Washington and California: A tale of two states and LTC

Washington state became the first in the nation to enact a publicly funded long-term care program when WA Cares took effect in July 2023. Meanwhile, a task force in California is examining the feasibility of a publicly funded LTC program in that state.

Members of the National Association of Insurance Commissioners Senior Task Force heard more about the California task force’s work as well as an update on WA Cares during the NAIC Spring Meeting.

The California Commissioner of Insurance set up a task force to recommend options for a public long-term care insurance program in that state, said Emily Smith, an attorney with the California Department of Insurance. A feasibility study recommending potential program designs was issued in December 2022 and an actuarial analysis of the cost and viability of the recommended designs was issued in December 2023.

The California Legislature has not made any decisions about a public LTC program, Ryan Delatorre of the CDI said. If the legislature does decide to proceed with legislation to establish a program, lawmakers may choose to adopt all, some or none of the task force recommendations.

Task force recommendations

Some of the task force recommendations, he said, include:

- Those who are unable to perform two out of six activities of daily living as well as those with cognitive impairment would be eligible for benefits.

- Benefit inflation would be based on the Consumer Price Index.

- Participants would have a 5-year or 10-year vesting period, with partial vesting after three years or five years, respectively.

- Formal or informal caregivers would be reimbursed, subject to a training requirement.

- Home modifications and home assessment would be eligible for coverage.

- All program designs would have partial to full domestic and international portability.

How would such a program be financed? Delatorre said the task force made the following recommendations:

- A progressive payroll tax and an income-based tax for self-employed individuals.

- A contribution cap of $400,000 in most designs, indexed with inflation.

- A contribution waiver of the first $30,000 in all designs, indexed with inflation.

- Contribution rates split 50/50 between employee and employer.

The task force also looked at some ways a publicly funded program could work with private LTCi and with Medi-Cal, California’s Medicaid program. They recommended:

- Private LTCi would pay before the public program would pay.

- The public program would pay before Medi-Cal.

- Individuals may opt out of the program if they buy eligible LTCi coverage prior to the public program’s effective date.

Delatorre said the task force also recommended forming a working group to explore supplemental private insurance options.

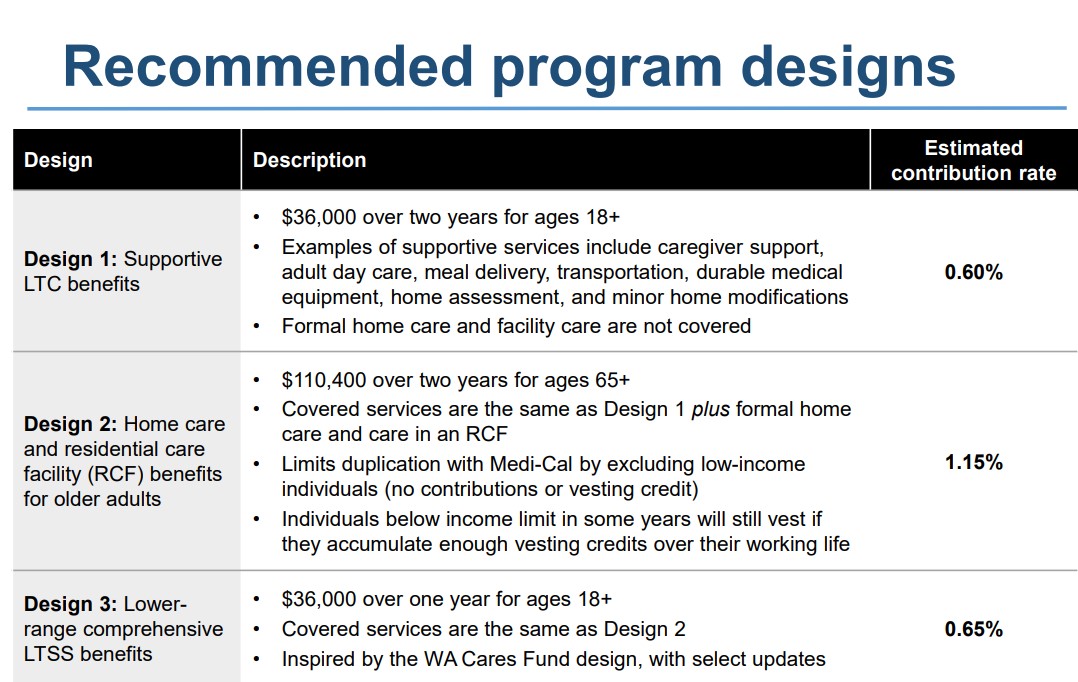

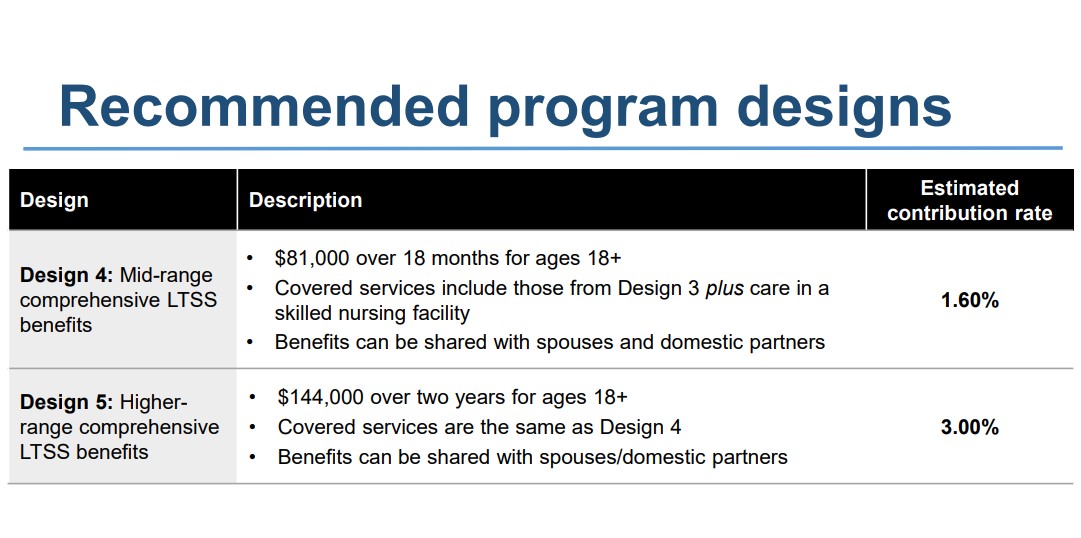

A breakdown of the task force’s five recommended program designs is as follows:

Update on WA Cares

Meanwhile, the NAIC task force heard an update on a commission’s recommendations on structuring a supplemental private LTCi market in Washington state.

Benjamin Veghte, director of the WA Cares Fund, said the reason for looking at a supplemental private LTCi market is “we’re very aware of the fact that our program has a modest premium for a modest benefit.” The fund is designed to provide Washington residents up to $36,500 adjusted for inflation per lifetime to pay for long-term care.

“WA Cares provides a foundation of long-term care security for all Washingtonians,” he said. “But many of us may want more insurance. And just like many of us want more retirement security and choose to save money in a 401(k) or an individual retirement account, we see a supplemental private long-term care insurance market is analogous to that.”

Veghte said he hopes that by establishing a supplemental insurance market, “for the first time – outside of the employer or the group space – a broad segment of the middle class will be able to afford private long-term care insurance.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on X @INNsusan.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Regulators consider guideline to best-interest rule to address ‘deficiencies’

Colorado gears up to add AI regulations for health insurance

Advisor News

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

More Advisor NewsAnnuity News

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsLife Insurance News

Property and Casualty News

- Jeff Landry asks state-created insurer to pay for fortified roofs. Here’s why.

- Could AI claims settlement without a lawyer become the new norm?

- Nancy Guthrie abduction puts focus on 'kidnap and ransom' insurance

- U.S. insurers optimistic despite increased headwinds

- Bowhead Specialty Holdings Inc. Reports Fourth Quarter and Full Year 2025 Results

More Property and Casualty News