EBRI: When it comes to decumulation, RMD rules are a ‘default strategy’

RMD rules are more than just guidelines, according to EBRI research released last week. Instead, “RMD rules clearly are a default strategy for many people in what they take out of their IRAs," according to Craig Copeland, director, Wealth Benefits Research, EBRI.

Under IRA required minimum distribution rules, you cannot keep retirement funds in your account indefinitely and you generally have to start taking withdrawals from your IRA, SIMPLE IRA, SEP IRA, or retirement plan account when you reach a government-specified age.

“The impact of these rules is significant and how we define these can have a really big impact,” said Copeland, during Retirement Symposium: The Forces Transforming Retirement, hosted Tuesday by Milken and the Employee Benefit Research Institute. His presentation was Impact of the RMD Rules on IRA Distributions: An Examination of the Rule Changes from 2019-2021.

RMD rule has 'a really big impact'

“How we define these can have a really big impact on what people's decisions are and how they're taking their RMDs,” said Copeland. “Not only taking it out but also how much they take out is impacted by the RMD rules. They're more likely to take out what's prescribed instead of something that may be on a more ad hoc basis.”

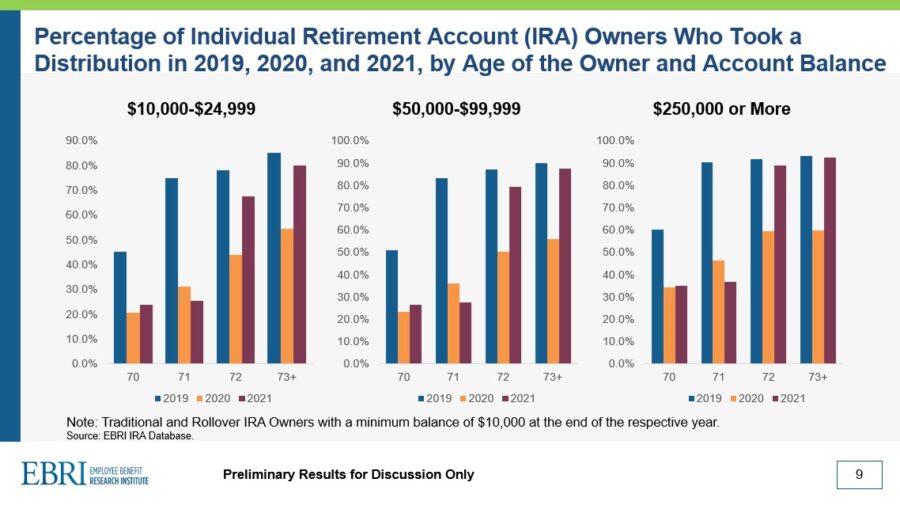

Copeland said the EBRI research showed there are no significant differences in withdrawal strategy by account balances and gender, and Roth distributions did not seem to be impacted.

Basically, Copeland said, the impact of RMDs is that they are essentially driving the way “people are making their decisions to withdraw assets.”

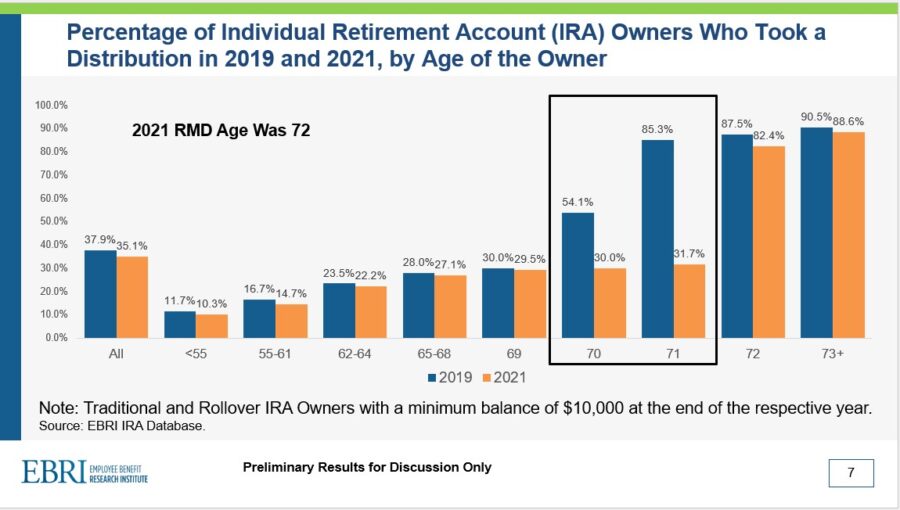

Copeland said 2019, 2020 and 2021 “were very important years because 2019 was the last year when the [RMD] age was 70 1/2. In 2020, it was supposed to move to age 72, but that ended up being suspended because of Covid legislation. So 2021 was the first year that the RMD age moved from 70 1/2 to 72. And we wanted to see what that impact was on people's decisions to make those distributions.” In 2023, said Copeland, the age for RMD was increased to 73. Under the Secure 2.0 Act, the age will increase to 75 in 2033.

“Depending upon your age, there is a life expectancy factor that is published by IRS,” he said.

“You have to calculate it for each individual account that you have, but you do not have to take [the required distribution] out of each of the individual accounts," he said. If you have more than one fund with an RMD, you could opt to take the total RMD out of one or more of the accounts, not out of each of them, he explained.

'Does this matter to people's decisions?'

Copeland explained that data for the RMD study came from the EBRI IRA database, which has data from over 3 million individual retirement accounts from various record keepers. “This is actual participant-level data so we can see what they're doing ... It was important to only focus on accounts that we could follow. So if someone had an account and then depleted the entire thing, that was not what we felt was a retirement strategy. So we're not including those people.

Copeland said the overwhelmingly bulk of the money studied was from employer plans. There was a separate analysis for Roth because of the different rules, he said.

Some of the data examined included end-of-year balance, total distribution amount taken during the year, and the age and gender of the participant.

“The percentage of people that took out a distribution in a given year, by age, is the first thing we look at. And one thing that you could see is that really until you get to those RMD ages, you do not have a lot of people taking out distributions. You have about a third of the people – 30%, 25% – particularly when you get to 62 to 69 when you think most people would be retired and needing to change assets into money.”

Copeland said most people in the research group were not taking distributions "until they're required to."

Copeland's main takeaways included:

• The RMD rules are the defacto default withdrawal strategy for many who have IRAs.

• These rules have a major impact on when IRA owners take a distribution and the amount of the distribution.

• The distribution rate is smaller among those who are taking required distributions than for those who are taking distributions before they are required.

• Account balance and gender appear to not have a large impact on the distribution decisions.

• Roth distributions were age-indifferent at ages 62 or older and not impacted by the 2020 suspension of RMDs.

"Are people with higher account balances more responsive to these changes or are they less responsive?" asked Copeland. "If you look at it, there's really the same type of responses across all of the balance groups."

"The next thing is by gender ... The percentages almost are identical between males and females," he said.

The research also showed that those who started taking distributions before they were required to actually took out more. "Once they were at the age that they were required to [take a distribution], the average distributions went down. It looks like it's impacting how much you take it out because you have that very specific formula under the RMD requirements that tells you how much they should be taking out."

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

John Forcucci is InsuranceNewsNet editor-in-chief. He has had a long career in daily and weekly journalism. Contact him at johnf@innemail.

One-liners that could generate business for you

Most experts advise insurers not to expect federal AI guidelines

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News