Principal Bets On Employer Market In Pivot

Principal Financial plans to push further into employee benefits as companies try to make themselves more attractive in a competitive job market, according to executives in the company’s fourth-quarter earnings call on Tuesday.

Principal was an outlier in finding success in the employee benefits space in 2021 by focusing on smaller businesses, said CEO Dan Houston.

“We deliver tremendous growth aided by increased demand for benefits, robust hiring, and favorable wage trends and our target market,” Houston said. “Notably, group benefits full year in group growth was a record 4% for the total block, and over 5% in business with under 200 employees. Full year sales for specialty benefits were up 10% in premium and fee growth was over 7%.”

Brokers can expect the company to expand in this space, with Houston pointing to corporate-owned life insurance as an example of a promising product line in the company’s push into worksite benefits.

“It's exciting because that certainly fits with our strategy of exiting the retail a portion of life and doubling down on the business life insurance,” said Houston, who promised more details to come during a 2022 Outlook call on March 2. “We see that as a real growth opportunity.”

The earnings call followed last week’s news that the company found a private-equity buyer, Sixth Street Partners, for its fixed retail annuity and life insurance business in a $25 billion deal.

Principal had announced last summer that it was exiting the life and annuity lines under pressure from activist investors to focus on more profitable business, such as wealth management.

“The execution of our strategic review has made us a better company prepared to compete and win in an evolving market,” Houston said.

The company has been focusing on managing assets in the United States and growing business internationally as part of its pivot, but a large part of its strategy has shifted to workplace benefits. Corporate-owned life insurance, or COLI, is just one tool in Principal’s suite of products, such as vision, dental, life and disability, in what Amy Friedrich, U.S. insurance solutions president, sees as the company’s role of consultant with employers.

“We've built up a huge market-leading position in terms of being experts in the nonqualified marketplace,” Friedrich said, also mentioning that Principal increased the average number of products per case from 2.66 products per case in 2020 up to 2.75 in 2021. “That’s unique in the industry as well.”

The company plans to build on those employer relationships through brokers.

“When you're establishing a benefit for the first time, you often are in a position you can help consult. You can help the broker advisor get educated about these products, and you can help that business owner get educated,” Friedrich said. “With that consulting side of the practice on building new markets, you also get a relationship established, and that relationship tends to pay off.”

The strategy is not a one template for each employer, but requires a different entry point for each client.

“Some of the things that we look at is what benefit design are they trying to fill. Sometimes they're looking at dental, vision first, because they're the most utilized benefits,” Friedrich said. “What we've seen post-pandemic is the heightened awareness of needing life and disability coverage has brought those to the forefront. So we're seeing small employers start the conversation there and then fill in with some of the other benefits.”

The company plans to develop products such as accidental and critical illness coverage to fill out the worksite portfolio.

“We've been quietly and slowly building up those capabilities,” Friedrich said. “And we see those as a potential future margin expansion opportunity, as well as have high interest to our customer base.”

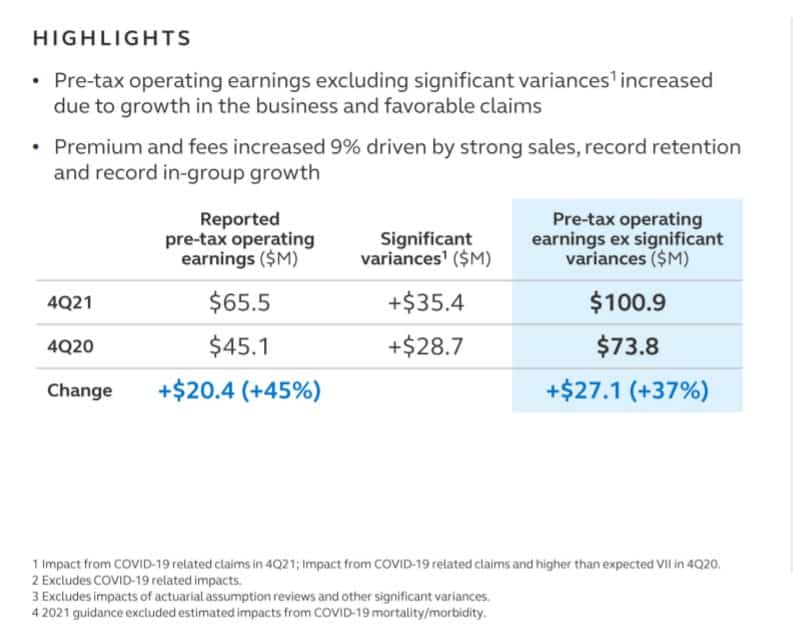

The company’s performance exceeded expectations. In quarterly and full year results:

Quarterly earnings were $498 million, up 25% from year-prior quarter. [Excluding “significant variances,” the result was $470 million, or 17% over the prior year.]

Full year earnings were $1.848 billion, up 35% over 2020. [Excluding “significant variances,” the result was $1.809 billion, up 15%.]

In other news, the company announced a retirement and personnel change.

Retirement and Income Solutions President Renee Schaaf is retiring after 41 years with Principal. She will be replaced by Executive Vice President and General Counsel Chris Littlefield, who was previously CEO of Fidelity & General and Aviva USA.

Littlefield will be responsible for leading the retirement business at Principal, serving the retirement savings and income needs in a full spectrum of retirement plan types, along with trust and custody and income solutions, for over 40,000 employers and 10 million individual customers, according to the company’s announcement.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

State Farm Punting On Super Bowl Advertising In Favor Of TikTok

Help Clients Have Positive Impact Through Shareholder Engagement

Advisor News

- Does your investor client know how much they pay in fees?

- Get friends to do business: 2 distinct approaches

- Unlocking hidden AUM: Prospecting from within your client base

- Protests in D.C. Take Aim at Health Insurance, Financial Institutions, Oil & Gas Interests

- Charitable giving tools available for taxpayers; due to expire

More Advisor NewsAnnuity News

Health/Employee Benefits News

- DOCCS commish: Striking NY correction officers will lose health insurance Monday

- Leadership: The Virginia Power 50 List

- Research Conducted at Cleveland Clinic Has Provided New Information about Insurance (High-intensity Home-based Rehabilitation In a Medicare Accountable Care Organization): Insurance

- Researchers from Marshall B. Ketchum University Describe Findings in Insurance (Office Procedures for Older Adults By Physician Associates and Nurse Practitioners): Insurance

- GOP lawmakers commit to big spending cuts, putting Medicaid under a spotlight – but trimming the low-income health insurance program would be hard

More Health/Employee Benefits NewsLife Insurance News