2025: Taxing decisions due

John Resnick had a very busy fall, meeting with high net worth clients concerned about what 2025 will mean for the tax code — specifically, the expiring estate tax provisions. As this issue went to press, Resnick worked to close an estate tax plan for a $700 million estate. Just another day at the office.

Based in Naples Fla., The Resnick Group focuses on estate planning, life insurance guidance and business succession.

Clients are very attuned to the sunset of the Tax Cuts and Jobs Act at the end of 2025, Resnick said. If the estate tax exemption reverts to the pre-TCJA amount, it will represent the biggest estate tax increase in 85 years, he added.

“Although the change won’t affect most Americans, the hardest hit will be thousands of people who own privately held family-owned companies, whose net worth is mostly tied to their business,” Resnick said. “In more than 25 years of helping family firms, I can never recall a single business owner at that level who considered themselves wealthy. Most are plowing everything they make back into the business, and usually pay themselves last.”

The estate tax has long been a target of conservative lawmakers, who call it the “death tax.” After gaining full control of the White House and both chambers of Congress in 2016, Republicans teed up the estate tax for a major overhaul.

The TCJA more than doubled the maximum that families can give their beneficiaries without incurring federal gift or estate taxes. This applies to gifts made either while alive or as part of an estate.

The gift and estate tax exemption is adjusted annually for inflation and is $13.61 million for a single person in 2024. Unless Congress acts to extend the current language, the estate tax will revert to 2017 levels, or about $7 million.

It is just one of many taxes up for debate regardless of who occupies the White House or controls Congress. Taxes are set to be the dominant issue of 2025, and advisors and agents have a lot riding on what decisions are made.

Life insurance strategy

Even at the higher $13.61 million estate tax threshold, it isn’t hard for successful business owners to hit that figure, Resnick said. If it reverts to $7 million, it will have a significant impact on estate planning, he added.

“Many of these families will be heavily impacted because they typically don’t keep a lot of cash sitting in bank accounts,” Resnick explained. “What’s worse, estate taxes are due in cash nine months after death, so trying to pay the tax can be devastating to some.”

Life insurance is a popular strategy to help high net worth clients avoid leaving their heirs with painful estate tax bills.

An irrevocable life insurance trust is created outside the client’s taxable estate, and the trust’s income is used to purchase life insurance on the client, Resnick said. When they die, the life insurance proceeds are paid 100% tax-free to the trust that is the named beneficiary. The trust can purchase assets from or loan money to the estate, which often doesn’t have the cash to pay estate taxes.

“If the life insurance is designed correctly, the cost to pay for the death benefit can be 50% to 80% lower than the cost of the estate paying the tax using its own resources,” Resnick said. “All this is accomplished 100% tax free. Life insurance in an ILIT can truly be one of the most powerful strategies available in the estate tax code.”

There are other strategies to mitigate the potential estate tax bill, Spivey noted.

“A lot of our clients are assessing, if they haven’t already done so, whether or not it makes sense for them to be proactively making gifts to utilize these elevated exemption amounts,” he said. “The IRS has come back and said that there isn’t going to be this recapture concept in play for those that do, and so many, many of our clients are looking at whether or not they should go ahead and make sizable taxable gifts … before the end of 2025.”

A married couple with four children can give away $36,000 to each child, for example, reducing their taxable estate by $144,000 every year.

The tax cuts

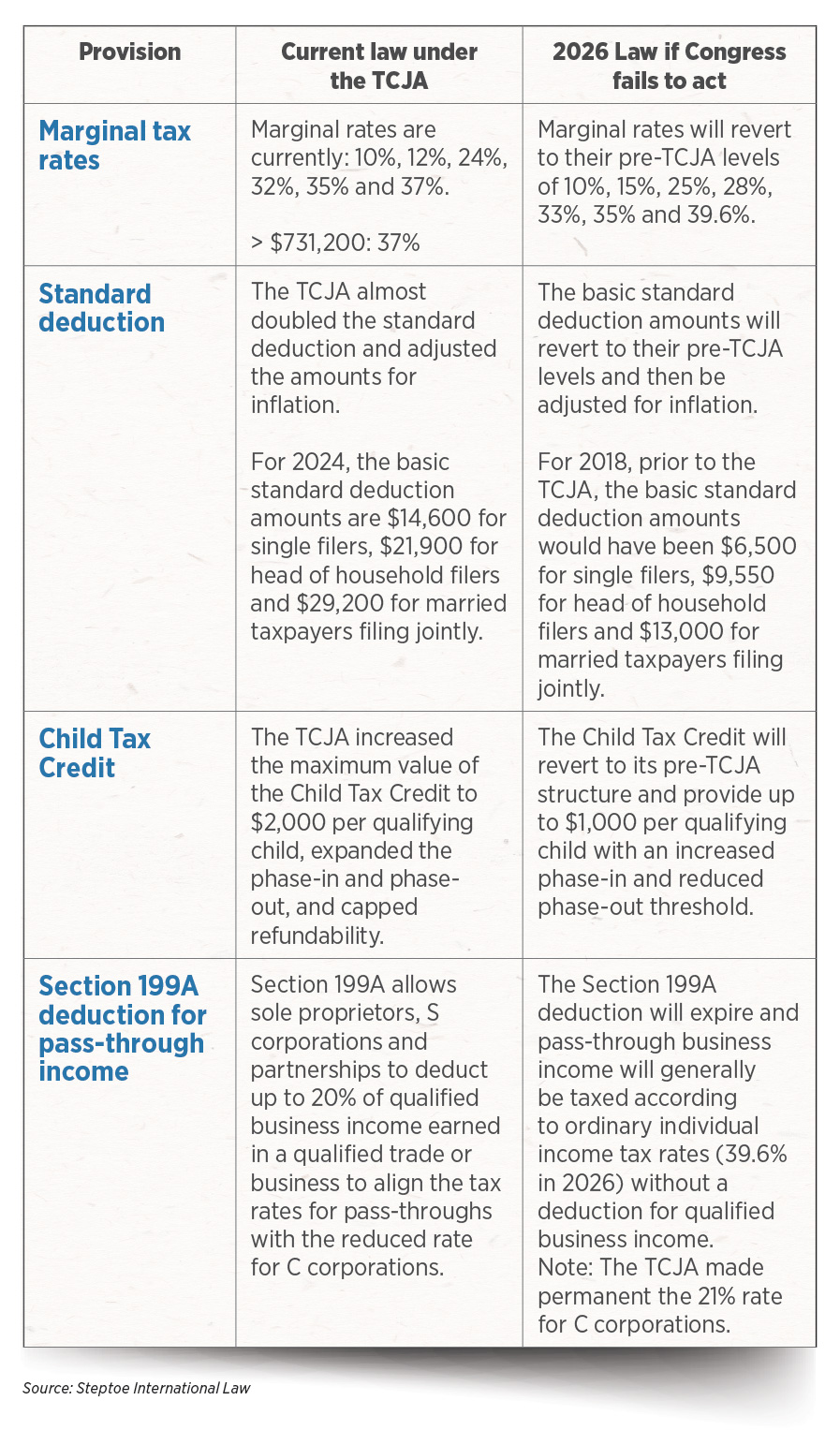

The Tax Cuts and Jobs Act was the most significant tax reform since the Tax Reform Act of 1986, which lowered the top tax rate for ordinary income from 50% to 28% and raised the bottom tax rate from 11% to 15%.

But unlike the 1986 tax bill, the TCJA changes were given a short lifespan.

Congress chose to make the individual provisions temporary to limit the 10-year revenue cost of the TCJA to the amount authorized in the Congressional Budget Resolution ($1.5 trillion), the Tax Policy Center explained, and to comply with Senate budget rules under the process used to pass the tax act and bypass the Senate filibuster, which required no increase in the federal budget deficit after the 10th year.

The Congressional Budget Office estimates that extending the tax cuts could cost the federal government around $4 trillion over 10 years.

Nevertheless, the TCJA touched on nearly every aspect of taxpaying life — from individual taxes to corporate taxes to the child tax credit. And, of course, estate taxes. So, nobody expects the TCJA to simply expire without plenty of debate.

“There’s likely to be significant legislation starting at the beginning of next year looking to fix some of these, to extend them, to not extend them,” Sutter said during a recent webinar for the National Association of Insurance and Financial Advisors. “The scope of what any tax legislation looks like will be heavily dependent on who controls the White House, who controls Congress, and what those numbers look like.”

To add to the tax confusion, the TCJA made some tax cuts permanent. In particular, the law reduced the corporate tax rate from 35% to 21% and repealed the corporate alternative minimum tax. These provisions do not expire.

Political differences

The hotly contested presidential election between Kamala Harris and Donald Trump took place after this issue went to press. But the winner will provide the tax policy template for 2025 negotiations, likely to take months.

On the estate tax issue, Harris has endorsed President Biden’s budget proposals, which would allow the estate tax exemption to expire and return to $7 million.

Trump wants to keep most of the TCJA in place, including the higher estate tax exemption. The Tax Policy Center estimates that just over 7,000 returns will pay estate taxes in 2024, while about 19,000 returns will pay estate taxes when thresholds drop after 2025.

Here are some other important likely starting points for congressional tax writers as they ponder a TCJA follow-up, courtesy of the Tax Policy Center:

1. Individual income taxes

The Biden-Harris administration has called for raising the top individual income tax rate from 37% to 39.6%. Harris has not offered detailed plans for the rest of the TCJA, though she has pledged not to raise taxes on those earning less than $400,000.

Trump supports extending provisions of the TCJA. Keeping these provisions and restoring certain business tax breaks would provide a tax cut at each income level, on average, but provide greater benefits to those above $450,000 in annual income.

In September, Trump announced he would eliminate the TCJA’s $10,000 cap on the state and local tax deduction, which was enacted as part of the 2017 law to offset the total cost.

2. Corporate taxes

The Harris campaign proposed raising the corporate tax rate to 28% and the corporate alternative minimum tax rate to 21%. Harris has also proposed raising the excise tax on stock repurchases from 1% to 4%. Some congressional Democrats are leery of these rate changes.

Trump proposed reducing the statutory corporate income tax rate from 21% to 15%, but his views on changes to the corporate alternative minimum tax rate were unknown as of press deadline.

3. Capital gains

Harris supports raising the tax rate on long-term capital gains to 33% (a 28% rate plus a net investment income tax rate of 5%). Harris also has indicated she supports a new tax on unrealized capital gains tax on the wealthy with a net worth of $100 million.

Trump has not indicated any specific plans for capital gains taxes.

Social Security fix needed

While maybe not a front-burner issue in the election, or in Congress, the looming Social Security crisis is definitely hanging out in the background.

Unless Congress acts, Social Security’s primary trust fund will be depleted in 2033, according to a 2024 report by the trustees. When that happens, each beneficiary will see their benefit cut immediately by 21%.

Lawmakers have known for decades that Social Security’s finances are unsustainable. The program will be an estimated $23 trillion short over the next 75 years, a gap between projected inflows and benefit payments that continues to grow. Yet, the last major adjustment to the Social Security program came in 1983 when Congress addressed both short-term financing needs and long-term challenges.

“Fear not about Social Security going away. That’s not going to happen,” said Goss during a recent conference. “The challenge is for Congress to come up with ways to either bring down the scheduled benefits, raise the tax revenue coming in, or some combination of the two, which they have always done in the entire history of this program.”

Social Security is funded through a payroll tax of 6.2% paid by both employers and employees (for a combined 12.4%) up to a certain level, known as the taxable maximum. Self-employed workers pay the full 12.4% tax. The SSA adjusts this limit annually to keep pace with the average wage index. In 2024, earnings up to $168,600 are subject to the Social Security tax.

Between 1983 and 2000, earnings for the wealthiest Americans “grew a lot faster than earnings levels for lower earners,” Goss noted. The top 6%, the ones with earnings above the taxable maximum, grew by 62% over that 17-year period, he said, while earnings by the lower 94% grew by 17%.

“That really is the primary reason why we’re falling short now relative to what we were expecting back in 1983,” Goss said.

Hike the ‘tax max’

Raising the earnings minimum for the Social Security tax, or the “tax max,” is usually the most popular solution to the revenue problem, Eskovitz said.

“Six percent of people earn above the cap, and so obviously people always love a solution where they don’t have to pay more,” he said.

Beyond that, “there’s an inherent fairness issue there,” Eskovitz said. Many people are shocked to find out that while they pay into the Social Security system from every paycheck, not everyone does.

“There are people who’ve stopped paying in, if you’re a millionaire, in the first quarter,” he said. “There are always those stories about people who stopped paying in after the first week of the year.”

Among the presidential candidates, Harris supports applying the Social Security tax to higher incomes. Trump has not endorsed specifics regarding Social Security but pledged to not cut benefits.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Riding the ‘long tail’ of opportunity — with AmeriLife’s Brian Peterson

A place to belong — with Thomas ‘T’ Priester

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News