Charitable gift annuities gaining in popularity

Charitable gift annuities are one of the simplest ways of giving but one of the most overlooked.

That was the word from two members of PNC Institutional Asset Management’s planned giving solutions group, who gave a webinar advising financial professionals of the ins and outs of this financial and philanthropic tool.

CGAs are gaining in popularity with donor prospects as they work with the charitable organizations of their choice, said Chip Giese, senior regional manager.

“A CGA starts in the heart and it starts with a gift,” said Chris McGurn, director. “It’s an easy-to-understand, one-page contract.”

Donors have several reasons to create a CGA, he said. Reasons include helping a favorite cause, easy to understand and establish, providing fixed income for life, providing a charitable gift deduction and reduction or bypass of capital gains on gifts of appreciated assets.

A CGA is an agreement between a donor and a nonprofit organization that provides the donor with a fixed income stream for life. The donor makes the gift, receives lifetime income and the organization receives the remainder of the funds in the annuity after the donor’s death.

How a CGA works

McGurn explained that in exchange for an irrevocable gift of cash, securities or other assets, the charity agrees to pay one or two annuitants named in the contract a fixed sum each year for life. The payments are backed by the charity’s general resources. The older the designated annuitants are at the time the gift is made, the greater the fixed payments the charity can agree to pay. In most cases, part of each payment is tax free, increasing each payment’s after-tax value. If the donor gives appreciated property, they will pay capital gains tax on only part of the appreciation. If the donor names themself as an annuitant, the capital gains tax can be spread out over many years instead of having it all come due in the year the gift is made.

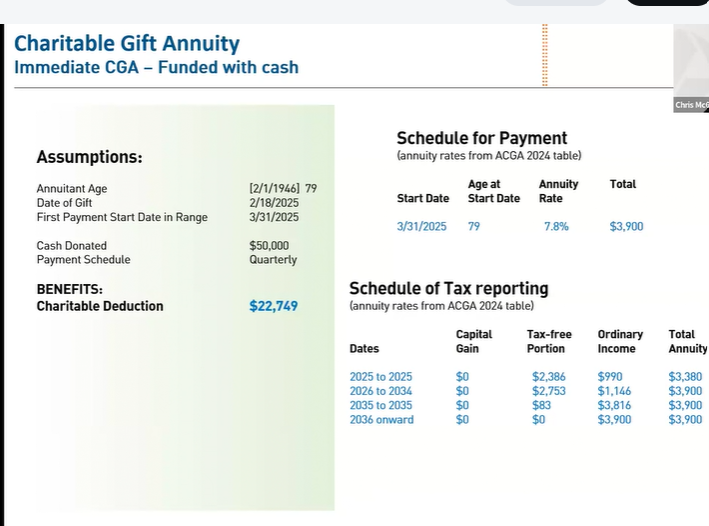

He provided a scenario in which a 79-year-old woman funds a CGA with $50,000 in cash. The payments and tax schedule would be as follows.

Giese noted that beginning in 2023, SECURE 2.0 expanded the definition of qualified charitable distributions to include distributions to create CGAs and charitable remainder trusts.

SECURE 2.0 allows a one-time maximum transfer of $54,000 in exchange with a charity for a CGA or a qualified CRT. The new QCD can be done only once during the individual retirement account owner’s lifetime and must occur within a single calendar year.

Each spouse may contribute up to $54,000 to a joint CGA from their respective IRAs. SECURE 2.0 specifies that at least one of the CGA beneficiaries must be at least age 70 ½ and the CGA must have a payout rate of at least 5%, which effectively places a lower limit on the spouse’s age.

QCDs can be made directly from an IRA – a one-time election of up to $54,000 to pass from IRA to charity in exchange for a CGA or a CRT, Giese said.

Stocks or mutual funds also can be used

A CGA also can be funded through stock or mutual funds, McGurn said. The stock must go directly from the donor’s stock account into the charity’s CGA account.

Donors may choose to create a deferred or a flexible deferred CGA, he said. This option allows the donor to choose when to take payments and is good for younger donors or for donors who want more flexibility and control.

A donor also can fund annual giving through a CGA. The donor can take the payment received from the CGA and donate all or part of it back to the charity, allowing an additional income tax deduction.

Donors also can use a CGA to fund an endowment to the charity, allowing for annual giving to continue.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Should financial advisors use AI? An expert weighs in

Cross-selling LTD insurance to life insurance customers

Advisor News

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- Data on COVID-19 Published by Researchers at Peking University (Socioeconomic Disparities in Childhood Vaccination Coverage in the United States: Evidence from a Post-COVID-19 Birth Cohort): Coronavirus – COVID-19

- 2025 Top 5 Health Stories: From UnitedHealth tragedy to ‘excess mortality’

- AMO CALLS OUT REPUBLICANS' HEALTH CARE COST CRISIS

- With federal backing, Wyoming's catastrophic 'BearCare' health insurance plan could become reality

- Our View: Arizona’s rural health plan deserves full funding — not federal neglect

More Health/Employee Benefits NewsLife Insurance News