Regulators debate need for proxy discrimination protections in insurance

State insurance regulators tackled race and insurance during the summer 2020 following the murder of George Floyd by a Minneapolis police officer.

The National Association of Insurance Commissioners established a Special Committee on Race and Insurance, which met regularly. Still, it made little news or reached any weighty conclusions.

That changed this week when regulators hosted a lengthy debate on proxy discrimination's meaning and cultural significance. Proxy discrimination occurs when a facially neutral trait is used as a stand-in for a prohibited trait.

Consumer advocates want to see greater protections for victims of proxy discrimination, or unintended “disparate outcomes” that can accompany the collection of personal data. For example, for decades some financial institutions used ZIP codes and neighborhood boundaries in place of race to avoid lending to neighborhoods that were predominantly African American.

The development and use of artificial intelligence to perform many functions of insurance underwriting is making proxy discrimination a much bigger issue. Peter Kochenburger is an NAIC consumer representative and visiting law professor at Southern University Law Center.

He spoke Monday during the Special Committee on Race and Insurance meeting at the NAIC summer meeting in Chicago.

“AI, data collection and the predictive models make it much more likely, if not inevitable, that there will be proxy discrimination without any intent to do so unless things are done,” he said.

The Feds might be interested

State insurance regulators are highly protective of their insurance oversight role. But Kochenburger reminded the committee that a lack of action to counter proxy discrimination “invites a federal response.”

Critics have long claimed that state insurance regulators are slow to investigate discrimination practices.

Kay Noonan, general counsel for the NAIC, discussed court developments regarding proxy discrimination and the related “disparate impacts,” a judicial theory that allows a challenger to prove discrimination by a facially neutral practice because it allegedly disproportionately harms members of a protected class.

“There remain some open questions of when unfair treatment results in unfair discrimination as defined by in the state statutes,” she said. “Consensus on the definitions of these various terms is going to be essential to the extent that the regulators decide that the appropriate thing to do here is to develop further regulator guidance.”

To date, the NAIC has produced a pair of documents that touch on proxy discrimination and are not prescriptive.

Iowa Insurance Commissioner Doug Ommen was unsatisfied with both presentations by Kochenburger and Noonan.

“Why do we need proxy discrimination even in the discussion if we're only determining whether or not disparate impact is something that we would consider to be problematic?” Ommen asked. “If it's problematic, we can debate it. But why do we need to substitute now this idea of proxy discrimination, which I think has different meanings in employment, certainly different meanings in credit and finance? Why do we need that now in our insurance landscape?”

“It's a test or standard utilized in all in pretty much other areas of financial services regulation,” Kochenburger said. “Why shouldn’t it be insurance? Why is insurance so special that insurance consumers, unlike banking, credit, consumers and all others, should not have the benefit or the protection of a disparate impact analysis.”

ZIP code discrimination alleged

There are numerous examples of how big data algorithms discriminate against communities of color. For example, consumer advocates point to a 2018 study by Consumer Reports and ProPublica that found disparities in vehicle insurance prices between minority and white neighborhoods that could not be explained by risk alone.

Robert Gordon is the senior vice president, policy, research & international for the American Property Casualty Insurance Association. Appearing before the special committee on Monday, Gordon addressed studies showing disparate vehicle insurance rates.

“Every study has also found that the urban losses and expenses were also higher. In other words, it's place, not race,” Gordon said. “What a lot of it the activists get wrong is that policyholders in urban areas with dense vehicle traffic, they're not paying more for their coverage. They're paying commensurately for their much higher level of risk.”

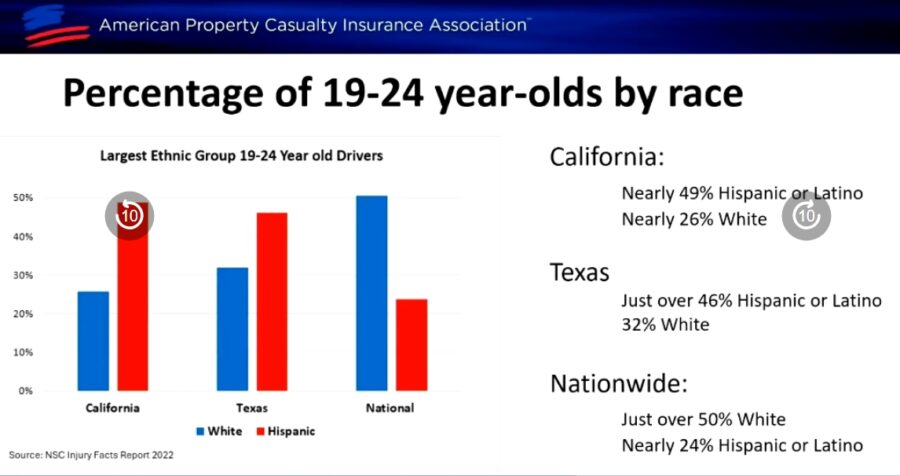

At times, it is difficult for insurance companies to do business in such narrowly defined lanes, Gordon said. He gave the example of a vehicle insurer that uses youth as a rating factor, which is “highly correlative of accident frequency and severity.”

In California, that would be disproportionately impacting Hispanic and Latinos, which is a protected class.

“If an insurer intentionally discriminates against Hispanics, that would be disparate treatment against a protected class, and that is unlawful,” Gordon noted. “If an insurer uses age with the intent of discriminating against Hispanics, then that would be proxy discrimination against a protected class, which is also unlawful.”

But if an insurer uses age not to discriminate based on race, but because age is highly predictive of driving behavior, “then the data shows it would have an initial disparate impact, but it's not prohibited, and frankly, it makes a lot of sense,” he explained.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Extreme weather could crack a retirement nest egg

Why insurers must maintain a personal touch in a technology-driven era

Advisor News

- Wall Street CEOs warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

- FSI announces 2026 board of directors and executive committee members

- Tax implications under the One Big Beautiful Bill Act

- FPA launches FPAi Authority to support members with AI education and tools

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Illinois extends enrollment deadline for health insurance plans beginning Feb. 1

- Virginia Republicans split over extending health care subsidies

- Illinois uses state-run ACA exchange to extend deadline

- Fewer Americans sign up for Affordable Care Act health insurance as costs spike

- Deerhold and Windsor Strategy Partners Launch Solution that Enhances Network Analysis for Stop-Loss Carriers and MGUs

More Health/Employee Benefits NewsLife Insurance News