Trump pick for Treasury: extending tax cuts the ‘most important’ issue

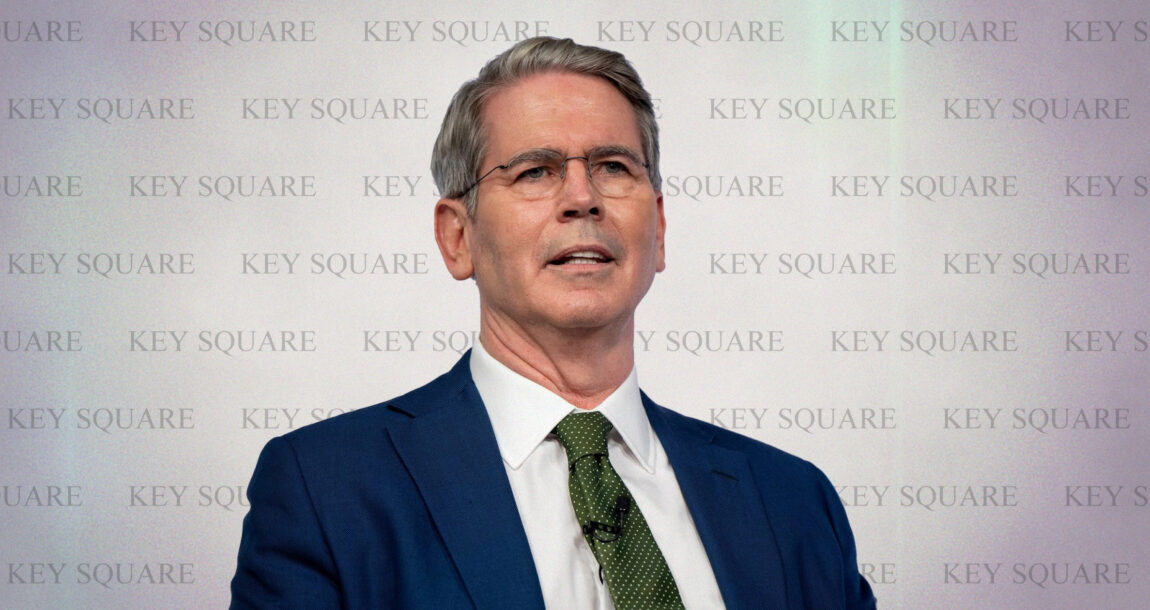

The 2017 tax cuts that helped corporate America, particularly insurance companies, should be extended, according to President-elect Donald Trump’s candidate for U.S. treasury secretary, Scott Bessent, CEO and CIO of hedge fund Key Square Group.

Testifying at his confirmation hearings before Congress Thursday, Bessent said Trump’s tax cuts, set to expire at the end of this year, should be sustained. “We must make permanent the 2017 Tax Cuts and Jobs Act and implement new pro-growth policies to reduce the tax burden on American manufacturers, service workers, and seniors,” he said.

Letting tax expire could be crushing

Bessent said extending the 2017 tax law “is the single most important issue of the day.” He said letting the law expire would unleash a $4 trillion tax hike that could crush the U.S. economy.

"If we do not renew and extend, then we will be facing an economic calamity," he said. "We will see a gigantic middle-class tax increase."

The TCJA granted significant benefits to corporations and high-income earners, with smaller, temporary advantages for middle-income households. Critics have argued that the law increased income inequality and ballooned the federal deficit, while proponents highlight its role in spurring economic growth and investment.

Among the biggest beneficiaries was the insurance industry. The corporate tax rate reduction from 35% to 21%, a part of the act that was already made permanent, was a major benefit for insurers, as it directly boosted their after-tax profits. Companies like Allstate, Chubb, and Travelers have experienced higher profitability since they retain much of their earnings in taxable investments.

Health and life insurers, like UnitedHealth and MetLife, also benefited from lower tax rates, which reduced their overall costs and allowed for reinvestment or shareholder returns.

Impact on insurance companies

The TCJA, however, also changed how insurance companies calculate their reserves, specifically limiting the ability to deduct future claims reserves. This led to higher upfront tax liabilities for some insurers, particularly those in property and casualty sectors, which keep large reserves to cover future claims. As a result, insurers needed to adjust their pricing strategies and reserve management practices.

Allstate, for example, reported notable financial benefits from the TCJA. In its 2018 Annual Report, a year after the tax cuts were implemented, Allstate reported revenues approaching $40 billion, with premiums increasing by 6.9% from the prior year. While various operational factors influenced this growth, the substantial decrease in the corporate tax rate directly contributed to higher net income, the company noted.

The increased after-tax earnings gave Allstate greater financial flexibility, the company said, enabling it to reinvest in its operations, enhance shareholder value, and strengthen its competitive position.

“Many [companies] bolstered their claims-paying reserves to better protect policyholders,” said Yehuda Tropper, CEO of New Jersey-based Beca Life Settlements. “While smaller insurance companies saw the most dramatic impact since the cuts freed up capital for growth and competition with larger carriers, mutual insurers returned some benefits through reduced premiums for policyholders.”

Tropper said he has seen how insurers improved financial strength from these cuts and became more competitive.

“This financial health leads directly to reduced cost of insurance increases that ultimately benefit policy owners,” he said.

Critics, of course, said the benefit to low-income households was modest at best. Some households saw a minor change or small tax increases due to the elimination of certain deductions. Residents in states like California and New York faced limitations on state and local tax (SALT) deductions, increasing their overall tax burdens. Estimates from various economists put the cost of the various tax cuts from nearly $6 trillion to $10 trillion over 10 years.

But Bessent, whose nomination to the Treasury post seems a sure thing, said spending cuts and shifts in existing taxes would offset the costs of extending the tax cuts.

Bessent: USA has 'a spending problem'

“We do not have a revenue problem in the United States of America,” he said. “We have a spending problem.”

Bessent said the Trump administration and Congress need to implement "pro-growth policies to reduce the tax burden on American manufacturers service workers and seniors.” Included are Trump's promises to lower the corporate tax rate even further, to 15% from 21%, for companies manufacturing products in the United States, and to exempt income from tips and Social Security from taxation.

Trump has “a generational opportunity to unleash a new economic golden age that will create more jobs, wealth and prosperity for all Americans,” Bessent said.

"I firmly believe that, if confirmed, and with your counsel and support, we can usher in a new, more balanced era of prosperity that will lift up all Americans and rebuild communities and families across the country," he said in prepared remarks.

If confirmed by the Senate, Bessent would be the first openly gay Treasury secretary and confirmed cabinet member of a Republican administration. The South Carolina native's husband, former New York City prosecutor John Freeman, and their two children, sat behind him during testimony Thursday.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

PBMs reaped substantial profits from dispensing prescription drugs, FTC finds

State Farm giving LA homeowners an option to renew coverage

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Mental health remains in the forefront 5 years after pandemic

- Proxy Statement (Form DEF 14A)

- Idaho Senate approves Medicaid budget

- John Oliver sued by health care boss

- Pharmacy bill passes House committee

More Health/Employee Benefits NewsLife Insurance News

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- AM Best Affirms Credit Ratings of CMB Wing Lung Insurance Company Limited

More Life Insurance News