Health insurers hike ACA premiums, but not due to possible subsidy losses

Editor’s Note: This is the third in an ongoing, occasional series examining the potential health coverage impacts that may occur as the COVID-19 public health emergency and associated emergency government benefits wind down.

Health insurers are hiking premiums for plans sold on the Affordable Care Act exchanges in 2023. But the possible end of expanded subsidies enabling Americans to buy coverage is not one of the driving forces behind those rate hikes.

An estimated 3 million people who get their health insurance through the Affordable Care Act exchange could lose their coverage unless Congress acts before the end of the year.

The American Rescue Plan Act of 2021, enacted as COVID-19 continued to ravage the nation, increased the premium tax credits for purchasing ACA insurance coverage and extended those credits to more people. This enabled more people to purchase health insurance, swelling the ranks of those covered under the exchanges to a record of 14.2 million. However, the enhanced tax credits are set to expire after 2022.

ARPA increased advanced ACA premium tax credits for all eligible income brackets, including extending tax credits to those who earn more 400% of the federal poverty level. These subsidies, which make plans more affordable, are set to end with the expiration of ARPA on Jan. 1, 2023.

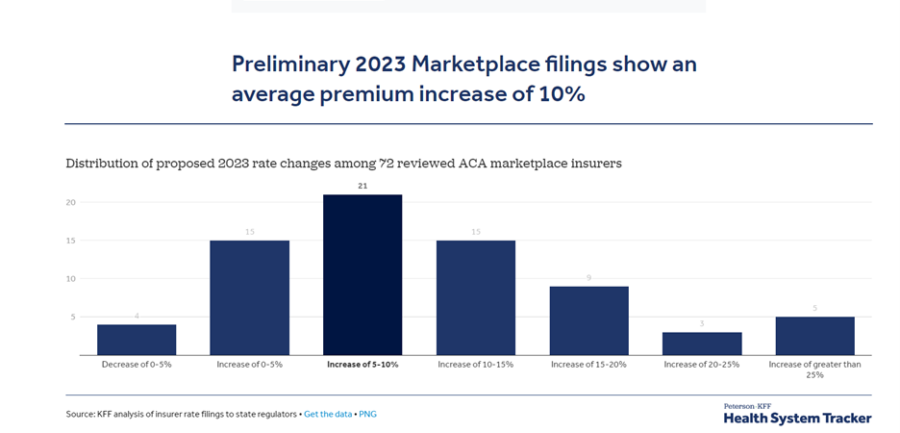

A Peterson-KFF study of 72 health insurers who offer coverage on the ACA marketplace in 13 states and the District of Columbia showed that the median proposed premium increase is 10%, after premiums were nearly flat over the previous two years. The study examined rates in Georgia, Indiana, Iowa, Kentucky, Maryland, Michigan, Minnesota, New York, Oregon, Rhode Island, Texas, Vermont and Washington.

But two factors are contributing to those rising rates. The first is a rebound in health care usage, as more consumers return to the doctor and undergo medical procedures that they put off in the midst of the COVID-19 pandemic. The second factor is inflation as prices paid to providers and pharmaceutical companies are increasing.

Just under half of the insurers Peterson-KFF reviewed said the possible expiration of ARPA subsidies would have an impact on 2023 premiums. Of those insurers that said the subsidy expiration would have an impact, about half said the expiration of ARPA would have a neutral impact, while the other half said it would increase premiums slightly – often no more than around 1%.

For example, Excellus Health Plan in New York told Peterson-KFF the expiration of ARPA subsidies would have a nearly neutral impact on rates (0.2%), saying, “The population that is most likely to drop without these enhanced credits have better morbidity and substantially lower cost than those unlikely to move. This shift in the population would impact both expected claims and risk adjustment amounts.”

In Michigan, Oscar Insurance told Peterson-KFF “due to the uncertainty related to the potential extension of the expanded subsidies, Oscar assumed they are due to expire at the end of 2022, which is expected to decrease market membership and subsequently increase market morbidity. The expiration of the subsidies has a premium impact of +1.7%. Should the subsidies be extended, it would decrease the rates by 1.7%.”

Meanwhile, in California, state officials announced that rates would increase an average of 6% next year for the 1.7 million people who purchase coverage through Covered California, the state-operated health insurance marketplace. That's a big jump after years of record low increases, when rate increases averaged about 1% in the past three years.

Insurance companies that sell policies on and off Connecticut’s Affordable Care Act exchange are seeking an average increase of 20.4% on individual health plans next year.

Some insurers told Peterson-KFF the expiration of ARPA subsidies would have a slight upward effect on their premiums, but also said that if Congress extended the subsidies before rates are finalized in the fall, the insurers would reverse that increase. Congress is currently considering an extension of these subsidies, but it is unclear whether they will act before 2023 premiums are locked in.

How high could they go?

Out-of-pocket premiums for consumers who get ACA coverage in states that use HealthCare.gov, could go up by about 50% if the enhanced subsidies are not renewed, said Krutika Amin, associate director, Peterson-KFF Health System Tracker.

“So for a 60-year-old who's making right about four times the Federal Poverty Level, the subsidy cliff is going to come back,” she told InsuranceNewsNet. “Right now, they get helped by a marketplace plan. But if those extra ARPA subsidies expired, premiums can go up a lot more, especially for older people.”

If the enhanced subsidies are not renewed, Americans could face some steep out-of-pocket premiums for 2023, according to a study by Avalere Health for America’s Health Insurance Plans.

- A 27-year-old earning $19,191 per year (149% of Federal Poverty Level) could face an annual increase in out-of-pocket premiums of almost $800 per year.

- A 46-year-old person earning $41,860 per year (325% FPL) could face an increase of $1,300.

- A 55-year-old couple earning $70,551 per year (405% FPL) could face an increase of more than $9,000.

“Putting this in perspective, the average household monthly grocery bill is about $400. So this will really put people in tough situations. There will be making tough tradeoffs between paying for household needs and paying for health insurance,” Amin said.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Trust and success go hand in hand, American College study says

Seniors turning 65 increasingly favor lower cost Medigap options

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News