Big rules are coming; Prudential exec hopes they aren’t ‘overly conservative’

When regulators get too conservative with rules, it can have unintended consequences for the financial services industry, a Prudential executive said.

As an example, Rob Falzon, vice chair of Prudential Financial, pointed to an August vote by state insurance regulators to relax a 31-year-old rule on reporting interest rate-related losses.

An industry trade group lobbied for the rule change, which Reuters reports will free up hundreds of millions of dollars that insurers can use to write new policies or reinvest in business innovation.

The change is to the interest maintenance reserve [IMR], an accounting standard that helps carriers smooth their annual income across market conditions, according to a recent Conning report. IMR is a reserve held according to standard accounting principles to deal with fluctuations in the interest rate.

"The asymmetry in the accounting for IMR that was occurring [during] the low-interest-rate environment didn't bother the industry," Falzon noted. "Suddenly, in a high-interest-rate environment, it became a capital constraining issue for the industry."

Falzon spoke this week during an opening session of the KPMG 35th annual Insurance Industry Conference in Orlando, Fla.

Big shortfall in coverage

Americans face a $12 trillion shortfall in life insurance coverage, according to LIMRA, while that number rises to $30 trillion when measuring the total retirement savings gap, according to the World Economic Forum.

"As regulators think about policyholder protection, they need to expand the lens of what consumer protection means," Falzon explained. "If consumer protection is solely focused on the solvency of the industry and ability to meet promises, but not focused on the availability of product in the market, you're only meeting half the problem.

"If regimes are overly conservative, if regulation around distribution is overly conservative, it impedes the industry in actually providing solutions into that broader socio-economic demographic that's not being served today, and results in what we're now seeing."

Rules and regulation is top of mind now in financial services as artificial intelligence, climate change, fiduciary duty and private equity are all drawing attention. Regulators from state insurance departments to the Securities and Exchange Commission to the federal Department of Labor are all working on new rules of note.

The growing investment by private equity firms in insurance is a particularly thorny issue. These asset managers are attracted to the piles of money insurers control from policyholders. However, insurers are also obligated to pay out money on insurance contracts, often decades into the future.

Regulators want to know that PE firms are taking that obligation seriously and not gambling away policyholder premiums on risky investments. The National Association of Insurance Commissioners identified 13 regulatory considerations relating to the risks presented by PE-owned insurers, or traditional insurers with similar structures.

For example, there are concerns around structural transparency and whether nonapproved control or economic ownership is being facilitated indirectly through contractual arrangements like investment management agreements.

"Where they're particularly focused on is conflicts of interest that can occur in these arrangements," Falzon explained, "and are the investment manager agreements being done on a true arm's length basis. ... Because some of the structures are done in a way that you can't actually understand what's happening there. So I think they're very concerned about transparency."

'Let's get it moving'

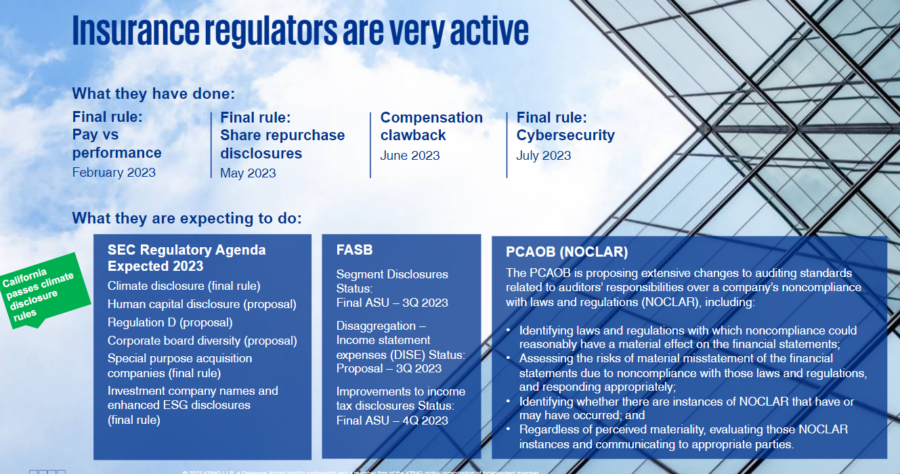

Ed Chanda, partner, national sector lead, insurance, KPMG US, introduced a slide with all of the rules and regulations recently passed and others in various stages of completion:

"A lot of this has been in the pipe for a long time and somebody said, 'Let's get it moving,'" Chanda said.

Of note, the SEC rule on climate change "probably the most-commented rule in SEC history, so it's understandable why it's taking them some time to get it out," he added. California got tired of waiting and passed it own climate rule last week, Chanda said.

If signed by Gov. Gavin Newsom as expected, the two laws will require significant climate-related disclosure requirements for thousands of U.S. public and private companies that do business in California.

Senate Bill 253 requires companies with greater than $1 billion in annual revenues to file annual reports publicly disclosing their direct, indirect, and supply chain greenhouse gas emissions, verified by an independent and experienced third-party provider.

SB 261 requires companies with $500 million in annual revenues to prepare biennial reports disclosing climate-related financial risk and measures they have adopted to reduce and adapt to that risk, with the first report due by January 1, 2026.

"We think that the state of California is not the only state that's going to do this," Chanda said. "We expect New York to follow, and maybe several others."

The focus needs to be on finding the "lowest common denominator" in the various climate reporting rules being proposed, Chanda advised. That way, companies can get a head start on the information they are most assuredly going to need to provide.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

ProPublica investigation examines insurance claim appeals

Allstate, other insurers among those facing robocall lawsuits

Advisor News

- Does your investor client know how much they pay in fees?

- Get friends to do business: 2 distinct approaches

- Unlocking hidden AUM: Prospecting from within your client base

- Protests in D.C. Take Aim at Health Insurance, Financial Institutions, Oil & Gas Interests

- Charitable giving tools available for taxpayers; due to expire

More Advisor NewsAnnuity News

Health/Employee Benefits News

- UnitedHealth says execs kept no secrets, asks court to toss lawsuit

- DOCCS commish: Striking NY correction officers will lose health insurance Monday

- Leadership: The Virginia Power 50 List

- Research Conducted at Cleveland Clinic Has Provided New Information about Insurance (High-intensity Home-based Rehabilitation In a Medicare Accountable Care Organization): Insurance

- Researchers from Marshall B. Ketchum University Describe Findings in Insurance (Office Procedures for Older Adults By Physician Associates and Nurse Practitioners): Insurance

More Health/Employee Benefits NewsLife Insurance News