Help clients understand rising long-term care costs

With inflation in the headlines from Wall Street to Main Street, clients who think this is only a current challenge should be forgiven. Let’s face it — today’s discussions center on near-term fixes to the issues right in front of us, whether it is new legislation or individuals and families thinking about how to manage the rising day-to-day costs of gas and groceries.

As every advisor knows, addressing inflation has always been a necessary fixture of any long-term financial security plan. This is especially true when it comes to helping clients plan for long-term care in retirement.

While the current environment challenges household budgets across the country, it is also a unique window in which advisors can proactively talk to clients about the consequences of inflation for their retirement savings decades from now and help them put a plan in place to manage long-term care risk.

Unlike day-to-day expenses, long-term care planning is not an area where individuals and families can easily make cuts or trade-offs to offset inflation. Any decision regarding caregiving is not just financial but also has practical, physical and emotional aspects — which highlights the importance of helping clients plan today so they may have more care choices, regardless of tomorrow’s markets or the economy of the future.

Costs keep going up

Many of us will need to rely on assistance with daily activities as we age. It might be help with simple tasks such as walking, bathing and dressing, or more dedicated care in situations where there is a chronic condition such as dementia or Parkinson’s disease.

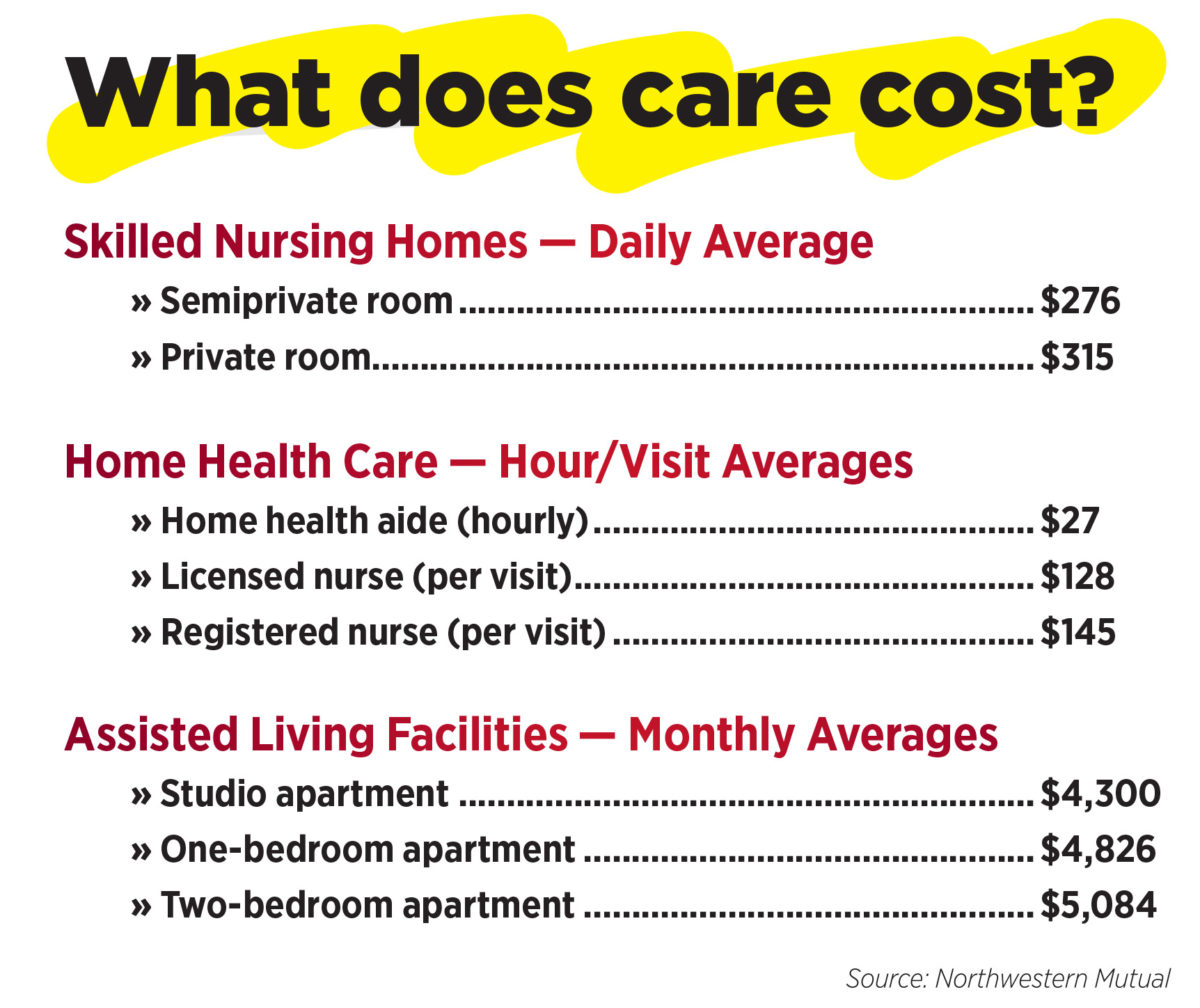

The simple fact is the cost of this type of care is rising consistently. Even if the current inflation we are seeing across the economy at large is contained, the costs of long-term care are likely to continue rising. According to Northwestern Mutual’s Cost of Care Calculator, the average cost of a home health aide today is $27 per hour, and it is projected to rise to $49 per hour by 2042.

The leading driver of this cost is growing demand. By 2030, all baby boomers will be at least 65 years old, and according to the U.S. Census Bureau, older adults are projected to outnumber children under age 18 for the first time in U.S. history by 2034. To date, caregiving for the elderly has been largely provided by informal networks of younger family members and friends.

Demographic trends suggest this cannot continue at the same level.

Growing demand for care, coupled with the shrinking safety net of informal caregivers, is putting even more pressure on the already tight labor market for professional caregivers. This is pushing up wages and, in turn, the cost of care.

For many people, finding cost-effective care may become extremely challenging. This reality must be acknowledged as early as possible in an individual’s financial life to maximize the time to plan and save accordingly. The time for clients to understand this reality is right now.

Encourage clients to talk to their loved ones

In a world of increasing costs, caregiver shortages and increased demand for services, it is essential that clients talk to their loved ones about their expectations for their own care and how costs will be covered.

According to Northwestern Mutual’s 2019 CARE study, 36% of Americans ages 18 and older are currently or have been caregivers, and two in five of them did not know in advance they would step into a caregiving role. This can put a lot of stress on everyone — the individual needing care and the loved ones providing it.

When clients explain their preferences and expectations clearly, it helps shape what is needed practically and financially and avoids unexpected burdens. Areas to help them consider include:

» Do they want to age at home, or would they consider selling the home and moving? If so, where, and what are the comparative costs?

» If they have children, is there an expectation that the children will step in to help with care? If so, has this been discussed explicitly? Adult children are not always in a position to leave their careers or split time between caring for younger children and an aging parent.

» Would they be comfortable with a professional caregiver coming into the home, or would they prefer to be in an assisted living facility? Both scenarios have different financial considerations.

Protect the nest egg

In this inflationary environment, it is also essential to help clients protect their plans and savings.

Too many people work hard to save and build up their retirement nest egg, only to see it be repurposed to pay for the high cost of home health care or assisted living services for which they had not planned. Our 2021 Planning & Progress Study found that only a third of adults have plans for their own long-term care needs.

These conversations are never easy. No one wants to think about failing health or losing their independence. Still, these honest conversations are essential to ensuring the correct framework and contingencies are in place to reduce stress and financial burden down the road.

Fortunately, there are many options to help people manage their long-term care risk. The long-term care insurance marketplace has evolved over the past decade to meet a wide variety of needs with products that are more flexible, can provide benefits whether or not care is needed, and offer a range of options to ensure benefits are aligned with the higher costs of care in the future.

Use the current environment to jump-start conversations with clients now. A retirement plan isn’t safe unless long-term care planning is part of it. The sooner clients start planning for it, the more options and flexibility they will have as they age.

Advisor input crucial to the annuity-buying decision

The increasing demand for standards of care in the sale of life insurance: ‘Back to the Future’

Advisor News

- Beyond Finance: How an inclusive approach builds client trust

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

More Advisor NewsAnnuity News

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

More Annuity NewsHealth/Employee Benefits News

- CommunityCare names Josiah Sutton new president and CEO

- Strengthening Roots, Shaping the Future: Josiah Sutton Appointed CEO of CommunityCare

- Artificial intelligence was hot topic at Kentucky Chamber’s inaugural Healthcare Innovation Summit

- Cancer coverage for firefighters clears Senate

- New lawsuit challenges Connecticut Medicaid eligibility rules

More Health/Employee Benefits NewsLife Insurance News

- Michal Wilson "Mike" Perrine

- Proxy Statement (Form DEF 14A)

- AM Best Affirms Credit Ratings of Subsidiaries of Old Republic International Corporation; Upgrades Credit Ratings of Old Republic Life Insurance Company

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News