Indexed life insurance leads the way with strong 2024 sales, Wink finds

Indexed life products led the way as 2024 life sales registered gains in several categories, Wink reported.

Indexed life sales for the fourth quarter were $868.3 million, up 15.9% compared with the previous quarter, and up 9.1% compared to the same period last year. Total 2024 sales for indexed life were $3 billion.

The year closed with a record-setting quarter for indexed life sales, topping the prior fourth quarter 2023 record by 9.1%, according to Wink’s Sales & Market Report. It was also a record-setting year for indexed life sales, topping the 2023 record by 7%. Indexed life sales include both indexed UL and indexed whole life.

Both indexed life and annuity products sold strongly in 2024 as the stock market registered big gains.

Items of interest in the indexed life market included National Life Group keeping its No. 1 ranking in indexed life sales, with a 17.4% market share, Pacific Life Companies, Transamerica, John Hancock, and Nationwide, rounded the top five, respectively.

Life Insurance Company of the Southwest’s FlexLife was the No. 1 selling indexed life insurance product, for all channels combined, for the quarter. The top primary pricing objective for sales in the quarter was Cash Accumulation, capturing 71.4% of sales. The average indexed life target premium for the quarter was $13,285, an increase of nearly 1% from the prior quarter.

Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc.: “The fourth quarter is nearly always the best quarter of the year for sales. It is not surprising that indexed life knocked it out of the park this quarter.”

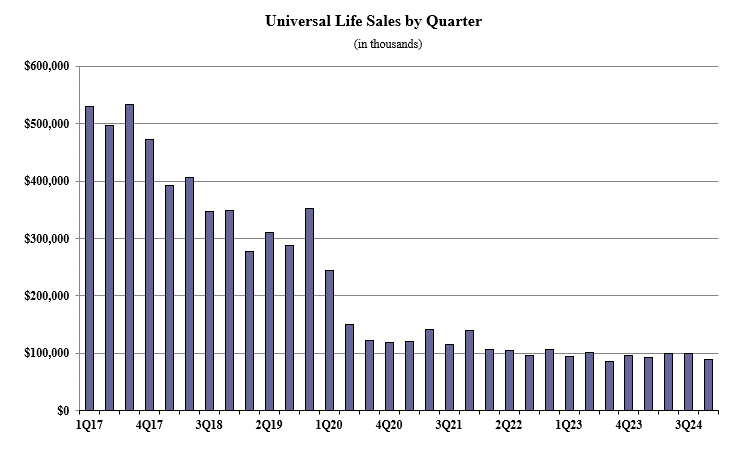

All universal life sales for the fourth quarter topped $1.3 billion, up 17.4% compared to the previous quarter. Total 2024 sales for all universal life were $4.6 billion. All universal life sales include fixed UL, indexed UL, and variable UL product sales.

Noteworthy highlights for total all universal life sales in the fourth quarter included Pacific Life Companies ranking as No. 1 in overall sales for all universal life sales, with a market share of 11.91%. Life Insurance Company of the Southwest’s FlexLife, an indexed universal life product, was the No. 1 selling product for all universal life sales, for all channels combined, for the quarter.

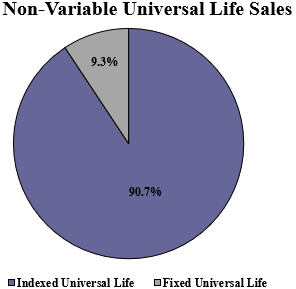

Non-variable universal life sales for the fourth quarter were $954.9 million, up 12.6% when compared to the previous quarter and up 7.2% compared to the same period last year. Total 2024 sales for non-variable universal life were $3.4 billion. Non-variable universal life (UL) sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the fourth quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 15.9%. Life Insurance Company of the Southwest’s FlexLife was the No. 1 selling product for non-variable universal life sales, for all channels combined, for the quarter.

Fixed Universal Life (UL) sales for the fourth quarter were $88.9 million, down 11% compared to the previous quarter and down 7% compared to the same period last year. Total 2024 sales for fixed UL were $383 million.

Items of interest in the fixed UL market included Nationwide retaining its No. 1 ranking in fixed universal life sales, with a 17% market share, John Hancock, Pacific Life Companies, Protective Life Companies, and Prudential completed the top five, respectively.

Nationwide’s Nationwide CareMatters II was the No. 1 selling fixed universal life insurance product, for all channels combined for the quarter. The top primary pricing objective of No-Lapse Guarantee captured 37.7% of sales. The average fixed UL target premium for the quarter was $6,664, a decline of more than 14% from the prior quarter.

Variable Universal Life sales for the fourth quarter were $374.7 million, up 31.6% compared with the previous quarter. Total 2024 sales for variable universal life were $1.2 billion.

Items of interest in the variable universal life market included Prudential retaining the No. 1 ranking in variable universal life sales, with a 35.3% market share, Pacific Life Companies, John Hancock, RiverSource Life, and Nationwide completed the top five, respectively.

Pruco Life’s VUL Protector was the No. 1 selling variable universal life product, for all channels combined for the fourth consecutive quarter. The top primary pricing objective for sales this quarter was Cash Accumulation, capturing 51.8% of sales. The average variable universal life target premium for the quarter was $24,291, an increase of more than 21% from the prior quarter.

"Variable Universal Life sales fare better when the market is increasing," Moore said. "In addition, VUL sales were not that great last quarter. The big fourth quarter push saved the day."

Whole life fourth quarter sales were $1.2 billion, up 20.4% compared with the previous quarter, and up 4.5% compared to the same period last year. Total 2024 sales for whole life was $4.3 billion. Items of interest in the whole life market included the top primary pricing objective of Final Expense capturing 59.9% of sales. The average premium per whole life policy for the quarter was $3,946, an increase of nearly 8% from the prior quarter.

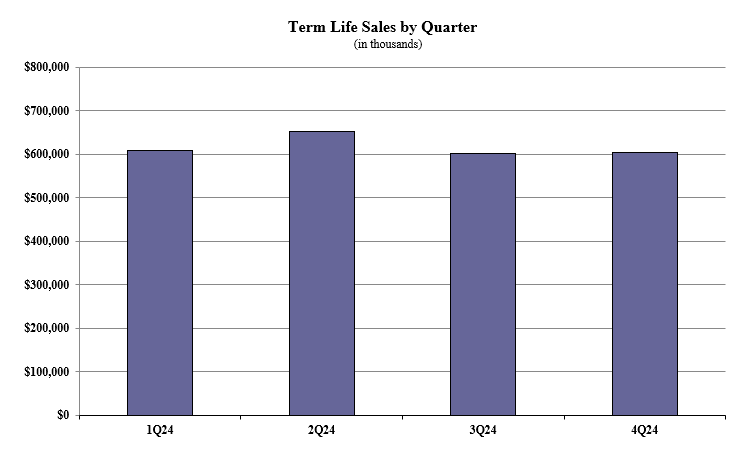

Term life fourth quarter sales were $603.9 million, up less than 1% when compared with the previous quarter. Total 2024 sales for term life were $2.4 billion.

Companies of interest in the term life market included Prudential ranking as No. 1 in term life sales, with a 5.7% market share. Pacific Life Companies, Massachusetts Mutual Life Companies, Corebridge Financial, and Protective Life Companies completed the top five, respectively.

Pruco Life’s Term Essential 20 was the No. 1 selling term life insurance product, for all channels combined, for the quarter. The average annual term life premium per policy reported for the quarter was $2,350, a decline of nearly 3% from the previous quarter.

N.Y. fines auto insurers $20M for timely reporting failure

Lithium batteries and natural disasters: A dangerous combination

Advisor News

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- Thousands in state face higher health insurance costs

- Thousands facing higher health insurance costs

- Trump wants GOP to 'own' health care issue but show 'flexibility' on abortion coverage restrictions

- Ascension to stay in-network with BCBS

- New Mexico's insurance exchange sees record enrollment ahead of Jan. 15 deadline

More Health/Employee Benefits NewsLife Insurance News