Would you rather purchase items retail or wholesale?

You’re a business owner, and you’re considering purchasing life insurance. How do you wish to pay the premium? You generally have three options:

1. Write a personal check.

2. Have your business pay the premium.

3. Have your qualified plan write the check.

Of these options, only option 3 allows a tax deduction for the insurance premium through contributions to the plan. When you purchase business or personal property, do you want to purchase it retail or wholesale?

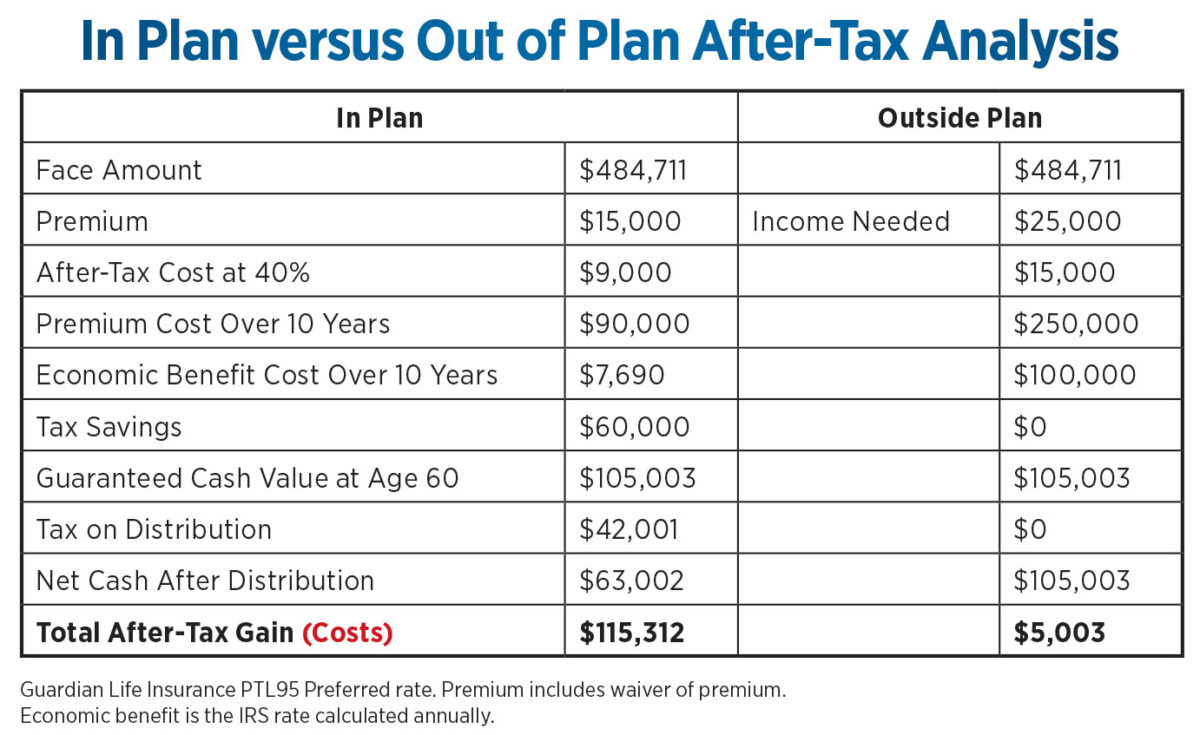

Now the question is, “How do you wish to pay the premium?” Using after-tax or tax-deductible dollars? Let’s look at the math. You own a closely held business, you’re 51 years old, in a 40% tax bracket, looking to retire in 10 years and considering purchasing $484,711 of permanent life insurance. (See chart below.)

The premium for death benefit is $15,000; in a 40% tax bracket, you would need to earn $25,000 to pay the premium. Considering the premium is in a qualified plan, contributions to the plan, within limits, are tax deductible; therefore, the after-tax cost of the premium is $9,000.

A portion of the premium that is not tax deductible represents the pure death benefit, or the current economic benefit stated as the one-year term rate for the amount at risk (face amount minus cash value times the stated year’s rate). For example, the first-year economic benefit cost is $1,220; taxed at 40%, this individual would pay $488 for $484,711 of death benefit.

Fast-forward 10 years. This policy has the potential for dividends; however, we will review only the guaranteed values in this article. The guaranteed value in 10 years is $105,300. A qualified plan has several exit strategies for life insurance that are beyond the scope of this article; I will focus on only one strategy, which is taking a distribution of the policy. I will also assume the fair market value of the policy is the cash value.

Considering the tax savings, the economic benefit cost, the cash value and tax upon distribution, over the course of 10 years, you would be better off by $110,309 having your qualified plan pay the premiums with tax-deductible dollars. Factoring in the tax savings and taking a distribution of the policy from the plan, you would net $115,312, whereas if you paid for the life insurance with after-tax dollars, you would net $5,003.

But what if you die while the life insurance is in the plan? After all, you needed the death benefit to begin with, you were looking for an alternative to pay the premium and using tax-deductible dollars made sense in your situation.

For our example, death occurs in year 10. The impact on your beneficiary would be $379,708 ($484,711 minus the cash value of $105,003), which would pass income-tax free to your beneficiary. The $105,003 of cash value plus your other investments in the plan would be a taxable distribution, which may be transferred to an individual retirement account to further delay taxes and continue tax-deferred growth.

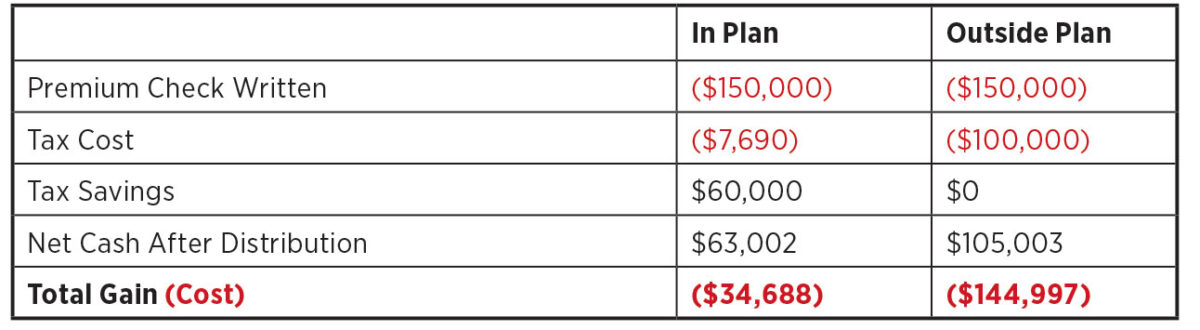

Let’s look at the math from another perspective, the actual premium inside the plan versus the premium being paid outside the plan. (See chart below.)

For $484,711 of permanent death benefit, the total premium cost over the 10-year period for this 51-year-old is $34,688 ($3,469 per year) for a permanent policy. This represents the annual cost of the premium plus the tax cost (economic benefit), minus the tax savings and the net after-tax distribution — as opposed to $144,987 ($14,499 per year) for the same policy.

For this article, we considered paying the tax from the policy, which is one option. To maintain the full policy’s death benefit and cash value, the tax could have been paid with other discretionary dollars. I usually recommend setting up a sinking fund with the tax savings from the deduction to the plan and using that fund to offset the taxable distribution.

Incorporating life insurance in the investment lineup is a fiduciary consideration and therefore must be for the benefit of all participants and their beneficiaries.

Do the math. How do you want to pay for the insurance?

Ernest J. Guerriero, CLU, ChFC, CEBS, CPCU, CPC, CMS, AIF, RICP, CPFA, national president of the Society of Financial Service Professionals, is the director of qualified plans, business markets for Consolidated Planning. He may be contacted at [email protected].

The Power of Persuasion — with Lynne Franklin

Building a bridge — With Deshawn Peterson

Advisor News

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

- Most Americans surveyed cut or stopped retirement savings due to the current economy

- Why you should discuss insurance with HNW clients

More Advisor NewsAnnuity News

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

- Suitability standards for life and annuities: Not as uniform as they appear

- What will 2026 bring to the life/annuity markets?

- Life and annuity sales to continue ‘pretty remarkable growth’ in 2026

More Annuity NewsHealth/Employee Benefits News

- Hawaii lawmakers start looking into HMSA-HPH alliance plan

- EDITORIAL: More scrutiny for HMSA-HPH health care tie-up

- US vaccine guideline changes challenge clinical practice, insurance coverage

- DIFS AND MDHHS REMIND MICHIGANDERS: HEALTH INSURANCE FOR NO COST CHILDHOOD VACCINES WILL CONTINUE FOLLOWING CDC SCHEDULE CHANGES

- Illinois Medicaid program faces looming funding crisis due to federal changes

More Health/Employee Benefits NewsLife Insurance News