Pandemic Increases Interest In Combination Products

The 2020 pandemic affected consumer interest and awareness of financial products in many ways. LIMRA’s consumer sentiment survey showed increased consumer concerns related to financial security and an increased interest in life insurance as COVID-19 made the risk of illness and mortality top of mind for many. Interest in combination life insurance/long-term care products, which are a solution for consumers’ life and long-term care needs, also increased during the pandemic.

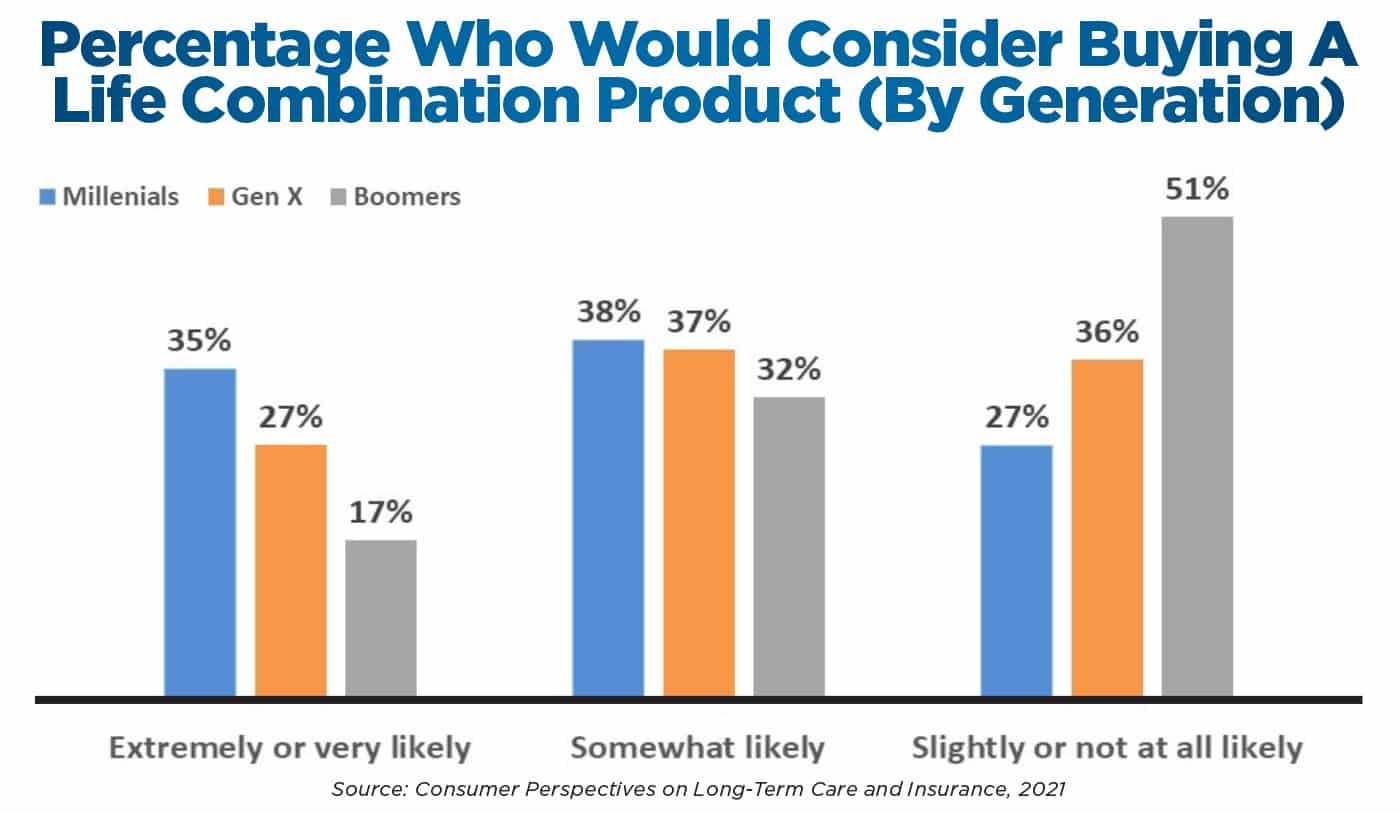

In early 2021, 26% of consumers were extremely or very likely to consider a combination product when shopping for life insurance — up from 17% only two years ago. This jumps to 36% of people who are facing high levels of stress as caregivers, either for adult relatives or for children. These consumers recognize better than anyone the value of planning ahead for long-term care needs.

We were surprised to find that interest in these products decreases with age. Millennials are the most likely to consider combination products. This group probably finds the concept of a one-stop solution to life and long-term care needs appealing. They also are less likely to own life insurance, and many in this generation and in Generation X are part of the high caregiving stress group “sandwiched” with young children at home and older relatives who may need care.

The expense of long-term care and the desire for an economical form of coverage are key reasons consumers are interested in combination products. Among respondents who were at least “somewhat” likely to consider these products when shopping for life insurance, 35% cited concerns that long-term care costs would deplete or exceed their savings, and 33% thought combination products would be a more economical use of their current assets.

When asked about the attractiveness of particular features of long-term care coverage, the second-most widely valued feature was the ability to lock in premium rates that will never increase (cited by 41% of respondents).

Above any other feature, consumers valued the ability to choose to receive care either at home or in a facility (43% of respondents). Overall, consumers would prefer to receive care at home, with 31% responding that they would prefer staying at their own, a family member’s or a friend’s home to receive care regardless of the costs or level of care needed. An equal percentage would prefer receiving care at home until transitioning to a facility as needed based on cost or care needs.

Millennials showed the strongest preference for the option of staying in their homes before transitioning to a facility, while baby boomers and Gen X consumers were more likely to prefer exclusively at-home care. Just over 1 in 5 respondents were not sure of their preference, though 25% of Gen X consumers were uncertain. These consumers may have still not yet felt the need to plan for long-term care, and they are just beginning to take on caregiving responsibilities for their parents (something baby boomers may have already experienced).

Even in the midst of the COVID-19 pandemic and its severe impact on nursing homes, the majority of consumers preferred in-home care for comfort as opposed to safety concerns. Three out of four people who preferred to receive long-term care at home (exclusively or until transitioning to a facility) agreed “it would be more comfortable,” while only 42% were concerned with the safety of assisted living and skilled nursing facilities. This result reflects some optimism among consumers back in January that long-term care facilities would remain a safe choice in the future. And even so, the comforts of being at home can’t be overvalued.

Tailor A Disability Plan To Your Client’s Needs And Budget

Attitude Is Everything with Robert Miller

Advisor News

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

- Tariffs alter Q2 economic outlook downward, Morningstar says

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- Health Insurance Shares Climb After Medicare Reimbursements are Boosted

- Medicaid expansion at risk: 'My life was saved by the citizens of Ohio'

- Obamacare rule changes could shorten enrollment, limit coverage through Pennie, ACA marketplaces

- Most older adults say Medicare and other insurance should cover obesity drugs, and many show interest in using them: Michigan Medicine – University of Michigan

- 2024 Annual Report

More Health/Employee Benefits NewsLife Insurance News

- 5 trends shaping and challenging the insurance industry

- Proxy Statement (Form DEF 14A)

- Symetra Partners with Nayya to Introduce Digital Leaving Planning Solution

- Krispy Kreme's owner is seeking approval to buy Shenandoah Life

- Krispy Kreme owner to acquire Roanoke-based Shenandoah Life

More Life Insurance News