How health care costs change the face of women’s planning

Women today face a unique financial challenge that can significantly impact their long-term security: the double burden of rising health care costs and unpaid caregiving responsibilities. These factors not only affect their retirement savings and career trajectory but also necessitate a more strategic approach to financial planning.

As women continue to outlive men and assume the majority of unpaid caregiving roles, their financial needs are evolving. For insurance professionals and financial advisors, understanding these challenges is critical to developing comprehensive long-term care strategies to help women protect their assets, plan for longevity and ensure a financially stable retirement.

The financial strain of caregiving and longevity

Caregiving is one financial hurdle women face. Women comprise nearly two-thirds of unpaid caregivers in the U.S., often caring for aging parents, spouses or other family members, and most of them continue to work while juggling caregiving duties. According to a 2024 Wells Fargo study, women also account for 82% of paid home health and personal care aides.

This added strain takes a physical and emotional toll that can impact the caregiver’s own health. It also affects their future earning potential, as they may need to reduce their work hours or take an unpaid leave of absence to manage their caregiving tasks. In some cases, they also end up losing employer-provided insurance benefits, which means they’ll likely spend more on their medical expenses than they otherwise would have.

At the same time, women live longer than men — between five and six years longer, on average, according to the National Center for Health Statistics. And while longevity is generally an advantage, it also correlates with more time spent in long-term care facilities.

Why women pay more for health care

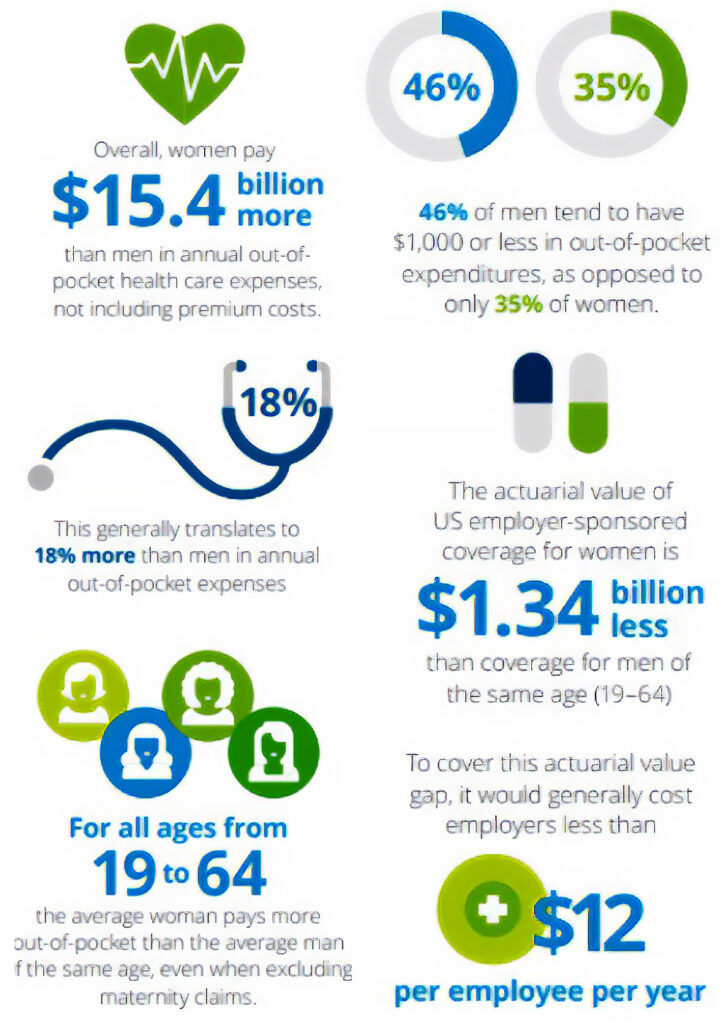

A Deloitte report estimates that, cumulatively, women in the U.S. spend $15.4 billion more than men in out-of-pocket health care expenses annually. Health care costs disproportionately impact women for several reasons.

» Longer life expectancy: Women require more years of medical care, increasing their overall spending.

» Greater likelihood of requiring LTC: Because women tend to outlive their partners (who could potentially act as caretakers), they are also more likely to end up in nursing homes than men are. In fact, more than 70% of nursing home residents are women, according to the American Association for Long-Term Care Insurance.

» Chronic conditions: Women are more likely than men to live with chronic conditions like diabetes, arthritis, dementia, depression and obesity.

» Inflation and rising medical costs: The cost of long-term care services and insurance premiums is steadily increasing, making early planning essential.

» Wage disparities: Women still earn less than men do on average, leading to less retirement savings and a greater reliance on Social Security and Medicaid.

In many ways, the data paints a bleak picture about the dual burden that women face. But the situation is far from hopeless. Financial advisors and insurance professionals who take a proactive role can help their female clients develop a financial plan that accounts for longevity, rising expenses and the potential need for professional care.

How can advisors help their female clients? There are several useful strategies worth pursuing.

Prioritizing long-term care planning

Women should begin planning for long-term care as early as possible to take advantage of lower premiums and more flexible coverage options. Advisors should educate clients about:

» Traditional long-term care insurance: This type of insurance protects assets and ensures access to quality care.

» Hybrid LTCi policies: These combine life insurance or annuities with long-term care benefits, offering greater flexibility and value if care is never needed.

» Health savings accounts: Women can use tax-advantaged savings to help cover long-term care insurance premiums and other future medical expenses.

Integrating LTC into a holistic financial plan

Advisors should help women incorporate long-term care planning into broader financial strategies, ensuring that retirement income plans account for rising health care costs. They should also make sure that their estate planning and asset protection strategies align with care preferences and family dynamics. Finally, they should ask their female clients to discuss caregiving expectations with family members to avoid unexpected financial strain.

Building a supportive client relationship

Women often prefer a collaborative, relationship-driven approach to financial planning. Advisors who want to build trust with their clients should listen actively to their concerns, explain their options using clear terms, and provide ongoing guidance as their health care needs evolve.

Avoiding common mistakes

Advisors should also be aware of common financial missteps that women — and sometimes their advisors — make when planning for health care expenses. These include:

» Underestimating longevity: Failing to prepare for long-term care costs can lead to added expenses further down the road.

» Misunderstanding Medicare: Many consumers mistakenly believe that Medicare will cover extended care needs. It won’t.

» Focusing on short-term rewards: Prioritizing short-term financial goals over long-term security can lead to disastrous consequences.

» Delaying LTC decisions: This can result in higher premiums or ineligibility due to health conditions.

By addressing these gaps, financial professionals can help women take control of their financial futures and navigate the challenges of aging with confidence.

Taking action for financial security

Women’s financial planning must evolve to address the dual burden of rising health care costs and unpaid caregiving responsibilities. By proactively integrating long-term care insurance and comprehensive retirement strategies into their businesses, advisors can empower women to protect their assets while maintaining financial security in retirement.

For insurance professionals, this presents a tremendous opportunity to serve women more effectively by offering education, tailored solutions and long-term financial strategies that align with their needs.

Holly Westervelt, MBA, CLF, LUTCF, is vice president of sales for Krause Agency. Contact her at [email protected].

The six golden rules of client scheduling

Medicare: An important piece of the financial planning puzzle

Advisor News

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Reed: 2026 changes ABLE accounts benefit potential beneficiaries

- Sickest patients face insurance denials despite policy fixes

- Far fewer people buy Obamacare coverage as insurance premiums spike

- MARKETPLACE 2026 OPEN ENROLLMENT PERIOD REPORT: NATIONAL SNAPSHOT, JANUARY 12, 2026

- Trump wants Congress to take up health plan

More Health/Employee Benefits NewsLife Insurance News