Does working with an advisor really provide benefits to the consumer?

Americans who work with a financial advisor have more advantages than those who don’t, according to a recent Northwestern Mutual study. For example, they expect to retire two years earlier than those who do not have an advisor and they feel significantly more confident about their financial preparedness for the future.

Americans with an advisor also have saved twice as much money for retirement than those who do not have an advisor: $132,000 vs. just $62,000, according to the Northwestern Mutual's 2024 Planning & Progress Study.

Beyond the balance sheet, Americans with a financial advisor also feel more certain about their ability to reach their financial goals, and are more bullish, believing that they reach their goals more quickly. And three in four Americans with an advisor (75%) believe that they will be financially prepared to retire, compared to just 45% without an advisor who feel the same. Also, nearly two in three Americans with an advisor (62%) said they know how much they need to save to retire comfortably, while about one in three without an advisor (34%) agreed.

Moreover, Americans with an advisor predict that they will pay off their student loan debt three years sooner–at age 43 instead of at age 46.

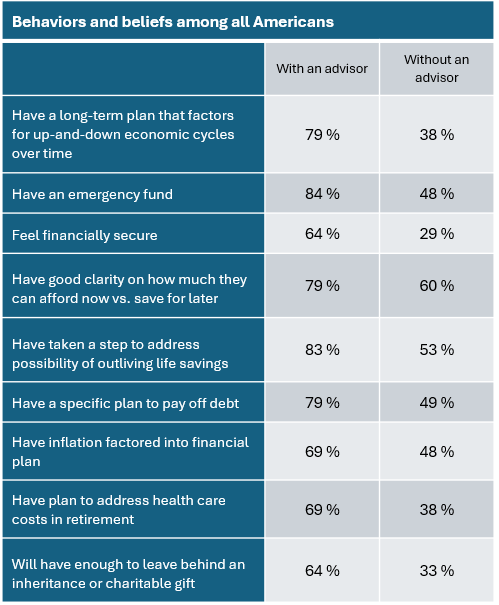

The emotional lift that expert advice can create is also visible among Americans' financial planning attitudes and beliefs:

"Americans who work with a financial advisor have better financial habits, superior outcomes, less anxiety, greater confidence and more time to live the life of their dreams," said John Roberts, chief field officer at Northwestern Mutual. "The impact isn't just about bigger numbers on a spreadsheet – it's about more days in retirement and more time enjoying the journey. A comprehensive financial plan that combines insurance, wealth management and an expert advisor is powerful. Like a personal fitness trainer, financial professionals show people the techniques and exercises that will help them become stronger and give them the encouragement they need to meet their goals."

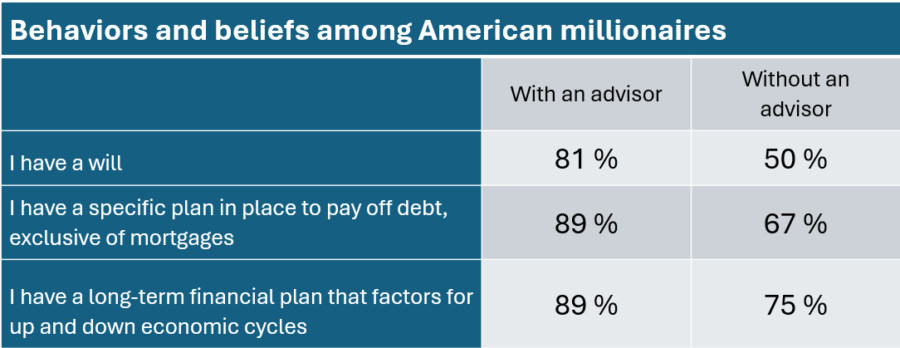

American millionaires with an advisor also feel more financially secure

Among Americans with at least $1 million in investable assets, there's a big difference in behaviors and beliefs between people with an advisor and others who haven't sought out expert advice, the survey said. These high-net-worth Americans with an advisor expect to retire a year sooner (61 vs. 62) and are more likely to believe they will be financially prepared for retirement than millionaires who lack an advisor (92% vs. 77%, a 15-percentage point difference).

Other notable differences among millionaires uncovered by the survey:

"The research shows that accumulating wealth isn't enough; people need expert advice to follow best practices, feel more secure, and reach their dreams faster," Roberts said. "Half of wealthy Americans who don't have an advisor don't have a will – but 81% who have an advisor have that essential estate planning document in place. That stat alone should send a clear message about the value of an advisor: They ask deeper questions, give better solutions, and help ensure people are financially prepared."

Average age to seek financial advice

Among people with an advisor, the average age their relationship began is 38. Interestingly, younger generations are engaging experts for financial advice earlier and earlier. The average Millennial with an advisor said they sought formal financial guidance at age 29 – nine years sooner than Gen X (age 38) – and a full 20 years before Boomers+ (age 49). Interestingly, 29 is also the average age when Americans get married, while the median age when a mother has her first child is age 30.

"Younger generations are saving, investing and seeking advice earlier than ever," Roberts said. "This can be transformational, because they will have more time to benefit from being in the market and the power of compound interest. Many wait for a life event like a wedding or a new baby to start planning with an advisor. It's important to remember, though, that the sooner you get started with a financial plan, the better your long-term results."

Americans' most trusted source for financial advice

Once again, people across the U.S. said that they trust financial advisors more than any other source for financial advice, according to the survey. More than twice as many Americans chose financial advisors (33%) over family members (16%), who ranked second. Interestingly, financial advisors were selected eight times more than online financial influencers and social media sites like Reddit and TikTok (4%). Gen Z was the only generation to perceive family members as the most trusted source of financial advice, followed closely by financial advisors.

"FinTok may pique people's interest, but to make the most of their money, Americans are turning to expert financial advisors to reveal their opportunities and their blind spots," said Roberts. "The research also shows more parents are interested in inviting their young adult and teenage children into annual meetings with their financial advisors. This credible combination of parents and financial advisors could be a game-changer, helping families instill planning knowledge and a lifetime of good financial habits with the next generation."

Nearly three in ten are seeking an advisor now

Seven in 10 Americans believe their financial planning needs improvement and many are taking action, the survey said. Nearly three in ten Americans (29%) who did not have an advisor before said that they plan to start working with one or have just recently started working with one.

"Financial advisors and comprehensive financial planning have never been more relevant or in-demand," Roberts said. "In this time of record-high financial anxiety, Americans are proactively seeking out expert advice for peace of mind."

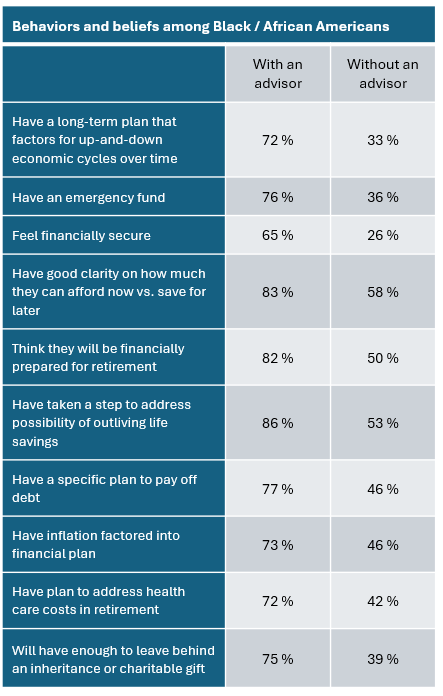

Benefits for Black consumers

While the research shows that financial advice can be impactful for all Americans, among Black and African American individuals, the influence is even more pronounced, the survey pointed out. It found that Black individuals with an advisor expect to retire three years sooner (age 61 vs. 64). They also have almost three times more in retirement savings on average than Black consumers who do not have a financial advisor 71,000 vs. $26,000). And they expect to pay off their college debt five years earlier (by age 41 vs. 46).

In addition, the study found these differences:

"Our industry's role in closing the racial wealth gap is crystal clear," Roberts said. "Financial advisors make an incredible impact in people's lives, and in the years ahead, we need to press even harder to grow our sphere of influence, and help more Americans access and build financial security."

Why so few Americans work with advisors

With so many advantages consumers derive from working with an advisor, it is surprising to learn that only about 35 percent of them use advisors, according to recent studies. So, what are some of the reasons for this low usage?

“I believe that there is an underlying sentiment in this country that only wealthy individuals work with financial planners, “explained Mike Salierno, financial advisor at Northwestern Mutual based in Clearwater, FL. “In reality, I believe everybody deserves a comprehensive financial plan. Certainly, as your financial situation becomes more complex, your plan and interaction with a financial planner needs to evolve.”

Salierno said that he has found that even the most basic financial planning concepts are not being taught in most high schools or universities throughout the country. “People need help with simple things like budgeting and choosing their benefits through work just as much as they need help with the more complex areas of planning like tax and estate strategies,” he said.

Lastly, Salierno believes that most prospects perceive the role of a financial planner to be solely around investment management. “While that is a piece to what we do,” he said, “there are many other areas that we help our clients in, and most of the time, those areas need to be done before working on investment and wealth-management strategies.”

Getting more consumers to use advisors

So, what steps can advisors and the industry take to persuade more prospects to hire an advisor and start reaping the benefits they provide?

“I believe advisors and the financial services industry in general can take a few steps towards helping prospects feel more comfortable engaging with, and hiring a financial planner,” Salierno said.

First, the industry can do a better job of helping clients understand the value of a comprehensive financial plan instead of targeting a specific product or service their firm may offer, Salierno added. “I think that by casting a wider net, we will be able to help more people with their financial security while utilizing a set of products and services as the tools that will help them get from point A to point B,” he said.

Second, Salierno said that he would urge financial planners and firms to build a more robust team targeted towards helping clients at specific points of their lives.

“For example, we are building a firm that will aim to help all clients, regardless of their investable assets,” he said. “While I understand not one advisor can be everything to everybody, building a firm with multiple advisors can help serve clients at different spots in their financial lives.”

Last, but not least, Salierno said that the industry needs to focus on multi-generational planning. “I would urge financial advising firms to ask their clients to be introduced to a generation before and a generation after them. We are about to experience one of the largest transfers of assets and businesses in this country, thanks to the baby boomer generation. Making sure that we are helping our clients from a legacy perspective can be a great way to help more people engage with a financial advisor.”

The study was conducted online by The Harris Poll on behalf of Northwestern Mutual among 4,588 U.S. adults aged 18 or older. It was conducted between January 3 and January 17, 2024.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

Time ‘to adjust’ on interest rates, Powell says, hinting at cuts to come

Independent distribution: How it’s changing the industry

Advisor News

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- After subsidies expire, skyrocketing health insurance premiums are here.

- Congress takes up health care again – and impatient voters shouldn’t hold their breath for a cure

- Guardant Health’s Shield Blood Test for Colorectal Cancer Screening Now Available for U.S. Military Members and Families

- Coalition in House backs health subsidy

- Stories to Watch in 2026: Health Insurance Woes

More Health/Employee Benefits NewsLife Insurance News