Independent distribution: How it’s changing the industry

As the number of independent advisors has grown, the influence of intermediaries has grown as well.

LIMRA’s 2023 U.S. Individual Sales Survey showed that 53% of all life insurance sales were done through the independent channel. Meanwhile, independent marketing organizations and brokerage general agencies have seen their business surge as well.

What does the rise in independent distribution mean for the insurance industry? Two LIMRA executives gave their views during a recent LinkedIn Live event.

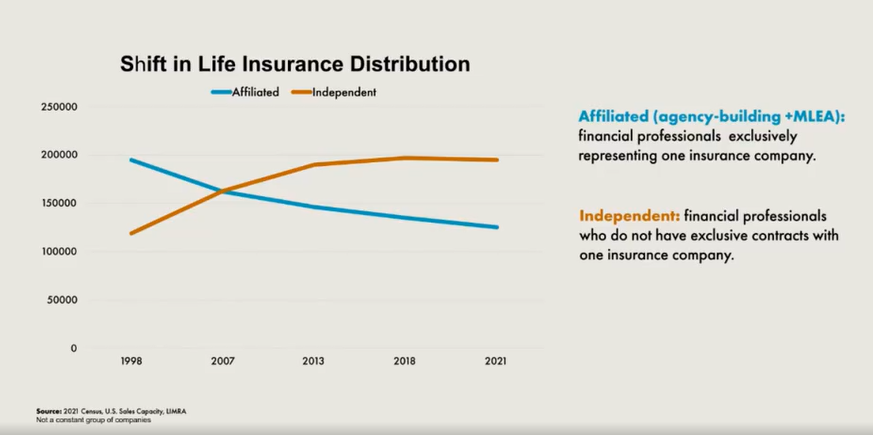

The shift in life insurance distribution over the past 25 years from the affiliated channel to the independent channel “has been a huge topic,” said John Carroll, senior vice president and head of annuities for LIMRA and LOMA.

Another shift that took place during that time is a shift in product, he said.

“When you think back 25 years, whole life and term were the big products,” he said. “Universal life was there and that shifted as the independents began taking on market share, it created space where UL now is the largest product in that channel. Indexed universal life didn’t really exist 15 years ago and today it’s 25% of industry sales and 90% of that is coming through the independent channel.”

The affiliated model is still strong, Carroll said, with the firms that are affiliated models among the largest carriers in the industry. But he added that LIMRA’s research shows “if you’re not one of those firms, you need to be thinking about multichannel distribution in a more meaningful way.”

As the independent channel continues to grow, that growth has been led by the influence of IMOs and BGAs, said Bryan Hodgens, LIMRA senior vice president and head of research. These organizations plan an essential role in supporting the independent advisor, helping them grow their practice, serving as a go-between for the advisor and the carrier.

Carroll noted what he called “an explosion of consolidation” among intermediaries.

“These are organizations and help and support independent agents. Go back 20 years and independent agents were very small. Over the years, they’ve grown bigger, they’ve consolidated, but as their businesses have grown, they need more support than they themselves can provide.

“So effectively that’s what these firms do, they build this infrastructure to bring advisors training and technology and product as well as case management and underwriting support.”

LIMRA research showed 9 out of 10 intermediaries surveyed said they are adding new carriers’ products to their platforms each year, Hodgens said.

Pricing and underwriting are two factors driving product placement to intermediaries’ platforms, Carroll said. But, all things being equal, providing great service and an overall advisor experience is what differentiates one intermediary from another, he said.

“Ease of business is everything,” he said.

Hodgens said LIMRA’s research also showed that:

- 42% of the intermediaries studied said they experienced an increase in life insurance production over the past two years.

- 65% of intermediaries expect their producer network to grow in the next three years.

- 42% of the producers surveyed are above the age of 55.

- 60% of intermediaries – which was up 31% from the previous year – are expecting revenues from financial planning and wealth management products and services to increase 10% or more a year for the next three years.

Carroll said that when carriers were asked what they see in distribution today, “the answer is nothing has really changed for them.

“The hope is that scale and that ability to do more drives more business, drives people to do more life business, and drives organic growth. And that I think is the basic premise of this whole model, which is to bring scale and drive growth.”

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Does working with an advisor really provide benefits to the consumer?

Cigna says 4th lawsuit still shows no evidence of improper claim denials

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Wellmark still worries over lowered projections of Iowa tax hike

- Families defend disability services amid health cuts

- RANDALL LEADS 43 DEMOCRATS IN DEMANDING ANSWERS FROM OPM OVER DECISION TO ELIMINATE COVERAGE FOR MEDICALLY NECESSARY TRANS HEALTH CARE

- Trump's Medicaid work mandate could kick thousands of homeless Californians off coverageTrump's Medicaid work mandate could kick thousands of homeless Californians off coverage

- Senator Alvord pushes back on constant cost increases of health insurance with full bipartisan support

More Health/Employee Benefits NewsProperty and Casualty News

- 2 attorneys are in a runoff to represent New Orleans East in the state House

- State insurance commissioner is focusing insurance discounts for fortified roofs

- Governor signs medical malpractice bill, predicts it will deliver quick results

- Home insurance rates rising in La Plata County amid growing wildfire risk

- Bill would increase cap on medical malpractice awards from $2.7M to $6M

More Property and Casualty News