Growth drives insurance distribution intermediaries’ priorities in 2025

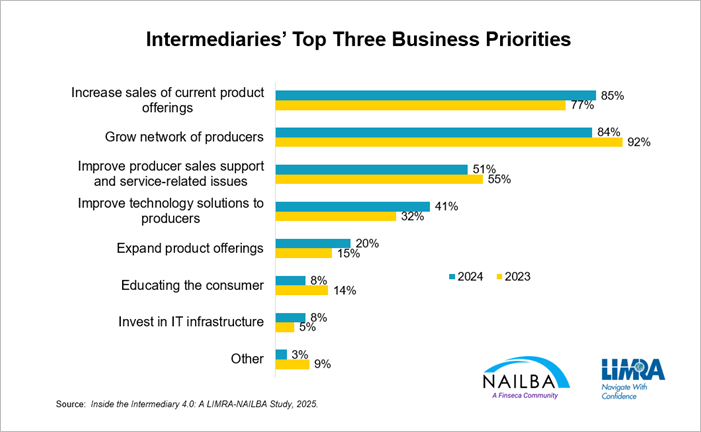

WINDSOR, Conn. and WASHINGTON, March 3, 2025 — More than 8 in 10 insurance distribution intermediaries — independent marketing organizations and brokerage general agencies — say their top business priorities are to increase sales of current product offerings and expand their network of financial professionals.

According to the new report, Inside the Intermediary 4.0: A LIMRA-NAILBA Study — BGA and IMO Survey Results, half of intermediaries (47%) are planning to invest in advanced sales support and underwriting to support their associated producers and drive sales growth. Another 4 in 10 report they will invest in wholesaling support and new business prospecting.

“Intermediaries have an increasingly important role in our industry and play an essential role with independent financial professionals by helping them build and grow their practices, and act as the expert go-between for financial professionals and carriers,” said Bryan Hodgens, senior vice president and head of LIMRA research. “Independent distribution accounts for more than half of retail life insurance and a substantial amount of the annuity business comes from the independent brokerage channel annuity sales. The success of these producers is largely because of efforts and investments made by intermediaries. This research offers critical insights into the evolving intermediary landscape, which is shaping the future of the life insurance industry.”

Beyond sales support investments, intermediaries report building specific programs to offer practice and marketing support, including how to target market segments, greater investment in digital services (e.g., e-delivery, e-application, e-signature), and coaching on team building and succession planning.

The latest in-depth study, conducted jointly by the National Association of Independent Life Brokerage Agencies (NAILBA) and LIMRA, highlights how BGAs and IMOs are adapting their business models, leveraging new tools, and responding to emerging consumer needs. Another aspect of growth uncovered is the effort to expand. The study finds more than half of intermediaries expecting an average of 21% growth in 2024 over 2023. Intermediaries report most of the growth is from partnerships with registered investment advisors, followed by property and casualty agencies.

“Understanding the evolving trends of the intermediary space is crucial for our members. NAILBA is committed to providing the knowledge and resources they need to thrive in a rapidly changing industry,” said Warren May, NAILBA leader. “This collaboration with LIMRA delivers valuable insights that will help the brokerage community better understand market trends and position themselves for success.”

To learn more about the findings and their implications, visit: Industry Insights With Bryan Hodgens: How Intermediaries Help Financial Professionals Grow Their Practice.

Proxy Statement (Form DEF 14A)

Investor Presentation March 2025

Advisor News

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

More Advisor NewsAnnuity News

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

More Annuity NewsHealth/Employee Benefits News

- Researchers from Boston University Report Findings in Managed Care (Unexplained Pauses In Centers for Disease Control and Prevention Surveillance: Erosion of the Public Evidence Base for Health Policy): Managed Care

- New Managed Care Study Results Reported from University of Houston (Impact of Adjuvant GLP-1RA Treatment on the Adherence of Second-Generation Antipsychotics in Nondiabetic Adults): Managed Care

- New Findings on Managed Care Reported by Lane Moore et al (State Disparities in Medicaid Versus Medicare Reimbursement for Hand Surgery): Managed Care

- New Kentucky House GOP budget fixes insurance issue, ups education spending

- Missouri and Kansas families pay nearly 10% of their income on employer-provided health insurance

More Health/Employee Benefits NewsProperty and Casualty News

- Legislature closes; everyone says they won

- Some are getting refunds on their Florida car insurance. How can you get one?

- Some are getting refunds on Florida car insurance premiums. How can you get one?

- Jeff Landry asks state-created insurer to pay for fortified roofs. Here’s why.

- Could AI claims settlement without a lawyer become the new norm?

More Property and Casualty News