Feeling The Need, Closing The Gap

As the world emerges from the pandemic, the life insurance industry is hoping to continue riding the wave of renewed consumer interest in the product.

COVID-19 made consumers consider their own mortality — and provided an incentive for many of them to buy life insurance.

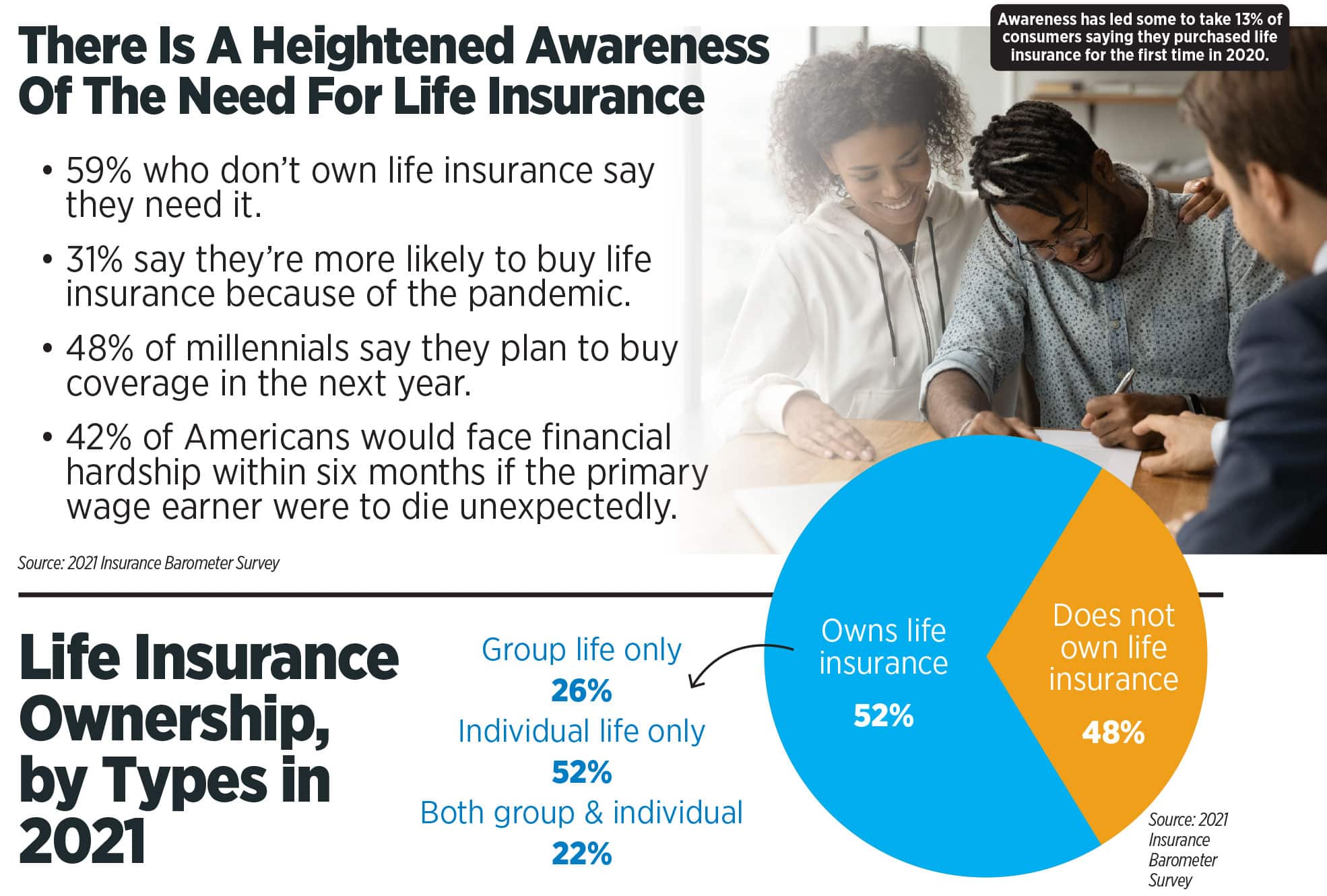

The 2021 Insurance Barometer Study by LIMRA and Life Happens showed that nearly one-third of consumers said they are more likely to buy life insurance because of the pandemic. More than two in five (42%) of those who had the virus said they are interested in purchasing coverage, and one-third of those who know someone who had COVID-19 said they are likely to buy.

The perceived need for life insurance is at a high point, the study showed, with 70% of Americans saying in 2021 that they need life insurance, up from 66% in 2019. But despite people recognizing they need life insurance, the coverage gap remains real, with only half (52%) of American adults owning any life insurance. Of that group, one in four has only group coverage from their employer.

Faisa Stafford, president and CEO of Life Happens, called the study results “the opportunity of a lifetime” for the industry.

“We want to make sure that we capture this moment and not leave this on the side,” said Stafford. “We know that wants and needs are now aligned more closely together. And we need to jump on that.”

“There are so many more people in the market wanting insurance than ever before. So the market is great,” she said. “But when we look at those who don’t own insurance as well as those who are severely underinsured, we see there are more than 100 million people to market to. That means we have a lot of work to do.”

Stafford said her organization was encouraged by the Barometer Study statistic that showed 30% of Americans bought life insurance for the first time in 2020. Those first-time buyers were mainly men, millennials, Blacks, high-income households and couples. But other market segments — particularly Generation X, Hispanics and women — are underserved.

She called for the industry to continue its use of digital channels to reach consumers where they are and to make it easier for them to buy.

“Consumers have become comfortable living their lives online, and we’ll be happy to be there with them. But we also have to be a step ahead of them,” she said. “Digital platforms are where the newer generations are headed, and we need to get them educated and ready to take the next step to becoming financially secure.”

‘Consumers Are Hungry’

“Consumers are hungry for information; they’re hungry for products — they want life insurance!”

That was the word from Chris Pirtle, managing director of Peake Financial in Silver Spring, Md. Pirtle was a panelist at LIMRA’s 2021 Advanced Sales Forum and gave his predictions on selling life insurance in the post-pandemic world.

Pirtle told InsuranceNewsNet “the consumer wants what we have to sell.”

“They’re hungry, they want to be called, and we have to reach out to them.”

But even though consumers may be eager to obtain coverage, that doesn’t mean they are beating down advisors’ doors. “Clients aren’t going to come to us, even though they want to talk to us,” he said. “We have to go back to the basics. We have to make the calls. If we do our activity, our app-tivity will happen as well.”After 31 years in the business, Pirtle said he has received more calls and referrals than ever before since COVID-19 hit.

“That tells me consumers want to talk to us. But we have to give them the information and meet them where we are,” he said.

With the days of cold-calling prospects behind them, advisors should get up to speed on LinkedIn to reach potential clients, Pirtle said. “It’s the best marketing and prospecting vehicle out there,” he said. “LinkedIn enables you to connect with anyone.” Pirtle said he uses the networking platform to obtain referrals and endorsements from his connections. He also posts information that he believes is relevant to clients and prospects, and makes sure to keep his LinkedIn network updated on his accomplishments.

Accelerated underwriting, which came into its own during the pandemic, is removing one of consumers’ biggest reasons for dragging their feet about purchasing life insurance, Pirtle said.

“With a good portion of underwriting now being done electronically, we can write up to $2 million, $3 million in coverage without having to take any body fluids,” he said. “That’s huge. A lot of folks previously used the underwriting process as a reason not to get life insurance, and now that reason has been taken away.”

Looming Tax Issues Are An Incentive

A new administration and a new Congress bring the prospect of new tax legislation. And that could launch “a perfect storm for a real renaissance in estate planning and the need for life insurance,” according to Wendell Stallings, advanced sales markets director with Ameritas.

“Advisors really need to be aware of the potential for tax reform, and they need to help clients prepare for it,” Stallings told InsuranceNewsNet.

President Joe Biden has called for reducing the estate tax exemption amount back to $3.5 million per person, immediately or retroactively to Jan. 1, 2021. Biden has also suggested increasing the estate tax rate from 40% to 45%.

Likewise, Biden proposed doing away with the “step-up in basis” that allows people to minimize or avoid capital gains taxes on inherited assets. But no legislation has been proposed yet, and such a change could have a tough time getting approved by a divided Congress.

But Stallings believes advisors should be proactive and discuss ways their clients can maintain liquidity in their estates should these tax reform proposals come to pass.

“Advisors who have these conversations with their clients now will put themselves ahead of the game should tax reform happen,” he said.

The pandemic taught advisors two lessons that can impact the way they do business in the year ahead, Stallings said.

“One was that successful agents were able to pivot because we were in a situation where we couldn’t see clients in person, we had to do everything virtually,” he said. “Although it did lead to a lot of logistical challenges, it left advisors and clients with greater latitude as far as being able to set up appointments and to be able to discuss and have conversations about the planning needs. And I think that virtual meetings will continue to be an option for clients and advisors in the future.

“But the second thing is that the pandemic provided people with an opportunity to understand they have a significant need for coverage,” Stallings said. “This really has awakened people to the fact that, yes, your mortality is a real thing. And I think for advisors going forward, they need to be able to modify their practice management, to be able to adapt to this new world and environment of being able to work more remotely and virtually with clients, and understand the efficiencies that that can bring about in their practice.”

Consumers’ increased awareness of their mortality, combined with aging population demographics, means a bigger role for life insurance, Stallings said.

“We have a large number of baby boomers going into retirement and beyond. And life insurance planning is something that’s very important to them — not only from the standpoint of having life insurance dovetail with their own specific retirement planning but also from a legacy standpoint as well. And we have many baby boomers who have received assets from their parents, and it’s important for them to continue that legacy going forward. Life insurance plays a significant role in their being able to do that.”

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

The Female Market Is NOT A Niche – with Arwen Becker

Looking For Life Amid COVID-19

Advisor News

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

More Advisor NewsAnnuity News

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

More Annuity NewsHealth/Employee Benefits News

- New Antibiotics Study Results Reported from Tehran University of Medical Sciences [Antibiotic consumption and medication cost in diabetic patients: Insights from Iran health insurance organization (IHIO) claims data]: Drugs and Therapies – Antibiotics

- Study Data from Humana Healthcare Research Update Knowledge of Type 2 Diabetes [Trends in use of continuous glucose monitors among individuals with type 2 diabetes enrolled in Medicare Advantage (2021-2023)]: Nutritional and Metabolic Diseases and Conditions – Type 2 Diabetes

- Research Data from Harvard Medical School Update Understanding of Managed Care (The

<i>

Lancet

</i> Commission On a Citizen-centred Health System for India): Managed Care

- New Managed Care Study Findings Have Been Reported by Researchers at University of Pennsylvania Perelman School of Medicine (Buprenorphine prescribing is increasingly delivered by primary care nurse practitioners to Medicaid beneficiaries): Managed Care

- Researchers at University of Maryland School of Public Health Have Reported New Data on Managed Care (Associations Between ACO Enrollment Status and Drug and Nondrug Costs Among Older Adults Newly Diagnosed With ADRD): Managed Care

More Health/Employee Benefits NewsLife Insurance News

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

- NAIFA and Brokers Ireland launch global partnership

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- Reimagining life insurance to close the coverage gap

More Life Insurance News