What will it take to bridge the personal finances gap for women?

Mary Grace Musuneggi has faced financial challenges as a widow, single mom and divorced woman. Those experiences have shaped her determination to help women overcome the lack of knowledge — and lack of confidence — many of them share when it comes to their personal finances.

Musuneggi was widowed with a 9-month-old son when she was 25 years old. Years later, she remarried, but that marriage ended in divorce.

When asked her marital status, she jokingly replies, “All of the above.”

Today, she is the chairman and CEO of The Musuneggi Financial Group in Pittsburgh, Pa., and founder of Single Steps Strategies, a life planning resource for women. She also is the author of two books, Single Steps: Strategies for Abundant Living and A Man Is Not a Plan: Success Strategies for Independent Women.

Musuneggi’s challenges as a widow, single mom and divorced woman inspired her to help women achieve financial independence and plan for whatever life might throw their way. And she is aware of the need to help women attain financial security. Consider a few statistics:

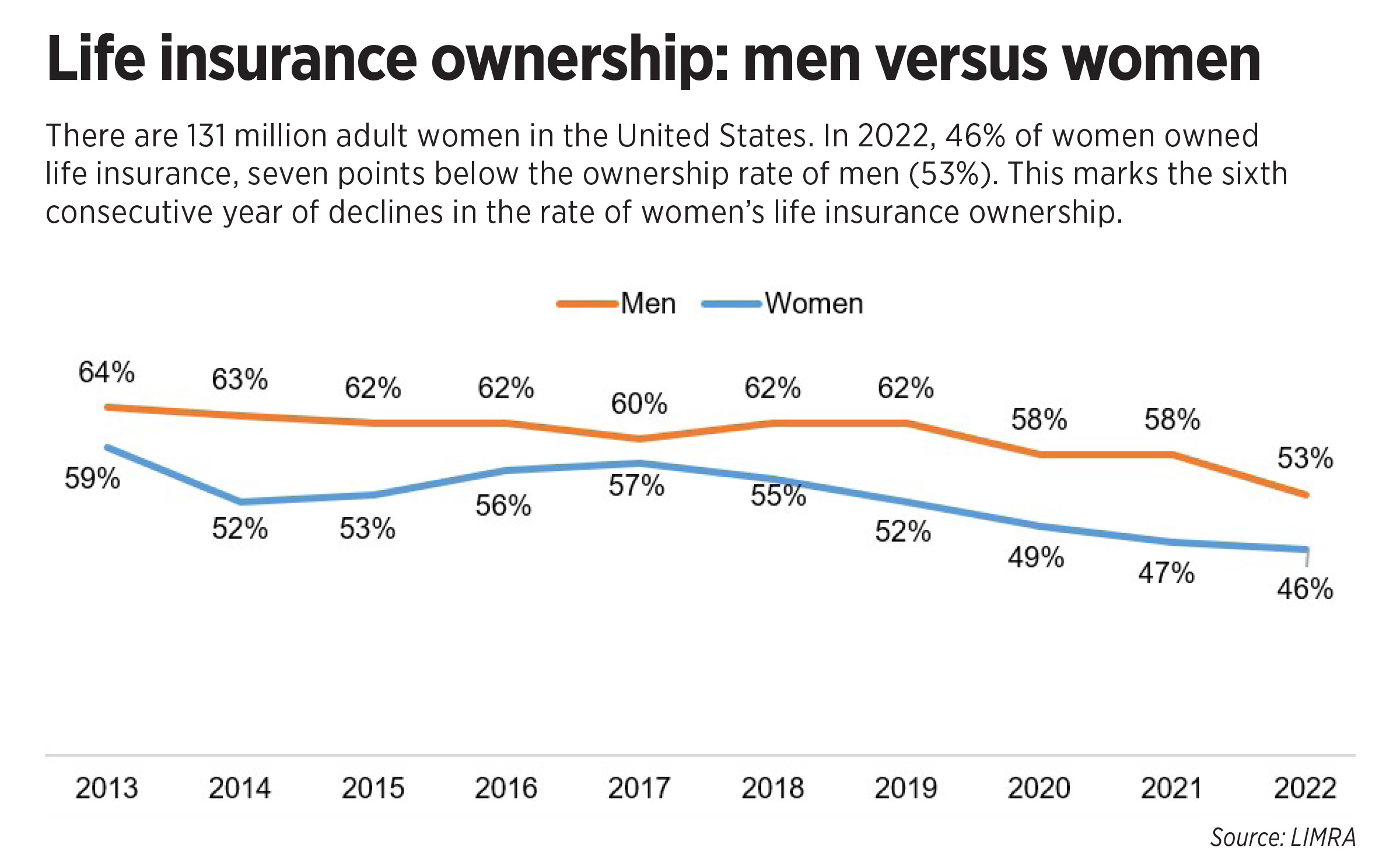

» In 2022, 46% of women owned life insurance, seven points below the ownership rate of men (53%). This marks the sixth consecutive year of declines in the rate of women’s life insurance ownership. (Source: LIMRA)

» 44% of women are very concerned about outliving their assets (versus 29% of men). (Source: LIMRA)

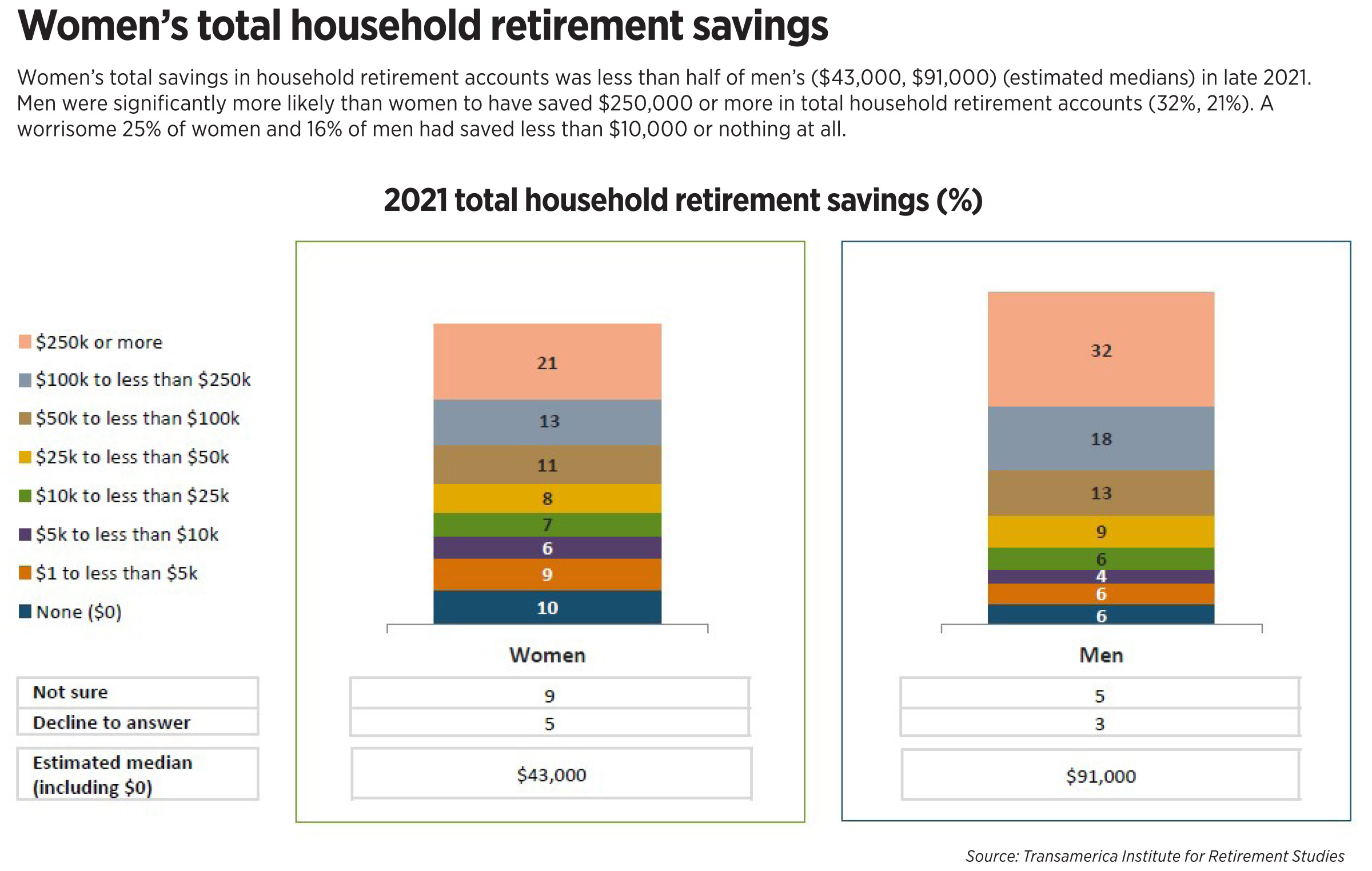

» Women workers have saved only $43,000 (estimated median) in all household retirement accounts. (Source: Transamerica Center for Retirement Studies.)

Musuneggi has seen these statistics play out among the women she serves in her practice, many of whom have lost a partner through death or divorce and are now navigating their finances alone.

“I heard more and more stories from women who are now trying to learn all the things they should have learned in high school and college and before they got married and whatever, and it was a struggle for some of them,” she said.

“Some of them were frustrated because they didn’t know anything. Some were scared to make mistakes. Not all of the women whose husbands died left them well off either. So, I said I wanted to focus on making sure, before these things happen, that women do not center their entire lives around believing ‘I’m secure because I have someone in my life.’”

That focus was the inspiration for writing A Man Is Not a Plan.

“Nobody else should be your plan. Not your father, not your bartender, not the girl across the street, not your business partners,” she said. “You need your own plan because the person who will take the best care of you is you.”

Musuneggi works with couples as well as single women, and she finds that “women have come a long way, but we still find that when we work with couples, the husband more than likely overrides the entire conversation. When I ask the wife about it, she says, ‘Oh, he handles all that.’ That ends the conversation right there. I say, ‘No, he doesn’t. We do this as a team. Everyone needs to be involved.’”

Going where the women are

Women began coming to Musuneggi when she started her practice because she went to them instead of waiting for them to come to her.

“I took the time to go to women’s organizations, to do workshops, to do speaking engagements,” she said. “Today, we do very little prospecting. People come to us. Part of it is because we have a program called ‘Friends Helping Friends.’ If someone’s a client, we encourage them to find their friends who might be good clients and to spread the word. About 98% of the new people we get as clients in a year are people who came to us.”

Musuneggi started Single Steps as a way to educate women about their finances.

“The whole focus of Single Steps is one step at a time. Let’s get you in front of someone you need to get in front of,” she said. “We decided if we were going to focus on women, we needed to have some way for women to learn. So, we gathered together a group of resources who were willing to give some free time to women. We have attorneys, accountants, counselors. We brought all these people together and said, ‘What we need you to do is be available and not charge anything for at least one session if one of our people calls, so that they can get some professional advice and not worry about having to pay for it.’ And these resources jumped on board; they said, ‘Yes, let’s do that.’”

In the decades Musuneggi has operated her practice, she sees the needs of women changing yet being the same.

“As much as we say, ‘You’ve come a long way, baby,’ I still see women and think, ‘It’s 2023! You do know this isn’t the way things are done anymore?’

“But at the same time, I see younger women who are starting out in a job that pays well, and they know they need to plan for their future. They’re ready to get started.”

Musuneggi said she believes the financial services industry must “work at not making this such a scary experience.”

“I’ve had women who have told me that they’ve gone to advisors, male and female, who’ve talked down to them. They don’t need that. They need somebody who’s going to counsel them. So I think we need to do a better job of saying, ‘We’re here as counselors — we’re not here to sell you bitcoin.’

“We need to tell women that [planning] needs to be the next life experience. You go to grade school, high school, college, get a job and start doing your financial planning. It all needs to flow together.”

Bridging the gap

LIMRA research shows a life insurance gap as well as a retirement savings gap between men and women. The reasons for those gaps are complex, but three main factors contribute to them, said Alison Salka, LIMRA vice president and director of research.

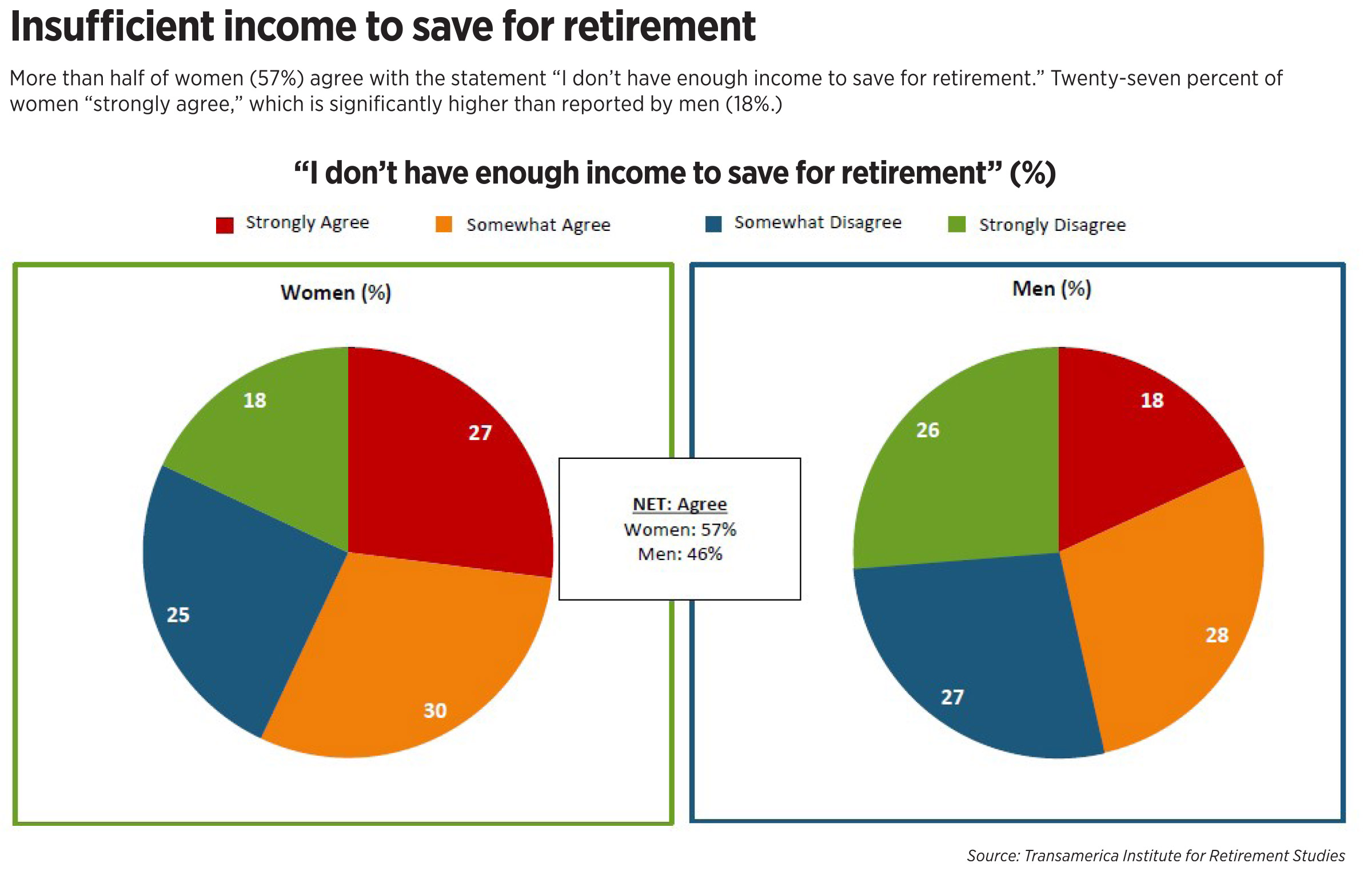

“First, there’s a pay gap. Women earn an estimated 82 cents for every dollar that men earn, so they earn less. So they may be less able to save. In addition, women are more likely to work in jobs that don’t offer benefits such as a retirement savings plan or life insurance, which means they have to take an extra step to seek out retail solutions. And they’re more likely to take a break in their employment to take care of other people. Our research has found that when they do that, their retirement savings likely take a hit.”

LIMRA conducted a study in 2022 to examine why women are less likely than men to own life insurance.

“We found that women believe they have less financial knowledge than men do,” Salka said.

“We also found women feel uncomfortable sharing personal information with financial professionals or with insurers. Women are more uncertain about making financial decisions because they believe they have less knowledge. That makes them feel more vulnerable when meeting with an advisor, and sometimes they’re afraid that someone may take advantage of that. All of these things hinder them from being able to have a full and good relationship with an advisor.”

Research shows women are stressed about their household finances, and the industry must take steps to help women address those concerns, Salka said.

“It starts off with understanding women’s concerns and looking at their goals. We also know that women tend to have self-professed lower levels of financial literacy. When they’re looking for financial relationships, they want to find somebody they’re comfortable with. So what the industry has done is tried to understand the needs of women, and they’ve tried to make advice more accessible, make educational material accessible to everybody.”

LIMRA also looked at the impact of female financial advisors on female consumers.

“We saw that female financial advisors tend to do more holistic planning, and they tend to do more budget and expense management,” Salka said. “From that, we can assume that women want or need those services more and that women advisors recognize that. I think giving women access to education and advice is crucial. Not everyone wants education, but I think it always should be accessible.”

Advice = wellness

Advisors have an opportunity to serve women by being aware of women’s unique concerns, Salka said.

“One way advisors can do a better job of reaching women is to ask for referrals,” she said.

“Women are more likely than men to consult friends and family when choosing an advisor. I also would say that advisors can do a better job when they reach out to women. Instead of saying, ‘I’m going to help you invest or look at these products,’ say, ‘This is about your wellness, your overall health. You want to be financially healthy in addition to being mentally and physically healthy. The way to do that is to take care of your finances.’”

Salka said advisors should start by helping women develop a formal written plan for day-to-day issues such as budgeting, then move on to a holistic plan that would include life insurance, an annuity or an individual retirement account or other retirement plan.

The industry is making progress in recruiting women advisors, Salka said, but women’s life insurance ownership remains down.

“I think the momentum to reach women is increasing, I think the effort is there, and the interest is there. But it takes a lot to reach women in a world where they are hyperdistracted and inflation is high. How do you get women to stop and take a minute and say, ‘I’m going to prioritize this; I’m going to meet with a professional’? It’s such a challenging environment overall.”

The rocky road to retirement

For the past 22 years, the Transamerica Center for Retirement Studies has looked at women’s retirement readiness. The outlook for women’s retirement prospects remains bleak, although some slow progress is being made.

Catherine Collinson is CEO and president of Transamerica Institute and TCRS. She said the risks women face in attaining retirement security have become part of the national dialogue — something that wasn’t the case 10 or 20 years ago.

The COVID-19 pandemic shone a light on women’s financial challenges and intensified the struggles that many women dealt with for years, TCRS found in its most recent study, “Emerging from the COVID-19 Pandemic: Women’s Health, Money and Retirement Preparations.”

Many women became stretched beyond their limits, juggling paid employment with home schooling and caregiving for aging loved ones, the study said. As these unpaid family responsibilities increased during the pandemic, many women also experienced employment setbacks. Some women gave up their employment and dropped out of the workforce altogether.

These factors put women further behind in saving and investing for retirement.

In addition, Collinson said, women are more likely than men to be busy with taking care of families and working in their jobs to the point where they don’t think about financial or retirement planning until a major life event hits them.

“It could be a divorce, a financial emergency, a health emergency, becoming a caregiver — any one of these things can prove to be a wake-up call and motivator for people to take charge of their situation.”

When TCRS asked women what would motivate them to become more engaged in retirement planning, the majority said they wanted to obtain advice that is easy to understand.

“Financial services still tends to be laden with jargon and technical terms,” Collinson said. “And those types of terms don’t resonate with women the way they do with men. It’s really important for women when an advisor is able to break things down and explain them in relatable, conceptual terms. And the starting point for the discussion on saving and investing for retirement is the sum of money you will need and that you will not run out of when you are retired. That can be a bit of an overwhelming proposition for most people.”

How does the industry help more women become financially secure? Collinson said it’s crucial “to offer assistance in an empowering manner.

“When we look at women being at greater risk than men of not achieving a secure retirement, it isn’t that women are ill prepared and men are super prepared,” she said. “Women are taking steps, and they need help and assistance to mitigate their risks. But men are far from perfect in the retirement plans. So we have to keep reminding ourselves that this is an everyone issue. It isn’t that men are good at it and women aren’t. In reality, relatively few people — women or men — are extremely good at it. Otherwise, we would not be so concerned about people achieving retirement security.

“When we approach retirement planning for women, we must be supportive, encouraging and empowering, offering guidance versus being critical of women and potentially undermining their confidence.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Advice from the Heartland — With Bonnie Maize

Women lag in retirement savings – and are stressed out about it, study says

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Idaho is among the most expensive states to give birth in. Here are the rankings

- Some farmers take hard hit on health insurance costs

Farmers now owe a lot more for health insurance (copy)

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

- Elevance making difficult decisions amid healthcare minefield

More Life Insurance News