Unlocking The Benefits Of Cash Value In IUL

By Jason Wellmann

As Americans plan for retirement, it’s likely they share a number of similar concerns: How to protect their family from the unexpected? What sources may be available to supplement their retirement income? How to help protect their assets from market losses? What methods can they use to potentially reduce taxes affecting their retirement income? How can they help ensure their retirement savings won’t be depleted by health care costs?

If your client is in need of life insurance coverage, permanent life insurance can help address all of these concerns by bridging the gap between their retirement savings and their retirement income goals.

A permanent life insurance policy addresses the primary need for death benefit protection for your client’s beneficiaries, but it also offers the potential to accumulate cash value tax-deferred that can be accessed later for a variety of needs through policy loans or withdrawal.

Unfortunately, a majority of Americans are uninformed about the many benefits that permanent life insurance can provide. According to the 2018 Life Insurance Needs Survey from Allianz Life, more than half (51 percent) of survey respondents are unsure or don’t believe cash value from permanent life insurance can be used to help fund college education, supplement retirement income or assist with other financial needs.

So how does accessing cash value from a permanent life insurance policy work? When can your client access their cash value? What are the advantages and potential disadvantages of using cash value in your client’s overall financial strategy?

Let’s take a closer look at the benefits and challenges of accessing the cash value of a permanent life insurance policy through examining a specific type of permanent life insurance – fixed index universal life insurance.

Exploring The Benefits Of IUL

Assuming the policy is properly funded, IUL policies give your clients the flexibility to pay premium when they want and in the amount they choose for the life insurance coverage they need. The premium, minus fees and charges, has the potential to build cash value in the policy through a variety of allocation options – including a fixed interest allocation.

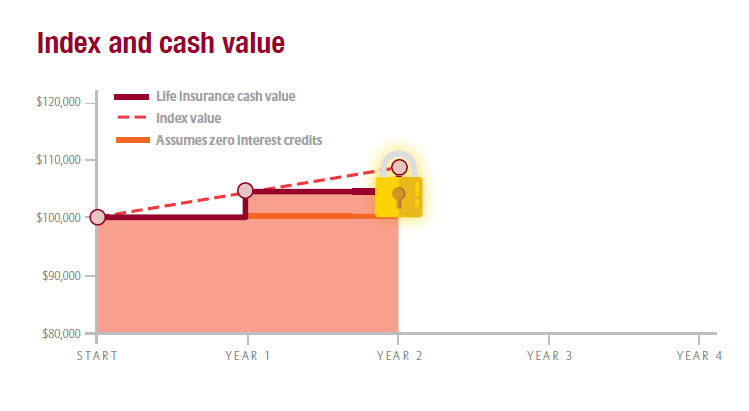

Here’s where the “index” part of IUL comes in. The policy’s cash value has the potential to earn indexed interest based on the annual return of an external index, and that interest is credited to the policy and locked in for that year, on the policy anniversary. Although an external index may affect the interest credited, the policy does not directly participate in any equity or fixed income investments.

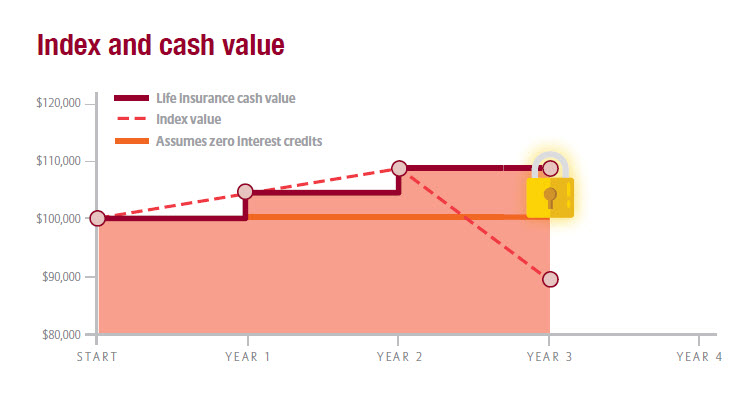

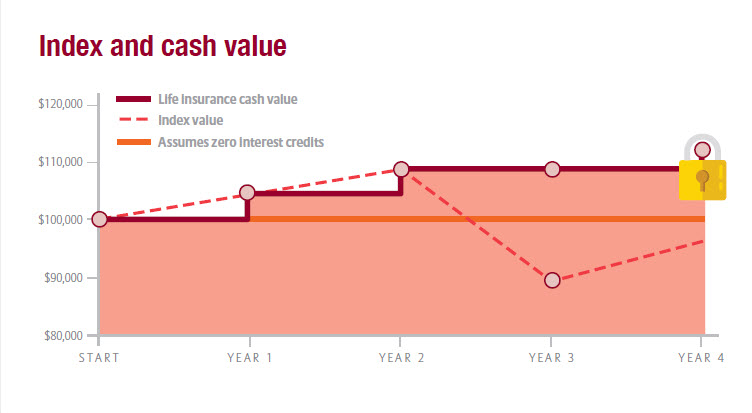

This hypothetical example is provided for illustrative purposes only, and does not represent the deduction of fees and charges which would reduce cash value.

As the index value grows, so does the Life Insurance Cash value (subject to certain limitations).

Each year that interest is credited to the policy, it is locked in for that year.

Even if the index value drops, the policyholder loses nothing because the cash value is not actually invested in the index.

Once the cash value is locked in on the policy anniversary, it can never be lost due to market volatility.

Therefore, if the index value drops, your client loses nothing because their cash value is not actually invested in the index. Once it is locked in on the policy anniversary, the cash value can never be lost due to market volatility – even if the index drops. It’s important to remember that indexed interest potential may be limited based on certain factors and that fees and charges will still reduce the cash value of the policy.

The opportunity to build cash value is very important as it allows your client to hold their policy and let that cash value grow in case they need it in the future for various financial needs, including supplementing retirement income. Keep in mind, the cash value from an FIUL policy isn’t intended to provide a guaranteed stream of retirement income, but it can help supplement income from other sources such as Social Security, 401(k)s, individual retirement accounts or personal savings through policy loans and withdrawals.

Tax Benefits And Flexibility

Cash value from an IUL policy also can be important for tax diversification purposes, which can be critical since no one can predict what income tax rates will be in the future. FIUL offers distinct tax advantages that may help address this concern.

First, an IUL policy gives your client the opportunity for tax-deferred cash-value accumulation. This means they don’t pay taxes on the interest the cash value in their policy earns while it’s accumulating. Over time, this could add up to greater cash value accumulation.

Second, IUL provides the potential for income-tax-free loans and withdrawals. Your client can access any available cash value whenever they want, and for any purpose.

In addition to these tax advantages, there’s another reason to consider using the cash value component of an FIUL policy: flexibility. Although life insurance does have health and financial qualifications, it isn’t subject to some of the same age and income restrictions as many other financial vehicles. This may give your client greater flexibility in managing their retirement income.

For example, generally there are no penalties for accessing an IUL policy’s cash value before age 59½ . Another advantage is that taking a loan or withdrawal from an IUL policy currently doesn’t affect your client’s Social Security income. This gives them the flexibility to access their policy’s cash value for emergencies or special occasions without impacting their Social Security benefits.

Plus, an IUL policy doesn’t have mandatory required minimum distributions beginning at age 70½ . This is important as your client determines their strategy for accessing their retirement funds from various sources.

Restrictions And Considerations

Like any financial product, IUL has a number of restrictions and considerations that clients must consider before they access their policy’s cash value. Here are the key topics you should discuss with them prior to making any decisions.

Qualification. Clients must be healthy enough to qualify through health underwriting, and also must qualify through financial underwriting.

Taxes. It’s important to keep in mind that how your client funds their policy may affect how the loans are taxed. It’s a good idea for them to consult with a tax advisor for guidance about their specific situation.

Policy loans and withdrawals. Policy loans and withdrawals will reduce the available cash value and death benefit, and may cause unintended consequences, including lapse or taxable events. Withdrawals in excess of premiums paid will be subject to ordinary income tax. If a policy is a modified endowment contract, policy loans and withdrawals will be taxable as ordinary income to the extent there are earnings in the policy. If these features are exercised prior to age 59½ on a MEC, an additional 10 percent federal tax may be imposed.

Index performance and interest potential. An IUL policy may be subject to market volatility to a certain extent and has the potential to earn 0 percent in any given year. The amount of interest the policy earns will impact the amount of cash value available and there is no guarantee the cash value will be sufficient to keep the policy in force or to support a policy loan or withdrawal strategy.

Guarantees. Although IUL policies do have a guaranteed minimum interest rate and are guaranteed not to lose value due to market volatility, it’s important to remember that fees and charges will still reduce the cash value of the policy. Also, IUL is not a guaranteed source of retirement income or a guaranteed income stream.

There are many benefits to using cash value from a permanent life insurance policy, but also several things for your client to consider before doing so. Along with providing the income-tax-free death benefit to help protect their family, the cash value from an IUL policy can offer flexibility for emergencies and discretionary spending, and help address some of their long-term concerns.

Jason Wellmann is senior vice president of life insurance sales for Allianz Life. Jason may be contacted at [email protected].

© Entire contents copyright 2018 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

When Getting The Boot Leads To A Sale

Investors On Spotify Growth: That Don’t Impress Me Much

Advisor News

- Does your investor client know how much they pay in fees?

- Get friends to do business: 2 distinct approaches

- Unlocking hidden AUM: Prospecting from within your client base

- Protests in D.C. Take Aim at Health Insurance, Financial Institutions, Oil & Gas Interests

- Charitable giving tools available for taxpayers; due to expire

More Advisor NewsAnnuity News

Health/Employee Benefits News

- DOCCS commish: Striking NY correction officers will lose health insurance Monday

- Leadership: The Virginia Power 50 List

- Research Conducted at Cleveland Clinic Has Provided New Information about Insurance (High-intensity Home-based Rehabilitation In a Medicare Accountable Care Organization): Insurance

- Researchers from Marshall B. Ketchum University Describe Findings in Insurance (Office Procedures for Older Adults By Physician Associates and Nurse Practitioners): Insurance

- GOP lawmakers commit to big spending cuts, putting Medicaid under a spotlight – but trimming the low-income health insurance program would be hard

More Health/Employee Benefits NewsLife Insurance News