to expire

Determining tipping points for climate risk management

Advisor News

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

More Advisor NewsAnnuity News

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News