Principal Financial Counters 1Q Losses With Strong Investment Gains

COVID-19 claims continued to bite into earnings at Principal Financial, but the Des Moines, Iowa-based insurer rebounded with growth in other sectors.

The company hosted analysts today for a first-quarter earnings call review of the numbers. Principal reported higher revenues across most of its business lines, lower expenses and higher assets under management (AUM).

Operating revenues declined nearly 30% year over year to $3.1 billion due to lower premiums and other considerations. Total expenses decreased 38.6% year over year to $2.6 billion due to lower benefits, claims and settlement expenses, dividends to policyholders as well as operating expenses.

Principal reported a record AUM of $820.3 billion, up 29.9% year over year.

“Our global, diversified, and integrated approach to financial security continues to differentiate Principal in the marketplace," CEO Dan Houston said. "Strong execution coupled with improving macroeconomic conditions drove growth in first quarter financial results. We’re optimistic about the opportunities that lie ahead as momentum has returned in many of our businesses."

COVID Loss Data

Principal took some heavy losses in the quarter, said Deanna Strable, executive vice president and chief financial officer. These included a $21 million impact from COVID-related claims and a $90 million impact from the integration of Wells Fargo’s Institutional Retirement & Trust business, which Principal acquired in July 2019.

"For the full year, we're now estimating a total of 275,000 U.S. Covid deaths, or about 75,000 in the remainder of the year," Strable said. "This is slightly lower than what was anticipated in our outlook due to the vaccine rollout."

At Principal's U.S. insurance solutions business, benefits, claims and settlement expenses increased by $102 million, to $771 million. Premiums increased $19 million to $702 million.

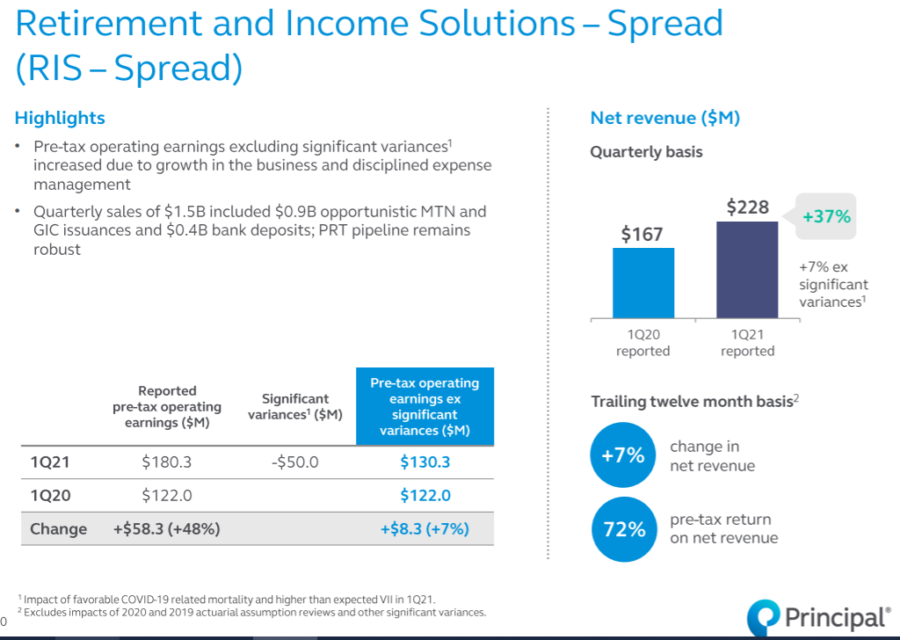

Principal sells annuities as part of its Retirement and Income Solutions unit, but executives did not mention annuities during the call. Pre-tax operating earnings in the RIS segment increased to $288 million on $1.2 billion in operating revenue, up from $205 million on $2.6 billion operating revenue in Q1 2020.

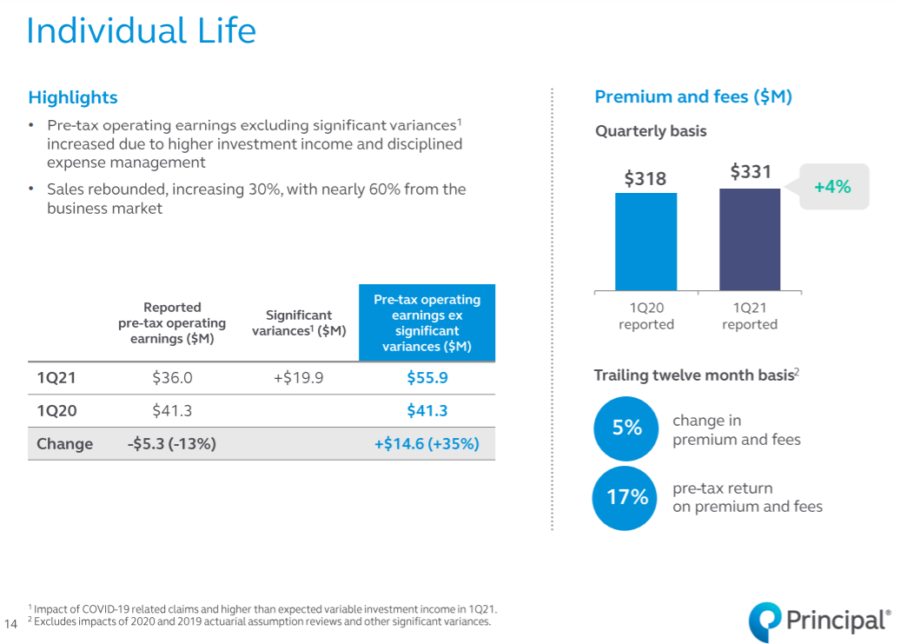

The insurer's U.S. Insurance Solutions unit includes life insurance. Revenues there grew 4.6% year over year to $1.2 billion driven by higher premiums and other considerations, net investment income, fees and other revenues.

Operating earnings of $95.2 million decreased 26.5% year over year, mainly due to poor performance at Specialty Benefits Insurance business.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Biden Tax Plan May Leave Estate Tax Alone, But Kill ‘Step Up’ Provision

The Pandemic’s Silver Lining? An Experienced Job Candidate Pool

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Senator Alvord pushes back on constant cost increases of health insurance with full bipartisan support

- Reports Outline End Stage Kidney Disease Study Findings from University of Utah (Medicare Advantage in the US mainland and Puerto Rico): Kidney Diseases and Conditions – End Stage Kidney Disease

- New Findings on Wilson’s Disease from Alexion Summarized (Patient Burden in the Treatment of Wilson Disease in the United States: An Analysis of Real-World Health Insurance Claims Data from the Komodo database): Nutritional and Metabolic Diseases and Conditions – Wilson’s Disease

- Legal Notices

- Higher premiums, Medicare updates: Healthcare changes to expect in 2026

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News