Brighthouse execs talk up new hedging program, break reinsurance news

Main takeaway: Concern over a sliding risk-based capital ratio continued during the third quarter for Brighthouse Financial.

President and CEO Eric Steigerwalt had candidly told Wall Street analysts on a second-quarter call that the insurer was disappointed with its underlying financials and a 380% to 400% RBC ratio. Insurers generally like to operate with a 400% to 450% RBC ratio.

RBC requirements provide for a ratio to assess the level of risk associated with an insurance company's assets.

Brighthouse finished Q3 with an RBC ratio between 365% and 385% and holding company liquid assets of $1.3 billion.

To address the low RBC, Steigerwalt teased a new reinsurance deal, which he announced had been finalized near the end of the hour-long call. The deal is expected to bring Brighthouse’s RBC ratio back to “the low end” of 400% to 450%, the insurer said in a news release.

Otherwise, executives declined to divulge any details on the new reinsurance.

“If you think about everything we've talked about here, obviously we want to make sure that we have appropriate capital in the operating company,” Steigerwalt said. “We have since the beginning run with a large buffer up at the holding company, and we intend to continue to do that.”

New hedging strategy

In addition to more reinsurance, Edward Spehar, executive vice president and chief financial officer, outlined a new hedging strategy.

Brighthouse began managing its Shield product sales on a standalone basis in July with the launch of a new product suite. The insurer is “expanding that approach” in the fourth quarter to include its Shield product with lifetime withdrawal benefits known as Shield Level Pay Plus and the residual sales of an old Shield product suite, Spehar explained.

“As part of this process, we have separated the annuity business into two categories,” he added. “The first is Shield new business, which represents approximately 95% of total VA and Shield sales. And the second is our in-force block of legacy VA and legacy Shield contracts.”

Work on a separate hedging strategy for the legacy block will continue into 2025, Spehar said.

“It is important to highlight again that while we are revising the hedging strategy, our focus on protecting the statutory balance sheet under adverse scenarios remains unchanged,” he noted.

The result will be “less strain” on new business, Steigerwalt interjected, and Brighthouse expects to see bottom-line results as soon as the fourth quarter. But the product quality or sales strategies remain unaffected, he added.

“Do [we] intend to slow down sales? No, we do not,” Steigerwalt said. “We're having a very good October and given our two goals of having appropriate capital levels and being able to write new business, all these initiatives are designed to make sure we can do both of those things.”

Management commentary

“While our estimated combined RBC ratio at the end of the quarter was below our target range, we continued to make progress on several strategic initiatives designed to improve capital efficiency, unlock capital and return to our target combined RBC ratio.”

– President CEO Eric Steigerwalt

Financial overview

Total Revenue: $2 billion ($1.2 billion in Q3 2023)

Net Income: $150 million ($453 million in Q3 2023)

Earnings Per Share: $2.47 ($6.89 in Q3 2023)

Share repurchases: $64 million

Stock price movement: Up nearly 1% Friday morning to $51.50

Segment performance

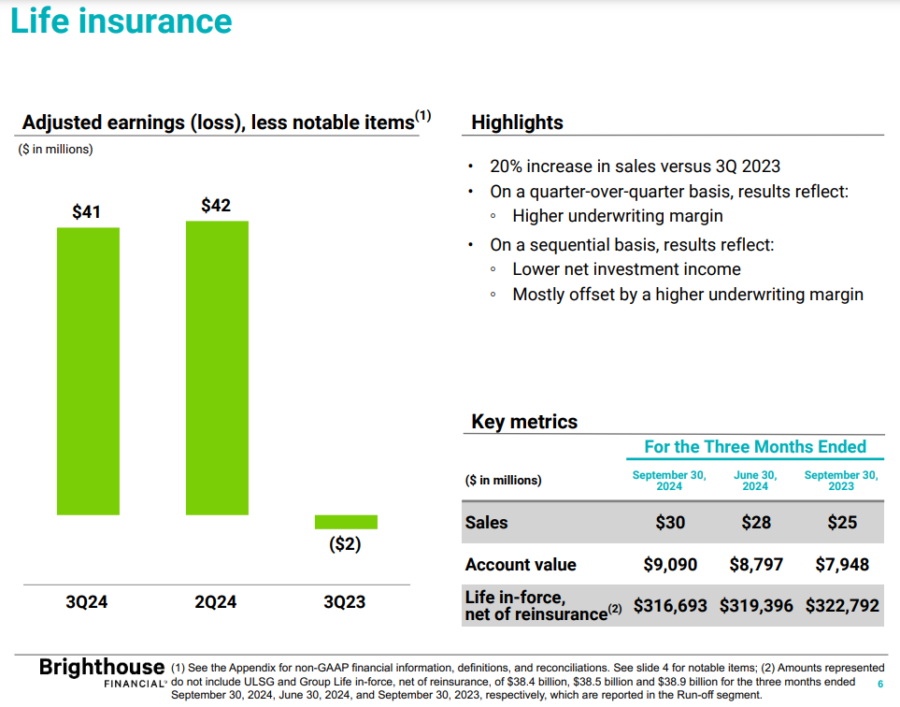

Life Insurance:

- Adjusted Earnings: -$25 million (-$73 million in Q3 2023)

- Sales: $30 million ($25 million in Q3 2023)

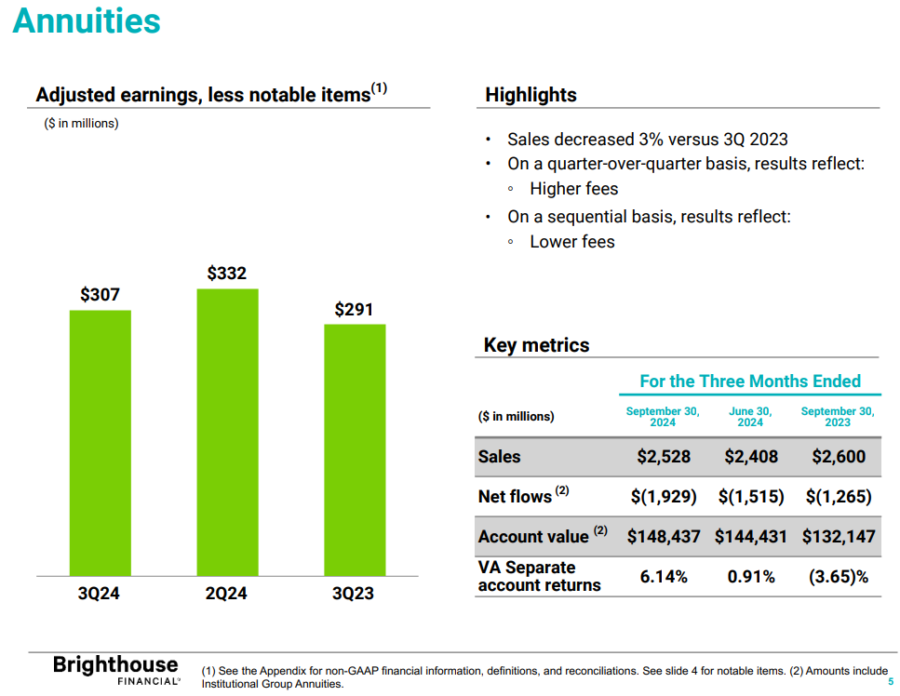

Annuities:

- Adjusted Earnings: $327 million ($319 million in Q3 2023)

- Sales: $2.5 billion ($2.6 billion in Q3 2023)

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Managing the annual enrollment welcome call surge

What will a new Trump presidency do for health care?

Advisor News

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

More Advisor NewsAnnuity News

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

More Annuity NewsHealth/Employee Benefits News

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- Iowa insurance firms warn bill would make health costs rise

- Farmers among many facing higher insurance premiums

- Mark Farrah Associates Analyzed the 2024 Medical Loss Ratio and Rebates Results

- PID finds violations by Aetna Insurance

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of The Cigna Group and Its Subsidiaries

- U-Haul Holding Company Announces Quarterly Cash Dividend

- Jackson Earns Award for Highest Customer Service in Financial Industry for 14th Consecutive Year

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

More Life Insurance News