Advisor input crucial to the annuity-buying decision

An investor may have many reasons for choosing whether to buy a deferred annuity when it’s offered. For example, some investors purchase annuities to generate lifetime-guaranteed income, others to accumulate assets and others to protect their principal. Non-buyers may refrain from purchasing deferred annuities offered to them because of fundamental objections to the product or feeling that their financial situation does not require a deferred annuity.

Recent LIMRA research shows clients’ financial advisors are also critically important to these purchase decisions. The specific actions taken by advisors can help or harm their probability of closing an annuity sale. Moreover, clients’ experiences working with their advisors when discussing deferred annuities have important ramifications for the advisors’ practices’ future success.

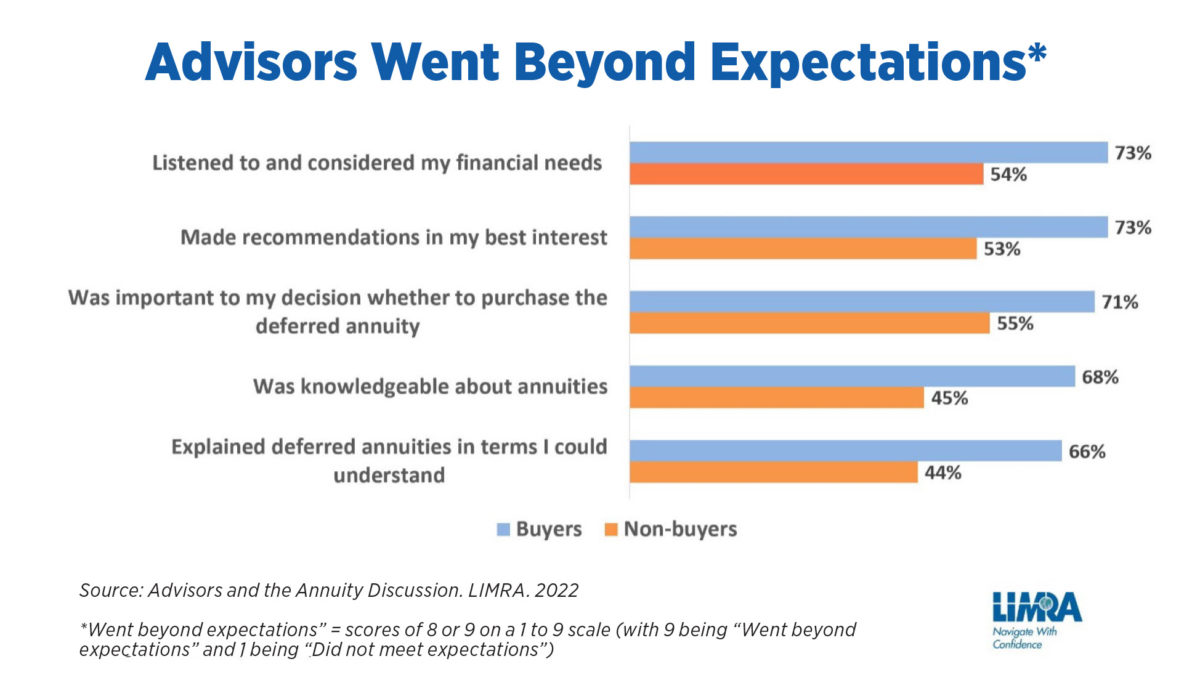

LIMRA surveyed more than 900 investors, all of whom were aged 45 to 80, had household investable assets of $100,000 or more, and had met with their advisors within the past three years and discussed deferred annuities. Participants were asked to assess their advisors’ performance during these interactions. Across a range of measures, investors who decided to buy deferred annuities rated their advisors more favorably than non-buyers did.

Advisors who listened to their clients and ensured they understood the annuity products, demonstrated strong annuity knowledge themselves, and made recommendations perceived as being in the best interests of their clients tended to have a better chance at completing a sale.

In addition, buyers were significantly more likely than non-buyers to be satisfied with their advisors, to be willing to undergo the same process again if the need arises, and to recommend their advisor to family or friends. As referrals are usually the lifeblood of future business development, it is essential that advisors strive to treat every interaction with clients as an opportunity to demonstrate their value.

Could the advisors of the non-buyers have done something differently that would have resulted in sales? Yes. Our research shows that most non-buyers (58%) feel that their advisors could have. According to non-buyers, the top improvement advisors could make is increased communication. If advisors can provide better explanations of the advantages and benefits of the deferred annuity product, the product’s fees, how the deferred annuity would fit into the portfolio, and the differences between deferred annuities and other types of annuities, a sale would be more likely.

Training on deferred annuity products and listening to clients could help more people feel comfortable with investing in these products.

Instructing advisors on the deferred annuity value proposition and its unique sales process could help increase sales. Having fine-tuned listening skills, especially during the needs analysis phase of the sales process, is critical. More education to help advisors understand how deferred annuities fit into formal retirement plans for managing income, expenses and assets in retirement would also be valuable.

Advisors should also be prepared to meet clients at their level of understanding about deferred annuities, which is likely to come from a variety of information sources beyond the advisor. They need to acknowledge that some clients will come into the meeting with their own (perhaps strongly felt) ideas about annuities based on the resources they have consulted. Being able to address a wide range of common objections will be essential for success.

Matthew Drinkwater, Ph.D., FSRI, FLMI, AFSI, PCS, is corporate vice president, LIMRA and LOMA. He may be contacted at [email protected].

Annuities cast a light when things seem dim

Help clients understand rising long-term care costs

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- $2.67B settlement payout: Blue Cross Blue Shield customers to receive compensation

- Sen. Bernie Moreno has claimed the ACA didn’t save money. But is that true?

- State AG improves access to care for EmblemHealth members

- Arizona ACA enrollment plummets by 66,000 as premium tax credits expire

- HOW A STRONG HEALTH PLAN CAN LEAD TO HIGHER EMPLOYEE RETENTION

More Health/Employee Benefits NewsLife Insurance News