Looking For Life Amid COVID-19

Elaine Tumicki has tracked life insurance sales data for decades and has never been more excited than right now.

Her enthusiasm is rooted in the new post-pandemic realities. To keep it simple, life insurance is a hot property.

“Even personally, I get excited to see the next month’s sales,” said Tumicki, vice president for insurance product research for LIMRA, during a recent webinar. “I don’t think I ever would have said that before.”

Sales are up by double digits across many products and lines, with records being smashed. Life insurance application activity ended the second quarter up 7.3% for the year, the MIB Index reported, after record-setting year-over-year second-quarter growth.

All signs point to a heightened mortality awareness brought on by the tragic COVID-19 pandemic. The global pandemic’s true costs will undoubtedly end up in the hundreds of billions, with tens of millions of victims straining the health care system.

Nearly everyone is feeling those human costs in some way, with many turning to life insurance for future protection.

“The bottom line is COVID had people worried and thinking about their mortality,” Tumicki said, which LIMRA confirmed with its annual surveys. “In fact, almost a third of consumers said that they were more likely to buy life insurance because of the pandemic than they were before the pandemic.”

IUL Is King

The Dow Jones Industrial Average is up about 80% from a pandemic low of 19,174 on March 20, 2020. Stocks are up more than 30% in a one-year lookback and about 16% from six months ago. In short, the market is flying, with seemingly no end in sight.

It’s no surprise that indexed universal life policies that give owners an opportunity to play the stock market are selling well. In fact, extremely well. May 2021 IUL sales were up 24% over the previous May, LIMRA reported.

“IUL and fixed UL are a much more face-to-face kind of a sale,” Tumicki explained. “It’s a lot harder to sell a product like that online, so it took a while for producers selling those products to adapt.”

A big positive in the insurance business is the versatility of products. The pandemic continues to prove the truth of that statement. In addition to the market-driven IUL products, term life is also selling well, largely through direct-to-consumer channels.

Overall life insurance premium was up 17% in April and 24% in May, Tumicki said, with nearly all channels reporting strong growth.

“My guess is that in 2021, what we’re seeing is more organic growth,” she added. “People are buying life insurance not to replace an existing policy but because they’re suddenly concerned about mortality. They’re recognizing the importance of life insurance and how it can protect their families.”

Illustration Updates

Global Atlantic is a big seller of IUL and has been for many years. The company made a series of deals in 2021 to strengthen its hand in the market. KKR put private equity might behind Global Atlantic by acquiring the insurer in a $4.7 billion deal that closed Feb. 1.

Dave Wilken, co-head of individual markets for Global Atlantic, said the company is going full speed ahead with its life sales strategy. Getting younger people to convert their concerns into actual policy purchases is a priority, he added, one made easier by the versatility of life insurance today.

“We’ve evolved to really have life insurance bring so many different pieces of value not associated with the death benefit,” he explained. “So I think the one thing we’re focused on is to continue the innovation that brings multiple pieces of value to consumers.”

Global Atlantic was one of several insurers that participated in an update of Actuarial Guideline 49 by the National Association of Insurance Commissioners. The update will restrict IUL illustration guidelines going forward and surely will have an impact on sales.

After a monthslong, at times contentious process, not everyone was satisfied with the resulting compromise.

“I can see the positive in it,” Wilken said. “I think there were some things about it that really limited the opportunity for a consumer, to be honest.”

In the biggest change, IUL products with multipliers or other enhancements cannot provide better illustrations than non-multiplier designs. Also, the new AG 49A permits the IUL illustration crediting rate to be 50 basis points higher than the policy loan rate.

“I think we get to the right spot where there aren’t these more wild illustrations by carriers that were driving some inappropriate potential performance demonstration,” Wilken said. “And there was disparity among carriers, so I think we got back to a level playing field.”

Regulation remains fraught with landmines, and insurers are not opposed to pulling out of markets. Lincoln Financial pulled its insurance products out of New York in July because its electronic signature process does not comply with the state’s requirements.

“Lincoln will be suspending new sales of certain term and indexed universal life products in New York until a new, electronic-compliant application and process can be implemented,” the company said in a statement.

Other insurers are simply exiting the market under pressure from analysts and investors. Principal Financial Group announced in late June that it will stop selling consumer life insurance products and pursue sales of a block already in force.

These trends are likely to continue into 2022.

Tax Changes

It is certain that life insurance products will change in 2022 thanks to a provision included in a pandemic relief bill last year.

The bill changed the IRS Rule 7702 minimum interest rate required on cash value. The rule was originally designed to keep cash value at a certain level below the face value in order to consider it life insurance, rather than purely an investment vehicle.

The rate can now float in relation to actual market rates, but it had remained unchanged since 1984, despite near-zero interest rates of the past several years.

“That interest rate was basically hard-coded into the tax code,” Timothy Pfeifer of Pfeifer Advisory told InsuranceNewsNet in April. “The net effect is that people could put less money into their contracts, or, set another way, they could accumulate less money, before violating the definition of life insurance. The industry was at a disadvantage because people couldn’t put in as much money.”

The new rule means consumers can put more dollars into their cash value insurance, but they will also see less face value. Lower face value also means that producers will get less commission, unless companies change the compensation structure.

Carriers are scrambling to reprice products and recode systems because the rule went into effect on Jan. 1, despite industry requests to postpone the effective date until July.

Uncertain Future

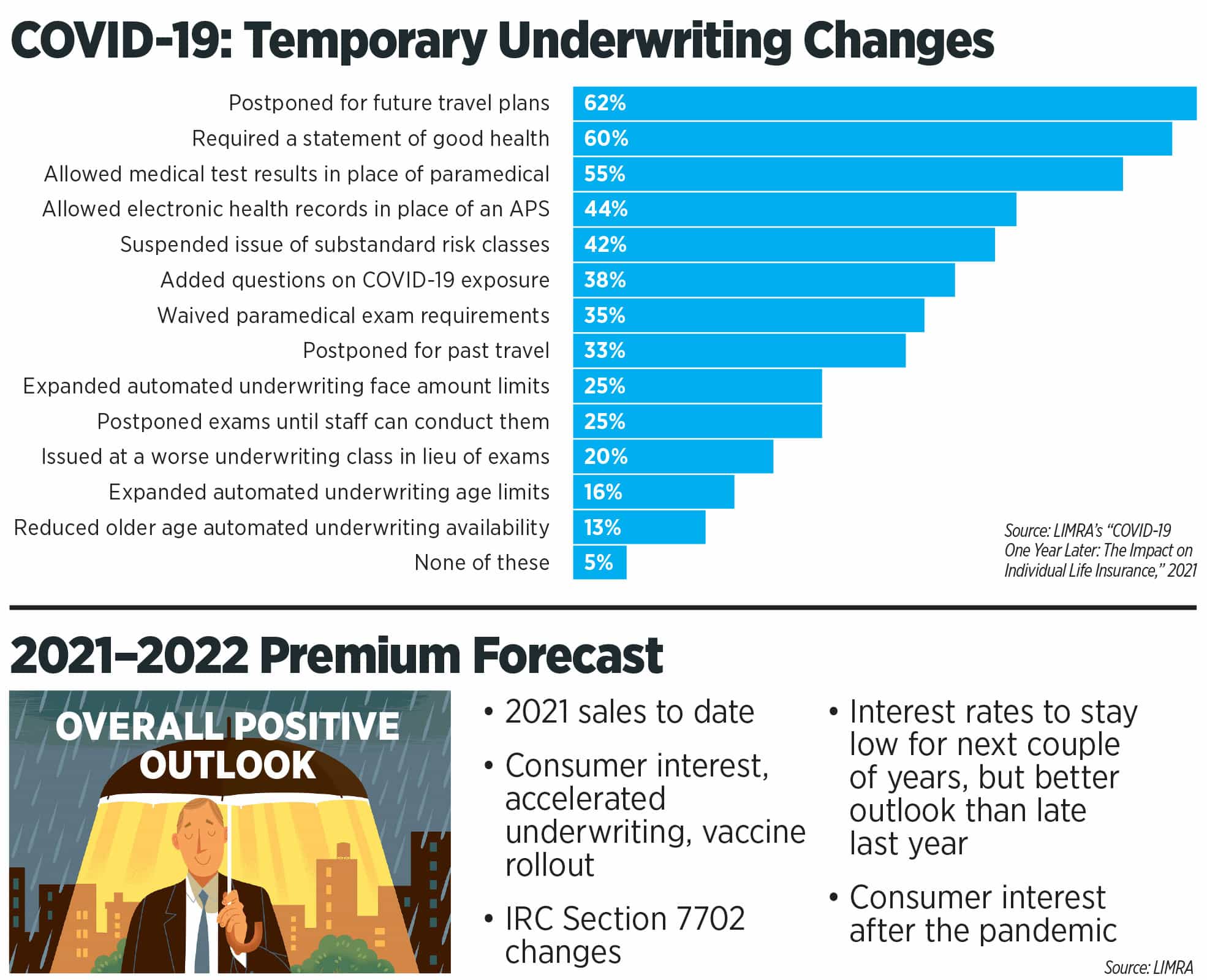

Agents have spent a significant amount of time since the onset of the pandemic dealing with change — in particular, application and underwriting changes forced by COVID-19 restrictions as well as a desire by insurers to reduce risk.

Some of those changes will be made permanent, and some things will return to the old ways. There is some speculation that insurers might require a COVID-19 vaccination as part of underwriting. As this issue went to press, no insurer had taken that step.

Change is the theme, from the first sales call to the final regulatory approval, but Tumicki and LIMRA remain bullish on life insurance sales for the remainder of 2021 and into 2022.

“We’re thinking right now, low- to mid-single-digit [sales increases] for next year and higher for this year,” Tumicki said. “We’re looking at probably high single digits, maybe even double digits overall for premium growth for 2021.”

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Feeling The Need, Closing The Gap

Life Insurance Premium Up 21% In The Second Quarter, LIMRA Reports

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Legals for December, 12 2025

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

- AM Best Upgrades Credit Ratings of Starr International Insurance (Thailand) Public Company Limited

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

More Life Insurance News