Biden Tax Plan May Leave Estate Tax Alone, But Kill ‘Step Up’ Provision

The estate tax would not be changed, but step-up in basis would be eliminated under President Joe Biden’s tax plan to be revealed today, according to a report.

Wealthy families would be able to breathe a sigh of relief because the exemption rate would not be lowered to $3.5 million, down from $11.7 million, as Biden had promised in campaigning, according to a Bloomberg News report.

But eliminating the step-up in basis would slam heirs with a significant capital gains tax bill, particularly if that rate is increased to match income tax rates, as Biden is proposing. With the Medicare surcharge, the top rate would be 43.4%.

Heirs would not enjoy as generous an exemption level in the estate tax. Gains less than $1 million would be exempt, according to reports.

The elimination in the step up is another piece of the Biden administration’s strategy to tax the wealthy. A Biden staffer and nominee published a paper on the subject in 2019, according to The Washington Post. Lily Batchelder, Treasury Department nominee, and David Kamin, deputy director of the White House’s National Economic Council, said nearly 40% of the wealth of the top 1% comes from accrued and unrealized capital gains, adding that the top 1% holds about half of all such realized gains.

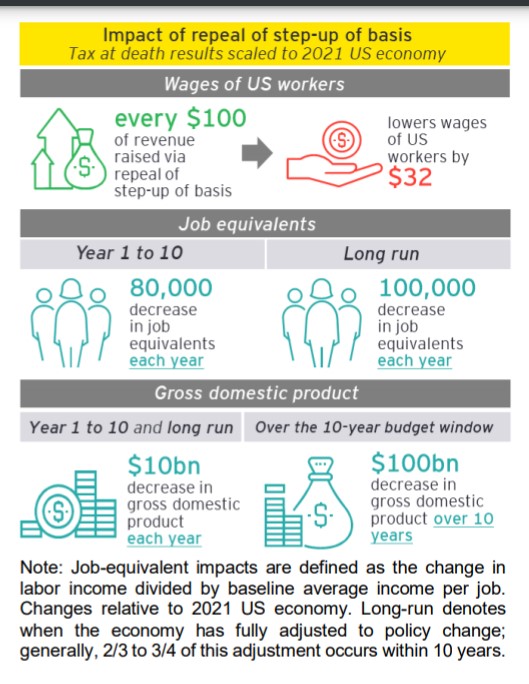

Organizations representing small businesses are rallying against the elimination of the step up, saying it would devastate businesses between generations. According to a report by EY for the Family Business Estate Tax Coalition, the repeal would eliminate 80,000 jobs each year and cut GDP by $10 billion annually.

There are two approaches if it is repealed. One would be taxation upon death, when tax on the capital gain between purchase and inheritance are due upon death, or carryover, which comes due when the asset is sold. Although both are onerous, the report said, the tax at death is particularly troubling.

“By raising the tax burden on investment, the repeal of step-up of basis via tax at death increases the cost of capital, which discourages investment and results in less capital formation,” according to the report. “With less capital available per worker, labor productivity falls. This reduces the wages of workers and, ultimately, GDP and Americans’ standard of living.”

Even with the carryover, wealthy families would be facing an enormous tax bill in most cases. With multiple heirs, large assets such as farms and franchises are often sold to settle the estate.

Nevertheless, momentum is building against the step up provision. The Penn Wharton Budget Model shows that raising the capital gains rate would decrease revenue while the step up would increase revenue for the federal government.

“PWBM estimates that raising the top statutory rate on capital gains to 39.6 percent would decrease revenue by $33 billion over fiscal years 2022-2031,” according to a Penn Wharton blog post. “If stepped-up basis were eliminated — as proposed in President Biden’s campaign plan — then raising the top rate to 39.6 percent would instead raise $113 billion over 2022-2031.”

Biden is expected to unveil the tax plan tonight at the Capitol.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

How Does President Biden’s First 100 Days Compare To Trump?

Principal Financial Counters 1Q Losses With Strong Investment Gains

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- ‘They won’t help me’: Sickest patients face insurance denials despite policy fixes

- Thousands of Missouri construction workers with Anthem health insurance left scrambling

- Don't let death penalty turn Luigi Mangione into a martyr

- More than 5M could lose Medicaid coverage if feds impose work requirements

- Don't make Mangione a martyr

More Health/Employee Benefits NewsLife Insurance News

- 2024 ModeSlavery Report (bpcc modeslavery report 2024 en final)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News