Timeless influencers: Financial professionals and life insurance brands

Strong brand awareness can be particularly important in industries such as the life insurance industry, where customers make long-term commitments involving significant financial investments.

The benefits of having a well-known brand in this space are many — including reassuring potential customers of a company’s stability, enhancing perceived value, and fostering customer loyalty — which contribute to improved marketing efficiency and sustained business growth. Nonetheless, investing in advertising to build brand awareness among consumers is not a focus for all life insurance companies as some prioritize distribution strategies that leverage financial professionals to reach and retain their customers.

In an update to research conducted in 2014 and 2019, LIMRA explored consumer awareness of life insurance brands in 2025 and the factors driving consumer perceptions. Among the study’s findings, we see clear evidence of the important role distribution partners play in raising brand awareness.

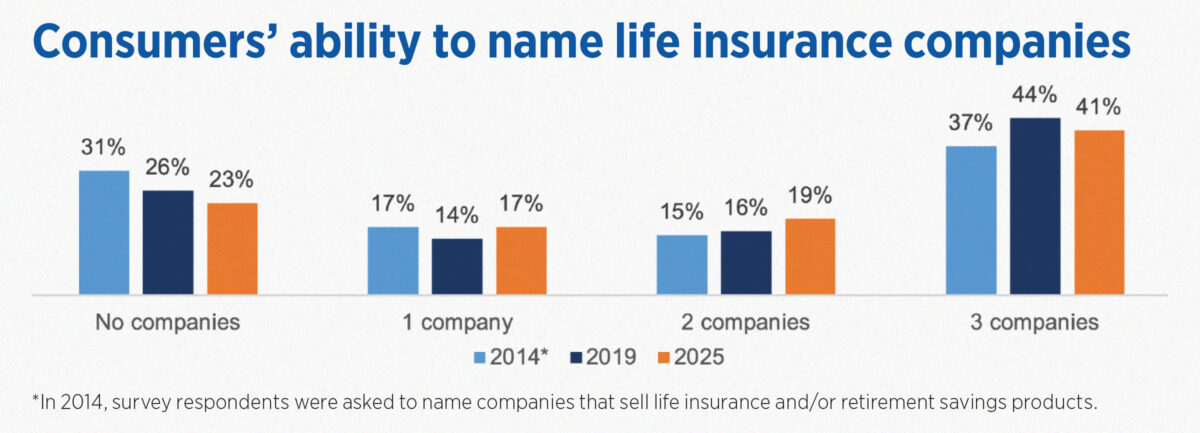

Americans’ ability to name a life insurance company unaided has improved over the past decade, yet nearly 1 in 4 adults still cannot name a single carrier today and a majority cannot name three (see chart). As you might expect, awareness increases with age (up to age 65), wealth, financial knowledge and confidence in the industry. Consumer groups showing higher brand awareness include men, Black Americans, parents of young children, life insurance owners and people who work with a financial professional to make at least some of their household’s financial decisions. Notably, half of adults who work with a financial professional can name three companies that sell life insurance compared with one-third of people who manage their finances independently. This effect remains true even when other factors such as age, wealth and ownership are taken into account.

While there are more than 700 life insurance companies in the U.S., survey respondents named 257 unique entities (including some insurance agencies, associations and nonspecific entities like “Mutual”). The 10 most frequently named companies in 2025 accounted for 56% of all consumer mentions. As people often don’t differentiate between different types of insurance companies, the list of the best known “life insurance” companies includes personal line insurers again this year.

Top 10 leaders in consumer mindshare

• MetLife

• State Farm

• Prudential

• Allstate

• New York Life

• Liberty Mutual*

• Mutual of Omaha

• Progressive*

• Nationwide

• GEICO*

*Company does not manufacture life insurance itself, but places business with other carriers.

Here again, the study’s results reveal the influence of strong distribution networks in the life insurance space. For example, we see companies such as Northwestern Mutual and MassMutual rise in the mindshare rankings among adults who work with financial professionals. Respondents receiving professional advice were less likely to point to advertising as a reason for their recall — 40% compared with 46% of people who do not work with a financial professional — and more likely to attribute their awareness of a life insurance brand to ownership (41% versus 32%) and/or the company’s reputation (33% versus 27%). Where reputation was a reason for recall, consumers who work with financial professionals tend to have slightly higher opinions of the life insurance companies. It’s worth noting that opinions of the companies named were largely positive across the board and almost never negative.

LIMRA’s study underscores the importance of brand awareness in the life insurance industry and highlights the important role financial professionals can play in this process. For companies that prioritize distribution over advertising, leveraging the influence of financial professionals can significantly enhance consumer awareness and trust.

Jennifer Douglas is part of a team responsible for implementing and managing processes to ensure the quality of LIMRA’s research program. She may be contacted at [email protected].

What high-performing advisors are doing differently in 2025

What Medicare beneficiaries really want in AEP

Advisor News

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

More Advisor NewsAnnuity News

- Trademark Application for “EMPOWER MY WEALTH” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Conning says insurers’ success in 2026 will depend on ‘strategic adaptation’

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

More Annuity NewsHealth/Employee Benefits News

- OnMed and Triple-S Expand Healthcare Access Across Puerto Rico

- CVS Health Makes Health Insurance Simpler and More Affordable for Americans

- Obamacare sign-ups drop, but the extent won’t be clear for months

- Lawmakers advance Reynolds' proposal for waiver

- NC Medicaid leaders seek new funding strategy as work rules loom

More Health/Employee Benefits NewsLife Insurance News