Women lag in retirement savings – and are stressed out about it, study says

Nearly half of women say their retirement savings are behind schedule – and they may have trouble ever catching up, with 60% of retirement women saying they had to stop working earlier than they planned, according to a study.

Those are a few takeaways from Goldman Sachs’ annual Retirement Survey & Insights Report showing a wide gulf between men and women on retirement security. Using a rule of thumb for retirement income, 80% of retired women are not making enough vs. 70% of men. Even worse, 35% of women are receiving less than 40% of their pre-retirement income vs. 22% of men.

Behind schedule

“Lower lifetime earnings, greater caregiving needs and time out of the workforce, all result in a broader impact of competing financial responsibilities leading to lower retirement savings and Social Security benefits,” according to the study’s researchers. “In addition, since women on average have longer lifetime expectancy, there is more concern about having sufficient savings given a longer retirement than men.”

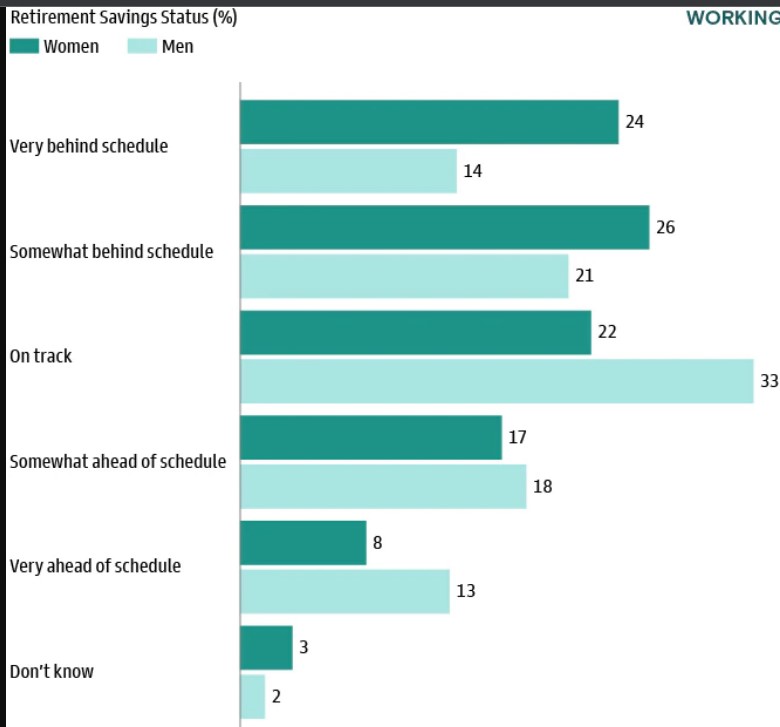

Although it is widely understood that women typically lag men financially, the Goldman Sachs survey showed just how wide that divide is. For example, 49% of women said their retirement savings were behind schedule vs. 35% of men, with 24% of women saying they were way behind in savings vs. 14% of men.

Women are less confident than men that they will be able to meet their retirement goals, with 33% of women saying they are concerned about it vs. 19% of men. Nearly half (47%) of women have some level of confidence that they will meet their retirement needs vs. 68% of men.

Although it is only half of women are at least somewhat confident they will meet their retirement needs, even they might be optimistic.

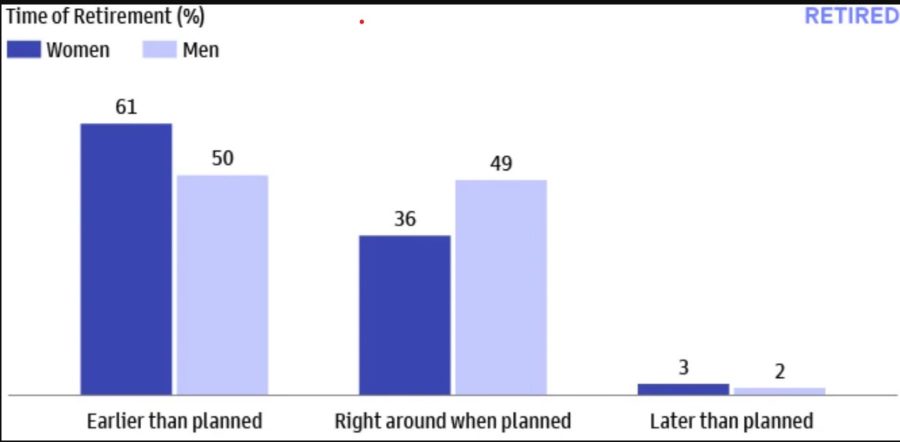

More than 60% of women said that they retired earlier than planned and of those 66% retired for reasons outside their control.

Even though most women retired earlier than expected, the next wave of retirees, Gen X, expects to retire between 65 and 69 years old.

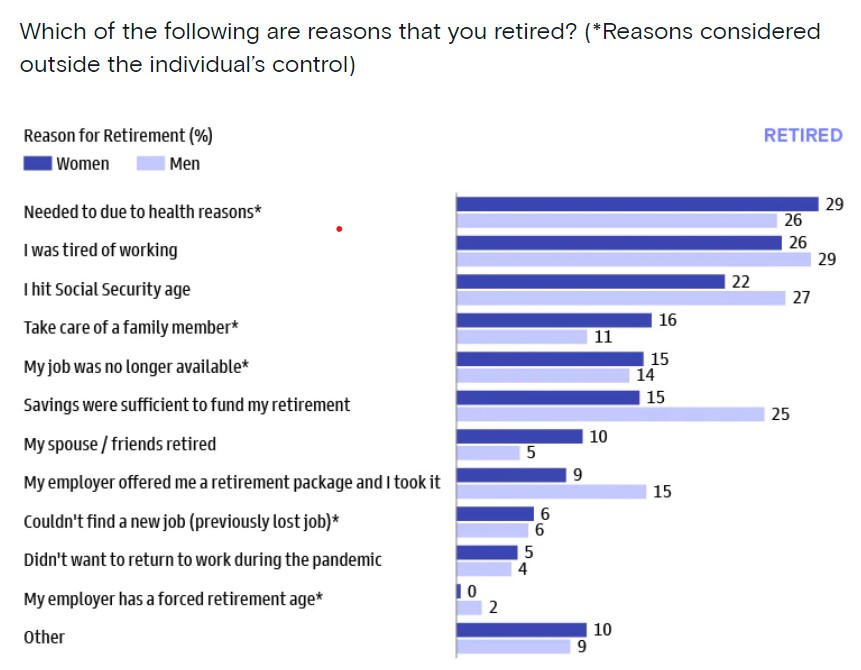

Women tended to retire for health reasons, with 29% citing that reason vs. 26% of men. More men were able to work until retirement age, as 27% saying so vs. 22% of women.

The gender divide was widest when it came to people retiring because they saved a sufficient amount, with 25% of men saying so vs. 15% of women.

Women are more overwhelmed by monthly expenses to save for retirement, with 77% saying so vs. 68% of men. Other financial hardship was a close second with 71% saying they were dealing with expenses such as home repair vs. 63% of men. More than a third of women needed to take time off to care for a family member during their working lives.

Even though women face steeper financial challenges, they end up dealing with them on their own – 69% say they manage their retirement savings on their own vs. 63% of men. A quarter of women work with a financial advisor vs. a third of men.

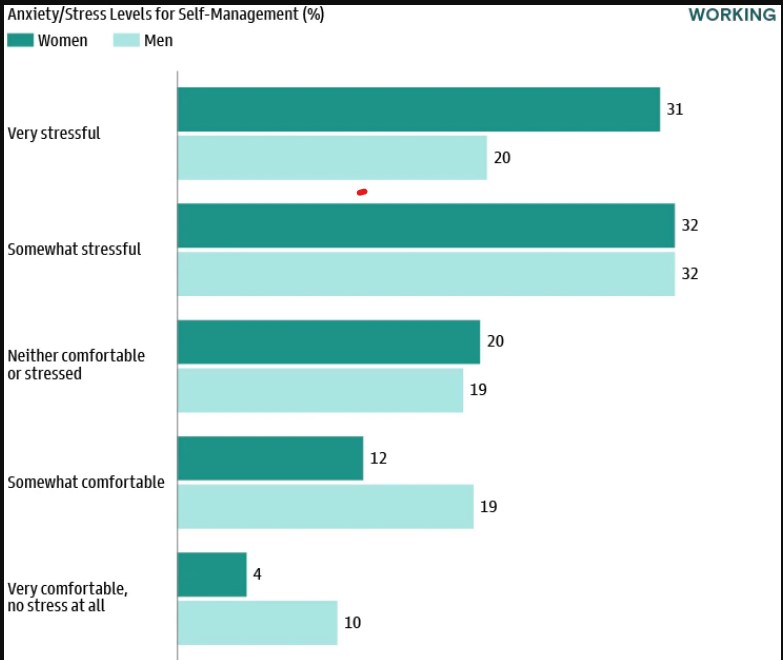

Women are clearly not enjoying the process with 64% saying they find self-management at least somewhat stressed, 31% saying they see it as very stressful vs. 20% of men in another stark divide.

While women are more likely to manage their retirement savings, they are more likely than men to say they want help. Close to half of women (46%) said they found financial advice very or extremely important vs. 40% of men.

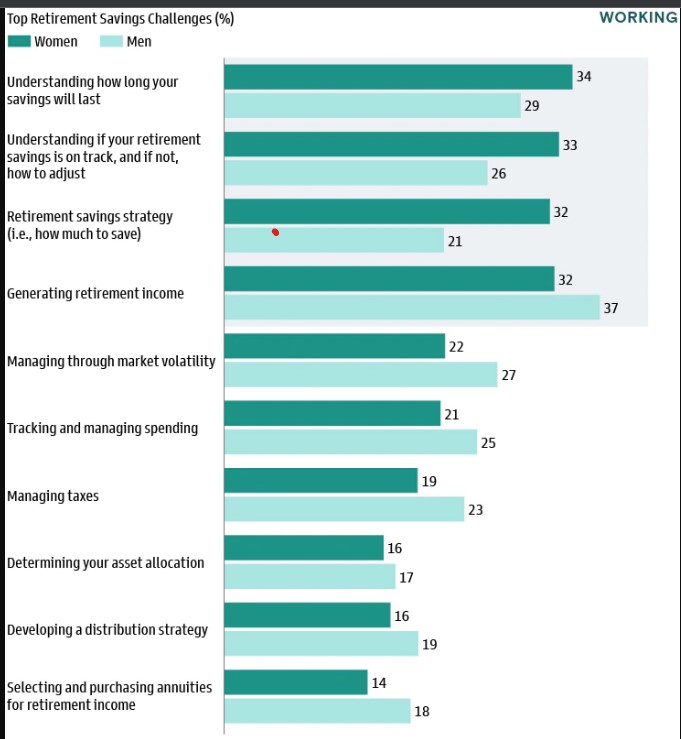

Women were also likely to struggle with issues that advisors would be ideally suited to assist with – understanding how long savings will last and if those savings are on track.

Advisors might have their work cut out for themselves though to make inroads with women.

In another gender divide, women cited advice from family members as their top choice with 32% picking that vs. 27% of men. Men by far preferred a financial advisor, with 36% saying that was their top choice vs. 27% of women. In good news for employers, about a third of men and women valued employer retirement program advice.

“The obstacles women face are opportunities for plan sponsors to offer solutions that meet them where they are on their retirement savings journey,” according to the report. “Personalized education and advisory services from a solutions provider can help support the unique factors affecting women.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

What will it take to bridge the personal finances gap for women?

Study finds retirement confidence gap between men and women

Advisor News

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- More cancer coverage for firefighters clears hurdle

- AG files suit against Syracuse claiming misappropriated funds

- Legislation for more cancer coverage for firefighters clears the Iowa Senate

- Gentry Mountain Mining Under Fire Due to Recent Allegations

- Rural Hospitals Question Whether They Can Afford Medicare Advantage Contracts

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Jackson Announces New President and Chief Risk Officer

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- AM Best Revises Issuer Credit Rating Outlook to Stable for Life Insurance Company of Alabama

More Life Insurance News