How consumers choose their financial advisor

A question for financial advisors: How do you become the financial professional consumers want?

People consider multiple factors when choosing to work (or stay) with a financial professional. Advisors, therefore, must understand clients’ expectations to win their business. Recent LIMRA research on consumer sentiment identifies key attributes they value as well as the role of holistic financial services.

Clients deem trustworthiness (66%), experience (60%), expertise (50%) and communication skills (48%) as the most important qualities in a financial professional. Only 1 in 3 consumers say personal characteristics like age, race or gender are essential, but of those who do emphasize personal traits, they almost exclusively value an advisor’s personality (92%).

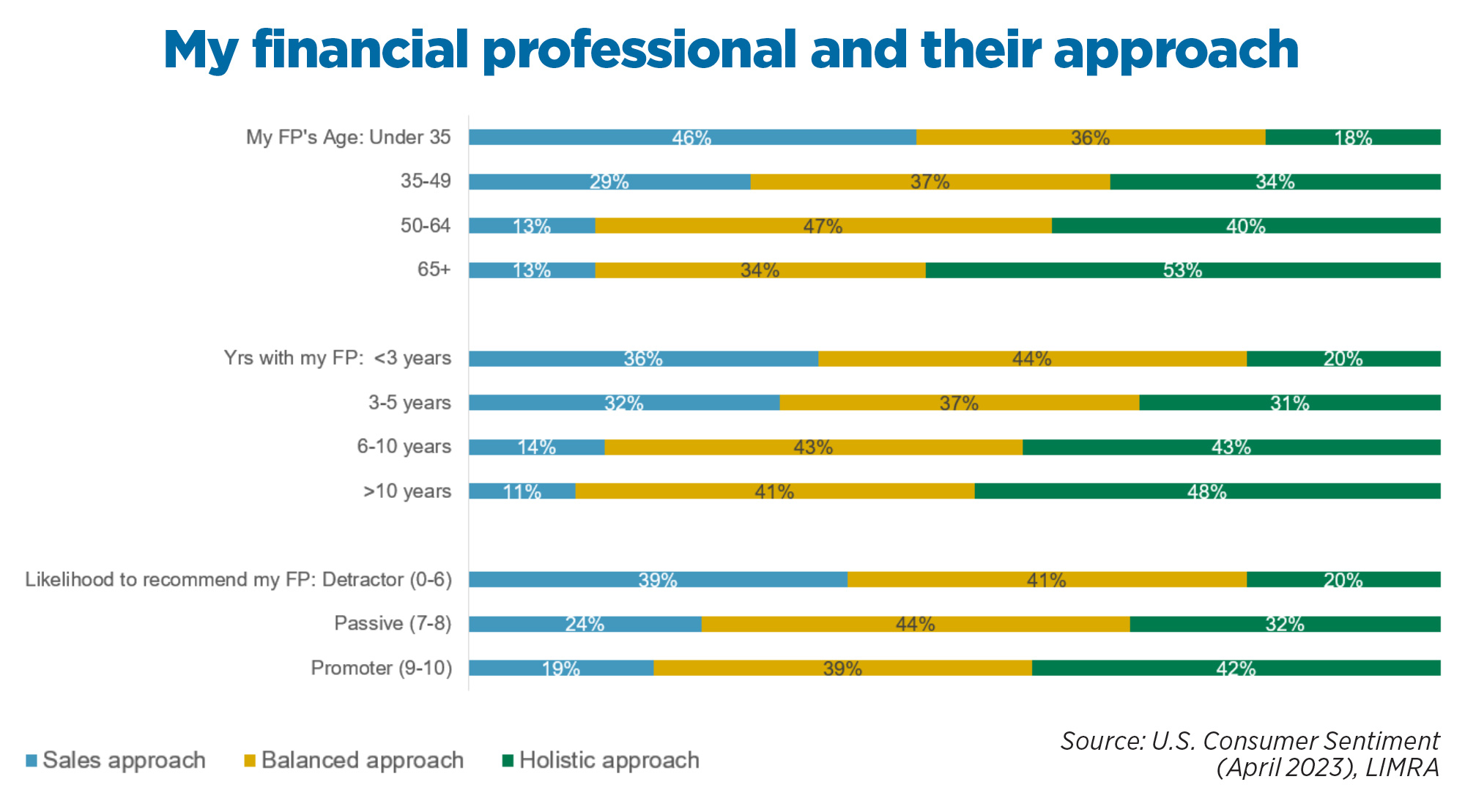

Consumers also value a holistic approach to financial advice. LIMRA research suggests advisors who help their clients address more areas of their financial vulnerabilities instead of using a sales approach are more likely to be successful. Consumers could view a sales-only method as reactionary instead proactive. Clients already working with a financial professional especially value a holistic approach to finances (45%).

Our study found clients who worked with their financial planners longer or who perceived their advisor as being older say their financial professional takes a holistic approach to financial services. In addition, clients are more likely to recommend their financial professional when they provide comprehensive financial planning. This indicates advisors should provide clients with a wide array of services and products.

As mentioned previously, while few clients are concerned about a financial professional’s personal characteristics, all things being equal, there are some trends to note. A financial professional’s age is the second highest-ranked personal characteristic that consumers value (67%). Consumers with an age preference lean toward professionals in the 35-49 age range (34%) and 50-64 age range (18%). With age comes the assumption of experience and expertise.

Clients might want the same financial professional long term, so they would prefer someone in their prime working years.

Regarding gender, about 1 in 5 adults prefer to work with a financial professional of the same gender because they believe the advisor can better relate to them. Clients also assume certain skills associated with that gender: Female financial professionals are thought to have better soft skills (communication, agreeableness, understanding), while male financial professionals are perceived as having sharper hard skills (knowledge, efficiency and experience). However, 8 in 10 consumers (84%) have no preference for gender.

One in four consumers say they would prefer to work with a financial professional with an ethnic or cultural background similar to theirs. Black and Hispanic consumers express this at higher rates (36% and 30%, respectively).

Yet an unspoken ingredient for a successful client-advisor relationship is time. Building trust with clients and providing products and services tailored to a client’s needs do not happen overnight but are cultivated over time. Therefore, advisors should be aware that they are playing the long game with many of their clientele.

Consumers have a lot to consider when choosing a financial professional. For financial advisors to be successful, they should prioritize building client relationships around trustworthiness, provide a breadth of financial products and services, understand the consumers’ needs, and become a vital source for guiding clients through every step of the financial journey.

Erin Bowler is senior research analyst, distribution research, LIMRA and LOMA. She may be contacted at [email protected].

Supporting the next generation of financial planners

Public policy and planning address retirement concerns

Advisor News

- Most Americans surveyed cut or stopped retirement savings due to the current economy

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Reed: 2026 changes ABLE accounts benefit potential beneficiaries

- Sickest patients face insurance denials despite policy fixes

- Far fewer people buy Obamacare coverage as insurance premiums spike

- MARKETPLACE 2026 OPEN ENROLLMENT PERIOD REPORT: NATIONAL SNAPSHOT, JANUARY 12, 2026

- Trump wants Congress to take up health plan

More Health/Employee Benefits NewsLife Insurance News