I Object! When Prospects Balk At Getting Coverage

As advisors, we strive for a higher standard when recommending life insurance, similar to how we suggest automobile or homeowners insurance: to safeguard against an event that would lead to financial hardship.

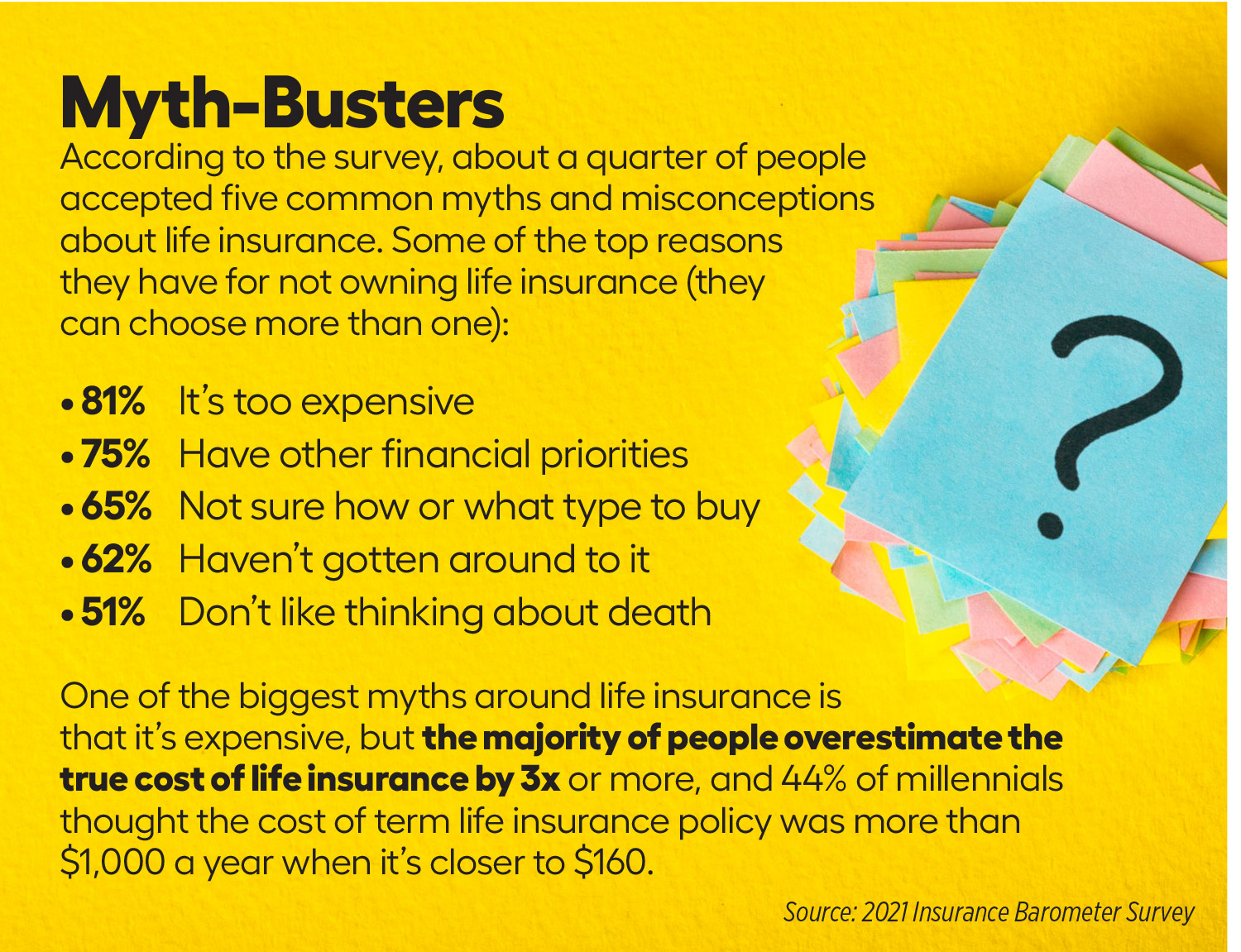

While auto and homeowners insurance cover expenses in the event of car or home damage, life insurance protects an individual’s financial security. Most people recognize they need life insurance, but few own it. Consider these statistics from the 2021 Insurance Barometer Study:

» Almost 1 in 3 consumers surveyed (31%) say they are more likely to buy because of the COVID-19 pandemic.

» Slightly more than half (52%) of American adults own some form of life insurance coverage, a decline of 2 points from 2020. Overall, life insurance market penetration is now 11 points below the 2011 high of 63%.

Individuals who sell life insurance understand the No. 1 challenge is cutting through the confusion and mitigating conflicts of interest when recommending life insurance. In my experience, there are several common reasons that most often prevent people from making a purchase. Here are five common scenarios as well as ways advisors can address those objections.

Scenario 1: I’m already paying for auto and homeowners insurance on top of monthly expenses like my mortgage and utilities. How am I supposed to afford life insurance?

The most common reason clients are reluctant to buy life insurance is because of cost. In many cases, clients believe life insurance is too expensive, they have other financial priorities, or both.

Particularly when life insurance competes against less avoidable monthly expenses — such as housing, car payments and food — advisors must explain the importance of life insurance and why it should be a priority. Life insurance is a safety net, making it as vital as auto or homeowners insurance — if not more so.

Advisors can appeal to clients who see cost as a significant barrier by emphasizing term life insurance over universal or permanent life. Compared with universal or permanent life insurance, term or temporary life insurance is on average around 30 times cheaper. In addition to being more popular and affordable, term life insurance can be purchased for a shorter period of time for low monthly premiums. For example, the cost of a 20-year term life insurance policy can be as low as $14 per month for a 30-year-old.

Scenario 2: Why should I trust that your company is any different from the others?

While this may seem harsh, it’s a legitimate question that must be answered. Most people just don’t trust insurance companies. As advisors, we sell a product that nobody likes, few understand and most believe is too expensive. In addition, many of our clients may have had prior negative experiences with insurance companies, such as poor services or unfair treatment on a claim.

It’s no easy feat earning customers’ trust. To win over distrustful clients, we must learn who our clients are and why they are buying insurance. This means focusing on establishing meaningful relationships rather than focusing on our own fancy brochures and big offices. It means selling our clients only life insurance products that they need and making only the promises we can keep. When we establish meaningful connections with our customers, we not only encourage them to stick with our company, but we also increase the likelihood they will recommend our services to friends and family.

Scenario 3: The idea of buying life insurance makes me nervous. I don’t want to think about my own death.

No one likes thinking about death — least of all their own. In my experience, many of my clients are reluctant to purchase life insurance simply because they don’t want to focus on their own mortality. And yet, accepting and planning for one’s own mortality is vital to building a strong financial framework for your loved ones.

Now — you might ask, “How do we find a solution?” First, we can address aversion to thinking about mortality by shifting the focus to the people our clients will leave behind in the event of their death. With life insurance, someone can have the funds to pay for daily expenses, mortgage payments and even college tuition for the people they love. To help clients realize this, ask prospects the following questions:

» Who would receive a life insurance check in the event of your death?

» How would they support themselves without your income if you don’t have life insurance?

» Will your loved ones suffer financially if left to handle your final arrangements?

Scenario 4: I’m young, single, childless and healthy. Why would I need life insurance?

This is a common pushback I often encounter when working with young adults. Considering that millennial consumers will likely dominate the market for a number of years, it’s particularly important for advisors to know how to sell to this age group.

Studies have found that millennials — often fettered by student loans — may struggle to save money for purchases such as life insurance or buying a home.

As agents, we can win over young clients by highlighting the value of investing young. Life insurance plans are the most affordable when the purchaser is young, with term plans starting around $15 per month for a $500,000 policy for applicants between 25 and 30. For every year prospective policyholders delay buying coverage, premiums may increase by around 8% to 10%.

Financial advisors can also remind millennials that in addition to replacing lost income, life insurance can help pay off outstanding loans. While federal student loans are automatically canceled after the borrower dies, private student loans do not offer the same liability protection.

Parents and other cosigners will likely be held responsible for paying back the remaining balance on a private loan in the event of the student’s death — that is, if no life insurance has been taken out to cover it.

Finally, no matter how healthy or young, no one is indestructible. As life insurance advisors, we can reach young, healthy millennials by gently reminding them that illness and injury can strike suddenly and unexpectedly. After falling seriously ill or getting injured, it becomes almost impossible to take out life insurance.

Scenario 5: I’m unsure of how much life insurance I need, what type to buy, or the best provider to buy from.

All insurance is invisible and intangible, but life insurance is especially complicated with its hundreds of different terms, exclusions and forms. Overwhelmed by the different policy options, model and providers, or confused by coverage formulas and puzzled by the process of purchasing life insurance, many prospects can get lost in the shopping phase.

In the end, we must steer overloaded prospects in the right direction with brief, straightforward pitches that are informative and transparent. Now more than ever, consumers are becoming turned off by flashy ads and sales pitches. They are seeking real answers.

To successfully market to today’s consumer, we must be more informed, transparent and concise. In addition to supplying them with honest, useful and relevant answers, we can remind prospects that completing an application is free — even after they apply, nothing is final and they still have time to make a final decision once accepted.

Brian Greenberg is founder of True Blue Life Insurance. He has been a member of MDRT since 2013 and is the author of The Salesman Who Doesn’t Sell. Brian may be contacted at [email protected].

California Insurance Agent Sentenced For Stealing Premiums

Sell More With Less: Using A Virtual Assistant

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

More Annuity NewsHealth/Employee Benefits News

- Research from Northwestern University Feinberg School of Medicine Yields New Findings on Managed Care (Systematic Review of Managed Care Medicaid Outcomes Versus Fee-for-Service Medicaid Outcomes for Youth in Foster Care): Managed Care

- Researchers from University of Alabama Report Details of New Studies and Findings in the Area of Managed Care (Nursing leadership in Housing First implementation: A comparative analysis of care coordination approaches across four U.S. states): Managed Care

- Studies from Johns Hopkins University Bloomberg School of Public Health in the Area of Mental Health Diseases and Conditions Described (Mental health care use after leaving Medicare Advantage for traditional Medicare): Mental Health Diseases and Conditions

- New Findings from Robert L. Phillips and Co-Authors in the Area of Health and Medicine Reported (Estimation of Mortality via the Neighborhood Atlas and Reproducible Area Deprivation Indices): Health and Medicine

- Far fewer people buy Obamacare coverage as insurance premiums spike

More Health/Employee Benefits NewsLife Insurance News