Brighthouse: annuity success, RBC struggles, as possible sale rumors fly

The curious case of Brighthouse Financial could be summed up in one question posed during the middle of the insurer’s Q4 conference call with analysts Wednesday.

“Does it make sense for this company to be public on a standalone basis?” a Jefferies analyst asked.

Brighthouse posted very strong Q4 earnings of $5.88 per share, beating the Zacks Consensus Estimate of $4.44 per share. Its Shield Level annuities hit record sales of $10 billion for the year. Even Brighthouse’s small life insurance segment saw record sales.

The insurer’s share price is up more than 25% in the past month on reports that executives are looking for a buyer. Brighthouse should be an attractive target for a private equity firm looking for a toehold in the annuity space.

Still, Brighthouse continues to have trouble achieving and maintaining a responsible risk-based capital ratio. That has analysts concerned.

Brighthouse struggled throughout 2024 to bring its RBC ratio up to the industry standard of 400% to 450%. RBC requirements provide for a ratio to assess the level of risk associated with an insurance company's assets.

It took a $100 million infusion from the holding company for Brighthouse to finish Q4 with a 400% RBC ratio. CEO Eric Steigerwalt and CFO Edward Spehar spent much of Wednesday’s call explaining that decision.

Without the $100 million, Brighthouse would have finished the year with an RBC in the “mid-390s,” Spehar said.

“We have repeatedly stated that we believe our franchise value is driven by distribution and that we are committed to our distribution partners and the customers that they serve,” he added. “Given the importance of both distribution and the financial strength of our operating companies, we determined it was prudent to make a relatively modest contribution from the company.”

The Brighthouse financial plan calls for its RBC ratio to be “relatively stable” over the next few years without additional funds from the holding company, Spehar said.

During the closing months of 2024, Brighthouse sealed a pair of reinsurance deals to reinsure legacy blocks of fixed annuities and universal life and variable universal life products, Steigerwalt noted. Holding company liquid assets remain at $1 billion.

Those developments give Brighthouse the flexibility needed to keep its RBC ratio strong, executives said.

Steigerwalt rejected the notion that Brighthouse is not diversified enough to remain a public company and be successful. It has been seven-and-a-half years since Brighthouse split off from MetLife and the insurer repurchased more than $2.5 billion worth of stock during that time, Steigerwalt said.

In Other News

Surprisingly, there were no questions about recent reports that Brighthouse is looking for a buyer.

The Financial Times reported two weeks ago that the Charlotte, N.C.-based Brighthouse is working with investment bankers at Goldman Sachs and Wells Fargo on a potential sale, the Times reported.

In a follow-up email response, a Brighthouse spokesman said the insurer does not comment "on rumors and speculation."

Quarterly Snapshot

- Corporate expenses in the fourth quarter of 2024 were $210 million, down from $244 million in the fourth quarter of 2023 and up from $203 million in the third quarter of 2024, all on a pre-tax basis.

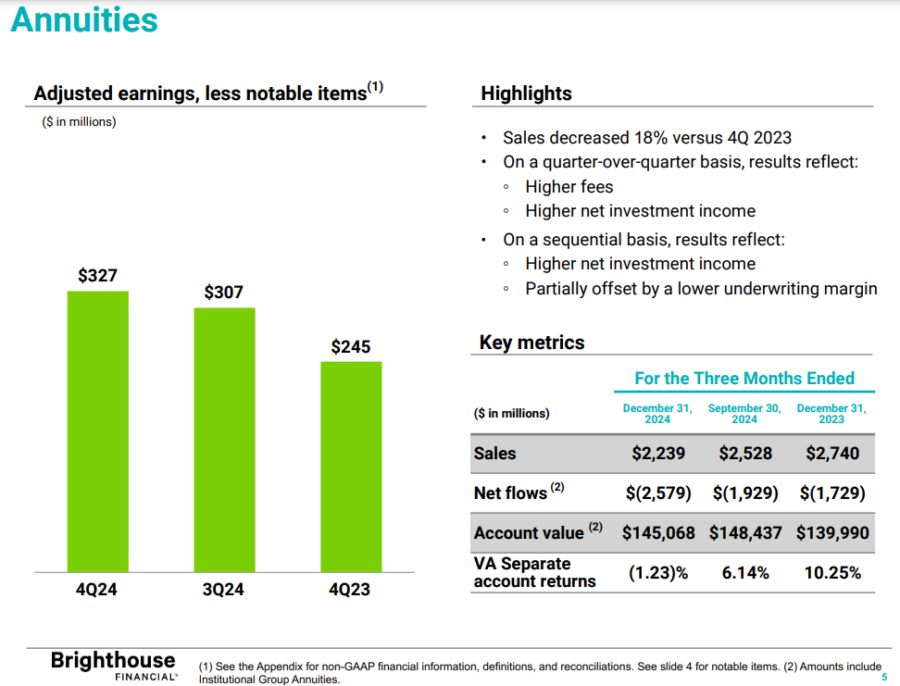

- The annuity segment included a $48 million unfavorable notable item related to actuarial model updates.

- Annuity sales decreased 18% quarter-over-quarter, 11% sequentially and 5% year-over-year, primarily driven by lower sales of fixed deferred annuities.

Management Perspective

“All I can tell you is we're going to continue to run the company as we have. And when you do hit periods of complexity, you just power through it, which is exactly what you've seen us do over the last couple of quarters, including the fourth quarter. And that won't stop as we go through 2025.”

– CEO Eric Steigerwalt on whether Brighthouse is nimble enough to remain a public company

By The Numbers

- Net Income: $646 million (-$942 million in Q4 2023)

- Earnings Per Share: Adjusted earnings share of $5.88 ($2.92 in Q4 2023)

- Share Repurchases: $60 million in Q4 2024, and $250 million for the full year

- Stock Price Movement: $58.12 per share, down 0.6% at midday Wednesday

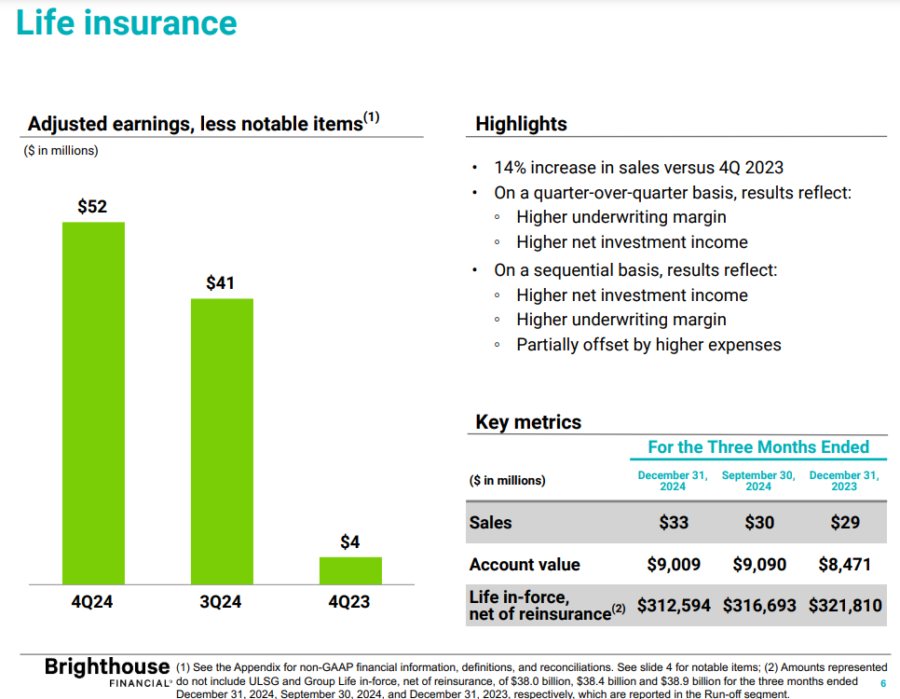

Life Picture

- Adjusted Earnings: $52 million ($4 million in Q4 2023)

- Sales: $33 million ($29 million in Q4 2023)

Annuity Picture

- Adjusted Earnings: $327 million ($245 million in Q4 2023)

- Sales: $2.2 billion ($2.7 billion in Q4 2023)

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Has catalytic converter theft finally peaked?

CVS Health: Profits drop, with Medicare Advantage, Aetna challenges

Advisor News

- Wall Street executives warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

- FSI announces 2026 board of directors and executive committee members

- Tax implications under the One Big Beautiful Bill Act

- FPA launches FPAi Authority to support members with AI education and tools

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- How Will New York Pay for Hochul's State of the State Promises?

- As the January health insurance deadline looms

- Illinois extends enrollment deadline for health insurance plans beginning Feb. 1

- Virginia Republicans split over extending health care subsidies

- Illinois uses state-run ACA exchange to extend deadline

More Health/Employee Benefits NewsLife Insurance News