Could COVID-19 Lead To Higher Life Insurance Sales?

The effect of the COVID-19 pandemic on Americans is immeasurable. Our health and well-being concerns became all-consuming over the course of the last 18 or more months. As vaccines are now widely available and many people have begun to venture out in public, financial advisors and life insurance agents have begun face-to-face meetings with their clients again.

But what about gaining new business? What has the pandemic done in terms of life insurance awareness and purchase intent? LIMRA and Life Happens fielded their 11th annual Insurance Barometer study in January during the height of the “second wave” of the pandemic in much of the U.S.

Historically, the majority of Americans have preferred to purchase life insurance in person with an agent or advisor. As use of technology has become nearly ubiquitous and people have grown accustomed to conducting meetings and transactions online, this trend has shifted. In 2011, 64% of consumers said they preferred to buy in person; by 2020, just 41% felt this way. It is not surprising that the preference for online purchasing nearly doubled from 17% in 2011 to 29% in 2020.

During the pandemic, more Americans of all ages became accustomed to transacting online. Life insurance and other similar products can be confusing for prospective clients, and face-to-face is still the most preferred method of finalizing such purchases. It is clear, however, that the industry must adapt to the changing channel and distribution landscape.

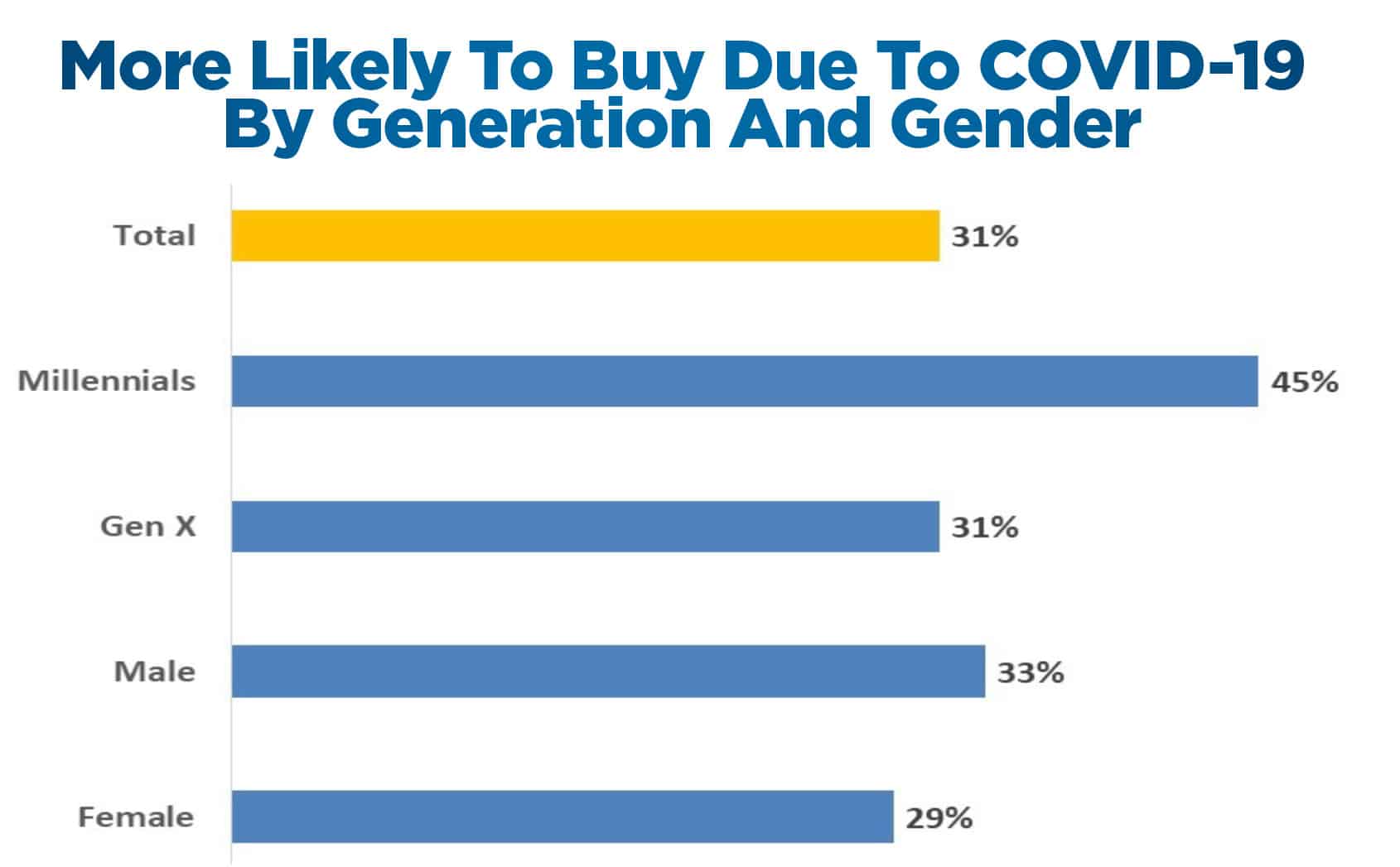

Life events such as births, marriages, job changes and deaths of family and friends prompt people to consider purchasing life insurance. The COVID-19 pandemic is a life event that all of us have experienced at the same time, over an extended period. The pandemic lifted the likelihood of buying life insurance for many consumers; almost one in three (31%) said they were more likely to buy because of the pandemic.

Two-thirds of those surveyed said they personally knew someone who had tested positive for COVID-19. Of those individuals, the likelihood of obtaining life insurance in 2021, at 33%, was nearly the same as it was for the entire respondent pool. For those who tested positive themselves, that number rose to 42%. This shows that it is often personal experience — whether starting a family or battling a dangerous virus — that drives life insurance sales.

Of course, purchase intent does not equate to sales. Even the most well-intentioned consumer may have some perceptions about life insurance and the industry that put roadblocks in their way.

More than half of the survey’s respondents (53%) admit they are unsure what product they would need or how much coverage to purchase. Nearly half (45%) stated that they have simply put off purchasing, and more than a third (36%) believe they would not qualify for coverage.

These are significant obstacles for the industry and indicate the need for compelling communications to help consumers build appreciation for the broad value proposition that life insurance offers.

According to the 2021 Insurance Barometer, slightly more than half (52%) of American adults own some form of life insurance coverage (e.g., individual, employer sponsored), which is a decline of two points from 2020. This marks the lowest level of self-reported ownership to date in the 11 years of this study. Perhaps with online purchasing increasing before the pandemic and so many more people now comfortable conducting business and transactions online, the life insurance industry could be looking at higher sales as it navigates this post-pandemic world.

As part of LIMRA’s Markets Research team, Steve Wood is responsible for providing analyses and insights for some of the industry’s most compelling reporting. You can contact him at [email protected].

Advisors Are Helping Clients Grow Greener

The Five W’s Of Creating A Memorable Family Reunion

Advisor News

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

More Advisor NewsAnnuity News

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

- Trademark Application for “EMPOWER MY WEALTH” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Conning says insurers’ success in 2026 will depend on ‘strategic adaptation’

- The structural rise of structured products

More Annuity NewsHealth/Employee Benefits News

- New Vaccines Findings from University of California Riverside Outlined (Emergency Department Survey of Vaccination Knowledge, Vaccination Coverage, and Willingness To Receive Vaccines In an Emergency Department Among Underserved Populations – …): Immunization – Vaccines

- Researchers at George Washington University School of Medicine and Health Sciences Target Artificial Intelligence (Health Insurance Portability and Accountability Act Liability in the Age of Generative Artificial Intelligence): Artificial Intelligence

- Nevada's health insurance marketplace sees growth since inception and new public plan

- Data from University of Indonesia Advance Knowledge in Diabetes Mellitus (The Impact of Performance-based Capitation On Diabetes Care: Evidence From Indonesia’s National Health Insurance Program): Nutritional and Metabolic Diseases and Conditions – Diabetes Mellitus

- Findings from Jason Zhang and Co-Researchers Advance Knowledge in Managed Care (A Regional Analysis of Medicare Reimbursement Rates for Plastic Surgery From 2012 to 2025): Managed Care

More Health/Employee Benefits NewsLife Insurance News