Brighthouse execs blunt about ‘disappointing’ Q2 capital numbers

Main takeaway: Brighthouse Financial CEO Eric Steigerwalt opted for unusual candor while unpacking second-quarter results with Wall Street analysts Thursday morning.

“While the second quarter had many positive developments, including record sales of our flagship Shield annuities, the first deposits received through BlackRock LifePath Paycheck and strong adjusted earnings results, our preliminary statutory results were disappointing,” he said.

Variable annuity hedging issues contributed to a drop in Brighthouse’s risk-based capital ratio to below where the insurer prefers to operate. Brighthouse saw an approximately $600 million decline in statutory combined total adjusted capital, Steigerwalt explained.

RBC requirements provide for a ratio to assess the level of risk associated with an insurance company's assets. Insurers generally like to operate with a 400% to 450% RBC ratio. Brighthouse finished Q2 with a 380% to 400% ratio.

The fluctuating risk and “underperformance of equity hedges” primarily drove the disappointing results of the VA and Shield annuity segment, according to Ed Spehar, executive vice president and chief financial officer.

“We are seeing additional complexity associated with managing the VA and Shield risk on a combined basis,” Spehar said in reference to the equity hedging. “We have a number of initiatives underway designed to address these issues. One specific action that was implemented last month is standalone hedging for all Shield new business.”

Brighthouse reported adjusted revenue and earnings that beat predictions by Wall Street analysts. Quarterly net income of $34 million improved over the Q2 loss reported last year. In the first quarter, the insurer booked a loss attributable to a retroactive reinsurance charge.

But Brighthouse executives are focused on getting the insurer’s capital reserves healthy. The insurer maintains a “robust liquidity position,” Steigerwalt said, with liquid assets of the holding company of $1.2 billion at the end of the quarter.

Analysts pressed for a more definitive timeframe for boosting the RBC ratio, but Steigerwalt didn’t budge.

“Look, we don't want to be cavalier about just saying, this getting back to our 400 to 450 range, will happen in the course of a couple of weeks,” he said. “That just doesn't seem appropriate to do that. We've never operated that way, and I've never spoken that way.”

Management Commentary

“We are not pleased with our statutory results this year. To that end, we have been actively engaged in a number of specific initiatives, including reinsurance opportunities, which are designed to improve capital efficiency, unlock capital and restore the RBC ratio to the target range within the next six to 12 months.”

-CEO Eric Steigerwalt

Additional Notes

Partnerships: During the quarter, Brighthouse recorded the first deposits – more than $340 million – from its LifePath Paycheck product partnership with BlackRock.

Earlier this year, the two companies announced LifePath Paycheck, which offers “guaranteed income” via a target date fund.

When a participant enters retirement, they will receive a guaranteed amount of funds in a paycheck-like manner that is meant to provide a stable source of income. By providing access to guaranteed income through a target date fund, LifePath Paycheck is meant to be more stable than a standard 401(k).

“We expect inflows associated with LifePath Paycheck to be uneven on a quarter-to-quarter basis as defined contribution plans implement the solution,” Steigerwalt said. “We do not expect much activity in the third quarter, but we expect more activity in the fourth quarter. We are thrilled with the launch and LifePath Paycheck’s success to date.”

Financial Overview

Net Income: $9 million ($200 million loss in Q2 2023)

Adjusted Earnings: $346 million ($271 million in Q2 2023)

Earnings Per Share: $5.57 per share ($4.04 in Q2 2023)

Share repurchases: $64 million

Stock price movement: down more than 6% midday Thursday to $41.68

Segment Performance

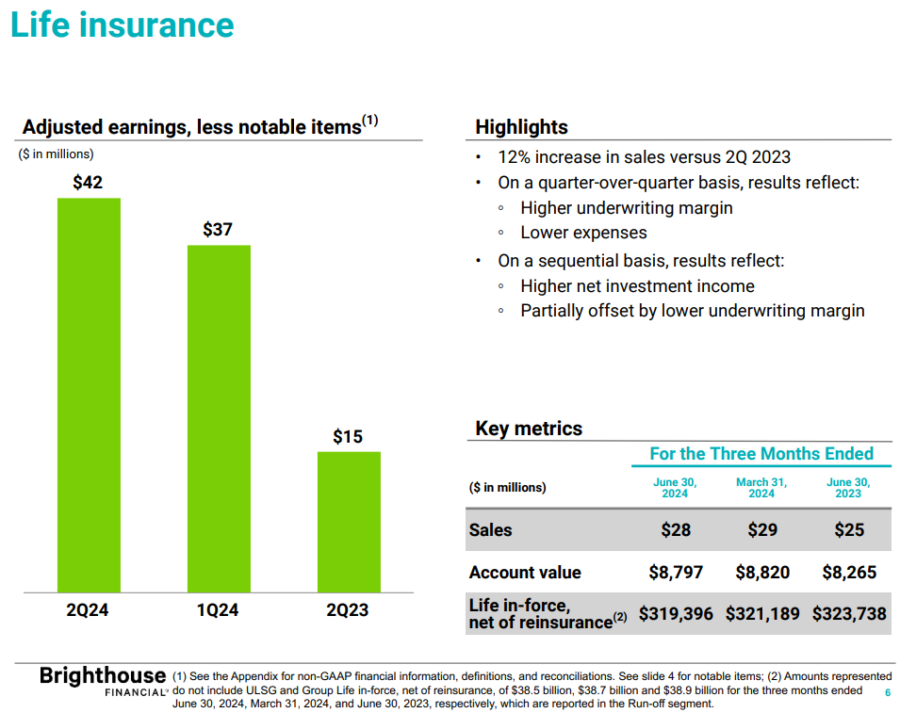

Life Insurance:

- Adjusted Earnings: $42 million ($15 million in Q2 2023)

- Sales: $28 million ($25 million in Q2 2023)

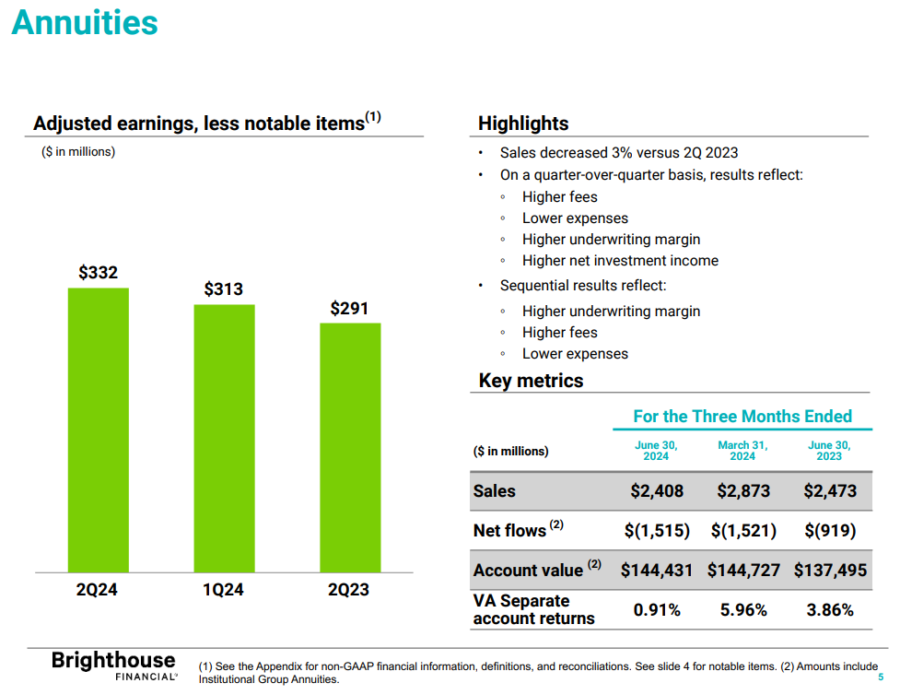

Annuities:

- Adjusted Earnings: $332 million ($291 million in Q2 2023)

- Sales: $2.41 billion ($2.47 billion in Q2 2023)

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Brookfield Asset Management crosses $1 trillion in AUM in big Q2

Jackson Financial reports strong Q2 earnings, despite hedging hits

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

More Life Insurance News