Not Your Parents’ Senior Market

Adam Hyers has been serving the Medicare market for so long that now he is beginning to work with the children of his original clients.

And this new generation of older clients does not want to work with him in the same way as their parents did.

Hyers is owner of Hyers and Associates in Columbus, Ohio, a firm he founded 20 years ago. But he started serving the senior market several years prior to that. During his 25 years or so in business, he has seen some stereotypes about working with seniors fall by the wayside.

For example, forget about the conventional wisdom that older consumers don’t want to do business online and only want to meet with their advisors in the office or “across the kitchen table.”

“Many older clients are on Facebook because that’s where they’re going to see what the kids and the grandkids are up to and see the pictures of people in their family having vacations and doing other things. So there’s absolutely no question that older clients are more comfortable online than they were a decade ago,” he said. “And then many of them are in different types of online groups where they’re gathering information and learning about Medicare products.”

Older clients may select an advisor based on a referral from a friend or relative, but Hyers said he has found many of his clients also go online to research an advisor before they agree to do business.

“They will check with the Better Business Bureau or Google ratings to see what kind of reviews an advisor has,” he said. “That’s why it has been so important for us to build trust online by having good reviews, strong ratings. After you’ve earned someone’s trust, you might ask them to write a review somewhere, and you can post those reviews on your website.”

Hyers relies on internet marketing to reach these online-savvy seniors.

“I attribute some of our success to writing articles, posting content or creating advertising that touch on some of the things that people in this age group are looking for,” he said. “It might be dental and vision coverage to go with a Medicare Supplement or Medicare Advantage plan, or perhaps it’s about a higher annuity rate. Maybe it’s about something aimed at seniors, such as Silver Sneakers. I listen to and gather information from the conversations I have with people and try to find the themes that come up most often, and then touch on those themes when we add content online.”

The increase in automation regarding Medicare plans and related products also has been a big change Hyers said he has seen over the years. He believes clients see that change as being more convenient for them, while the advisor sees increased online tools as adding more efficiency to their work.

Hyers said he has many out-of-state clients who enroll in coverage through his website. They can select a dental or a vision policy or a prescription drug plan in addition to enrolling in a Medicare plan.

The difficulty in holding in-person client meetings during COVID-19 lockdowns led to many clients becoming more comfortable with meeting online and performing tasks online, Hyers said.

“I also think people now realize how much time [in-person meetings] take up,” he said. “Seniors can be and are often just as busy as we are. They have things to do and places to go. When they’re ready to enroll, they want to get it done and then move on to their next project.

“And I also think the days of being the Medicare agent on the road all week are going away. So we have to work more electronically and online. This allows us to be more productive.”

Another big change Hyers said he has seen in the market is the increasing number of choices consumers have in selecting Medicare products.

“I don’t want to say that all these choices are making consumers tough shoppers, but I do believe they are becoming more informed shoppers,” he said. “They have specific needs and specific requests. So you want to make sure that you’ve got a whole quiver full of arrows; otherwise, that business may go somewhere else.

Dominate your ZIP code

Medicare open enrollment for 2023 begins Oct. 15 and runs through Dec. 7. As the U.S. population continues to age, the size of the senior market keeps getting bigger. The number of Medicare beneficiaries is projected to grow from around 63 million in 2020 to more than 93 million in 2060, according to KFF research.

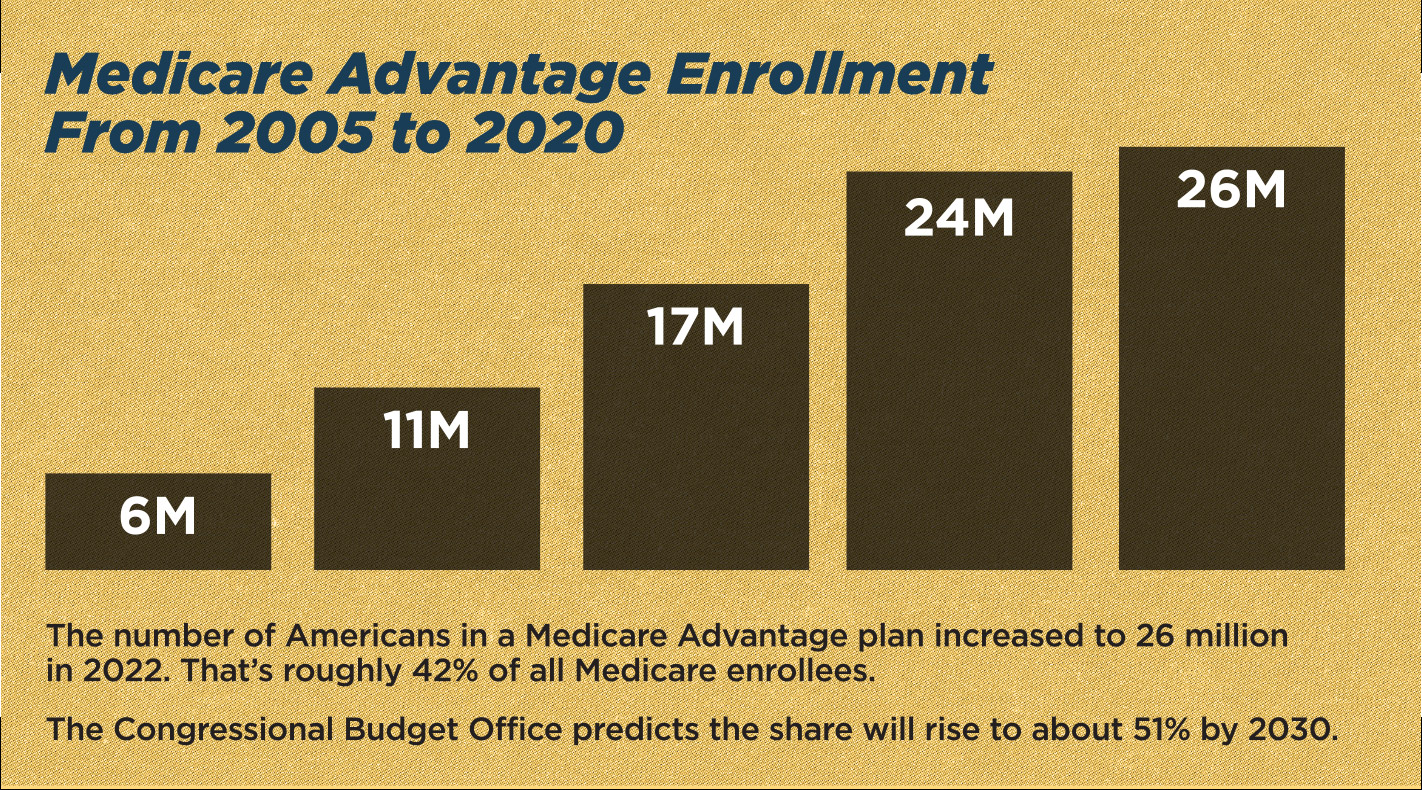

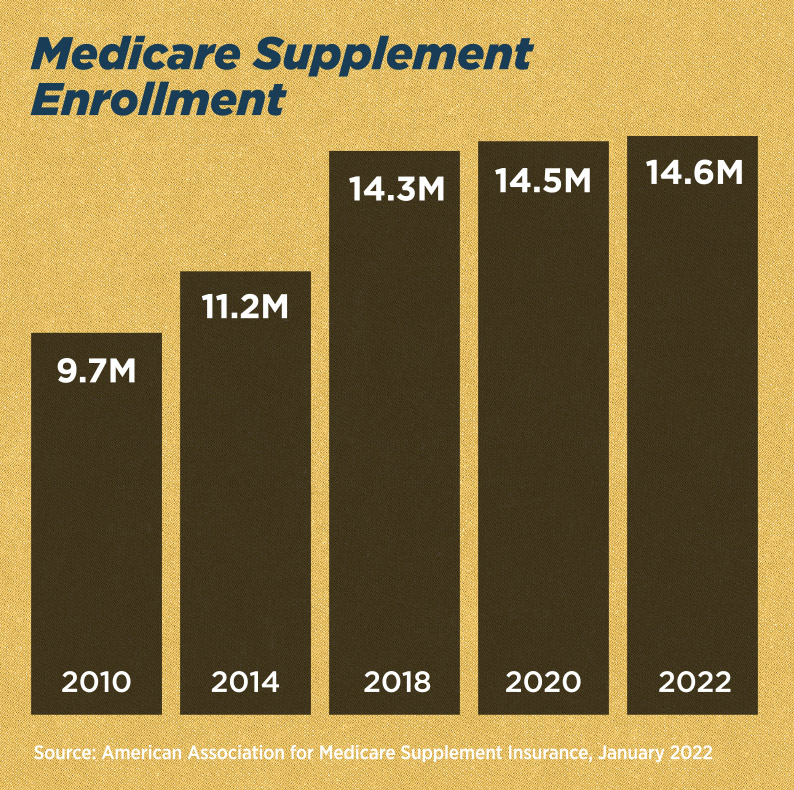

Jesse Slome is director of the American Association for Medicare Supplement Insurance and has spent a big portion of his career in tracking trends and statistics for that market segment. He has seen enrollment in Medicare Advantage plans rocket from 6 million in 2005 to 26 million in 2022. Medicare Supplement enrollment also is on the rise — from 9.7 million enrollees in 2010 to 14.6 million in 2022.

One of the biggest challenges Slome said he sees for advisors who want to serve the senior market is the competition they face from what he calls “mega marketers,” Medicare Advantage companies that flood the TV airwaves and magazine advertising pages with celebrities endorsing their products.

How does an individual advisor compete with the likes of Joe Namath or Jimmie “J.J.” Walker? By “dominating their ZIP code,” Slome said.

“It’s by establishing yourself as the local go-to person for Medicare plan information and ultimately, solutions,” he said.

“I believe that the future for Medicare agents and brokers is communicating and educating seniors to the fact that Medicare is a national program, but the available options are local,” Slome said. “A consumer can call all the call centers and all the toll-free numbers they want, but they should speak to a local Medicare specialist.”

Just as Hyers found his clients are spending more time online researching their options, Slome advised those who want to serve the senior market to develop a strong online presence.

“It’s important for advisors to create a good LinkedIn profile because prospects will look you up online,” he said. “Today, we don’t just go out to eat at a restaurant; we go online and find which restaurant has the most stars or the best ratings and we eat there. So it’s important that advisors also have good ratings and good comments online as well.”

After creating a strong online profile, an advisor can take several other steps toward dominating their ZIP code, Slome said. Some of those methods can be as old-fashioned as putting a magnetic sign on their car advertising their services. Conducting seminars in public libraries or community centers will work for someone whose market is in a smaller community.

Slome said some advisors he knows will contact employers in their community and offer what their health care options are to come in once a year to explain to workers who are turning 65 or who are about to retire.

Advisors won’t get every consumer who wants to enroll in coverage, Slome said.

“There’s a certain group of consumers who will call a number they see advertised, and they will do whatever the person on the other end of the phone tells them to do,” he said. “But there certainly is a segment of the population who will see the advertising and say, ‘I think I can do better. I want to talk to someone.’”

Educate yourself and your clients

Sandy Salcido’s advice to those who want to succeed in working with seniors can be summed up in one word: education.

Salcido owns Take Action Insurance Services in Rancho Cucamonga, Calif., and has specialized in the senior market since 2010. She was inspired to serve that market segment after caring for her mother-in-law, who was on Medicare when she was diagnosed with amyotrophic lateral sclerosis and ultimately died from the disease.

“We didn’t know anything about Medicare at the time,” she said. “We didn’t know anything about ALS. And so we had a hands-on experience and learned about that. After she died, I wanted to learn more about Medicare because at the time, my parents were 65 years old, and I wanted to educate myself so that I could help them.”

In addition to educating themselves about Medicare, Salcido said, advisors also should educate their clients on the options available to help them make the best decisions.

She also has seen older clients becoming more comfortable with doing business online. “That’s been the biggest change I’ve noticed in the past 12 years,” she said. “Someone who was turning 65 years old 12 years ago didn’t have the technical savvy that someone turning 65 today has. We are having more Zoom meetings and communicating more by text than ever before.”

That technical savvy can be a two-edged sword, she added. “Clients are bombarded with messages about different products, and sometimes they can be pulled into something that’s wrong for them.”

Salcido said she can’t protect people from being lured by an advertising message, but she can educate them to make an informed choice.

“I want my clients to be educated,” she said. “I tell them, if you see something interesting out there, come talk to me about it, and we can check into it and see if it’s the right thing for you.”

Help clients live their best lives

Serving older clients means discussing long-term care and other issues in addition to Medicare.

And it’s about more than selling them something, said Lori Gubash, national sales director for long-term care and Medicare with The Krause Agency, an independent marketing organization based in DePere, Wis.

“Don’t go in telling your client what they need, but instead, ask them what they need to live their best life in retirement,” she said.

Asking questions is one way to determine what a client envisions for their later years and how you can help them meet that vision, Gubash said.

“Ask questions such as, if you were to need care, what would you want that to look like? Do you want to stay in the home you live in now, or do you want to move to another community? Where do your children live, and do you want to live close to them?”

Gubash said she never leads a client meeting with a discussion on policies or products. “I just listen,” she said. “You have to engage that person and not treat them like a number or as just another sale.”

The COVID-19 pandemic “made people stand up and take notice” of the prospect of their own need for care, Gubash said.

“It scared a lot of people out of their belief that the need for care isn’t something that will happen to them. People are looking at their longevity differently, and they want to mitigate their risk.”

When a consumer begins thinking about their long-term care risk, Gubash said, the first person they turn to is an advisor, and the first thing they want to know is what they can afford.

One of the trends she is seeing in long-term care insurance is that more carriers are offering coverage for short-term care — care that extends for 364 days or less — and that coverage does not require medical underwriting. She also is seeing more life insurance and annuity products that have an LTC or a critical illness benefit, and those products are appealing to those who haven’t quite reached senior citizen status yet.

“Saying you’re too young to consider long-term care is not an option anymore,” she said.

Above all, Gubash said, advisors should listen to their clients’ concerns and questions instead of jumping in with possible solutions.

“If you’re out there using scare tactics or spreadsheeting someone, your client will end up with ‘analysis paralysis,’ and they will put off making a decision indefinitely.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Unbundled, untied & un-mutualized: The road to fiduciary

Rising auto insurance premiums eroding home/auto bundling, survey finds

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- FACT SHEET: PLEDGES FROM MEDICAID TECHNOLOGY COMPANIES TO SUPPORT COMMUNITY ENGAGEMENT IMPLEMENTATION AND RELATED MEDICAID SYSTEM IMPROVEMENTS

- SSI in Florida: High Demand, Frequent Denials, and How Legal Help Makes a Difference

- SilverSummit continues investment in rural healthcare

- Could workplace benefits help solve America’s long-term care gap?

- Long-Term Care Insurance: What you need to know

More Health/Employee Benefits NewsLife Insurance News